Today’s issue in preview:

- Donald Trump sends one of our top trades to new highs… did you profit?

- As we expected, the space trade is soaring to new highs. Are you on board?

- Boomer health care stocks for the win

Donald Trump sends one of our top trades to new highs… did you profit?

Donald Trump wants military spending to go way up, and our advice to own drone stocks is paying off like a broken slot machine. Are you profiting?

In late 2024, I urged colleagues to invest in drone stocks for one simple reason: After years of progress and innovation, military and surveillance drone makers can now produce large amounts of effective drones at low cost. Many drone applications now have very high “cost-to-damage inflicted” ratios. This is why drones have played a significant role in the Russia/Ukraine war.

The now pervasive use of drones in warfare means we are in what military experts call a “Revolution in Military Affairs.”

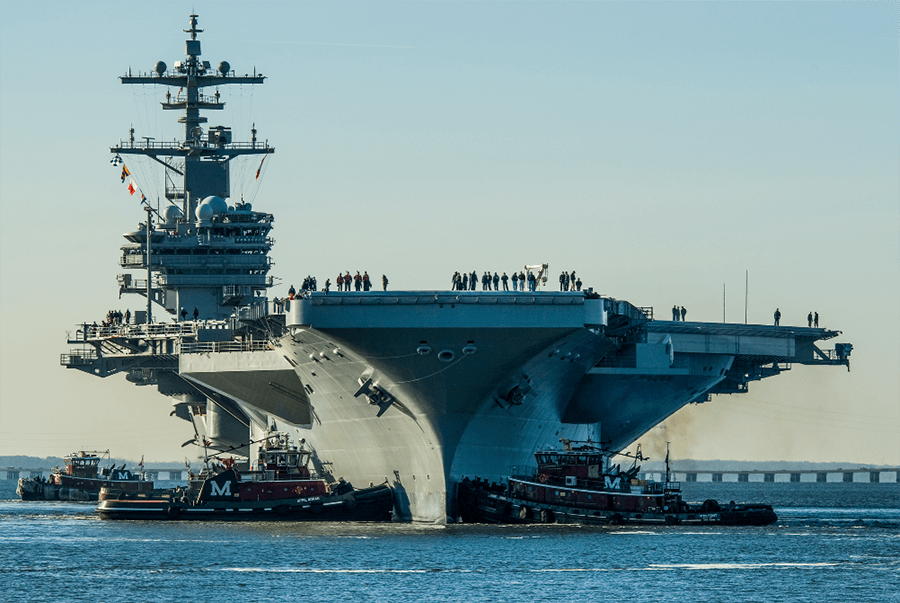

A Revolution in Military Affairs is a fundamental change in how wars are fought, typically driven by technological innovation. For example, the introduction of mechanized warfare in the form of tanks, battleships, and airplanes drastically changed the battlefield. Airplanes, in particular, introduced a whole new dimension to war.

I’m deeply anti-war and anti-surveillance, so a big part of me wants to see drones manufactured only for peaceful activities like delivering pizza and Amazon packages. However, I don’t make the rules.

Governments around the world are buying drones like crazy. Drone maker revenue is soaring. We have an investment megatrend on our hands.

But don’t take my word for it. Take the market’s word.

Yesterday, Donald Trump said he would like to see military spending go up substantially so America can have a “dream military.” His statement sent many defense stocks soaring.

Military drone makers in particular are having a big day today. Leading drone maker Kratos (KTOS) climbed 17% to reach an all-time high. It’s up 287% since our original note. Drone maker Ondas (ONDS) climbed 19% to reach an all-time high. It’s up 1,660% since our original note.

The drone megatrend is set to last for many years. Given its potential to revolutionize war, surveillance, and communication, I believe this uptrend keeps running.

Drone makers soar to new highs

As we expected, the space trade is soaring to new highs. Are you on board?

If Trump is going to ramp up defense spending, the space trade is going to benefit. That’s what the market is telling us today.

On September 22, 2025, I put a spotlight on space stocks and said it’s a sector the “public could go wild for.” I stated the bull case like this:

When people think of investing in space, they often go towards the business of launching rockets and Elon Musk’s SpaceX. But many of the most promising “space stocks” are in the business of space-based communication platforms and equipment. Think government surveillance, military communication, GPS, internet service, and cell service.

The best big picture fundamental case for space stocks right now is that the Trump administration believes America is in a hugely important competition with China and other countries for “space dominance.” This means regulatory and financial support for the U.S. space industry.

… Top performing individual space names worth checking out include Rocket Labs (RKLB), BlackSky (BKSY), Planet Labs (PL), and AST SpaceMobile (ASTS).

As warfighting becomes increasingly high-tech, soldiers are utilizing space-based assets more and more. This means more satellites in the heavens… which means more rocket launches are needed to get them there. It means more specialized communication systems to shuffle data, audio, and video back and forth.

In other words, increased military spending will result in increased space spending.

It’s no wonder the ARK Space Exploration & Innovation ETF (ARKX) and the Procure Space ETF (UFO) soared to new highs after Trump’s message about increased military spending. These are two of the largest space-industry-focused ETFs on the market. The trend tailwinds are blowing for the space trade.

The space trade is paying off

Boomer health care stocks for the win

I’ve been urging you to own Boomer health care stocks for months.

Did you act and make terrific returns?

Regular readers know that Boomer health care is one of our highest conviction long-term investment themes.

The bull case here is simple: More than 10,000 Americans reach retirement age every day. This is the enormous Baby Boom generation entering the later stages of life… and a significant opportunity for the health care industry.

Boomers are in a phase of life where health care and longevity spending skyrocket. For many boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.

This means that many health care fields are experiencing huge demand now – and will for at least the next decade.

That means stocks in Big Pharma, medical devices, and diagnostics and testing.

On October 1, 2025, I pointed to the upside breakout in health care stocks as evidence that the market was agreeing with the bullish case.

Since then, health care stocks, as tracked by the State Street Health Care Select Sector SPDR ETF (XLV), have soared. It’s up 12% in under four months. This week, XLV broke out to a new all-time high. It’s a bull market in Boomer health care. Invest accordingly.

Boomer health care for the win

Market Notes

- Aerospace and defense giants RTX Corp (RTX), Lockheed Martin (LMT) and General Dynamics (GD) all hit one year highs today.

- Healthcare leaders Eli Lilly (LLY) and Merck & Co (MRK) reached yearly highs as the health care boom continues.

- Industrial giant in the aerospace industry, Allegheny Technologies (ATI), just hit a 1-year high.

- Technology supergiant Alphabet (GOOG) reached an all-time high today.

- Automakers General Motors (GM) and Ford (F) reached new 1-year highs today.

Recent Issues

A tidal wave of cash is headed towards this high tech sector. How to get your share of it.

A massive AI bottleneck is generating giant stock market winners. Do you own them?