Today’s issue in preview:

- You don’t follow this industry, but it could rise more than 100%

- Soaring power demand is poised to push these stocks higher

- The space trade is generating big winners. Are you profiting?

You don’t follow this industry, but it could rise more than 100%

Last year was extraordinary for investors in critical resources. Lithium miners advanced 59%. Uranium advanced climbed 59%. Copper miners advanced 88%. Gold miners advanced 152%. And silver miners took the gold medal by advancing 162%.

Trends tend to persist, and winners tend to keep on winning, so critical resources will continue to perform well in 2026. I bet big on the sector in 2025, and I’m betting big in 2026.

Given that the “trend tailwinds” are blowing heavily in favor of critical resources, I’ve been looking for markets outside of the ones mentioned above. Are there any “off-the-radar” resource trends that could join the resource boom in 2026?

Nickel mining is a good candidate.

Nickel lacks the broad appeal of gold. People aren’t going to tune into documentaries or podcasts about nickel mining.

However, nickel is a key ingredient of our modern economy. The bulk of annual nickel production is used to make corrosion and rust-resistant stainless steel, which is used in buildings, bridges, appliances, tanks, and pipes.

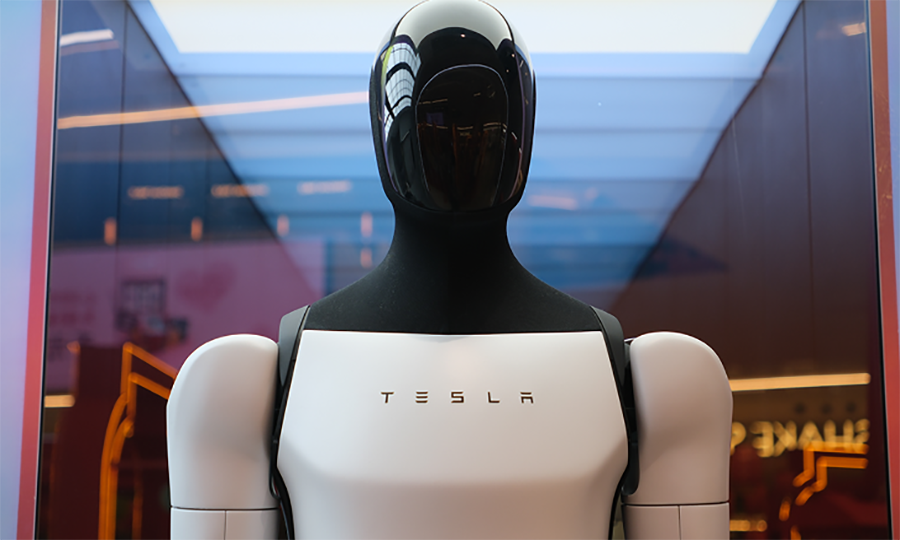

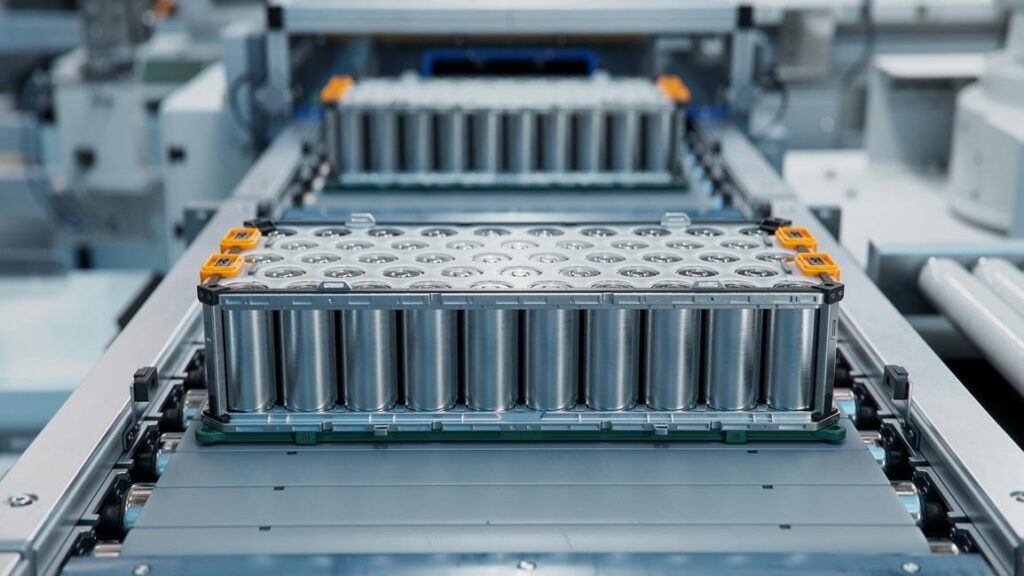

But nickel is also a tech play. It’s a major ingredient in batteries that power cars and electronic devices. As we’ve covered recently, high-tech batteries are a good “ripple effect” way to invest in EVs, AI, and robotics.

Many of the AI-powered robots coming our way over the next decade require high-tech batteries. The International Renewable Energy Agency reports that nickel demand for electric vehicle batteries could triple by 2030.

The nickel market has been mired in a long-term bear market. Although consumption is rising, so is supply. But some industry insiders believe the oversupply issues are about to end. Things could go from “terrible” to “less terrible” in the beaten-up nickel mining industry. That’s when big returns are possible.

Rather than dig into individual nickel miners, I’m inclined to go with the easy “one click and you’re in” vehicle called the Sprott Nickel Miners ETF (NIKL). It holds a basket of leading nickel miners.

As you can see in the chart below, NIKL had a rough first half of 2025. Since then, it has entered an uptrend and recently broke out to a new 1-year high. Given the tailwinds blowing behind critical resources, I like the idea of owning out-of-favor nickel miners. The upside here is 100%+.

Nickel miners break out to a 1-year high

Soaring power demand is poised to push these stocks higher

Last year, solar energy stocks were some of my biggest winners.

In our September 23 issue, I made the case for being bullish on this theme:

The power consumption theme is one of the AI megatrends’ largest and most profitable facets. Industry experts believe solar energy can’t compete with nuclear and fossil fuels to supply enormous amounts of “always on, always there” baseload power needed for AI data centers.

However, inexpensive and easily installed solar systems can supply smaller individual power consumers, such as homes, offices, stores, and small factories. This means demand for solar power is increasing because AI is driving up the price of other forms of electricity.

Right after we published our bullish note, solar stocks – as tracked by the Invesco Solar ETF (TAN) took off like a rocket, climbing 20% in under two months. Since then, TAN has corrected and digested its gains.

As you can see in the chart below, TAN has begun trading near the upper part of its sideways consolidation. TAN will likely clear this consolidation soon and reach new highs.

The solar theme is poised to reach new highs

The space trade is generating big winners. Are you profiting?

Over the past month, space industry leader Rocket Labs (RKLB) has advanced 74% and recently hit an all-time high.

It’s a strong signal that the “space trade” is alive and well.

Did you take our September 22 advice to get in?

On September 22, we put a spotlight on the upside breakout in space stocks and said it’s a sector the “public could go wild for.”

At the time, we stated:

When people think of investing in space, they often go towards the business of launching rockets and Elon Musk’s SpaceX. But many of the most promising “space stocks” are in the business of space-based communication platforms and equipment. Think government surveillance, military communication, GPS, internet service, and cell service.

The best big picture fundamental case for space stocks right now is that the Trump administration believes America is in a hugely important competition with China and other countries for “space dominance.” This means regulatory and financial support for the U.S. space industry.

… Top performing individual space names worth checking out include Rocket Labs (RKLB), BlackSky (BKSY), Planet Labs (PL), and AST SpaceMobile (ASTS).

We “re-highlighted” Rocket Labs on December 15 while discussing the emerging “data centers in space” (aka “orbital compute”) theme.

Given the U.S. government’s strong support for the space industry and its growth potential, we believe this uptrend keeps running.

Market Notes

- The Dow Industrials (DIA) ETF reached a new all-time high today. It’s a bull market.

- The SPDR Health Care ETF (XLV) reached a new all-time high today. It’s an aging Boomer-led bull market in health care.

- Defense giants RTX (RTX) and General Dynamics (GD) reached a new all-time highs today. Our advice to be long defense is paying off.

- Steelmaking giant ArcelorMittal (MT) reached a new all-time high today. This is a bullish economic signal.

- Geothermal energy giant Ormat (ORA) reached an all-time high today. The bull market in all forms of electric power continues.