On January 17, Micron Technology (MU) announced an agreement to buy a fabrication site from Powerchip Semiconductor Manufacturing Corporation (“PSMC”) in Taiwan.

The acquisition made headlines not only for its $1.8 billion price tag, but also because of what it means for Micron – as well as the AI industry as a whole…

Demand for AI memory chips has reached unprecedented levels, despite some signs of AI fatigue. And it’s giving chipmakers like Micron a historic opportunity.

Let’s dig into how this fab-site acquisition impacts Micron, the AI sector, and investors.

Details of the Micron-PSMC Deal

Micron wants this deal to help it produce more dynamic random access memory (“DRAM”) and high-bandwidth memory (“HBM”).

DRAM is a type of memory used for typical computing. It’s slower, but more compact and less expensive. HBM, meanwhile, is essential for AI training, data centers, and more… But importantly, these chips are made by stacking DRAM vertically to get higher bandwidth while using less power.

That’s why this acquisition is so important to Micron. Both types of memory are in short supply today. And both are important to the AI boom.

The PSMC fabrication site – situated in Tongluo, Taiwan – will give Micron a massive 300,000-square-foot fab cleanroom to produce its semiconductors.

Once the deal closes in the second half of 2026, Micron plans to ramp up both its DRAM and HBM production. It expects “meaningful” DRAM wafer output by the second half of 2027.

Micron also has another $100 billion fab site that just broke ground in Onondaga County, New York. Micron has said that this will be the largest semiconductor facility in the U.S.

These new fab sites will help the company grow – by meeting the soaring demand for memory chips in AI cloud infrastructure…

The Growing Memory Demand for AI Cloud Infrastructure

Micron’s purchase is just the latest example of the market’s love affair with AI. As more AI data centers open around the world, the demand for chips rises with them.

When demand spikes, you get severe supply shortages. That’s Economics 101. And sure enough, supply hasn’t kept up… Many manufacturers have already sold out their 2026 HBM capacity to AI customers.

That, in turn, has sent memory prices soaring.

I covered the impact of HBM back in November 2025, writing…

HBM chips are so in demand that Micron, SK Hynix, and Samsung’s HBM capacity sold out through the rest of 2025 and into 2026. That sort of demand means one thing – pricing power. Those simple supply-and-demand economics make HBM manufacturers a very intriguing play for investors.

In short, the world needs more memory. The companies that sell it are in a powerful position. That means we should continue to see higher memory prices.

Just as one example, the current memory demand has resulted in a significant price increase for Samsung’s 2026 contracts. The company is reporting percentage increases in the high teens to low 20s.

This is addressing an urgent need across the AI industry. To see just how pressing this is, let’s dig deeper into the supply setup…

The Impact of Micron’s Fab-Site Purchase on the AI Industry

Micron’s acquisition stands to impact the entire AI market. PSMC’s fab in Taiwan will help the company speed up production of both HBM and DRAM.

Fixing that production bottleneck will benefit the hyperscalers and companies focused on AI infrastructure… such as Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), and Meta Platforms (META).

Again, these companies are facing a huge supply shortage. It’s so severe that it’s cannibalizing the consumer-electronics space…

Computers, smartphones, gaming consoles, and tablets all require DRAM. The companies that make everyday tech products are seeing rising costs for a dwindling supply of memory… And that means customers will end up footing some of the bill.

EE Times reports that consumers are likely to pay higher prices for electronics this year (up to 10% more for smartphones and up to 20% for PCs).

There’s only so much memory and components to go around. Every HBM takes three times more wafers than conventional DRAM to manufacture.

So the memory makers are doing what makes sense for their businesses… They’re focusing on building DRAM components for the high-value and high-margin HBM market. After all, hyperscaler customers will pay top dollar to power their AI data centers.

In other words, this AI supercycle has prompted Micron and its competitors to prioritize HBM for AI data centers over the standard DRAM for consumers. Micron even made headlines at the end of 2025 for announcing that exact shift publicly… winding down its consumer-focused business in favor of AI.

That’s one reason why Micron’s purchase of the PSMC fab site is so important to the entire AI industry. The company can now increase its total DRAM output by up to 15% by 2027 to help meet the AI-fueled demand.

All the same, these price increases could be sticky. Companies like Micron are tackling the supply crunch… But if demand remains high, the situation may take time to resolve.

What the PSMC Fab Site Means for Micron

Chip and semiconductor production doesn’t happen overnight. It could be another year – probably more – before memory-chip production can meet demand.

The PSMC site purchase will help, though. And in the meantime, it will bring in revenue for Micron.

Between Micron’s new fab facility in New York and its newly purchased complex in Taiwan, the company is aiming to heavily increase memory production. And instead of waiting for another facility to be built from scratch (like the one in New York), the Taiwan plant gives Micron a fully equipped cleanroom that’s ready to produce.

Importantly, this also signals a change in strategy for the company…

For decades, Micron operated under a “technology for capacity” model. Essentially, Micron used to partner with other manufacturers (generally in China or Taiwan), giving them the processes they needed to make advanced DRAM technology. PSMC was one of the manufacturing partners that built memory chips for Micron under this model.

In return, Micron could manufacture products at high volumes – without having to build the chips itself. The company saved money by avoiding big capital expenditures (“capex”).

Now, though, Micron is pivoting to owning its own fabs. It hasn’t said why, but we can speculate. For one thing, owning fab sites allows Micron to control its innovative process technology.

For another, DRAM technology has evolved over time. The company may feel that modern fabrications are simply too complex and expensive to put in the hands of its business partners.

Regardless, the purchase of the PSMC fab site has, more or less, ended Micron’s technology-for-capacity business strategy… But it has also allowed Micron to take control of its own supply chain. And the company has locked in a domestic supply source with its fab site in New York. That’s a useful cushion against global uncertainty.

Micron Stock Has Investors Intrigued… Here’s What You Should Know

The news of the PSMC fab-site acquisition helped boost shares of Micron. The stock has spiked roughly 10% since the announcement.

But this company has been performing well for some time. As of Friday, January 22, Micron was up 39% since the start of the new year. And it has skyrocketed more than 500% from its low in April 2025.

This shouldn’t surprise investors. Micron’s 2025 fiscal year was incredibly strong. It reported nearly $37.4 billion in revenue. For comparison, Micron’s 2024 fiscal-year revenue was around $25.1 billion.

Even more impressive, non-GAAP (generally accepted accounting principles) earnings per share for fiscal 2025 were $8.29. That figure obliterated Micron’s fiscal 2024 adjusted earnings per share of $1.30.

Micron’s freight train hasn’t slowed down either. Its first-quarter fiscal 2026 revenue increased 57% year over year to around $13.6 billion.

As with any stock, MU has experienced highs and lows. But Micron has also been one of the top-gaining stocks in the Nasdaq 100 Index and S&P 500 Index for several years.

MU was trading at an adjusted $13.82 per share at the end of 2015. Over the next 10 years, Micron stock exploded by nearly 2,000%.

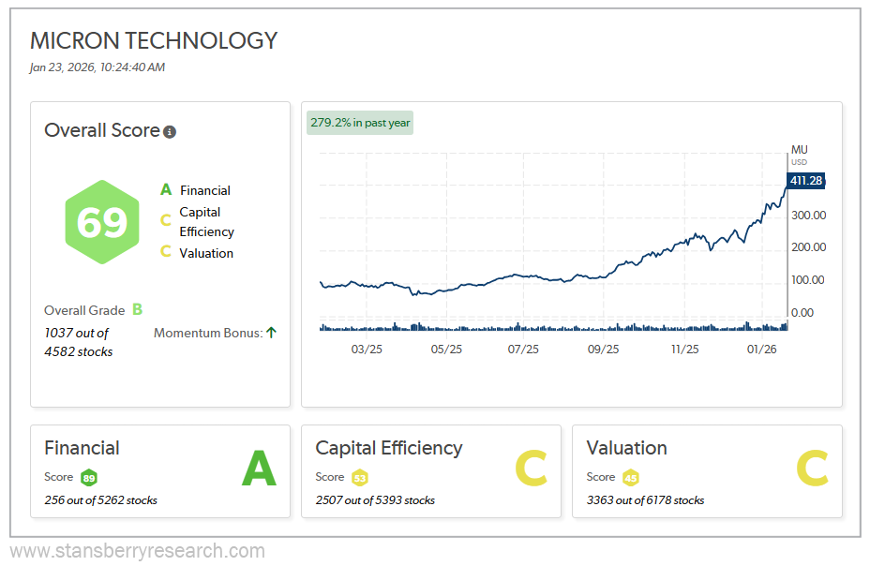

Our Stansberry Score (courtesy of our subsidiary Stansberry Research) monitors and measures stocks and their long-term potential. MU earns a solid “B” grade, thanks largely to its impressive financials (“A”) that rank well within the top 300 stocks in that category.

While Micron’s capex and valuation grade out as average (“C”), it has a Momentum Bonus at its back thanks to the recent rally. And the company has already soared nearly 300 spots in the overall rankings since November 2025.

After its impressive rise, this stock certainly isn’t cheap. But to say that Micron is a beneficiary of the overwhelming demand for memory chips is an understatement. Its stock performance over the past year – and even the past 10 years – is proof of that.

Now, with an operational fab cleanroom ready to accelerate DRAM production, Micron is poised to not only catch up to, but possibly pass, its main competitors – Samsung and SK Hynix.

Bottom Line: Investors Are Bullish on Micron

We’ve all seen how volatile AI-related stocks can be. It just goes with the territory for technology… especially newer tech.

That said, Micron’s ascent is unlike many we’ve watched. It’s nearly unprecedented in the memory industry. That bodes well for Micron right now, which is why analysts and investors are bullish on MU.

The caveat, of course, is this: Will the AI-driven demand for memory eventually wane? Probably, at some point. That’s just the cycle of technology.

But the demand likely won’t fade anytime soon. And, especially as Micron ramps up its memory production later this year, that makes MU an intriguing stock to monitor.

Good investing,

David Engle

Editor’s Note: A former hedge-fund manager known for spotting early winners is sharing an urgent announcement…

He called Netflix (NFLX) at $7.78 per share (up 4,200% since)… Apple (AAPL) at $0.35 per share (up 20,000%)… and Amazon (AMZN) at a split-adjusted $2.41 per share (up 3,200%).

Now, this renowned investor just released a list of his favorite AI stocks… and not a single Magnificent Seven name made the cut.

Instead, an AI stock you’ve likely never heard of was just flagged as “near perfect” in his new investment-scoring system.

Click here to watch his brand-new presentation, where he reveals the name, ticker symbol, and why this could be the smartest AI move of the year… especially if you’re over 50.