Today’s issue in preview:

-

AI is creating huge winners and losers at a breakneck pace. Here’s how to stay on the winning side.

-

This bet on AI power consumption is poised to run higher. How to invest

-

We nailed the homebuilding trade… why it’s likely going higher

-

Our recommendation to own oil stocks, robotics, and Boomer health care continues to pay off

AI is creating huge winners and losers at a breakneck pace. Here’s how to stay on the winning side.

As another week goes by, the AI megatrend tears the stock market in two parts.

If a company makes something AI cannot, it’s probably in the good part.

If a company makes something AI can, it’s probably in the bad part.

Being on the wrong side of this megatrend is like being on the wrong side of a tidal wave.

Over the past four months, businesses in a broad category I’ve called KIDS work have suffered historic declines in market values. KIDS is my acronym for Knowledge work, Information collection & analysis, Data collection & analysis and Software.

Generally, these businesses sell digital products and services. We’re talking consulting firms. Credit rating agencies. Financial data providers. Software firms. You can’t stub your toe on what they sell.

These companies sell products and services that AI programs could produce for very low cost soon. If someone using AI can code a product or service into existence, then any business related to it is in danger.

AI will put some of these KIDS work companies out of business. But keep in mind, it doesn’t have to put them out of business to make them stock market losers. AI only needs to lower the cost of producing what they produce over the long run. This will throw a heavy wet blanket on their growth rates, profit margins, and P/E multiples. So, let’s say the KIDS category is probably on the bad side of AI.

The good side of the AI-driven “K-shaped stock market” contains companies that produce things you can stub your toe on. Bulldozer engines. Industrial water pumps. Refined copper. Welding machines. Power line cables. Things AI cannot code or prompt into existence. These industries are booming. Investments in them are soaring in value and many reached fresh all-time highs this week.

Over the past six months, I’ve cited the exceptional strength in large manufacturers such as Cummins (CMI, engines) and Caterpillar (CAT, construction equipment) as evidence that this part of the economy is doing very well.

But importantly, a large amount of smaller, lesser known – but absolutely critical – U.S. manufacturers are reporting excellent business results and enjoying soaring share prices.

These companies typically don’t make front-page news. No investment analyst will “go viral” for making a call on these stocks. They operate with little fanfare, providing critical equipment and services the U.S. economy cannot function without. Our factories, vehicles, homes, and cities wouldn’t function without their specialized pumps, cables, motors, filters, valves, gaskets, bearings, and switches. And their businesses are booming.

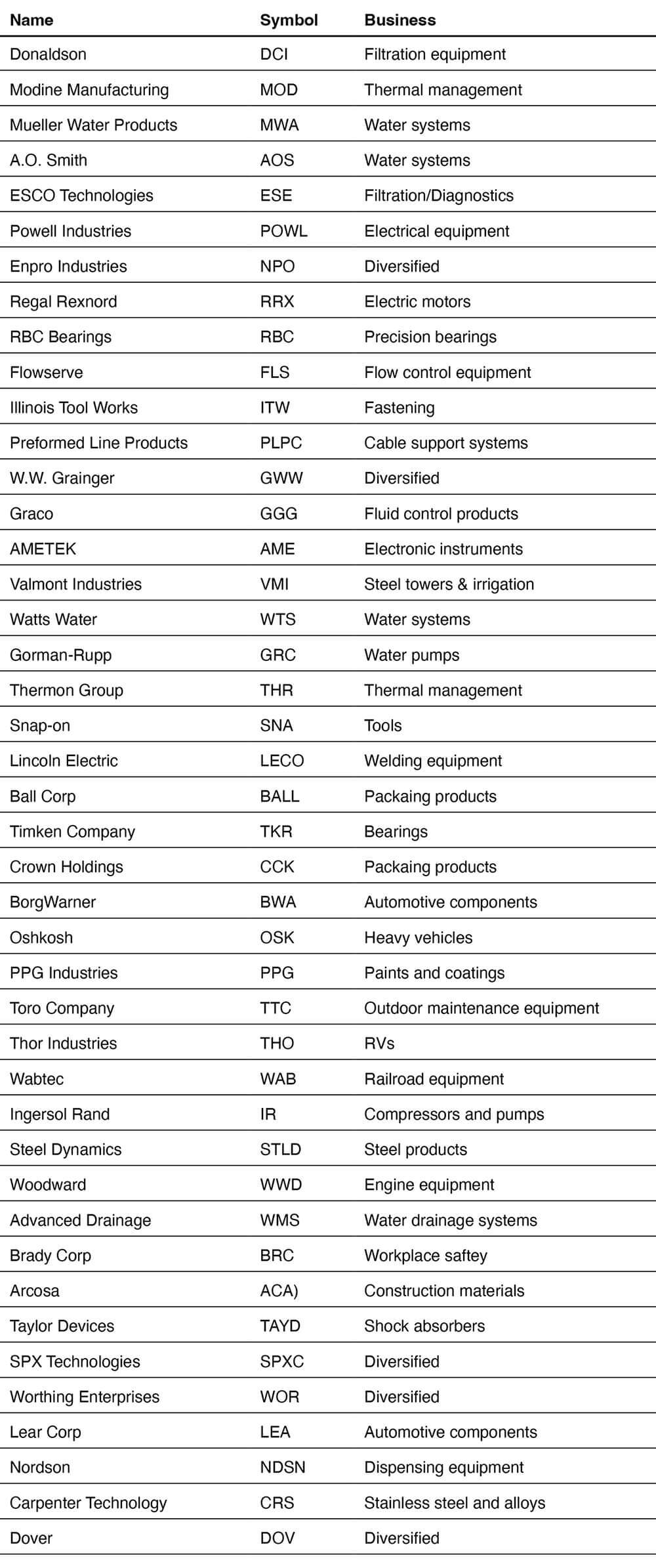

Below is a list of “not well-known” U.S. manufacturers at or near new one-year highs. Forgive the length, but what’s happening is incredible:

You can see that these companies make things you can stub your toe on.

In addition to excellent business conditions, manufacturing stocks are benefiting from K-Shaped money flows. Investors are selling companies vulnerable to AI-driven disruption and buying companies that are not.

The companies listed are not producing glamorous products that excite millions of consumers at the mall, but they have the wonderful quality that you cannot code or prompt any of them into existence. As incredible as AI is, it cannot create an industrial water pump or a bulldozer engine.

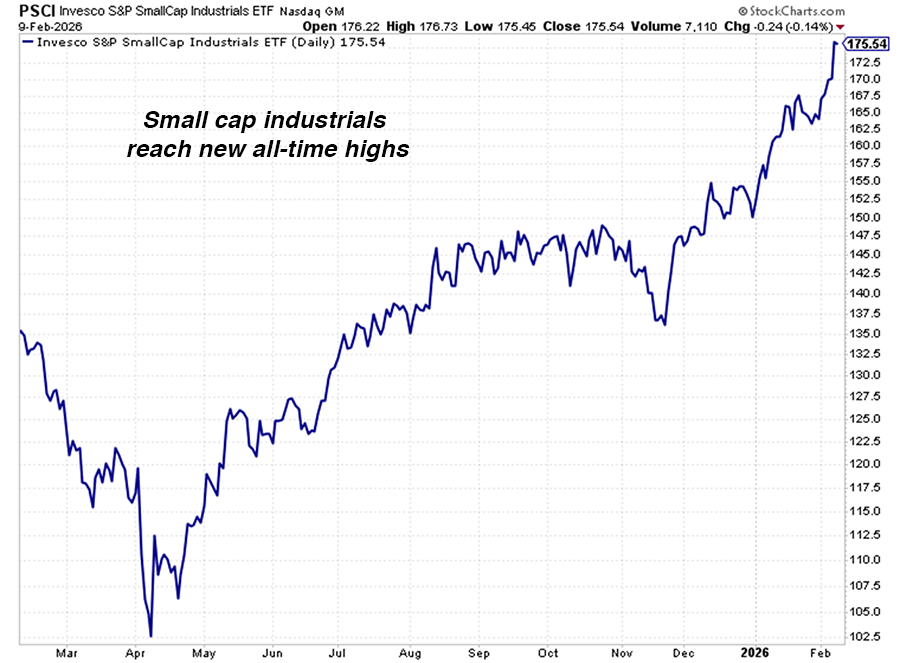

The above factors are why the large-cap industrials ETF – the Industrial Select Sector Fund (XLI) – and the small-cap industrials ETF – the Invesco S&P SmallCap Industrials ETF (PSCI) – are trending higher and near their all-time highs. I expect this trend to continue running. Let’s stay long things you can stub your toe on.

This bet on AI power consumption is poised to run higher. How to invest

Given the situation above, my new favorite stock screener is a simple question: Does the company make something I can stub my toe on?

If the answer is no, I’m likely avoiding it. If the answer is yes, I’m interested.

Few things can pass the “toe test” like 150-foot-tall electrical power line towers and the miles of aluminum power lines that are hung from them. This is one reason the Power Grid Upgrade theme continues to be one of my highest-conviction ideas.

On October 7, I detailed how the world’s largest companies are making the biggest business “bet” in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars per year on data centers, AI chips, and other infrastructure components. Their total investment in this space will run into the trillions.

All that AI infrastructure is poised to consume huge amounts of electricity. Goldman Sachs forecasts global data center power demand will climb 50% by 2027 and as much as 165% by the end of the decade.

This creates a big investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s a giant network of power stations, transmission lines, substations, and underground wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s no Netflix, and your iPhone doesn’t charge.

Industry experts say the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) gave the energy sector a D+ in its 2025 Infrastructure Report Card, citing concerns about rising energy demand, aging infrastructure, and a lack of transmission capacity.

Soaring electricity demand… a grid badly in need of an upgrade… AI supremacy on the line… trillion of dollars of economic output on the line…

This is a recipe for a bull market in companies that build, repair, and upgrade our power grid.

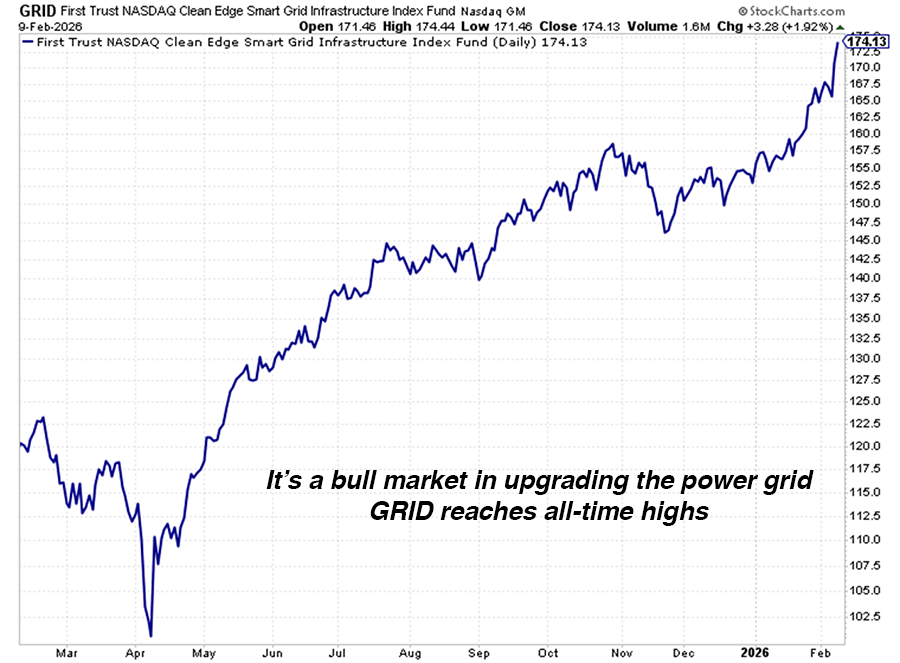

This is a broad theme with individual leaders such as Quanta (PWR), MYR (MYRG), Hubbell (HUBB), Monolithic Power Systems (MPWR), and Eaton (ETN) on the menu. If you prefer ETFs, the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) is an option. It owns a diversified basket of companies that manufacture electric grid components and perform grid-related installation/construction services.

As you can see in the chart below, the market likes the Power Grid Upgrade theme. GRID is up 45% over the past year and just broke out to a new all-time high. This trend is your portfolio’s friend.

We nailed the homebuilding trade… why it’s likely going higher

You can also stub your toe on a new washing machine. This fact makes it a good time to check in on our housing rebound trade. In preview, it’s proving to be a winner.

Back in November 2025 (and again in January) I looked at the beaten up housing sector and figured it was due for a strong rebound in 2026.

In 2025, most housing-related stocks badly lagged the broad market. Some were down more than 25%. This underperformance was driven by two factors:

-A lack of new home supply means most newly built homes are unaffordable to most people.

-Existing home sales have stalled because current homeowners have low mortgage rates they don’t want to lose after selling. This dynamic has “frozen” many housing markets.

This situation brought doom upon the housing trade in 2025. Stocks such as Trex (TREX, decking), Whirlpool (WHR, appliances), Ownings Corning (OC, insulation), JELD-WEN (JELD, doors & windows), Lennox (LII, HVAC), American Woodmark (AMDW), and Builders Firstsource (BLDR, diversified building products) all declined in 2025. The S&P Homebuilders ETF (XHB) was one of the worst-performing funds in 2025.

Home affordability has become a major issue in U.S. politics. A large percentage of young voters can’t afford homes and are upset about it. Home affordability metrics are at all-time extremes, to the negative side.

Trump & Friends know this trend could cost them elections, so I’ve long believed they will make significant efforts to improve the situation, which would be positive for the housing trade.

Another data point of interest is that master investor David Tepper has taken a large position in beaten-up appliance giant Whirlpool. Tepper is a master of timing profitable megatrends. Any time he bets big on an industry, it’s worth noting.

This trade is off to a great start. Since my original note, the two big homebuilder ETFs are up 12.5% and 15.5% respectively… and many housing-related stocks have staged big rallies. Whirlpool, for example, is up 32% and just this week, broke out to a five-month high. The housing rebound trade is a winner so far.

Market Notes

-

Our longstanding recommendation to invest in the robotics theme continues to pay off. The ROBO Global Robotics and Automation Index ETF (ROBO) reached a new all-time high today.

-

The huge levels of AI infrastructure investment continue to drive related stocks higher. Major semiconductor maker Taiwan Semiconductor (TSM) reached another all-time high today. Small-market-cap plays such as ASE Industrial Holding (ASX) and Entegris (ENTG) also reached yearly highs.

-

Optics giant Viavi Solutions (VIAV) hit new one-year highs today. This is in line with the AI Infrastructure build out theme.

-

Our recommendation from September 29th to own oil stocks is paying off. Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) all hit new yearly highs today.

-

Our recommendation to own Boomer health care investments continues to pay off. Drug industry giants Novartis (NVS) and Roivant Sciences (ROIV) hit new all-time highs today.

-

Mega hotel chain operators Marriott (MAR) and Hilton (HIL) reached new all-time highs today. These are bullish economic signals.

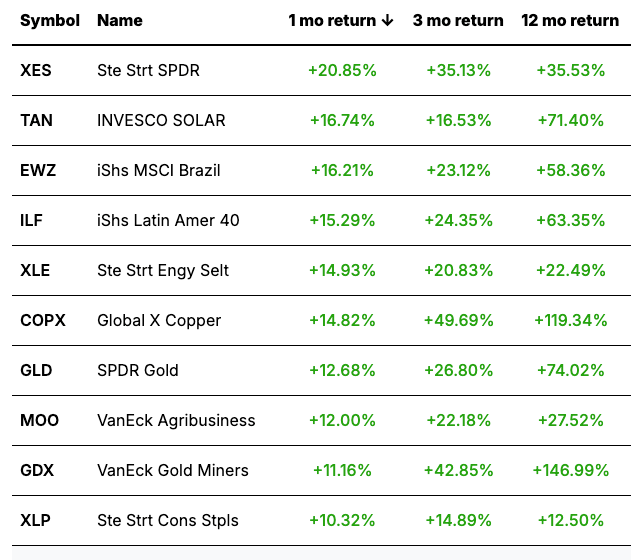

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends