It looks like Tesla (TSLA) may have some real competition in the robotaxi market this year…

At Las Vegas’ annual Consumer Electronics Show (“CES”) earlier this month, electric-car maker Lucid (LCID), autonomous-vehicle company Nuro, and ridesharing giant Uber Technologies (UBER) introduced their new robotaxi.

The vehicle clearly leverages the strengths of each company. As co-founder and co-CEO of Nuro, Dave Ferguson, said…

By bringing together Nuro’s proven level 4 autonomy, Lucid’s advanced vehicle architecture, and Uber’s global reach, we’re building a robotaxi service designed for real-world operations and long-term growth.

This isn’t the typical “super-cool tech prototype that’s years away from reality” innovation that’s often in abundance at CES.

This robotaxi is ready to roll in the San Francisco Bay Area in late 2026. And the companies aim to scale production shortly thereafter.

Tesla is ahead of that timeline with its Cybercab robotaxi, which is slated for mass production this spring.

Still, these developments all point to 2026 being the “Year of the Robotaxi” – and not solely because of the vehicles themselves.

Robotaxis and other self-driving vehicles are increasingly being viewed as infrastructure platforms… for AI… for chips… for software… and for the rest of the technology involved in making these vehicles the modern marvels they are.

As I’ll show, that presents some intriguing opportunities for investors…

Why Robotaxis Are Back in Focus in 2026

Large language models (“LLMs”) such as ChatGPT, Gemini, and Copilot have dominated the spotlight over the past few years. That hype is dying down, however, as LLMs gradually integrate into our daily lives.

The AI focus has shifted. Investment capital is now funneling into physical AI. That includes humanoid robots working in factories, self-driving tractor trailers delivering goods, and, yes… robotaxis transporting passengers to their destinations.

And as more investors put capital behind companies specializing in physical AI, especially vehicles, the autonomous technology within these innovations continues to evolve.

Nvidia (NVDA) CEO Jensen Huang spoke about this evolution at CES:

The ChatGPT moment for physical AI is here – when machines begin to understand, reason, and act in the real world.

What could this look like in autonomous vehicles?

Well, instead of simply “seeing” a pedestrian on the street through detection, the vehicle may learn to understand why the pedestrian is on the street through reasoning.

For instance, it may notice a person standing on the curb and waving and understand that the person is trying to hail a cab. The robotaxi would recognize this scenario and pull up next to its would-be passenger.

This type of technology is still in development. But it’s the type of breakthrough that could be just around the corner for robotaxis.

What is undoubtedly coming in 2026, however, is nationwide access to robotaxis as these companies roll out their services across America.

Let’s dig into a few of those robotaxi companies poised to make a splash…

Tesla: The High-Risk, High-Reward Robotaxi Incumbent

Last November, Tesla CEO Elon Musk confirmed that the company is hoping to begin “volume production” of its Cybercab in its Giga Texas factory in April 2026.

For scalability, this is potentially huge news for investors. Tesla is shooting for production of 2 million to 3 million Cybercabs per year, with a price point of less than $30,000 per vehicle.

Part of the appeal, according to Musk, is that these vehicles will eventually be sold for personal use. That makes the Cybercab an attractive low-priced option for car buyers.

It’s worth noting that Musk tends to be overly optimistic with his timelines and goals. That raises plenty of doubts as to whether Musk’s production targets will be met.

But Musk does envision the Cybercab, which was designed without a steering wheel or any pedals, to be “everywhere in the future.”

And if he’s right, Tesla may very well win the entire autonomous-vehicle market.

For Tesla’s stock, much is riding on Musk’s ability to get his company’s Full Self-Driving (“FSD”) vehicles approved and on the road en masse.

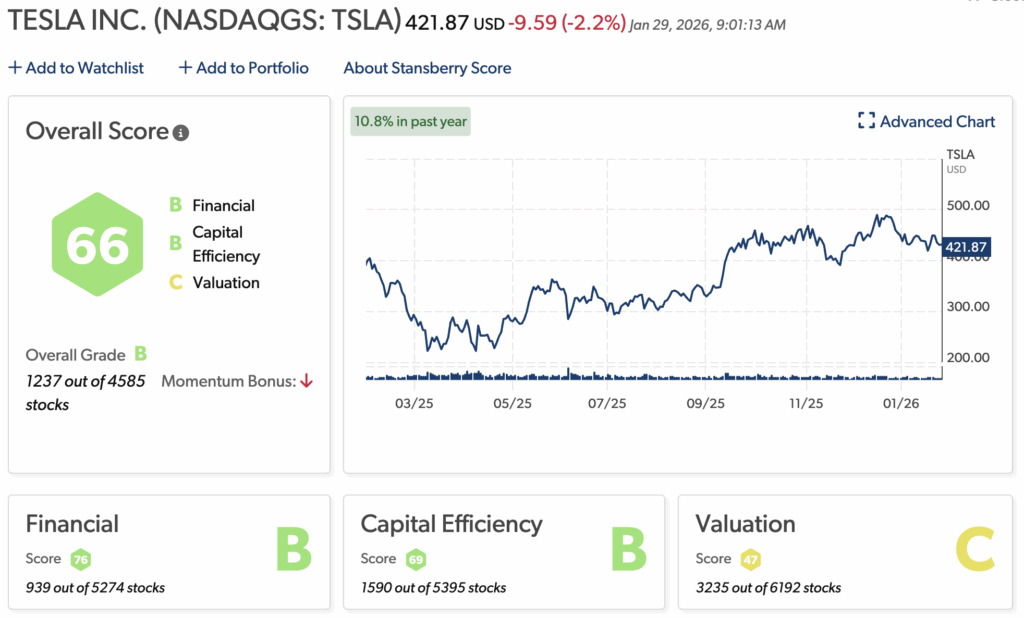

The Stansberry Score (courtesy of our affiliate Stansberry Research), which measures the quality of individual stocks, gives Tesla shares a “C” grade for valuation…

TSLA’s valuation is critical because it currently prices in the expectation of significant future earnings. And we know those are never a guarantee.

Hitting the future earnings priced into Tesla’s valuation would require the company to achieve a near-monopoly on the autonomous-vehicle industry.

Which is possible.

But if Musk and Tesla fall short of that expectation – due to regulatory issues, production delays, or competition – the stock’s valuation will look even worse… to the point that it’ll be considered overpriced. And that will significantly impact TSLA shares.

With so little room for error, 2026 is a critical year for Tesla as it strives to get its FSD vehicles produced and on American streets.

Alphabet’s Waymo: The Robotaxi Leader Investors Rarely Talk About

Waymo, Alphabet’s (GOOGL) self-driving technology company, flies curiously under the radar with investors. It’s a strange phenomenon, considering Waymo operates the only fully autonomous, paid, driverless robotaxi service in the U.S.

Then again, its parent company Alphabet casts a broad shadow.

But with Waymo’s current success and future expansion of driverless vehicles, it won’t be overlooked for long.

The company currently provides around 250,000 trips per week and has given a total of 20 million rides since 2020. Its vehicles operate 24/7 in Phoenix, San Francisco, Los Angeles, Atlanta, Austin, and Miami.

Waymo is also testing operations and planning rollouts in Philadelphia, Baltimore, Detroit, St. Louis, Dallas, Houston, San Antonio, San Diego, Pittsburgh, Orlando, Las Vegas, and Washington, D.C. within the next year.

Waymo plans on going international in London and Tokyo in 2026 as well.

But Waymo isn’t stopping there. It’s expanding manufacturing capabilities, with plans to double production at its Arizona facility this year. More than 2,000 vehicles are expected by late 2026.

And to save on production costs, Waymo rolled out its new, lower-cost fleet of Ojai vehicles, built by Chinese automaker Zeekr.

With this partnership and the increased production capacity at the Arizona facility, the company could deliver tens of thousands of robotaxis each year.

Its expansion plans are ambitious yet realistic. In early January, Waymo revealed that it’s aiming for 1 million weekly rides by the end of 2026, as well as service in 20 new markets.

This is all encouraging news for investors.

So is the fact that Alphabet owns Waymo…

While any stock presents some level of risk, investors can take comfort knowing that even if Waymo misses expectations – or fails completely – Alphabet still has highly successful and profitable primary businesses like Google search and Google Cloud.

Plus, though anything’s possible, Waymo doesn’t seem like a candidate for failure. In fact, as of mid-December, the company was in discussion with potential investors to raise money at a $100 billion (likely more) valuation.

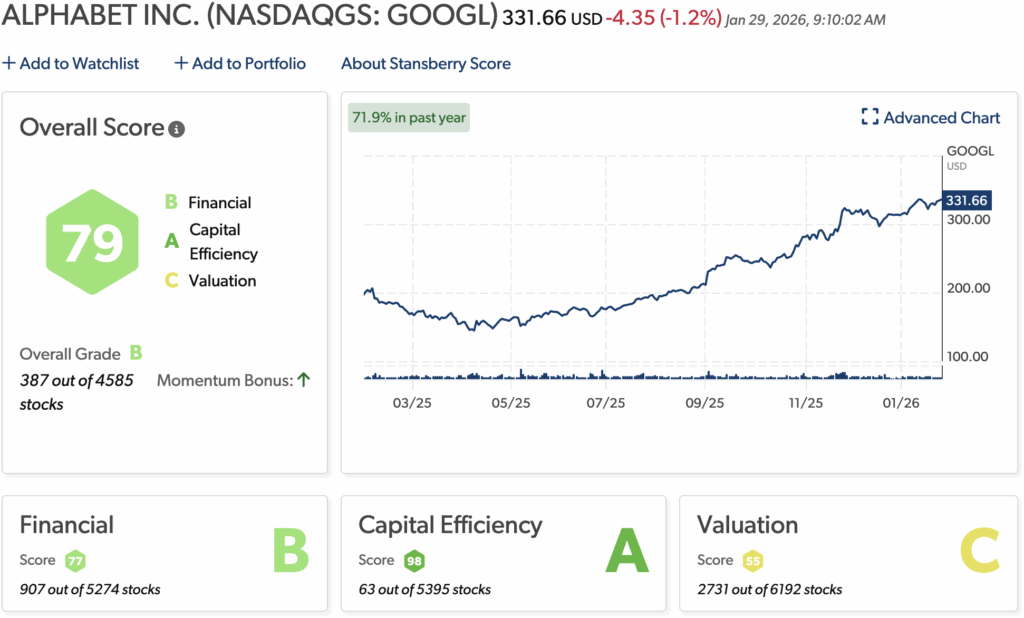

The Stansberry Score gives parent company Alphabet an overall “B” grade. That’s driven primarily by its outstanding capital efficiency, where it ranks among the top 75 of the nearly 5,400 stocks we track in that category.

The company gets a “C” grade for valuation, though it does rank within the top half of stocks in this category.

When it comes to financials, Alphabet earns a solid “B,” as a highly profitable business that generated an estimated $392 billion in full-year fiscal 2025 revenue.

The bottom line is, Waymo can likely only help – not hurt – Alphabet’s stock.

Uber, Lucid, and Nuro: A Robotaxi Partnership

Uber got into the autonomous-vehicle game a little more than a decade ago, when the rideshare leader formed an in-house team to create its own self-driving vehicles.

However, due to financial strain, regulatory problems, and a fatal car crash, Uber ended up selling its self-driving program to Aurora Innovation in 2020. It then shifted its focus to a partnership model, where it integrates other companies’ autonomous vehicles into its fleet.

That focus culminated in Uber’s partnership with Lucid and Nuro, which began last July. This collaborative effort combined Uber’s vast rideshare network, Lucid’s sleek electric vehicles, and Nuro’s AI platform to create the Gravity luxury SUV, which was revealed at CES.

Make no mistake… the Gravity isn’t just a robotaxi. It’s also a signal to Tesla that any thoughts of an autonomous-vehicle monopoly may be premature.

For investors, Uber is the much safer bet over Lucid (and Nuro is a privately held company). While Lucid is certainly a compelling business, its stock performance has been poor… to be generous.

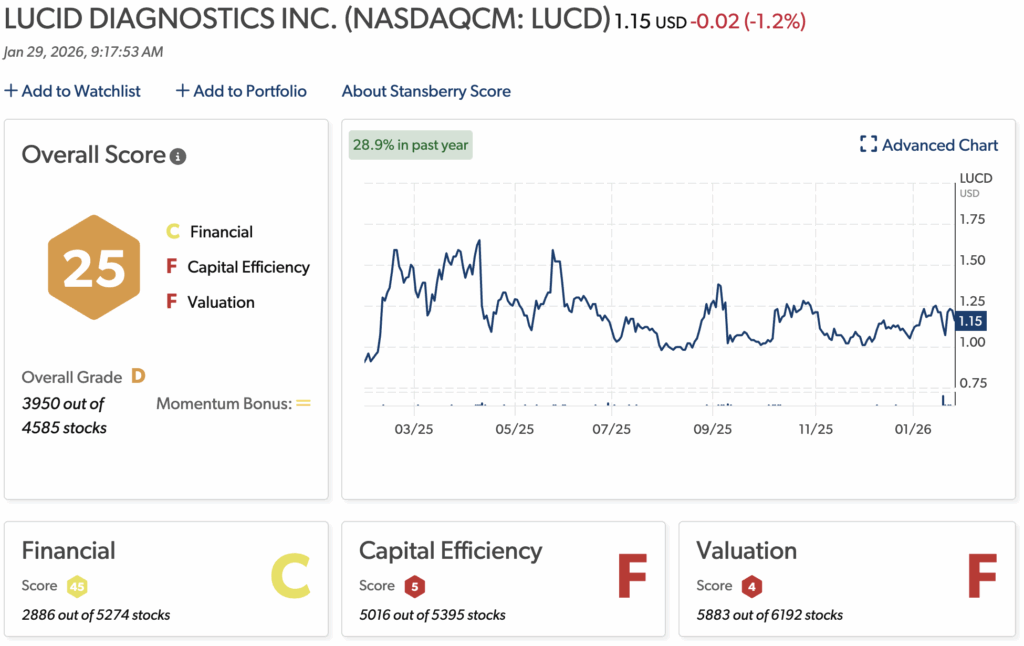

The Stansberry Score gives Lucid a “D” grade overall, ranking it near the bottom of the 4,500-plus stocks we track…

The reasons are clear. Lucid burns through cash and loses money on nearly every vehicle it makes.

And there has been little demand for its luxury electric vehicles, especially at their price points. The starting price for Lucid’s Air luxury electric sedan is nearly $71,000. That’s about $13,000 more than the average new electric-vehicle sales price today.

Lucid’s vehicles are praised by critics and beautifully made. But Lucid simply doesn’t make money on them. And in efforts to raise badly needed capital, the company has diluted existing shareholders and driven its stock price down through a series of reverse stock splits and share sales.

Uber, on the other hand, represents a solid and more stable play.

Because it provides the service and not the vehicles or technology, Uber can rely on its massive network of more than 180 million users no matter what type of vehicle is being used.

If the Gravity robotaxi doesn’t work out, Uber can pivot to another automaker and still maintain its user base. That offers Uber investors a measure of stability.

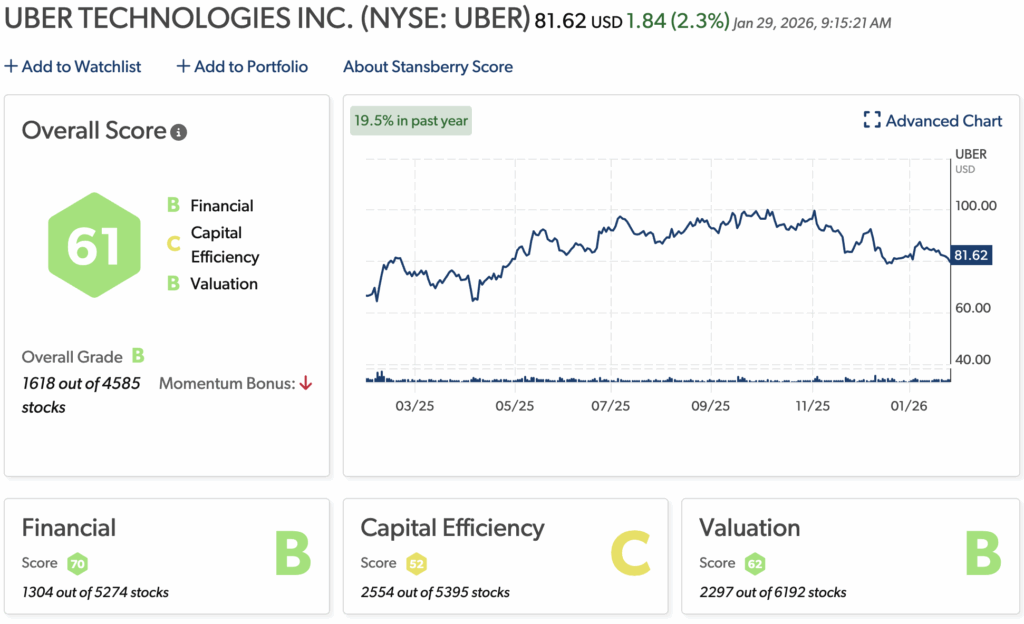

Uber’s stock ranks well in the Stansberry Score, with an overall “B” grade. Its financials are strong – at a “B” – as Uber has been a consistently profitable business over the past few years. Plus, its revenue, customer base, trip volumes, and bookings continue to increase, offering investors a strong foundation.

Analysts also remain bullish on Uber, with most rating the stock a “Strong Buy.”

If Uber’s partnership with Lucid and Nuro in the robotaxi race succeeds, consider it another feather in Uber’s cap. If it doesn’t, Uber can just take its massive customer base elsewhere.

Nvidia: The Alpamayo Reasoning Engine for Robotaxis

Nvidia and robotaxis? Yes, Nvidia innovation is everywhere. That’s why it’s one of the world’s most sought-after stocks.

In early January, Nvidia announced the rollout of Alpamayo. According to the company, it’s a “family of open AI models, simulation tools and datasets designed to accelerate the next era of safe, reasoning‑based autonomous vehicle development.”

The key phrase here is “reasoning-based.” And it’s a game changer.

The Alpamayo AI models bring human-like thinking to autonomous-vehicle decision-making. They are vision-language-action models that can think, step by step, through a variety of scenarios (including those the model hasn’t even encountered yet) to improve driving capability and safety.

This is technology that could evolve the entire self-driving-vehicle industry. And Nvidia holds the keys.

Besides Tesla (which uses its own AI), any company that wants to use these groundbreaking open AI models will have to pay Nvidia. And many are showing interest, including Lucid and Uber, Mercedes, and Jaguar Land Rover.

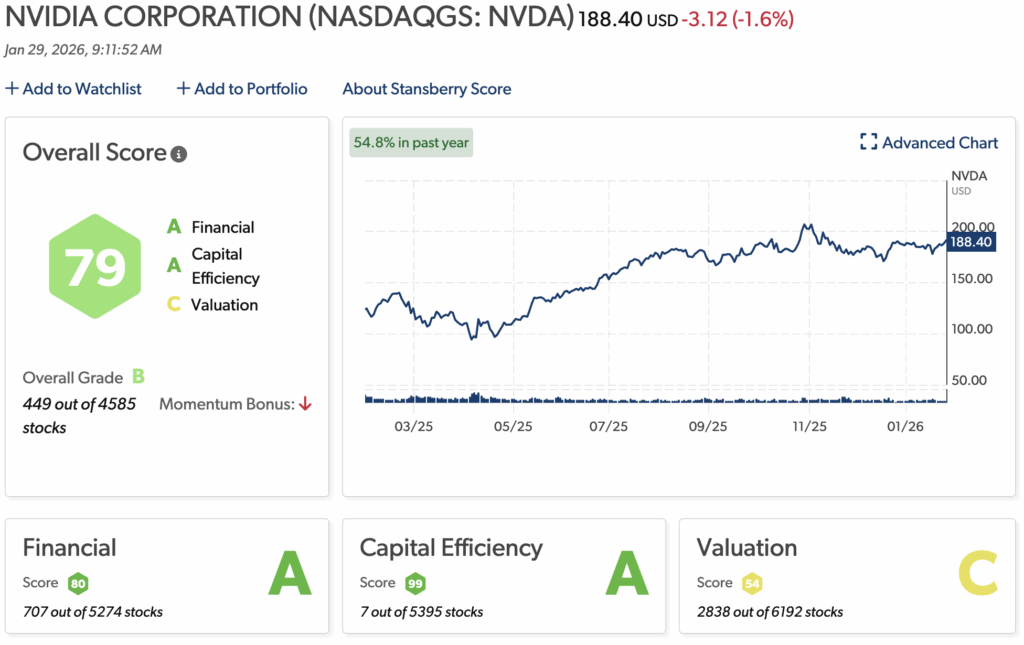

It’s innovations like these that make Nvidia’s stock so desirable. The Stansberry Score gives the company an overall “B” grade and ranks it well within the top 500 stocks.

That’s driven by its nearly unmatched capital efficiency, which not only earns an “A” grade but also ranks it within the top 10 stocks out of the nearly 5,400 Stansberry Research monitors in this category.

Between its chip and GPU market dominance (especially in AI), operational excellence, consistent innovation, wildly impressive profit margins, and massive free cash flow, it’s easy to see why Nvidia stock is so popular among analysts and investors.

Robotaxi Risks Investors Must Watch

Any product using new technology comes with risk. And one with so much at stake (like human lives) poses that much more.

Let’s look at a few risks investors should consider with robotaxi stocks…

Scalability

While robotaxis aren’t brand-new, their availability had previously been limited to specific markets. Waymo, for instance, only debuted in Phoenix in 2018 before moving into San Francisco and Los Angeles.

That all changed in 2025, as Waymo and Tesla began expanding into more areas. Now, robotaxis may be in most major cities by the end of 2026.

That, in and of itself, is a risk… This is uncharted territory. It remains to be seen how smoothly and successfully these rollouts go… if they go at all.

Remember, Tesla is planning to mass-produce its Cybercab this coming April – but that kind of robotaxi production is the first of its kind. So, it remains to be seen whether these vehicles can be manufactured at scale to begin with.

Safety and public perception

Robotaxi technology has certainly come a long way since 2018 (especially with the integration of AI). But that hasn’t calmed people’s nerves about riding in one.

A 2025 AAA survey on autonomous vehicles revealed that only 13% of American drivers would trust riding in a self-driving vehicle. That was actually a significant increase over the previous year, when only 9% said they’d trust a self-driving vehicle.

But even with that gain in trust, 61% surveyed said they were still afraid to ride in an autonomous vehicle.

Most safety data regarding robotaxis is largely inconclusive. Waymo touts its driverless-vehicle crash data versus national human-driver data, stating that Waymo robotaxis encounter:

- 92% fewer crashes that injure pedestrians

- 82% fewer accidents that injure cyclists or motorcyclists

- 96% fewer injury crashes at intersections

- 85% fewer crashes involving suspected serious injuries overall

Data for Tesla’s robotaxis, on the other hand, show that the company’s robotaxis are crashing at higher rates than human drivers.

A report examining Tesla’s crash data determined that its robotaxis are involved in an accident every 40,000 miles they drive. Cars driven by humans, meanwhile, average a crash every 500,000 miles driven. That means Tesla’s robotaxis are crashing at more than 12 times the rate humans do.

The data is inconsistent and needs more testing to show conclusiveness. However, the reality is that it only takes a few crashes for regulators to start halting robotaxi approvals – and that could grind the industry to a screeching halt.

Supply-chain issues

Robotaxis require a wide range of hardware and equipment. This includes light detection and ranging (“LIDAR”) technology, radar, cameras, AI chips, and GPS, to name a few. Then there are the actual automotive parts needed to build each vehicle.

Hardware bottlenecks, especially for sensors and chips, are real. This leaves robotaxi manufacturers with rising costs and potential production delays.

Plus, tariffs are damaging the robotaxi supply chain by raising the prices of important components and disrupting supplier networks.

President Donald Trump’s tariffs and ongoing trade wars are major risks to the robotaxi industry. These developments are worth watching moving forward.

Bottom Line: Building Smart Exposure to Robotaxi Stocks

The robotaxi stocks we covered tend to separate themselves into a few categories…

There are the “safe” bets, like Alphabet and Nvidia. These are highly profitable, innovative, and well-run companies that typically make consistent money for their shareholders.

Waymo is setting itself up to have a big year for Alphabet, with planned robotaxi expansion into several major metropolitan areas in 2026. But Alphabet also had the built-in advantage of not relying solely on Waymo for its success. Google search and Google Cloud are its real moneymakers.

For Nvidia, its Alpamayo AI models could prove to be a game changer in yet another industry. Nvidia is always at the forefront of tech, so it’s no surprise the company has developed yet another platform that businesses want for their products.

Then there’s Uber… another solid bet with a bullish outlook because of the demand for its services. Uber already dominates the U.S. market for rideshare services… Its 74% share dwarfs Lyft’s (LYFT) 24%. And with Uber’s network of 180 million-plus users potentially having access to a robotaxi service, its dominance may grow.

Tesla and Lucid are interesting cases. Tesla is obviously a successful company, but its overvaluation could become a major problem if Cybercab production doesn’t go according to plan this year.

Lucid, however, is a major risk. If its alliance with Uber and Nuro succeeds, perhaps the company can turn its financial performance around. After all, the company makes stunning luxury vehicles that Uber riders will enjoy. But it’s still hemorrhaging money, and its stock has been significantly diluted in recent years.

In short, this year is going to be a pivotal one for these companies and the entire robotaxi industry. And it’ll be fascinating watching it play out.

Regards,

David Engle

Editor’s note: If you’re 50 or older… or thinking ahead to retirement… legendary investor Whitney Tilson says this could be your smartest financial move of the entire AI boom.

It’s time to look past Nvidia and the “Magnificent 7.”

Whitney, a retired hedge-fund manager once dubbed “The Prophet” by CNBC, is sharing a new AI story.

His brand-new stock system just gave one company a near-perfect grade… and it’s not a name you’ve heard on the news.

The company just signed a huge new AI deal with a key tech partner, and you’ll soon see a massive nationwide rollout.

Whitney’s giving away the name, ticker, and full breakdown for free.