OpenAI is one of the market’s most hotly anticipated initial public offerings (“IPOs”), but will the company behind ChatGPT go public in 2026?

CEO Sam Altman has acknowledged that possibility:

I think it’s fair to say [a public offering] is the most likely path for us, given the capital needs that we’ll have.

There’s no shortage of interest among investors in an OpenAI IPO. Investors want to be able to invest directly in an artificial-intelligence (“AI”) company instead of indirectly through Microsoft (MSFT), which owns a 27% interest in OpenAI, or in “picks and shovels” plays such as Nvidia (NVDA).

At least one AI rival is already exploring an IPO. As the company behind the Claude chatbot, Anthropic may have a real chance at becoming one of 2026’s hottest IPOs.

While Anthropic at current valuations would be one of the largest IPOs ever, an OpenAI IPO would likely be even bigger, at least judging by its pre-market valuation. Its valuation hit $500 billion in October when the company disclosed a secondary sale of shares at that price tag. And OpenAI has been aiming higher in a potential future cash raise.

The vital issue for OpenAI, as is the case with many hot pre-market companies, is cash flow. Investors need to see that the company can eventually generate cash, or the IPO will ultimately fizzle out.

This goal doesn’t mean that OpenAI must be profitable when it goes public. Many companies have spent years in the public markets before turning a profit. Tesla (TSLA), for instance, went public in 2010. But it wasn’t until 2020 that the company turned in a full-year profit .

So, no, OpenAI does not need to be profitable right away. But the company must have a clear path to profitability in a relatively short time frame, say two or three years. That’s because OpenAI is generating billions and billions in losses.

So where do the chances for an OpenAI IPO stand now? And how much would the OpenAI IPO be valued at?

Before an OpenAI IPO, Watch Its Cash Flow

There’s just no way to sugarcoat this: OpenAI is hemorrhaging cash like no other pre-market company before it. Even by its own admission, it’s burning billions and will burn billions more.

Here are some key years and their projected earnings or losses:

- 2026: A loss of $14 billion

- 2028: A loss of $74 billion

- Through 2029: A loss of $115 billion

- 2030s: Profit

Investors tolerated Tesla’s unprofitability for a decade because revenue trended up each year, and earnings losses were relatively mild. Prior to 2020, Tesla’s largest annual net income loss was $1.96 billion . The other unprofitable years were typically a few hundred million. That’s tame compared with OpenAI.

These next few years may see losses swell to more than $200 billion cumulatively, if the company’s projections are correct. That’s a moving target for how much investors would need to pump into the company over that time span to keep OpenAI afloat.

The company is taking action in early 2026 to raise $100 billion to help fill the funding gap (more below). Of course, more funding gives it more time to move toward breakeven.

In late 2025, Altman touted the company’s $1.4 trillion in deals over an eight-year period. This figure could easily rise… and take projected losses with it.

Potentially more problematic, future costs may be rising more than expected. Firms deploying AI are now moving from the training stage – where they build the models – to the inference stage – where they run them. Many had been projecting lower costs as this transition took place.

But according to some reports, inference costs are running even higher than training costs. If so, higher costs could push back the breakeven point.

Because of these various issues and the uncertain economics, the situation is muddy. So, it’s important to carefully watch cash flow to see how fast OpenAI is approaching breakeven.

When Is OpenAI Going Public… Or Will It Ever?

Some investors may be expecting an OpenAI IPO sometime in 2026. But there’s another possibility that’s worth considering – OpenAI could skip an IPO… for years.

Decades ago, companies went public to raise additional funds to continue their growth journey. It was the only realistic option. Funding in the private market just wasn’t sufficient. But that’s no longer a problem.

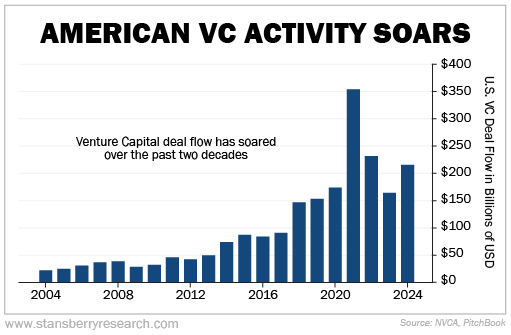

Data from the National Venture Capital Association tells the story. From around $22 billion in 2004, venture capital deal flow soared as high as $365 billion in 2021. And although those levels have come down, venture capital activity is still measured in the hundreds of billions of dollars each year.

Put simply, there is a flood of private capital for promising companies out there. And OpenAI has already demonstrated it can raise capital directly from large tech firms like Microsoft. The only question is if it will be enough for OpenAI’s ambitious goals.

Also, as a private company, OpenAI isn’t required to make regular disclosures. And its private investors would have an eventual IPO payday to look forward to. But as a public company, the conversation pivots to one question: When will you be profitable?

Given the uncertain path towards breakeven, OpenAI may not be ready to have that conversation. So, don’t be surprised if this blockbuster IPO is pushed back yet again.

In contrast, Anthropic is targeting breakeven by 2028, making a 2026 IPO more possible.

What Would an OpenAI IPO Be Valued At?

There’s little question that an OpenAI IPO would be among the most valuable companies to ever go public, if its pre-market valuation is an indication. (SpaceX is aiming for the largest IPO ever.)

OpenAI’s valuation has skyrocketed over the past 16 months based on its fundraising rounds:

- October 2024: Valued at $157 billion

- March 2025: Valued at $300 billion

- October 2025: Valued at $500 billion

In recent months, OpenAI has reportedly been trying to raise another round of cash that could push that valuation as high as $830 billion.

Then, presumably, any IPO valuation only moves up from there.

You’d need to factor in an increase for being public (the liquidity premium). And you might tack on a premium for the furor surrounding the stock when it debuts (i.e., the first-day pop).

If OpenAI gets that higher valuation and AI stocks remain red-hot, it could immediately join the trillion-dollar club. It might even rank among the world’s 10 most valuable companies.

That’s not too many “ifs” to become a reality.

To achieve that $830 billion valuation, OpenAI would need to raise about $100 billion in cash, according to plans it was formulating in December.

That level of cash should give it a good runway, given its extensive cash burn, without needing to tap the markets again so soon. In the recent past, OpenAI has raised cash every six months.

But even a hot property like OpenAI may have difficulty raising that amount of money.

In recent weeks, chipmaker Nvidia has backed off on a September announcement to invest up to $100 billion. Its new investment may be in the tens of billions of dollars, say insiders.

Still, other players may be more than willing to invest big money in OpenAI.

Microsoft is also poised to join a round of fundraising for OpenAI, and the company is likely to target $100 billion-plus in capital expenditures in the year ahead.

Meanwhile, Amazon (AMZN) may invest up to $50 billion, according to Reuters. Amazon recently announced that it’s planning an eye-popping $200 billion in capital expenditures in 2026 to accelerate its AI build-out.

OpenAI may also turn to sovereign-wealth funds to bridge the gap with its ambitious funding goal.

But whether OpenAI turns to private investors or public ones, all investors will eventually need to see a real path to profitability for the funding to continue. That’s the thing to keep an eye on.

Regards,

James Royal

Editor’s Note: It’s no secret that artificial intelligence is gobbling up energy at an unprecedented rate… straining America’s already vulnerable power grid.

All the big players are racing to find a new way to meet AI’s power-hungry daily demands, pouring in billions of dollars for alternative energy sources.

Regular folks can still get in on this tech, too – but time is running out.

Because Amazon may have just cracked the code.

This breakthrough technology is being hailed as “the Holy Grail of Power,” and Amazon just went all-in on it…

Get the details right here, including how to prepare and what to buy.