Today’s issue in preview:

- An under-the-radar technology that could catch fire

- The more data centers they build, the more these stocks go up

- Two megatrends are better than one: A stock at the nexus of robotics and the oil boom

An under-the-radar technology that could catch fire

Credit: koto-feja

Of all the analytical tools I have at my disposal, few of them are as useful as our custom-built Global Trend Tracker database. This analytical platform tracks over 200 ETFs and industry groups that represent every major asset class, stock market, and market theme. Every day, I look to see where the “GTT” is signaling an opportunity.

Over the past three months, an under-the-radar technology trend has consistently enjoyed a place near the top of our GTT performance rankings. This trend – focused on bleeding-edge innovation – could soon catch fire with investors. It’s called nanotechnology.

Nanotechnology is the science of manipulating matter at the molecular level. This technology holds the promise of creating very light, very strong “super materials”… plus revolutionizing energy production… plus creating tiny robots that could circulate in your body and eliminate disease.

For better or worse, many of the best stock market trades today require us to focus on “promise over profit.” Stocks can soar hundreds of percent in months, even when companies have little in the way of revenue or profit. Here in 2026, a great story – plus the promise of large future profits – is enough to send a sector skyrocketing.

The nanotechnology sector can easily enjoy a big “promise over profits” rally in the near future. Think of it… Super materials… Tiny robots that eliminate disease… or tiny robots that can recycle mountains of waste. This technology’s promise is enormous.

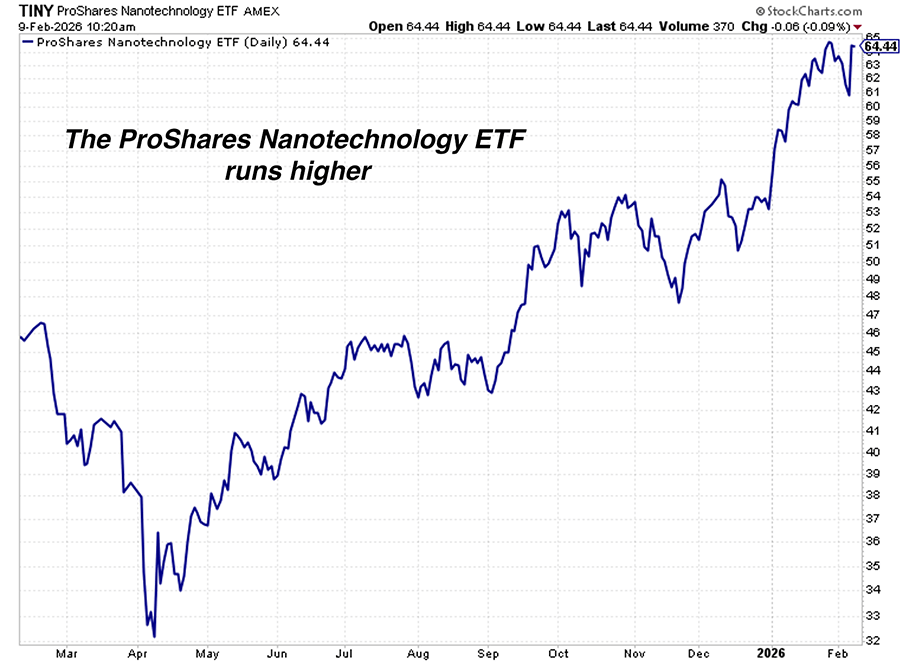

The market may be waking up to that promise. The ProShares Nanotechnology ETF (TINY) is one of the market’s top-performing technology funds over the past three months. It’s up 41% over the past year and sits near an all-time high.

To be clear, TINY is not a pure-play nanotechnology ETF. It holds many companies that currently count nanotechnology as a small part of their market value. Still, it’s trending higher and gives us something to monitor while we research individual players and bring them to your attention. This is a trend worth watching that could soon catch fire.

The more data centers they build, the more these stocks go up

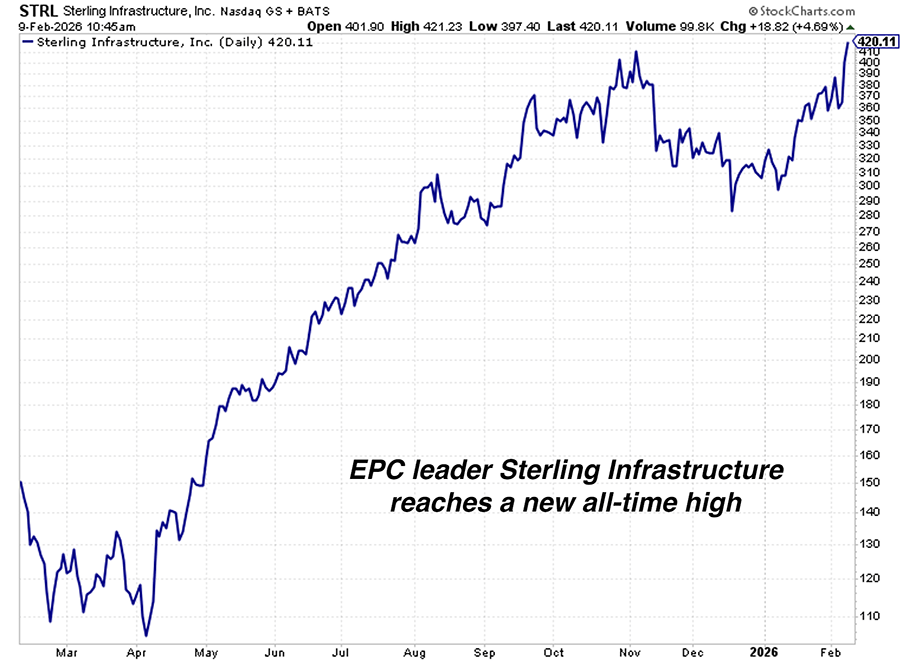

After taking a break to pause and digest some large gains, the “Build Baby Build” theme is back to generating winners in the engineering, procurement, and construction (EPC) business.

Regular readers are familiar with my bullish stance on selected EPC stocks.

On October 16, I forecasted that U.S. Engineering, Procurement, and Construction (EPC) stocks would benefit significantly from Donald Trump’s U.S. manufacturing capacity buildout boom.

EPC stands for Engineering, Procurement, and Construction. These firms design and build giant infrastructure projects such as airports, skyscrapers, power plants, subways, and data centers.

These firms are benefitting greatly from Donald Trump’s push to increase U.S. manufacturing capacity. The world’s largest manufacturers are poised to invest over $1 trillion in new U.S.-based factories.

The bull case for EPC stocks doesn’t stop there, though. They also have an “AI tailwind” blowing at their backs…

Business and political leaders believe the U.S. is in a “Great AI Race” against China. This race makes it urgent to build data centers and the electric infrastructure required to operate them.

Big tech companies such as OpenAI, Google, Microsoft, and Amazon are on pace to spend a stupendous $600 billion+ on AI infrastructure this year… with more than a trillion dollars to follow.

So, let’s add this up…

The world’s richest, most powerful companies are investing in hard infrastructure on an epic scale. And they want to invest it as fast as humanly possible. Plus, a forceful president has staked his legacy and reputation on expanding U.S. manufacturing capacity and winning the AI race. In other words, Build Baby Build is the dominant theme here.

This means the bidding process for many infrastructure projects will consist of EPC companies throwing out absurdly high $100 million+ bids… then Big Tech or the White House replying, “Sure, we’ll take five of them. Can you start yesterday?”

From April 2025 to October 2025, leading EPC stocks such as Primoris (PRIM) and Sterling Infrastructure (STRL) enjoyed a big rally. They then moved in a sideways consolidation pattern and digested their gains. But over the past week, these stocks have broken out to all-time highs. The Build Baby Build theme is creating winners again.

Two megatrends are better than one: A stock at the nexus of robotics and the oil boom

Credit: Andrey Suslov

I often say you want to work and invest in booming industries that are enjoying such strong revenue growth… such huge investment flows… and have so much future demand… that financially, you’re essentially running downhill.

When a megatrend is working in your favor, success comes easier. A megatrend turns a good idea into a great idea. It turns a big, expensive mistake into a tiny mistake. When a megatrend is working in your favor, even your morning coffee tastes better.

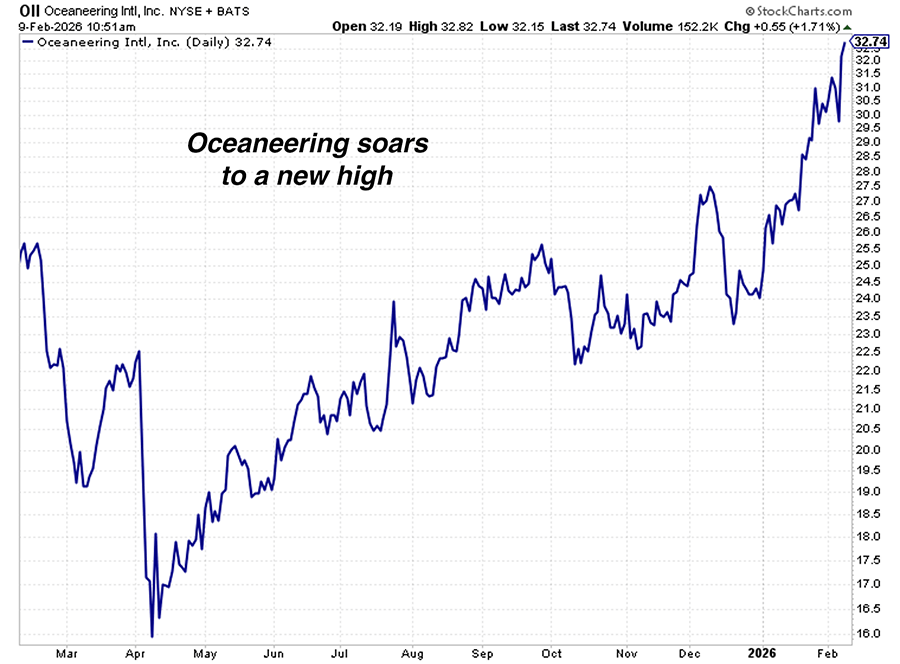

One of the only things better than having a megatrend working in your favor is to have two megatrends working in your favor. This is why high-tech oil & gas company Oceaneering (OII) is one of the strongest stocks in the market right now.

Regular readers know our September 2025 recommendation to own oil stocks has been a huge winner. Oil stocks are one of the market’s strongest themes right now. We are also very bullish on the robotics industry in the long term. It is poised to deliver huge breakthroughs in drones, humanoids, industrial robots, air taxis, and autonomous vehicles.

Oceaneering is benefiting from both trends. It is one of the oil and gas industry’s leading high-tech “oil service” companies. It does not produce oil and gas on its own.

Instead, it performs work on oil and gas rigs and pipelines with subsea robotic vessels. It also performs high-tech analysis of oil and gas infrastructure. The company’s machines can also assist the military with subsea infrastructure repair and installation services.

As you can see from the chart below, the market likes this stock at the nexus of oil plus robotics. Oceaneering is up 32% over the past year. The stock just hit a new high. Two megatrends are better than one!

Market Notes

- Our longstanding recommendation to be long the Power Grid Upgrade theme continues to be a winner. The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) reached a new all-time high today… and power grid infrastructure firm Quanta Services (PWR) reached an all-time high today.

- The extraordinary levels of AI infrastructure investment continue to shape markets. Giant AI semiconductor manufacturer Taiwan Semiconductor (TSM) reached an all-time high today… data center infrastructure leader Vertiv (VRT) reached an all-time high as well.

- Our September 29, 2025, bullish note on oil stocks continues its winning ways. The S&P Oil & Gas Equipment & Services ETF (XES) reached a new one-year high today.

- Our longstanding recommendation to invest in robotics continues to pay off. Actuator and bearings giant Regal Rexnord (RRX) reached an all-time high today.

- The quiet boom in U.S. manufacturing continues. Leading manufacturing stocks Oshkosh Truck (OSK), Flowserve (FLS), Tetra Tech (TTEK), and Woodward (WWD) reached new one-year highs today.

- The software industry continues to be a perilous area for investors. Major software firms Workday (WDAY), Atlassian (TEAM), and Monday.com (MDAY) reached new one-year lows today.

Regards,

Brian Hunt

Editor, Money & Megatrends

Recent Issues

An AI “demand shock” is set to hit this industry and drive stock prices higher

Who cares about Operation Epic Fury? These critical stocks just soared to new highs