Robotics is poised to take on a huge role in the global economy. And the industry is likely to get even bigger support soon, opening plenty of opportunities for investors.

That’s because this year, President Donald Trump and his administration are moving full speed ahead on robotic automation.

No, this won’t result in Judgment Day from the Terminator films. But, as I covered in a recent article on robot machine vision, the world is increasingly moving toward job automation that can save businesses billions of dollars. A mere five months after Trump’s plan to speed up American AI development and deployment, the administration is now making a big robotics push.

According to a recent Politico article, U.S. Commerce Secretary Howard Lutnick has met with CEOs of robotics companies. And he’s “all in” on accelerating robotics development. According to Politico, two sources confirmed that the Trump administration is considering issuing an executive order (“EO”) and a national strategy on robotics in 2026.

Once that news broke, robotics stocks reacted. Tesla (TSLA) shares closed up around 6% that week. And Teradyne (TER), a robotics company focused on industrial automation, soared 10.3%.

With robotics a priority on the president’s 2026 agenda, related stocks could get a boost this year. We’ll look at three companies that should benefit from Trump’s intention to accelerate American robotics development.

But first, let’s dig into why Trump’s robotics strategy should have investors paying attention.

What a National Robotics Strategy Means for Investors Right Now

Before investors start gobbling up robotics stocks, it’s important to know that Trump’s intention is not close to becoming a law or even a national strategy… yet. At this point, the government is considering an EO to accelerate robotics development in the U.S. But, as Trump has demonstrated time and again, he could change direction on a whim.

There does seem to be serious interest in automation within the administration, though. That’s enough to keep robotics stocks on your watch list until this all unfolds.

What we do know is that robotics is the next technological phase to follow AI. And it’s going to impact American automation and reshoring in big ways.

Automation: How Trump’s Robotics Push Could Help

The physical automation that robotics delivers is too tempting for businesses to ignore. This excerpt from my machine vision article illustrates why:

The global workforce faces a harsh reality today. AI and robots are now capable of performing tasks and jobs that only humans used to be able to handle.

Consider these examples:

- In 2021, Nestlé reported a 53% increase in productivity using pallet-loading robots.

- A factory in Dongguan, China replaced 90% of its human workers with robots. It reported a 250% increase in productivity and an 80% decrease in product defects.

- Amazon (AMZN) claims productivity has improved by up to 300% when using robots in its warehouses.

It makes sense. Robots are programmed for consistency. They’re not prone to human error. And they can work around the clock. For now, humans are still better at jobs that prize adaptability and dexterity… but AI and automation technology may soon close those gaps as well.

Amazon is a perfect example when making the case for robotic automation. More from the December 5 article…

You may have heard about this in the news recently after Amazon’s internal documents were leaked. The numbers, reported by the New York Times, are startling…

- The Amazon robotics team wants to automate 75% of the company’s operations.

- This automation plan means Amazon could avoid hiring as many as 600,000 employees in the coming years. Yet the company still expects to sell twice as many products by 2033.

- By 2027, Amazon hopes to avoid hiring more than 160,000 new workers by using automation.

- Automation is expected to save Amazon around $12.6 billion between 2025 and 2027.

This is exactly what companies hope to achieve with robotics investments… massive savings.

Money is always the primary driver of this type of innovation. But automation can also solve other current American workforce problems, like labor shortages, by automating tedious, dangerous, and physically demanding jobs. Think warehouse work, manual labor, and factory and assembly-line tasks.

In 2024, Deloitte projected that the U.S. manufacturing industry could require up to 3.8 million new employees between 2024 and 2033. The problem is, there were nearly 450,000 unfilled manufacturing jobs as of March 2025. Plus, 65% of industrial and manual services businesses reported difficulty finding qualified workers to fill their openings in 2024.

Robots can effortlessly fill those positions. They work 24/7, they remove human error and decision-making, and they increase precision, consistency, and efficiency.

Reshoring: How Robotics Can Help Bring Manufacturing Back to America

What will likely benefit from the Trump robotics push is American reshoring. Robotics decreases American manufacturing labor costs. And that makes the U.S. more price competitive. As of December 2025, the U.S. paid the world’s highest manufacturing wages… on average, between $5,000 and $5,500 per month.

When you compare American wages to those in Mexico, Vietnam, and China, it’s no surprise that 30% of all goods imported into the U.S. in 2025 were from just those three countries. For comparison, here are all four countries’ approximate average manufacturing hourly wages (converted to USD):

- United States: $29.51

- China: $7.38

- Mexico: $4.50

- Vietnam: $1.64

These wages clearly illustrate an important point… It’s expensive to make goods in America. Automating manufacturing tasks with robotics, however, could save American industries around $40 billion a year.

According to Redwood Software’s Enterprise Automation Index 2025, 36.6% of businesses using automation say it has reduced costs by at least 25%. And 12.7% report reduced costs of more than 50%.

This is how America can successfully bring manufacturing back to American soil.

Other Potential Trump Robotics Policy Impacts

If the Trump administration follows through on a robotics EO, businesses moving to robotic automation could reap even more benefits.

Funding, for one, is amply available. In fact, global funding for robotics startups reached a record high of more than $7.5 billion in 2024. And 2025 is likely to pass that record when the final tally comes in. As of late July of last year, robotics startups had pulled in more than $6 billion.

Federal grants are also available for some businesses investing in robotics. So are federal tax credits. These incentives should further motivate American companies to automate and reshore.

But let’s remember that there is no robotics policy yet. Trump hasn’t signed – or even promised to sign – any EO related to robotics or automation. But the initial buzz was enough to make waves in the market.

If and when policy is enacted, expect plenty of market volatility. Robotics stocks could soar or plummet depending on what any actual policy entails. That’s a ride investors should prepare for before taking any positions in this trend.

With all that in mind, let’s look at a few types of robotics stocks poised to benefit from a potential Trump automation push.

Tesla (TSLA): The Mega-Cap Robotics Winner

We all know Tesla for its electric vehicles (“EVs”). But Elon Musk’s mega-cap car company is also heavily involved in robotics and automation. Look no further than Tesla’s Robotaxi, the driverless rideshare service that was launched in Austin, Texas and continues to expand across the country.

But the Robotaxi is just the tip of the iceberg for Tesla’s robotics team. The company is honing its Optimus humanoid robot, with Musk aiming to deploy as many as 100,000 robots in Tesla facilities this year.

Here’s a peek at Optimus in action:

Source: X.com/@Tesla_Optimus

Optimus can do far more than run, however. By mid-2025 Optimus was lifting small objects and completing complex tasks like basic assembly work and pick-and-place functions.

But Musk is thinking bigger. He believes his robots will soon be able to build other robots. And that would essentially eliminate the need for humans along the assembly line. Now, Musk is known for his ambitious timelines… and falling short on them. But Tesla has already made great strides in automation.

Tesla’s five Gigafactories (three in the U.S., one each in China and Germany… and more to come) are already using a robotic workforce of large robotic arms and automated guided vehicles to handle, weld, and assemble the company’s EVs, energy storage products, and batteries.

These developments bode well for Tesla regardless of the Trump administration’s priorities. Assuming the White House does push forward with its automation agenda, Tesla will undoubtedly benefit.

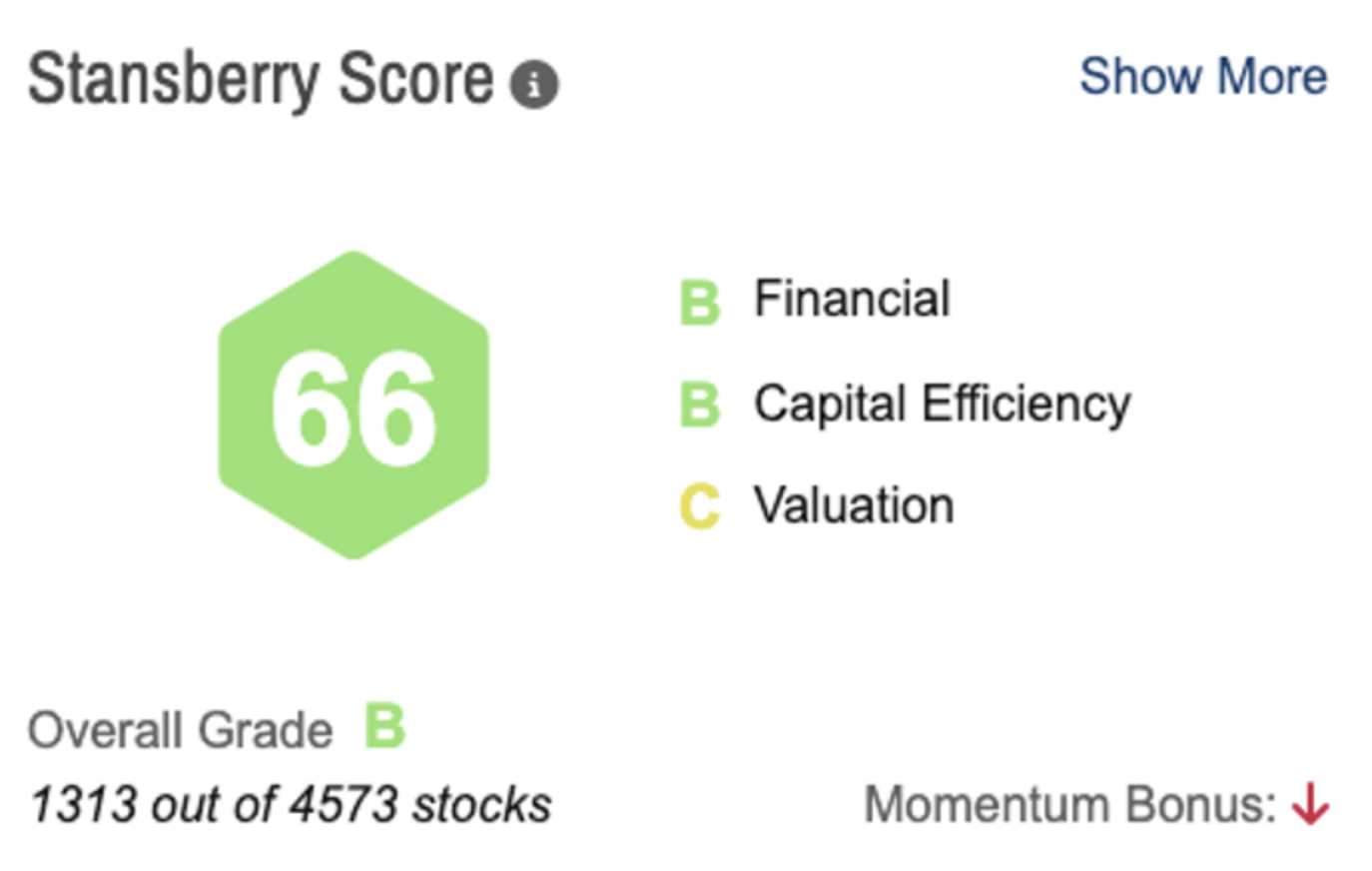

We use our Stansberry Score, courtesy of our affiliate Stansberry Research, to measure the quality of individual stocks. The system gives TSLA a solid “B” grade based on its above-average financials and capital efficiency, as well as a relatively solid grade on valuation.

Keep in mind, however, that Tesla is a very volatile stock. One look at its 52-week range ($214.25 low to $498.83 high) will tell you that you’re in for a bumpy ride. Plus, its five-year beta is 1.88, meaning its price volatility is nearly double the market average.

Symbotic (SYM): The Specialized Warehouse Automation Play

Symbotic, which designs and builds automated handling systems for large retailers and grocers to use in their warehouses, is another automation company worth keeping an eye on.

Its offerings include autonomous mobile robots, robotic arms and cells, AI-powered software, and high-density storage. Combined, these components can nearly fully automate warehouse operations. Their customer list is impressive, highlighted by Walmart (WMT), Target (TGT), and Albertsons (ACI).

But there is a caveat for investors to consider…

Walmart owns an 11% stake in Symbotic. And, for fiscal year 2024, the retail titan represented 87% of Symbotic’s $1.82 billion total revenue. Symbotic’s current backlog of around $22.5 billion is mostly attributable to Walmart and GreenBox, a joint “warehouse-as-a-service” venture between Symbotic and SoftBank.

Symbotic and Walmart are tethered, so there is some concern over concentration risk. That said, Walmart is the largest retailer in the world. And it’s aiming to automate all 42 of its regional distribution centers with Symbotic’s systems. That’s an awfully nice security blanket for Symbotic.

And so is Trump’s robotics push, when and if it materializes. Automating warehouses is right in Symbotic’s wheelhouse as a pure-play business focused on that specific task. So Symbotic feels like a logical beneficiary. But its stock has been volatile in recent years. Extremely volatile.

Upon news of its Q4 2025 earnings (highlighted by around $565 million in revenue) and its announcement of Medline as a new customer, SYM soared 55% over a five-day period in late November.

But from the November highs around $87, the stock fell to as low as $56 by mid-December, an approximate 35% nosedive. The bad news was the announcement of ten million newly issued shares, diluting existing shareholders.

Volatility aside, SYM had been performing quite well. The stock has delivered a total return of 175 over the past twelve months and recorded year-over-year revenue growth of 26% as of the fourth quarter.

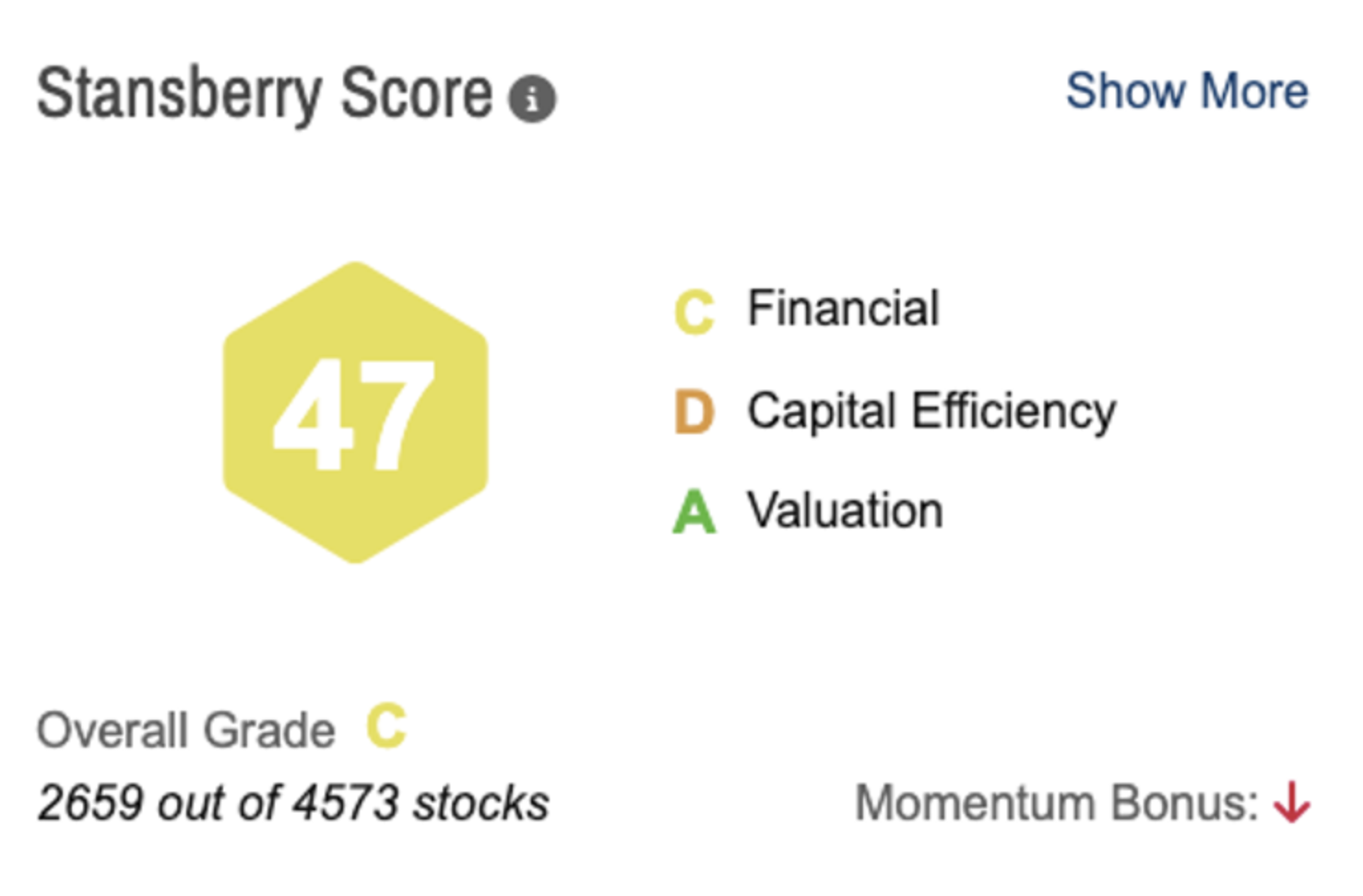

The Stansberry Score grades Symbotic a “C” overall, based on its excellent valuation (“A”), average financials (“C”), and below-average capital efficiency (“D”).

That valuation score comes with a caveat. Don’t bother looking up a price-to-earnings ratio for Symbotic. The company reported negative GAAP net income for 2025.

But, relative to sales, SYM trades with a 3.5 times multiple. For a company that grew its top line by 26% year over year recently – and considering it’s looking to grow revenue between 25% and 29% for Q1 2026 – that valuation could be remembered as a bargain if Symbotic continues to execute. The company is projecting more than $4 billion in annual revenue and nearly $350 million in earnings by 2028.

And with Walmart representing most of its current and future revenue, Symbotic could meet those lofty goals as Walmart continues to automate its supply chain.

Teradyne (TER): The Industrial Automation Cornerstone

Teradyne is an interesting competitor in the robotics industry… because robotics isn’t its primary focus. Of Teradyne’s reported 2024 revenue of $2.82 billion, only 13% was attributed to its Robotics division. Its primary revenue source was (and is) its Semiconductor Test segment at 75%. And its roster of customers includes Taiwan Semiconductor Manufacturing (TSM), Qualcomm (QCOM), IBM (IBM), and Apple (AAPL).

While its robotics division represents only a small portion of Teradyne’s revenue, its products are in high demand. And any action from the White House around automation could help the stock. As we mentioned, TER shares shot up 10.3% after the Trump administration’s robotics interest was reported.

Teradyne focuses its robotics efforts on autonomous mobile robots (“AMRs”) and collaborative robots (“cobots”). Its AMRs, built under the company’s Mobile Industrial Robots (“MiR”) name, automate the handling of materials and pallets in factories and warehouses.

Cobots, designed and built by Teradyne’s Universal Robots company, handle repetitive and potentially dangerous tasks such as machine tending, assembly, packaging, processing, and more. Cobots, as their name implies, are designed to work alongside people and make their jobs easier and more efficient.

Teradyne’s robots are exactly the types of innovation that will automate the industrial sector. Because their robots are reasonably priced and can handle a variety of tasks, small- to mid-size American manufacturers can start automating without spending a ton of upfront capital. And that opens the doors to reshoring manufacturing.

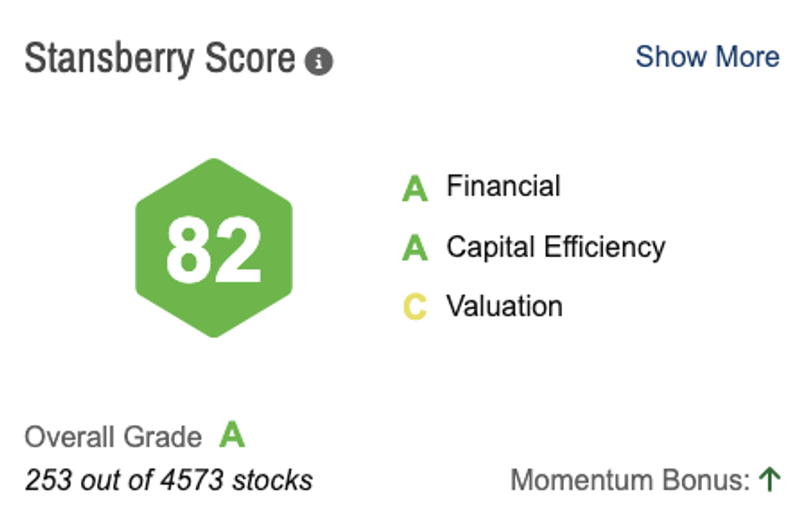

While Teradyne’s stock volatility is high with a five-year 1.85 beta, its overall performance is outstanding. You’ll see in our Stansberry Score that, despite its “C” for valuation, it earns high “A” marks in both financials and capital efficiency. That places it just outside the top 250 stocks out of the 4,600-plus that we follow.

Teradyne has been on a steady upward trajectory, with a 52-week price increase of 71%. And with the Trump administration’s focus on robotics, there’s reason to think it could continue on its path higher.

Why Robotics Could Become a Multi-Year Supertrend

Trump’s robotics push quickly made its way into and out of the news cycle. But the increase in industrial automation and the market’s reaction to it are likely to remain.

We covered the growing labor shortages, which are pushing automation to the brink of permanence in American factories and warehouses. And with that automation should come reshoring, as the investment in robots can make U.S. manufacturing more affordable again.

The efficiency, and subsequent savings, that robots deliver make automation an urgent priority for American manufacturing businesses. Consider…

- Automated storage and retrieval systems (AS/RS) can save up to 85% of storage space, reduce manual labor requirements by two-thirds, and improve pick accuracy to 99%.

- According to Sapio Research’s “Automation for Intralogistics” report, businesses using automation have experienced a 48% improvement in productivity and a 42% reduction in operating costs.

- A McKinsey case study showed that automation at a global consumer packaged goods firm improved productivity by more than 70% in its plant’s processing areas and by nearly 280% in filling and packaging.

The U.S. must accelerate the automation process to accelerate reshoring. We’re already far behind China, which installed around 300,000 new industrial robots in 2024 compared with America’s 34,000. For every new robot added to an American factory, China added nearly nine to its operations.

That’s not going to cut it. And it’s why Trump is focused on adding more robots to the American workforce.

Fortunately for businesses, the cost of robots has fallen into the “reasonable” range. For example, an average cobot costs between $15,000 and $75,000… with its entire system installed, that number is around $40,000 to $150,000. AMRs are in the same area, pricewise. Humanoid robots, however, can run between $100,000 and $1 million.

Simple math will show that the one-time, upfront cost of a robot (along with occasional maintenance and upkeep costs) pales in comparison to paying a full-time employee’s salary and benefits year after year. Factor in that robots are more efficient, less prone to errors, and immune to injury, and it’s a no-brainer for manufacturing businesses to go this route.

Between increased productivity, cost savings, and the growing number of smart warehouses, U.S. manufacturing could be on the verge of a generational boom. And robotics will be the key driver to the next American industrial revolution.

The Bottom Line: Potential Robotics Policy Should Benefit These Three Companies

We covered three robotics players, each with a different focus. And all three are positioned to lead the American push toward automation, especially if President Trump rolls out a national robotics and automation strategy.

- Tesla is the mega-cap of this group, and it stands out thanks to its global brand recognition and focus on humanoid robots.

- Symbotic offers plenty of high-growth potential as a pure-play business specializing in automating warehouse logistics.

- Teradyne will be a key player in American manufacturing reshoring with its focus on industrial automation. And its stock is an outstanding performer, offering investors solid growth prospects with lower risk.

As we go forward into 2026, keep an eye on further announcements from the Trump administration… especially any future executive orders related to robotics. With this news should come more information, such as funding details and regulatory incentives, to help you decide where to invest.

In the meantime, keep these three robotics stocks on your watch list as automation- and AI-related news rolls out.

Regards,

David Engle

P.S. Amazon recently slashed 30,000 jobs, the largest layoff in its history. Former hedge fund manager Whitney Tilson says it’s part of a much bigger shift. One that could reshape how we all work, invest, and build wealth in the years ahead.

He has spent the last decade preparing for this moment… And he just released something that could help everyday Americans get ahead.

Click here to learn more about this market move while there’s still time.