The new year began with literal fireworks. Early on the morning of January 3, the United States conducted a military strike on Venezuela and seized President Nicolás Maduro and his wife, Cilia Flores. A key component of this strike was the use of military drones, also known as unmanned aerial vehicles (“UAVs”).

While the Pentagon hasn’t officially confirmed which types of UAVs were used in Operation Absolute Resolve, those familiar with the technology believe that military drones such as the MQ-9 Reaper, the RQ-4 Global Hawk, or the super-secretive RQ-170 and RQ-180 stealth drones were deployed for this mission.

The use of military drones is no fad. It’s a long-term strategy shift. As is the use of artificial intelligence (“AI”) in drones. And that shift is just in its beginning stages.

A Look at the AI-in-Drone Market

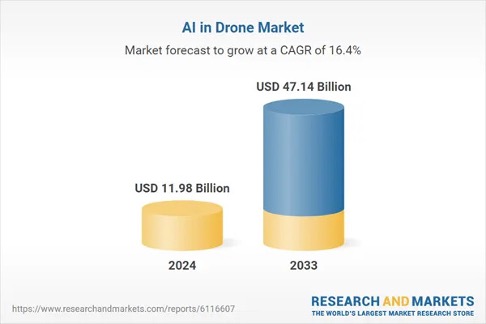

According to ResearchAndMarkets.com, the global AI-in-drone market should reach around $47.1 billion by 2033. That’s a huge increase from just less than $12 billion in 2024. It also projects an impressive 16.4% compound annual growth rate (“CAGR”) between 2025 and 2033.

And the U.S. will be the primary driver of this growth. The One Big, Beautiful Bill, signed into law in July 2025, allocated $33 billion for direct spending on drones and AI for the Department of Defense (“DoD”).

Of course, not all drones are used for military purposes. And not all military drones in use today are equipped with AI. But you can bet that most new drones will include AI technology. And that means the AI-in-drone market is one that will soon encompass most military and non-military drones.

That’s great news for the drone industry… and investors.

Recent Military Strikes Illustrate a Massive Shift Toward Drones and AI

The use of military drones has been prevalent throughout the conflict between Russia and Ukraine. In fact, drone technology has quickly evolved since the start of the nearly four-year war.

For example, AI-equipped drones can now hit their targets even through the dense fog of interference that has sent many a non-AI-equipped Russian and Ukrainian drone from the sky to the ground. Thanks to AI, these drones can lock onto the image of a target viewed through their onboard camera. The drone can then continue along its path autonomously, even after the drone pilot loses contact with the vehicle.

Ukraine has mastered the use of drones on the battlefield. In fact, it’s a major reason why the country is still in the fight with its much more powerful opponent. But Ukraine has also become a global leader in military-drone manufacturing. In 2025, production was expected to hit 2.5 million units.

With nearly 50% of military AI systems used in UAV and vehicle navigation systems, it’s clear that AI-equipped UAVs are driving the latest developments in military strategy, defense, and weaponry.

As Secretary of the United States Army Dan Driscoll noted, “If small arms defined the 20th century, drones will define the 21st.”

And that’s a compelling sentiment for investors seeking military-drone stocks with steady, long-term growth potential.

Let’s look at a few.

The Best Military-Drone Stocks to Add to Your Watch List

Lockheed Martin

A contracting partner of the U.S. military for more than 75 years, Lockheed Martin (LMT) is a relatively low-risk play for investors looking for a military drone-related stock.

The global aerospace and defense titan is on the cutting edge of drone and UAV technology, as well as AI-enabled targeting systems. For example, the company’s well-known yet hyper-secretive Skunk Works division (formally known as Lockheed Advanced Development Programs) recently demonstrated how AI can take over a UAV if unmanned missions run into unexpected problems.

Couple the company’s AI and drone innovation with its massive defense backlog ($179 billion as of the end of the third quarter of 2025) and long history of Pentagon relationships, and it’s clear why LMT is so successful.

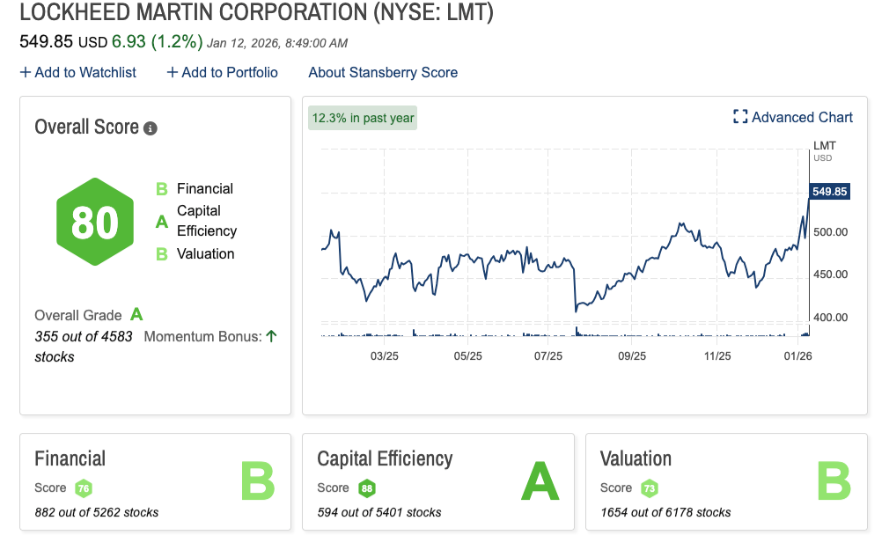

Our proprietary Stansberry Score, which measures the long-term investment quality of a stock, backs that up. Of the nearly 4,600 stocks we track, LMT ranks within our top 360, with an outstanding overall “A” grade.

LMT scores high marks across the board, with a “B” in financials (its substantial backlog and projected $74 billion to $75 billion 2025 full-year revenue are key drivers), an “A” in capital efficiency, and a “B” in valuation.

As battlefield technology evolves, and as the U.S. military continues spending on UAVs, AI, and autonomous systems, LMT is in a prime position to be a major beneficiary of that spending. And that sets Lockheed up for continued, long-term success.

L3Harris Technologies

Another high performer in the defense space is L3Harris Technologies (LHX). The Florida-based business provides a wide range of mission-critical solutions to global government and commercial customers through its newly restructured Space & Mission Systems (“SMS”), Missile Solutions (“MS”), and Communications & Spectrum Dominance (“CSD”) segments.

(L3Harris recently sold about a 60% controlling stake in its Space Propulsion and Power Systems business, previously a part of Aerojet Rocketdyne, for $845 million.)

The U.S. government is one of those customers, with contracts covering advanced defense and intelligence technology, avionics, and command/control systems for the DoD, Army, and Air Force, among others.

And, like Lockheed Martin, L3Harris Technologies is an innovator, particularly in the autonomous systems and counter-UAV technology space. A few prominent examples include:

- AMORPHOUS™: Artificial intelligence/machine learning (AI/ML) software that enables the simultaneous command and control of thousands of autonomous assets through one user interface.

- Uncrewed Surface Vehicles (“USVs”) and Autonomous Underwater Vehicles (“AUVs”): The company’s Iver4 AUVs and C-Worker/C-Target USVs are routinely used for maritime missions in a similar way that drones are used for air missions.

- VAMPIRE™ (Vehicle-Agnostic Modular Palletized ISR Rocket Equipment): A portable system that can be mounted on various vehicles, VAMPIRE uses an advanced sensor and a weapons station to fire Advanced Precision Kill Weapons System (“APKWS”) rockets to take down opposing drones.

- Drone Guardian: This technology offers drone detection, tracking, identification, and defeat capabilities.

- CORVUS-RAVEN: This portable electronic warfare solution provides fast detection and jamming of drone threats.

- Widow®: This mission-management software assists operators in quickly identifying and engaging targets through an integrated view of the battlespace.

L3Harris Technologies is laser-focused on next-generation defense technologies equipped with AI. Its partnerships with Palantir Technologies (PLTR) for its TITAN Army intelligence ground station that improves situational awareness, and Shield AI to integrate their Hivemind autonomy software into unmanned systems (which will improve surveillance and targeting capabilities), demonstrate as much.

L3Harris Technologies enjoyed a very strong year, reporting $5.7 billion in revenue in the third quarter… a 7% year-over-year (“YOY”) increase. The company also raised its full-year 2025 guidance to around $22 billion as demand for its solutions continues to grow.

The proof of that demand is its $34 billion backlog, about half of which is expected to convert to revenue within the next year. That promises near-term stability not just to the company, but to investors as well.

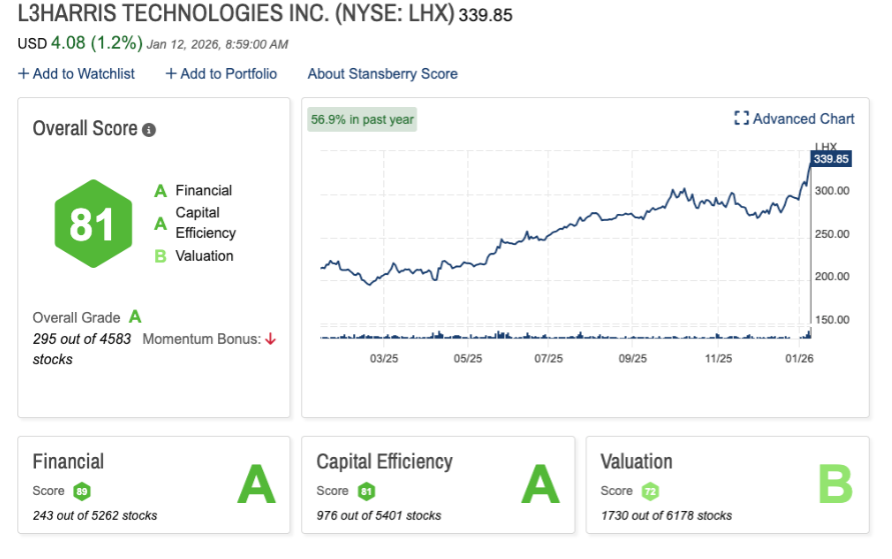

Our Stansberry Score shows plenty to like about LHX. And the market agrees, as LHX rang in the new year by hitting its 52-week high. We rate LHX slightly higher than Lockheed Martin, within our top 300, fueled by strong financials (“A”) and capital efficiency (“A”) and a rock-solid valuation (“B”).

AeroVironment (“AV”)

Known for its Switchblade loitering munition systems (better known as “suicide” or “kamikaze” drones) and Puma UAVs, AeroVironment (AVAV) is a pure-play business that has fully embraced AI and integrated it into many of its systems and technologies.

AVAV’s stock has risen, literally and figuratively, since the conflict in Ukraine began. As a significant military drone supplier to Ukrainian forces, AV’s revenue has increased 143.6% since the start of the Ukraine war.

And with Driscoll announcing late in 2025 that the Army plans to buy another million drones, there’s plenty of reason to be optimistic about AVAV’s prospects.

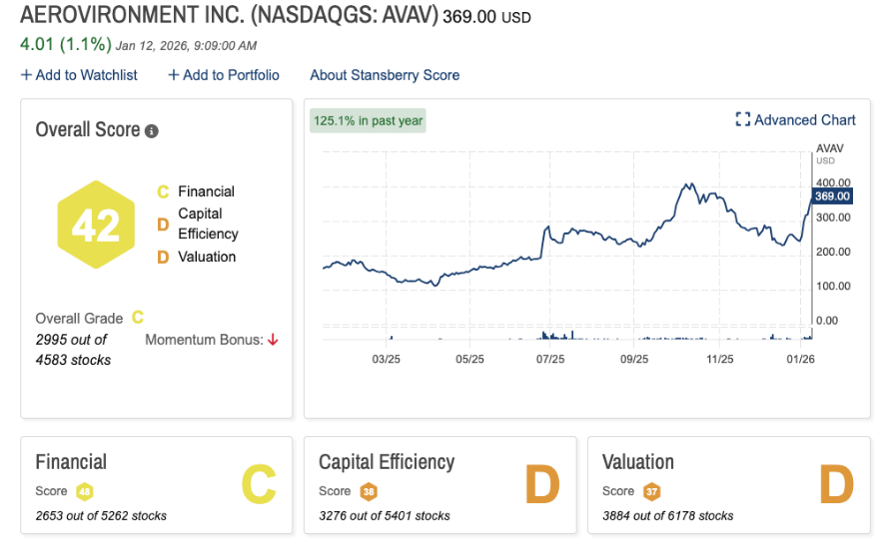

There’s also plenty of reason for caution if you’re considering AVAV stock. Our Stansberry Score rates AeroVironment below the middle of the pack with an overall “C” grade.

Its financials are decent (“C”), highlighted by record revenue of $820.6 million in fiscal year 2025… a 14% increase from 2024. AV also established a company record with $1.2 billion in bookings. And its backlog is significant… around $1.1 billion in funded backlog as of late 2025.

But the company is not profitable right now.

AV reported a $17.1 million generally accepted accounting principles (“GAAP”) net loss for the second quarter of fiscal 2026 compared with $7.5 million in net income in the year-ago period. AVAV is also projecting a full-year 2026 net loss of up to $38 million. And its gross margin for the second quarter of fiscal 2026 dropped to 22% from 39% during the second quarter of fiscal 2025.

AV is also burning through lots of cash. The company has recorded negative free cash flow since 2022.

That all contributes to our “D” grade for valuation.

AVAV shows strong future growth potential – especially after its 2025 acquisition of defense technology company Blue Halo, which will expand AV’s business beyond UAVs. AV’s backlog is significant, and its foray into broader autonomous systems should open the door for even more substantial contracts.

But AVAV is a risky, highly speculative play right now. It’s certainly worth watching, but there are safer bets out there.

Draganfly

If AeroVironment is considered risky, Draganfly (DPRO) is an even dicier play. This microcap doesn’t operate on the same scale as Lockheed or L3Harris, but its laser focus on building the world’s most advanced UAVs has helped the company gain traction in the military and government space.

Draganfly designs and manufactures custom airframes, payloads, and robotic systems, while offering management services for complex flight operations. Two of its more prominent contracts involve supplying its Flex FPV drone systems to the U.S. Army and providing the DoD with its Commander 3XL drones.

Like AeroVironment, Draganfly saw a nice bump in both revenue and product sales, growing double digits YOY in each of the first three quarters of 2025. Those positive developments were offset, however, by total net losses of around $13.4 million over the same period.

Also, like AeroVironment, Draganfly is not yet a profitable company. While it’s striving to scale its sales with military and government contracts, the business is burning through cash. The consistent net losses and negative operating income leave its cash flow negative.

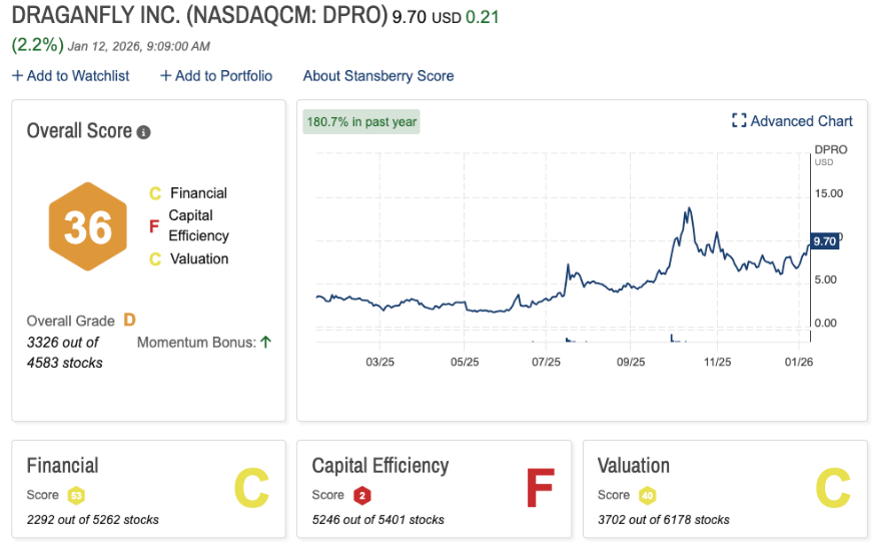

This is all reflected in our Stansberry Score, which grades DPRO a “D”. This is mainly due to its poor capital efficiency (“F”), which ranks near the bottom of the 5,400 stocks we track in this category. DPRO’s valuation isn’t much better, with a “C” grade that suggests the stock is overvalued.

DPRO is also highly volatile, with a five-year beta average well over 3. That means DPRO stock is at least 3 times more volatile than the overall market.

All that said, Draganfly still offers some upside thanks to its military and government contracts and UAV innovation. And despite some of its numbers, DPRO is considered a solid buy among many analysts.

If you’re considering investing in DPRO, weigh the growth potential as well as the elevated risk level involved with investing in a small, growing, volatile company that still loses money.

Keep Draganfly on your watch list as a potential long-term growth play.

Why Autonomous UAVs Are Reshaping Defense Tech

Autonomous UAVs have changed the way battles are fought and wars are won. Drones are a key component of 21st-century warfare because they’re more cost-effective, safer, faster, and far more scalable than traditional manned aircraft like jets and helicopters.

Also, with the integration of AI into UAVs, all it takes is one drone operator to control multiple UAVs. This saves on manpower and increases tactical flexibility.

More importantly, today’s UAVs are built smart. Many are designed to deliver real-time intelligence, surveillance, and reconnaissance. Their AI, machine vision, and autonomous targeting technologies deliver greater strike precision while keeping human pilots mostly out of harm’s way.

And it’s not just drones. Companies like the ones we highlighted are creating counter-UAV systems, battlefield sensors, and AI mission technology that have forever changed the battlefield landscape.

Ukraine, a massive underdog in its war against Russia, has managed to keep fighting its battle for nearly four years now… in large part because of the skillful, tactical use of military drones, UAVs, and smart technology.

As we’ve seen throughout the war in Ukraine, and as we just witnessed with the U.S. military operation in Venezuela, global conflict is, unfortunately, a persistent concern. And the militaries that will be most prepared are the ones that autonomize their operations and invest in drones, AI, and UAVs.

Why Military-Drone Stocks Are a Long-Term Investment Opportunity

Military drones are here to stay. Their cost-effectiveness and tactical success ensure that governments and military organizations will continue investing in this technology. So does the overall global climate.

The world has taken notice of Ukraine and its blueprint for successful drone warfare.

- Germany is spending nearly $12 billion on drones for defense.

- The U.S. is buying a million more drones.

- Taiwan is purchasing around 50,000 commercial-grade military drones for defense.

These are all recent examples of the long-term transformation of modern warfare… not a short-term trend.

AI, robotics, satellite communications (Ukraine’s use of Starlink for essential battlefield connectivity is a great example)… we’ve written about these technologies in this space before. They’re all game changers. And they all overlap in the design and production of military drones and UAVs.

That makes military drones a highly intriguing addition to investors’ portfolios.

Bottom Line: Why These Military-Drone Stocks Are the Ones to Watch

The four military-drone stocks we examined here touch both ends of the risk spectrum for defense stocks. There are the lower-risk giants (Lockheed Martin and L3Harris Technologies). And there are the volatile, high-risk businesses (AeroVironment and Draganfly).

If you’re seeking steady but modest gains with a lower investment risk, LMT and LHX are worth watching.

These are reliably strong, established companies with long track records of success, plenty of government contracts, and products and solutions that fill essential needs. So, there probably won’t be much rapid growth here. But there likely won’t be a risk of rapid decline either.

For investors willing to take a significant amount of risk with the potential for significant growth, AVAV and DPRO should be on your watch list. They both offer solid revenue growth and are riding the AI and drone tailwinds.

However, both military-drone stocks have proved to be extremely volatile. Many analysts see them as overvalued, and neither company is profitable yet.

If you’re willing to wait out the turbulence, investment in AVAV and DPRO may eventually pay off. But both companies need to start consistently making money and addressing operational challenges for that to come to fruition.

Let’s be honest… We all want to see global conflict end. Unfortunately, war is a reality. It has been for ages, and it likely will continue to be. And when there’s war, there’s a need for battlefield technology. So, why not consider investing in companies that are at the forefront of modern warfare? Especially those that are focused on AI integration.

Regards,

David Engle

P.S. Speaking of AI, we know that it’s devouring energy at an unprecedented rate… straining America’s already vulnerable power grid.

All the big players are searching for new ways to meet AI’s power-hungry daily demands, pouring billions of dollars into alternative energy sources.

You can still get in on this tech, too – but time is running out.

Because Amazon (AMZN) may have just cracked the code.

This breakthrough technology is being hailed as “the Holy Grail of Power,” and Amazon just went all-in on it…

Get the details right here, including how to prepare and what to buy.