Where would you invest $1,000 today?

It’d be easy in an ideal world. You’d simply pick a stock you know would grow your money with minimal risk. Maybe a blue-chip titan, or a well-established maker of something crucial to everyday life. Or maybe you’d just “buy the market” with an index fund and hope for the best.

But as we step into 2026, the stock market feels more uncertain than ever…

Investor fear is spiking. Recession rumors are swirling. And some of the biggest names on Wall Street are calling for a market drop.

So where should that $1,000 go?

This exact question was posed to 50-year Wall Street veteran Marc Chaikin in a recent discussion. Even the host interviewing him hesitated… a telling sign of how hard this question has become.

But Marc believes that even in a confusing market, there are “right place, right time” stocks that can potentially double your money even as others falter. And he’s built a system that can identify them before the rest of Wall Street piles in.

Table of Contents

What to Know Before Investing $1,000

Before you invest $1,000 into any one stock, you should know three things…

First, average investors almost always underperform…

When markets drop, everyday investors tend to lose more than the market itself.

In 2022, for example, we had a fairly average bear market… At its worst, the market was down 24%. But the average investor was down an incredible 44% amid the worst of the bear market!

And in good times, everyday investors lag behind too.

In 2023, the S&P 500 Index soared about 26%… yet the average investor only made 21%.

Why? Because most folks make emotional decisions, chase hot tips, or hold the wrong stocks at the wrong time.

That underperformance adds up. And being in the wrong stocks, no matter whether the market goes up or down, can cost you dearly.

Second, the good news is that Marc’s “right place, right time” stocks always exist…

No matter how volatile the stock market gets, there are always certain corners of the market that thrive. We’ve seen it repeatedly:

- In the pandemic crash of 2020, “stay-at-home” tech stocks like Zoom Communications (ZM) and Peloton Interactive (PTON) skyrocketed.

- In the 2022 bear market, energy stocks exploded upward even as most stocks sank.

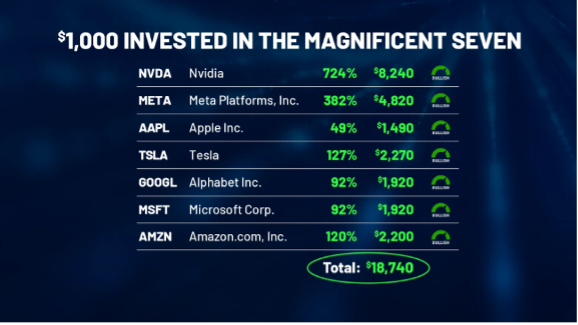

- In 2023, Big Tech stocks known on Wall Street as the “Magnificent Seven” soared because of the artificial-intelligence (“AI”) boom.

Wall Street banks, hedge funds, and billionaires often rotate into these winners early. And if you know where that money is flowing… like the indicators that Marc Chaikin has built for Wall Street… you can hitch a ride on a potential big gainer – even as others panic.

Finally, if you want to avoid the errors of most investors, you have to use a systematic approach to choose which stocks you invest in… and which you avoid.

Marc’s solution for finding these opportunities is his proprietary Power Gauge system, a 20-factor stock rating model built on his 50 years of Wall Street experience.

Marc takes a complex system and makes it super easy to understand. It boils fundamentals, technicals, and money-flow data down into simple ratings: “bullish,” “neutral,” or “bearish.”

A bullish rating can flag a stock likely to outperform, often as institutional money starts pouring in. And a bearish rating warns that a stock could lag or crash.

This system has an impressive track record. In fact, Marc’s system actually flashed bullish in early 2023 on every single stock in the Magnificent Seven that we mentioned earlier…

If you had put your $1,000 into any of these stocks, you would have made almost 50% in the worst case scenario as they ran to new all-time highs. And of course, in the best case with Nvidia (NVDA), you would have made 7X your money.

And right now, it’s more important than ever to have a system like this on your side…

The Big Picture: Investing Isn’t Fair

The market has been a roller coaster over the past few years: AI mania… a pandemic crash… a stunning recovery… inflation nobody saw coming… interest rates whipping up… then coming down.

No wonder folks feel dizzy.

As we head deeper into 2026, the picture isn’t any clearer. Recession talk is back. Volatility is creeping higher. Even some Wall Street CEOs are publicly preparing for things to get worse.

Whatever playbook worked last year… might not work now.

Here’s the frustrating part: this kind of chaos tends to hurt everyday investors the most.

The numbers back it up. In 2022, the S&P 500 dropped about 18%… not fun, but survivable. However, the average person investing in stock funds? They lost 21%. And as we mentioned earlier, during the scariest moments for the market, some portfolios were down more than 40% before clawing back late in the year.

Why the gap? Mostly behavior.

People panic. They sell after stocks have already cratered, then miss the bounce. Or they pile into whatever’s hot right as it peaks. This happens constantly. From 2018 through 2023, typical investors failed to beat the S&P 500 even once.

Not a single year.

Marc Chaikin argues this isn’t bad luck. Instead, it’s structural.

Wall Street has massive advantages: armies of analysts… sophisticated algorithms… the emotional discipline to buy when everyone else is running for the exits. Regular folks? They often end up stuck holding stocks they love that quietly turn toxic.

“When the overall market stumbles,” Marc says, “average investors are almost guaranteed to lose more.”

He points to 2008. The S&P 500 crashed 38% that year. If you were an investor then, you know how brutal it felt. But that figure still hides the even bigger real-world impact on average investors…

Between 2007 and 2011, 1 in 4 American households lost at least 75% of their net worth.

Meanwhile, banks got bailed out. The Treasury pumped roughly nearly $250 billion into more than 700 financial institutions. Wall Street was back to big bonuses in no time.

Marc saw this up close. His wife’s retirement account dropped 50% because of a money manager’s mistakes.

He couldn’t stop Wall Street from taking reckless risks. But maybe he could give regular people better tools to protect themselves. That’s where his Power Gauge system came from. More on that later.

The bigger point is this: 2026 could define your financial future.

Marc thinks we’re entering a rough stretch where many popular stocks will stumble. The S&P 500 doesn’t even need to crash for you to lose serious money. If you’re loaded up on the wrong names, you could watch $1,000 turn into $600 in a few months. As Marc put it in a recent interview:

What was once an easy ride with a clear investing road map has gotten much harder to read.

And I’m worried millions of American investors are about to drive straight off a cliff in 2026, as a result.

They’ll make every money mistake in the book – including missing out on one of the biggest wealth-building opportunities in recent history.

And instead of potentially making money in U.S. stocks over the months to come…

I’m afraid that the average investor is about to lose up to 40% of every $1,000 they invest today.

But there’s another side. Pick the right stocks, and you could actually grow your wealth even if the broad market goes nowhere. (And if you’ve never invested in stocks before, we’ve written How to Invest in Stocks: The Ultimate Beginner’s Guide for you, right here.)

The era of tossing money into an index fund and watching it climb might be on pause. What matters now is knowing which stocks have real potential… and which ones to ditch before they drag you down.

Idea 1: The Costly Trap of the Average Investor

If you’ve been investing for a while now, you’ve probably felt this already.

Maybe after you checked your portfolio during a pullback… and saw that you were down way more than the indexes. Or you bought a stock everyone was talking about, only to see it collapse shortly after.

It happens to almost everyone. We buy high. We sell low. Or we just hold the wrong things at the wrong time. There’s nothing surprising about it… It’s human nature.

The question is, can you afford to invest this way?

Can you afford to potentially lose 20%, 30%, or even 40% of every $1,000 you invest?

For most folks, the answer is no. Absolutely not.

But that’s exactly what happens when you’re not prepared.

Here are three reasons why regular investors keep underperforming… and what you can do to fix it in your own investing…

Top Investor Mistake No. 1: No Exit Strategy

Picking a winner isn’t enough. You have to know when to sell.

A stock that doubled one year can give it all back the next year…

Fiverr (FVRR) is a perfect example. The freelance platform was a COVID-19 darling. Chaikin’s system flagged it as bullish in November 2019, months before the pandemic hit.

And sure enough, the stock soared more than 1,000% in 2020.

Then, the work-from-home wave started fading.

By January 22, 2021, the Power Gauge flipped to bearish… a sell signal. Fiverr went on to drop 90% from its peak.

Imagine riding that rocket up… then all the way back down. A massive gain turns into a crushing loss. It happens constantly to average investors. But it doesn’t have to if you’re watching when the signal turns.

Top Investor Mistake No. 2: Holding Popular Names Too Long

We all have companies we admire. But yesterday’s darlings often become tomorrow’s disasters.

Marc points to The Trade Desk (TTD) as a current example. TTD was a high-flyer during the digital-advertising boom. But his system has rated it bearish for months now… based on both rising competition weighing on its fundamental metrics, as well as weakening technical trends.

His view: No matter what the broader market does, The Trade Desk is likely to struggle in 2026.

It’s a well-known stock. And that’s precisely what makes it dangerous. It’s probably in a lot more average investor portfolios than you might think.

The point isn’t that great companies can’t stumble. It’s that a great company isn’t always a great stock. When objective indicators flash warnings… like slowing growth or heavy insider selling… you have to pay attention.

Top Investor Mistake No. 3: Panic-Selling at the Bottom

Fear is brutal.

When your portfolio is deep in the red, every instinct screams to sell. Stop the bleeding. Get out.

But that usually means selling after the damage is done… and more often than not, missing the eventual rebound.

This pattern shows up in study after study. Regular investors pull money out during bear markets. They only come back once the recovery is already underway.

Look at 2022. By June, the S&P 500 was down around 20%. Many people had seen enough. They sold.

Those who panic-sold locked in losses. Those who held… or even better, who rotated into the right sectors… caught the recovery in the second half of the year.

Marc Chaikin’s advice: Have a plan before things get ugly… After all, it’s why he built his system for average investors.

How Do You Avoid These Top Investor Mistakes?

The key is to watch what Wall Street does. You can usually safely ignore what they say.

During the 2022 bear market, headlines screamed doom. Meanwhile, institutional investors were quietly loading up on energy stocks. In late 2023, commentators warned AI names were overbought. Hedge funds kept accumulating certain tech positions anyway.

To beat the crowd, you can’t be the crowd.

Idea 2: Finding ‘Right Place, Right Time’ Stocks by Following Smart Money

Even in the roughest stock market… someone is winning.

Every year, no matter how ugly things get overall, certain stocks boom. The trick is figuring out which ones before everyone else catches on.

Marc calls these “right place, right time” stocks. These are companies that are positioned in front of a massive tailwind… with money flowing in their direction. If you catch one of these stocks early, the resulting returns can change everything.

Just looking at the past few years, there’s plenty of examples of this…

2020: The Stay-at-Home Explosion

When COVID-19 hit, life changed overnight. Millions of people suddenly worked, shopped, and entertained themselves from home.

A handful of companies were perfectly positioned for that shift: Zoom for meetings… Peloton for fitness… Wayfair (W) for furniture… Etsy (ETSY) for crafts… and PayPal (PYPL) for payments.

The gains were staggering… Zoom nearly tripled. Peloton rose 250%. Wayfair jumped 386%. Etsy gained 259%. PayPal climbed 193%.

Marc’s system flagged all of them in spring 2020. The data showed heavy accumulation, with big investors quietly buying shares as stay-at-home demand exploded. Following those signals meant catching these moves before they became obvious.

And just as important, Marc’s system warned when the party ended. It flipped bearish on many of these names in 2021 before they gave back most of their gains.

2022: Energy Defies the Bear

When inflation surged and interest rates spiked in 2022, it crushed most stocks. The S&P 500 dropped 18%.

But energy had its best year in ages.

Oil and gas companies rode rising commodity prices and post-pandemic demand. While everything else fell apart, the energy sector soared more than 50%.

If you hid out in energy stocks, you didn’t just survive the bear market. You thrived.

Marc’s system started flashing bullish on energy names in late 2021. Occidental Petroleum (OXY) got a bullish rating on January 13, 2022. Months later, Warren Buffett started buying heavily, eventually accumulating 90 million shares. The stock more than doubled.

Some smaller names did even better. Both PBF Energy (PBF) and NexTier Oilfield Solutions climbed more than 200%… while Permian Basin Royalty Trust (PBT) shot up more than 550%.

These returns are even more extraordinary considering 2022 was a year when almost every single investor lost money.

Again, this was the “smart money” on Wall Street rotating into energy… while regular investors were panic-selling everything.

The money-flow indicators showed institutional cash flooding into oil and gas. And the macro setup between inflation and a reopening economy created a massive tailwind.

Classic right place, right time.

2023: AI Takes Over

By 2023, the story shifted again. Investors were obsessed with AI. And a handful of mega-cap tech stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Nvidia, Meta Platforms (META), Amazon (AMZN), and Tesla (TSLA) – earned the moniker the “Magnificent Seven” as they drove most of the market’s gains.

Nvidia was the standout, surging more than 200% on AI hype alone.

The S&P 500 rose 26% that year. But the average investor only captured about 21%. That means they were likely underweight the Magnificent Seven stocks that drove the lion’s share of the market gains.

Marc’s system went bullish on all seven of those names early in 2023, before the big run. If you’d put $1,000 into each when the ratings turned and held through the peaks, you’d have turned $7,000 into roughly $18,740. Compare that to about $8,800 from an S&P 500 index fund.

Smaller AI plays worked too. Vertiv (VRT), a company making power and cooling systems for data centers, became one of 2023’s top performers. The Power Gauge flagged it weeks before billionaire investor Jim Simons bought 2 million shares. And the stock ultimately gained more than 250%.

By following the money and watching fundamental improvements, you could have spotted Vertiv while it was still off Wall Street’s radar.

How to Make Sure You Can Spot These Trends

The commonality between these three time periods is that big money moves in trends.

First, it poured into stay-at-home plays… then energy… then AI and tech.

And if you can figure out where the next wave is heading, you stand to profit.

Marc’s approach centers on something called Chaikin Money Flow. It measures buying pressure versus selling pressure over time. Think of it as an X-ray of what big players on Wall Street are doing behind the scenes.

When a stock’s price isn’t moving much but money flow has been strongly positive for months, it’s a bullish signal.

When a stock looks stable but money flow is deeply negative? That’s a potential trap. Insiders and funds may be heading for the exits.

The Power Gauge incorporates money flow as one of its 20 factors. Every bullish rating has positive flow behind it unless something exceptional is happening. It’s a systematic way to follow the smart money… seeing evidence of institutional buying and getting in before the crowd notices.

To find your own “right place, right time” stock, you’d combine strong fundamentals with strong money flow.

Of course, not every bullish signal becomes a 10-bagger. Not every sector rotation is obvious in real time. That’s where a comprehensive system helps turn a fire hose of data into clear buy or sell decisions.

So with that in mind, take a look at how the Power Gauge actually works…

Idea 3: The Chaikin Power Gauge

When Marc Chaikin set out to help level the playing field between Wall Street and average investors, he knew one indicator wouldn’t cut it.

His Money Flow tool is incredibly useful. But over decades on Wall Street, he watched different experts swear by completely different metrics. Fundamental analysts obsessed over earnings and debt ratios. Quants tracked price momentum. Others watched insider buying or analyst upgrades.

Each person with their own favored tools had their own expertise.

So why not combine the best of everything?

The Chaikin Power Gauge is a 20-factor model that evaluates stocks from every angle…

It breaks “everything” down into four main categories: financial health, earnings performance, technical trends, and expert sentiment. In turn, each category contains five specific factors – the ones Marc found most predictive as far as where a stock is headed next.

Financial factors measure a company’s underlying strength and valuation.

That means free cash flow, debt-to-equity ratios, return on equity, price to sales, and price to book.

The goal is identifying companies that are fundamentally solid… as well as flagging ones that are financially risky.

Earnings factors track profitability trends.

Is earnings growth consistent year over year? How has earnings per share trended over the last 12 months? Has the company beaten or missed estimates? Is the stock cheap or expensive based on forward earnings? Are earnings volatile or steady?

These are all questions an investor should answer, which the Power Gauge does for you. Strong scores here suggest improving profits that the market might reward.

Technical factors gauge price and volume patterns.

Besides Money Flow, there’s price trend versus the 200-day moving average… volume trends… price strength relative to the overall market… and six-month performance versus the S&P 500.

These factors reveal whether a stock has momentum behind it or whether it’s lagging. Positive momentum often signals something good is happening. Persistent weakness can be a red flag.

Expert factors capture what informed insiders are doing.

Is the stock’s industry outperforming or lagging? Are executives buying shares or selling? Is short interest unusually high? Are analysts raising or lowering earnings forecasts? Are they upgrading or downgrading the stock?

Heavy insider buying plus rising analyst estimates plus a hot industry? That’s a lot of tailwinds converging.

Then each factor gets rated, with Marc’s proprietary formula determining how much each factor influences the final score.

The result is a single Power Gauge rating: very bullish, bullish, neutral, bearish, or very bearish.

- Bullish or very bullish means the stock scores well across most factors. It’s likely to outperform. Marc describes these as roughly the top 20% of opportunities.

- Bearish or very bearish means significant weakness… deteriorating fundamentals, poor money flow, negative expert signals. The stock is likely to underperform or decline.

- Neutral means nothing stands out either way. The stock will probably move with the market unless something changes.

By combining both fundamental and technical factors, Marc aims for the best of both worlds. A pure fundamental investor might miss a big shift in market sentiment. The technical factors catch that. A pure chart-watcher might overlook balance sheet risk. The financial factors flag it.

And based on the track record Marc shares, his system is adding real value for real investors.

The system has flagged a remarkably high percentage of top performers each year – often 8 out of the top 10 stocks across the market, and around 45 out of the top 50. In backtests, it identified 47 of the 50 best stocks of 2022, 44 of the top 50 for 2023, and 44 of the top 50 for 2024. Those were three very different market environments.

No system is perfect, of course. But that’s an incredibly impressive hit rate.

The fact is that a systematic approach stacks the odds in your favor compared with most investors who buy based on a fear of missing out… or sell in panic as the market moves. Look for stocks that rate well across multiple dimensions: strong financials, earnings momentum, positive technicals, and bullish expert activity.

What Is Chaikin Analytics?

Chaikin Analytics is a financial research firm built around one idea: to give regular investors access to the same tools that the pros use.

The company offers the Power Gauge rating system, screening tools, newsletters, and daily commentary. All of it is aimed at helping people make better investment decisions.

The core focus of the company is on its Power Gauge, which we just discussed. It scans more than 5,000 stocks and 2,300 exchange-traded funds every single day, and then rates each one as bullish, neutral, or bearish.

A Power Gauge user can pull up any stock and see not just the rating but the breakdown by category – financial health, earnings, technicals, and expert signals. It’s meant to be research done for you. Fifty years of Wall Street knowledge condensed into a simple gauge on your screen.

But Chaikin Analytics doesn’t manage money. And they don’t earn commissions on trades. They’re an independent publisher of investment research.

This matters because their incentives align with subscribers. And indeed, Marc Chaikin founded the company specifically to level a playing field he’d watched tilt against regular investors for decades.

Over the years, the company has built a solid reputation. WealthManagement.com named them Best Research Provider in 2021, beating Bloomberg and Morningstar. And even institutional investors have paid substantial fees to use Chaikin Analytics. The consumer version brings those same tools to regular people at a fraction of the cost.

Who Is Marc Chaikin?

Marc Chaikin’s career on Wall Street spans five decades… as a trader, stockbroker, analyst, and a software entrepreneur.

Marc started on Wall Street in the late 1960s. He ran the options department at Tucker Anthony in the 1970s and later founded his own firm, Bomar Securities. Along the way, he worked with some of the most successful investors in history… like Paul Tudor Jones, George Soros, Michael Steinhardt, and Steve Cohen.

And if you have a Bloomberg terminal or Reuters system subscription today, you can still access Marc’s indicators… They’ve been integrated into these professional-level tools for decades.

In 1998, Marc sold an analytics company and planned to retire. As he put it:

I had spent my life’s work collecting and interpreting financial data to get to that point. It had paid off… And now, I was ready for a life filled with tennis, books, and relaxation.

Then, 2008 happened. Watching his wife Sandy’s retirement account drop 50% pulled him back into the game to keep it from happening to other investors…

Although I was enjoying my retirement, I knew that I had the ability and knowledge to fix this problem. After all, I had developed the tools used by many Wall Street insiders.

As Sandy searched for a better solution, I promised myself that I would build the best set of quantitative tools for individual investors on the market. So I ended my retirement and got to work…

That’s how the “Power Gauge” came to life back in 2011. After exiting retirement that year, I went on to develop this set of quantitative tools specifically for individual investors.

Since then, Marc has appeared on CNBC, Fox Business, and Bloomberg TV. Market caller Jim Cramer even once said he’d learned never to bet against Marc Chaikin.

Click here to learn the full story behind his wife’s 401(k), why Marc built the Power Gauge, and how it can help average investors like you.

Common Questions About Marc Chaikin’s Approach

Question: Is Marc predicting a market crash in 2026?

Answer: Not exactly. His warning is more nuanced.

Marc isn’t saying the S&P 500 will collapse. He’s saying we’re entering a phase where many individual stocks could quietly lose 20%, 30%, or more… even if the broader market stays relatively flat.

The market will be volatile and selective. Overhyped stocks, especially those propped up during the easy-money era, could deliver a personal bear market to anyone holding them.

Question: Why do average investors always underperform, even in good years?

Answer: Studies consistently show that typical investors earn less than market indices. The culprit is timing and behavior.

These average investors sell during downturns, locking in losses. They re-enter after the rebound, missing gains. And in good times, they chase last year’s winners instead of this year’s.

Marc adds that Wall Street insiders have better information and discipline. They rotate money shrewdly while individuals often do the opposite.

The fix is a rules-based plan. Something like the Power Gauge imposes buy and sell discipline that removes emotion. Over time, this systematic approach can help close the performance gap… or even weight it in your favor.

Question: What does Marc mean when he says that the stocks you don’t buy matter more than the ones you do?

Answer: He’s talking about risk management.

One disaster can wipe out several winners. Say you put $1,000 into five stocks. Four go up 20% each… that’s $800 total gains. But if the fifth drops 80%, that’s $800 in losses. You’re flat, even as almost every one of the stocks you picked did well.

Avoiding a big catastrophe matters as much as finding winners.

Question: How does the Power Gauge find winners so early?

Answer: Everything is based on publicly available data, like SEC financial statements, stock prices, volume, and analyst reports.

What makes the Power Gauge so powerful is the combination and weighting of factors. Marc Chaikin distilled criteria that great investors use… like value, growth, momentum, and sentiment… into one algorithm.

By constantly updating its ratings, the system spots improvement before the media does.

It’s like an early warning radar for momentum shifts. It won’t always be right. Nothing is. But its track record suggests it tilts the odds in your favor.

Question: Can I access the Power Gauge myself?

Answer: Of course, Chaikin Analytics offers access through various subscriptions.

If you subscribe to the Power Gauge Report, you typically get a year’s access to the online platform. Log in, type any ticker, and see its rating and factor breakdown. You can learn how to subscribe to the Power Gauge here.

Many users say they won’t buy a stock without checking the Power Gauge first. It has become their second opinion.

Question: Does Marc Chaikin get everything right?

Answer: Nope. And he’d be the first to say so.

Success in investing isn’t ever going to come with 100% accuracy. That’s just not how markets work. What investors should focus on is getting their “batting average” with winning positions higher… and making sure they’re investing with a good risk-reward balance.

Sometimes a bullish-rated Power Gauge stock underperforms because of an unforeseen event. Sometimes a bearish-rated stock gets acquired at a premium.

Marc’s goal is that the Power Gauge winners, on average, outweigh losers. That’s how he helps everyday investors win against Wall Street.

Here’s How to Find Exactly What Stock to Put $1,000 in Today

When you use the Power Gauge, you can type any ticker into Marc’s straightforward system, and immediately know if it’s rated bullish, neutral, or bearish.

But Marc also goes far beyond offering a tool for you to evaluate the stocks you’re thinking about buying…

He recently used the Power Gauge to scan the entire universe of viable stocks in the U.S. stock market. And he pulled the ones with the highest profit potential… and least amount of risk.

Those stock names and tickers, along with in-depth buying instructions, are in his newest special report: The 2026 Chaikin Buy List.

These are the stocks that Marc wholeheartedly recommends you put $1,000 into in 2026.

And of course, if anything changes with any of these recommendations, or there’s an action Marc thinks you should take, he and his team will email and let you know.

The most important thing an investor can do in a chaotic market environment is to own the right stocks. And perhaps just as important, to not own the wrong stocks.

That’s where Marc’s system and advice come in.

By staying informed, using tools like the Power Gauge or similar analytic frameworks and keeping emotion out of the equation, you can navigate 2026 with confidence. Remember, even if the market gets tough, there are always profits to be made… as long as you’re willing to follow the signals and not the crowd.