Today’s issue in preview:

-

A bullish market signal is flashing. South American stocks rally as U.S. stocks fall.

-

Lunar Infrastructure is poised to generate massive stock market winners. Two players to watch.

-

How to profit from America’s next building boom

A bullish market signal is flashing. South American stocks rally as U.S. stocks fall.

The broad market suffered a large drop yesterday thanks to President Donald Trump’s fresh round of tariff threats over Greenland. The benchmark S&P 500 stock index fell 2.1%. Some high-profile growth stocks – Nvidia (NVDA), Tesla (TSLA), Oracle (ORCL), and Broadcomm (AVGO) – fell more than 4%.

During times of broad market weakness, I like to look for which stocks, ETFs, and themes are holding steady or advancing. It’s a “stress test.”

If the market drops 3%, you want to see what drops just 1%. If the market drops 2%, you want to see what climbs 1%. That sort of thing. This is often called “relative strength.” It allows you to spot the safer megatrends for investment.

It’s like looking at a beachfront neighborhood after a hurricane. Some homes lost their roofs, and some homes were blown away. But some homes were unbothered by the storm. Those are the strongest homes.

Yesterday’s “stress test” sent a clear message that the uptrend in South American stocks is one of the market’s strongest themes.

The iShares Latin America 40 ETF (ILF) – which is essentially the “S&P 500 of South America,” not only refused to decline yesterday, it climbed 1.2% to reach a new all-time high. It was one of the few stock-focused ETFs to advance yesterday. ETFs focused on Peru and Colombia also advanced to all-time highs.

Back in November, we highlighted how South American stocks were outperforming their more popular North American cousins. Additionally, we pounded the table multiple times last year on owning Brazilian stocks.

Bulls on South America point out how “left-wing, full-blown socialist” Latin American political parties look increasingly to be replaced by “less left-wing, not full-blown socialist” political parties. This should be good for the continent’s stock markets.

Latin American stock markets are also heavily leveraged to critical resource markets, including iron ore, agriculture, copper, and oil. The critical resources boom we’ve been covering is good for “LatAm” stocks.

After the removal of Nicolas Maduro from power in Venezuela, South American markets responded favorably to the idea of the U.S. exerting greater influence and strengthening financial ties on the continent.

Trends tend to persist, and rising markets tend to keep rising, so I still like the idea of owning South America. For now, I’m trading these markets with the thesis that more U.S. involvement in South American politics is good for the region’s stock markets.

To be clear, this is not some grand forecast on my part. This is what the market is telling us. And the market knows a hell of a lot more about Latin American politics than I do.

Fellow South America bulls can consider high-growth names such as “the Amazon of South America,” MercadoLibre (MELI), and fintech dominator Nu Holdings (NU). Or, you can go the diversified route with ILF. As you can see from the one-year chart below, ILF is running. I’m betting it will continue to do so.

Lunar Infrastructure is poised to generate massive stock market winners. Two players to watch.

On Feb. 22, 2024, a spacecraft built by Intuitive Machines (LUNR) touched down near the Moon’s south pole. The spacecraft – called Odysseus – became the first commercial vehicle ever to “soft land” on the lunar surface.

This mission was part of a NASA program called “Commercial Lunar Payload Services,” or CLPS. The program is focused on sending robotic landers and rovers to the Moon… with the goal of eventually building hard infrastructure there.

The hopes for CLPS do not end in the halls of NASA. Investors and stock traders look at CLPS and see the potential for a profitable megatrend: Lunar Infrastructure.

In short, the moon could become a hotspot for military installations, commercial investments, and communications infrastructure. “Cislunar space” – the region of space between the Earth and the Moon – is poised to boom.

There are two main drivers behind this emerging megatrend.

-

Cost: Space launch costs aren’t what they used to be. They’ve plummeted nearly 20x from ~$54,000/kg in the Shuttle era to $2,700/kg today. This has changed the math towards heavy cargo delivery and away from simple one-time exploration.

-

Geopolitics: The Moon is no longer just a destination. It’s becoming an 8th continent that China and the U.S. are fighting over for the “high ground”.

But just like any new area, you cannot settle it without hard infrastructure.

This megatrend’s winners won’t just be the launch providers such as SpaceX and Rocket Labs (RKLB), they will be the companies building landers, communication equipment, and orbital tugs (like tugboats, only in space) needed to land things on the Moon.

We can break Lunar Infrastructure plays into three key areas:

-

Landers: These are the “last mile” delivery trucks. They’re autonomous robotic vehicles designed to take cargo from lunar orbit down to the surface safely.

-

Orbital Tugs: These are the tugboats that operate in the vacuum of space. They attach to satellites or other space vehicles and ferry them from one orbit to the other (Low Earth Orbit to the Moon).

-

Communications: The Moon has no GPS and no cell towers. If a rover drives into a crater or onto the Far Side, it loses line-of-sight with Earth. We need a massive network of relay satellites to beam data back and forth to enable 24/7 operations.

Think of the Moon like you would any undeveloped real estate. The “utilities” must be installed before the broader economy can function. Just as roads and power lines preceded the suburbs, lunar infrastructure must precede lunar commerce.

The potential Lunar Infrastructure market is large, but many of the potential players are small. Estimates from Northern Sky Research and PwC put the cost of this build-out period (2025–2035) at over $25 billion annually, yet the pure-play cislunar stocks in the sector are currently valued at sub-$4 billion. The market hasn’t priced in a boom yet.

The dominant pure players are:

-

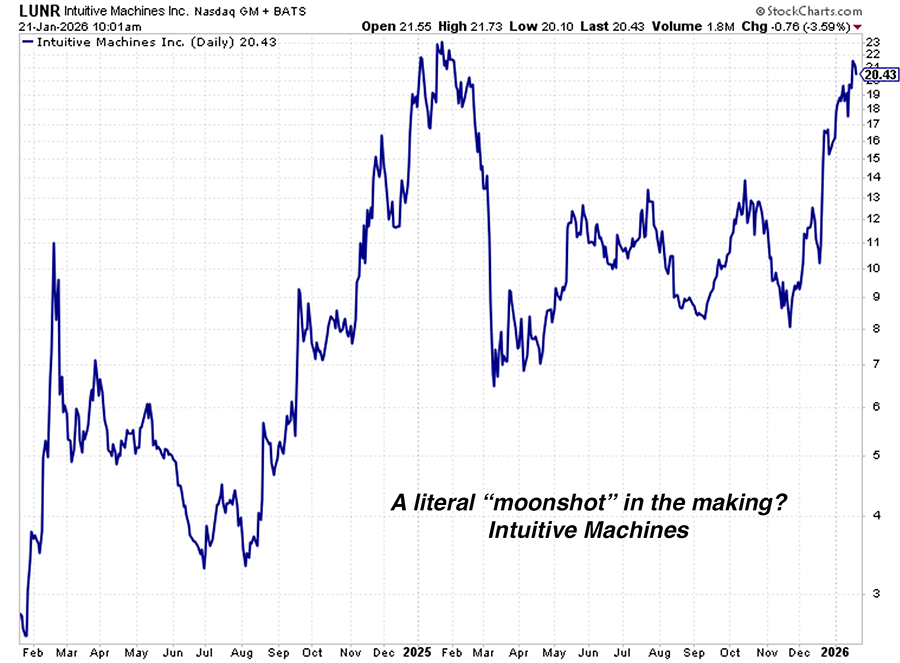

Intuitive Machines (LUNR): This is the only public company with a successful commercial lunar landing. On top of that, it has a huge NASA CLPS contract and a $4.8B communications contract that runs into the 2030s. The stock is only valued at $3.2B today.

-

Redwire (RDW): You cannot land heavy rockets repeatedly on the Moon without paved pads—the dust (regolith) effectively sandblasts the engines and nearby equipment. RDW owns the solution to this through its Mason project, which grades, compacts, and melts lunar soil into solid landing pads. RDW are only a $1.7B company.

When it comes to dominating an undeveloped territory, global powers such as the U.S. and China love to compete and spend money. Space launch costs have plummeted and will continue to fall. This means the race to own the Moon is on… and Lunar Infrastructure stocks are poised to benefit.

How to profit from America’s next building boom

In 2025, one of our most profitable recommendations was owning “critical resource” stocks that would benefit from Trump’s plan to massively increase U.S. manufacturing capacity.

Trump, many business leaders, and many military leaders believe the U.S. has outsourced far too much of its industrial capacity to China over the past 25 years. We outsourced significant portions of our semiconductor, appliance, medicine, weapons, and machinery production. The COVID-19 epidemic showed how depending on other countries for critical economic inputs makes the U.S. less secure.

Trump has staked his legacy and reputation on increasing our industrial base… and he’s working with business leaders to invest trillions to pursue this goal.

This megatrend provided a huge boost to critical resource stocks in 2025. Their output is key to building increased U.S. industrial capacity.

But don’t forget about “smart factory” stocks to invest in a U.S. industrial renaissance….

Any factory competing in today’s economy must be heavily automated. This means a big increase in manufacturing capacity corresponds to a big increase in the use of robotics, AI-powered software, and machine-sensing equipment.

This is good for the companies inside the ProShares Kensho Smart Factories ETF (MAKX). This fund owns a diversified basket of companies that build high-tech factories and the machines inside them. Major holdings include 3D Systems (DDD, 3-D printing), Emerson Electric (EMR, automation equipment), Ouster (OUST, machine sensory equipment), and Cognex (CGNX, machine sensory equipment).

As you can see in the one-year chart below, the market likes the “smart factories” theme. MAKX is up 28% over the past year and is poised to reach new all-time highs. Expect this fund to rise as America “goes big” on industrial capacity.

Market Notes

-

Gold advanced nearly 2% today to reach an all-time high of $4,850. Our recommendation to own gold stocks is paying off. Today’s new highs list is dominated by gold miners such as Agnico-Eagle (AEM), Kinross Gold (KGC), and Newmont Mining (NEM).

-

Uranium mining giant Cameco (CCJ) reached a new all-time high today. Our recommendations to invest in the nuclear energy theme is paying off.

-

Large steelmakers Nucor (NUE) and ArcelorMittal (MT) reached new one-year highs today. These are bullish economic signals.

-

Mega miners Rio Tinto (RIO), Freeport McMoRan (FCX) and Teck Resources (TECK) soared to new all-time highs today. The critical resources bull market we’ve highlighted many times is in full swing.

-

The S&P Oil and Gas Equipment and Services (XES) climbed 3.7% today to reach a new one-year high. The fund has soared 27.5% since our original bullish call in September.

-

The S&P Biotech ETF (XBI) reached a new all-time high today. The fund is up 37% since our original bullish call in September.

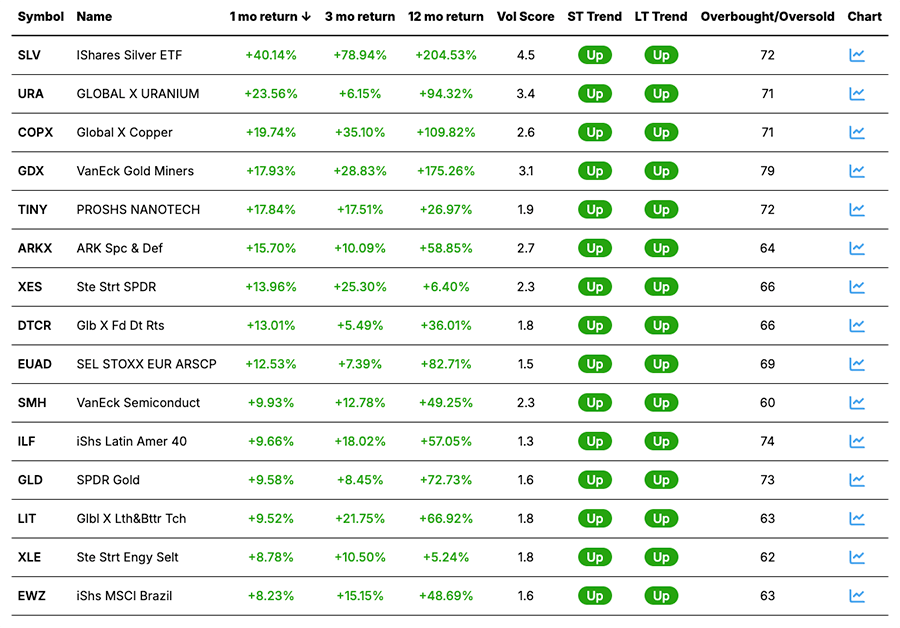

Today’s Trend Leaderboard

Top performing themes and trends over the past month

Regards,

Brian Hunt

Editor, Money & Megatrends