Today’s issue in preview:

- BULLISH: A critically important group of stocks just soared to an all-time high

- A unique way to invest in the space megatrend

- AI goes to the farm: How to invest in an agricultural revolution

- Full speed ahead: bullish economic signals from steelmaking, engine making, and heavy truck making.

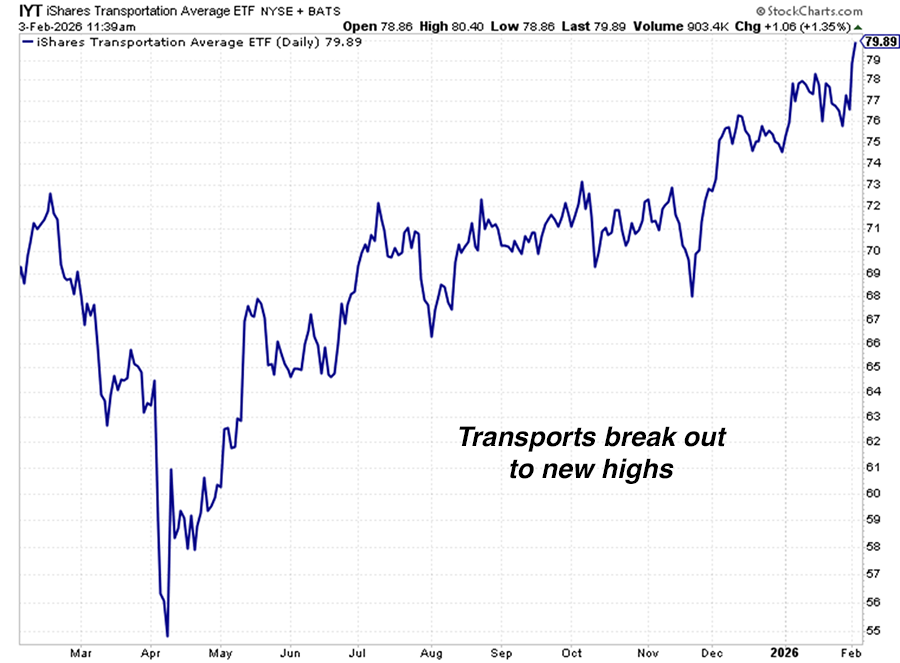

BULLISH: A critically important group of stocks just soared to an all-time high

Planes, trains, and automobiles are delivering good news today. Transport stocks are lighting up the Trend Leaderboard.

Over the past year, I’ve frequently cited the rising values of heavy equipment maker Caterpillar (CAT), engine maker Cummins (CMI), U.S. manufacturing stocks, and steelmakers as evidence that the U.S. economy is doing much better than apocalyptic forecasters would have you believe.

If the most important businesses operating in the most critical parts of the U.S. economy are doing well, then things can’t be all that bad in America.

With this in mind, let’s look at another critical industry that serves as a “real-world indicator” of American economic health: The transportation industry.

The iShares US Transportation ETF (IYT) is the market’s largest transportation-focused ETF. It owns a variety of companies involved in trucking, shipping, air travel, railroads, and transportation logistics. Major holdings include UPS (UPS), FedEx (FDX), Delta Air (DAL), Union Pacific (UNP), Norfolk Southern (NSC), and J.B. Hunt (JBHT).

Virtually every piece of clothing, every piece of furniture, every morsel of food, every appliance, every device, every building material, every tool, and every household good purchased in America is shipped multiple times on the way to its end user.

This means it’s fair to say IYT and its constituents are “highly economically sensitive.” The components of IYT do well when America is making things, buying things, and transporting things. They serve as the economy’s circulatory system.

The chart below shows IYT’s price action over the past 2 years. As you can see, IYT is in a long-term uptrend. Shares recently rallied to all-time highs. This is the market telling us the U.S. economy is doing a lot better than mainstream headlines would have you believe. Position yourself accordingly!

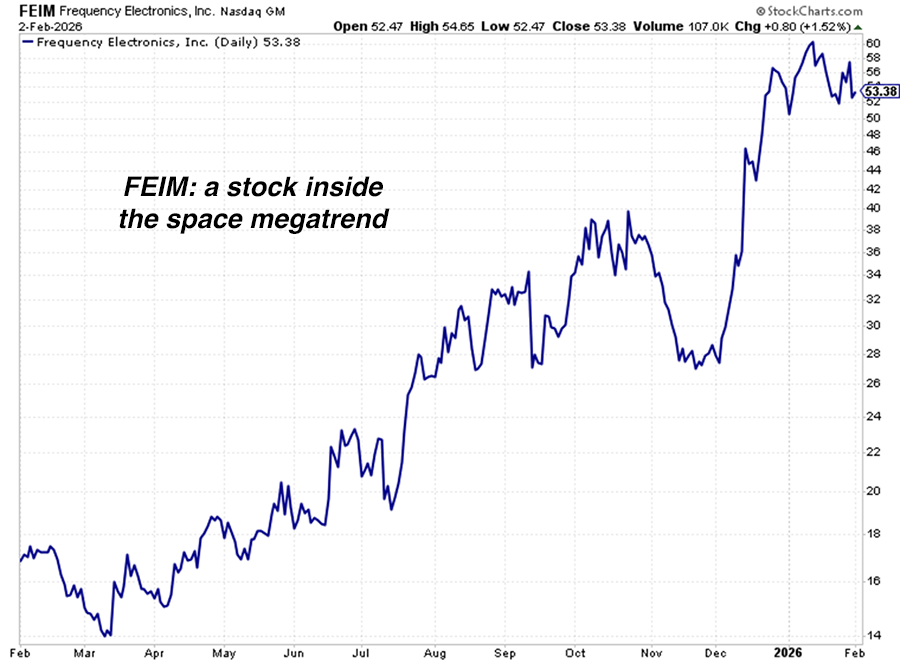

A unique, under-the-radar way to invest in the space megatrend

Over the past year, I have urged investors to be long both the space and high-tech defense themes.

These have turned out to be profitable bets. Defense giant Lockheed Martin (LMT) is up 41% over the past year. Drone company Kratos (KTOS) is up 188% over the past year. Rocket launch firm Rocket Labs (RKLB) is up 155% over the past year.

These gains are driven by a global push to make militaries more high-tech… and often leverage space-based satellites for surveillance and communication.

Governments and companies like SpaceX are launching thousands of satellites for global internet, connectivity, Earth monitoring, and military operations. It’s no longer a game of launching solo bus-sized satellites that take years to build. It’s about building a mesh/swarm of thousands of constellations in space that all work together.

From a defense perspective, a big network of satellites becomes virtually impossible to destroy. If one satellite goes down, it can be replaced quickly.

But a big satellite network requires a conductor. And in satellites, this conductor is an extremely accurate timekeeper called an atomic clock. These atomic clocks count the natural vibrations of atoms at exactly 9,192,631,770 oscillations per second, meaning they can stay accurate to the second over millions of years. They are truly incredible technological marvels.

But why is that timekeeping accuracy necessary?

In space, tiny timing errors cause huge problems. A one-nanosecond error in GPS timing (that’s a billionth of a second) leads to a 30cm positioning error on Earth. These minor errors can lead to communication failures, satellite crashes, mission failures, and so on.

Ultimately, a vast network of satellites is only effective if the atomic clock continues to timekeep at 9,192,631,770 oscillations per second.

Manufacturing these clocks is extremely difficult. It relies on highly precise physics that traps atoms in a vacuum. Remember these clocks must:

- Be highly precise

- Survive radiation, the violent vibration of a rocket, extreme temperatures, and be extremely light.

That’s a very tough bill to fill. One of the key players addressing this bottleneck is a small $500M US-based company called Frequency Electronics (FEIM). Around 80% of its revenue comes from space contracts, making this one of the purest plays on this subtrend inside the broader space megatrend.

That means a multi-trillion space buildout is highly reliant on a $500M clock company. It’s no wonder the stock is in a strong uptrend and near all-time highs.

As blazing technological progress rapidly creates huge new industries and demand spikes in all kinds of resources and manufactured products, expect to see more profitable sub-themes like atomic clocks

AI goes to the farm: How to invest in an agricultural revolution

It’s a bull market in “precision farming.”

As evidence, I present you the new all-time high in Deere & Company (DE), aka John Deere.

John Deere is America’s largest manufacturer of agricultural tractors and farm machinery. The company’s unique shade of green is a common sight in fields and farms across the country.

John Deere isn’t your typical 189-year-old stodgy manufacturing company, however. Bulls on the stock say it’s an AI company dressed as a tractor company.

Deere is often cited as one of the best ways to play the boom in big data analytics and AI because it has invested heavily in building its “precision farming” expertise and product suite. This includes data analytics and machine sensory technology that allow farmers to precisely place seeds, apply fertilizer, and spray crops with pesticides… all of which help reduce farming costs and improve crop yields. Deere is also rolling out autonomous operating features, which essentially turn tractors into farm robots.

Deere’s investment in technology and its massive manufacturing capacity give it a significant competitive advantage over its competitors. They have also helped Deere stock appreciate by 93% in value over the past five years, and it recently broke out to a new all-time high.

Deere is an excellent demonstration that when you have a megatrend as big and broad as AI or robotics, there are always many ways to benefit from it. Even a 189-year-old manufacturing company can adopt the technology and benefit from it. Deere’s total addressable market for precision farming around the world is gigantic, so I bet this uptrend continues for a long time.

Market Notes

- Our longstanding recommendation to invest in the “Boomer health care” theme continues to pay off. Health care giants Johnson & Johnson (JNJ) and Merck (MRK) reached new all-time highs today.

- Optics giants Ciena (CIEN), Lumentum (LITE), and Viavi (VIAV) hit new one-year highs today. These firms benefit from the AI infrastructure boom.

- Our recommendation to own South American stocks continues to pay off. The iShares Latin America 40 ETF (ILM) reached a new one-year high today.

- U.S. manufacturing giant Honeywell (HON) reached a new all-time high today. This is a bullish economic signal.

- Heavy truck component manufacturing giant PACCAR (PCAR) reached an all-time high today. This is another bullish economic signal.

- High-horsepower engine maker Cummins (CMI) reached an all-time high today. This is another bullish economic signal.

- Steelmaking giant ArcelorMittal (MT) reached an all-time high today. This is another bullish economic signal.

- Construction aggregate giant Vulcan Materials (VMC) reached an all-time high today. This is another bullish economic signal.

- The downtrend in software stocks continues. Software giants Adobe (ADBE), ServiceNow (NOW), Salesforce (CRM), Workday (WDAY), Atlassian (TEAM), Intuit (INTU), HubSpot (HUB), Trade Desk (TTD), and Docusign (DOCU) reached new 52-week lows today.

Regards,

Brian Hunt

Editor, Money & Megatrends