The Magnificent Seven stocks have dominated the headlines for years now. They’re some of the stock market’s largest companies, and many are plays on supertrends such as robotics or artificial intelligence (“AI”), a trend that has swept the market higher since 2023.

As measured by the Roundhill Magnificent Seven Fund (MAGS), these seven stocks have delivered, as a group, returns of 102% over the past two years, handily beating the S&P 500 Index at approximately 51% over that same period.

As stunning as the performance of the Magnificent Seven stocks is, other AI stocks have been riding their coattails, delivering even better returns.

What are the Magnificent Seven stocks?

The Magnificent Seven stocks are a group of seven companies that are heavily involved in AI. The name is an allusion to The Magnificent Seven, a 1960 western film that follows seven gunslingers through the 19th-century American West.

These companies earned the nickname in 2023 because their stock performance remained robust following a down year in 2022, boosting major stock indexes such as the S&P 500 and the Nasdaq 100.

The Magnificent Seven consists of the following stocks:

- Apple (AAPL)

- Alphabet (GOOG and GOOGL)

- Amazon (AMZN)

- Meta Platforms (META)

- Microsoft (MSFT)

- Nvidia (NVDA)

- Tesla (TSLA)

These stocks led stock indexes higher from 2023 through 2025, and their heavy index weighting and continued popularity mean that they’re likely to power the indexes in 2026, too. These stocks are “magnificent” because they’ve performed well despite a number of factors, such as high interest rates, that hurt small- and mid-cap stocks during the same period.

Given their massive investments in AI, this group of stocks became a way for investors to play that supertrend – and to do so with financially strong leaders. These stocks have proved to be durable blue chips, even if some analysts argue that they’re overvalued for now.

Investors can buy these stocks directly or even through exchange-traded funds (“ETFs”) that are based around them. The Roundhill Magnificent Seven Fund is one example.

Alternatively, because of their heavy weighting in major indexes, investors can also get exposure to them through funds that track the S&P 500. The SPDR S&P 500 Fund (SPY) is an example in that category.

And, yes, by simply tracking the S&P 500, investors are gaining outsized exposure to these seven companies.

Magnificent Seven stocks lead major stock indexes

Both the S&P 500 and Nasdaq 100 are market-cap-weighted indexes, meaning that larger companies get higher representation. Because of their huge market capitalizations – that is, the total value of all their existing shares – the Magnificent Seven stocks make up a huge proportion of these indexes. They’re also featured in thousands of other ETFs and mutual funds.

Looking at just the S&P 500, here’s how the Magnificent Seven stack up:

Source: Slickcharts, January 8, 2026

Together, these stocks comprise 34.3% of the S&P 500’s total weighting. The index’s 493 other stocks comprise the remaining difference of around 65.7%. So, the Mag Seven stocks have a huge impact on how this bellwether index performs.

While not typically lumped in with the Magnificent Seven, Broadcom (AVGO) arguably deserves a spot among this group. With a 2.5% weighting in the S&P 500, this large tech player bumps the combined weighting to 36.8%.

These weightings aren’t static. They change over time in response to the relative performance of the stocks. So if Amazon begins to outperform other stocks – as some analysts anticipate the company will accelerate its AI efforts – then its weighting in the index will increase.

Naturally, if one of these stocks falls, its weighting in the index falls as well. For example, if Tesla declines more than other stocks – noted short seller Michael Burry says it’s “ridiculously overvalued” – its impact on the index will also decline.

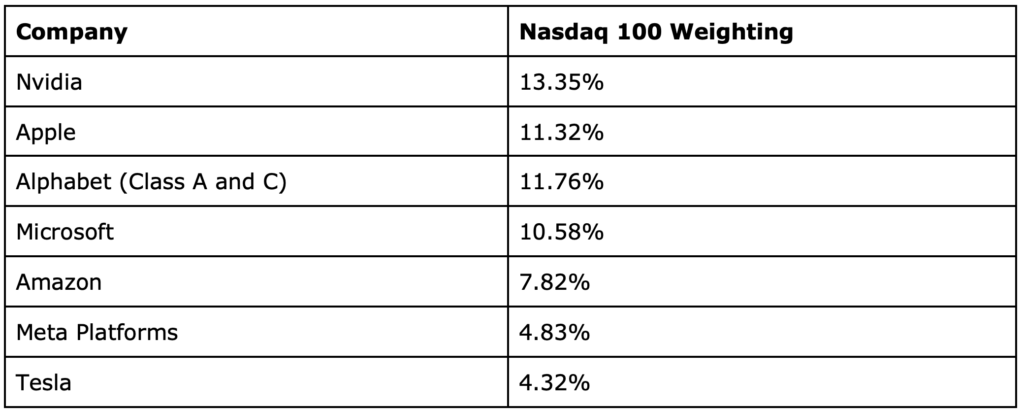

The Magnificent Seven weighting in the Nasdaq 100 is still more uneven.

Source: Slickcharts, January 5, 2026

Here, the Magnificent Seven stocks make up nearly 64% of the Nasdaq 100’s weighting. The other 93 stocks make up just 36%. Again, adding in Broadcom – with its 4.7% weighting – the combined share comes to nearly 69%. In fact, these Mag Seven stocks have performed so strongly that the Nasdaq 100 was reweighted in 2023 to help lower these stocks’ outsized effect.

So whenever you buy a fund based on these stock indexes, each share contains a similar proportion of these Magnificent Seven stocks. Many other funds also own these stocks, and they’re a huge factor in the performance of thousands of ETFs and mutual funds.

These large weightings are also a huge factor in the returns of the major indexes themselves. Looking at just the S&P 500, the Magnificent Seven contributed 55% of the total return of the index from 2023 through 2025, according to S&P Global.

What makes the Magnificent Seven stocks so popular?

First and foremost, the Magnificent Seven are popular due to their outstanding performance, but that performance itself is due to a few factors.

High returns: The strong 2023 performance of the Magnificent Seven following a dour 2022 earned them their nickname. These stocks showed market leadership, and investors flock to strong performers until they show they’re no longer strong. These big tech stocks seemed to keep rising even while many other stocks lagged.

Strong operations: These tech stocks are among the market’s best businesses, with many earning tens of billions each year. They have cash-rich balance sheets, high margins, and sustainable competitive advantages – a ton of positives for investors.

Future growth: The Magnificent Seven have significant growth opportunities, whether that’s in AI fields (Microsoft, Amazon, Alphabet, Nvidia), robotics (Tesla), or a variety of other moonshots (Alphabet’s Waymo, for example). These companies are investing big bucks to be the leaders in the industries of the future.

All of this has led to strong earnings growth. Looking at just the most recent data, the Magnificent Seven reported third-quarter earnings growth of 18.4% year over year. That compares with approximately 13.1% from the broader S&P 500.

Earnings growth for the Magnificent Seven has been strong, and it’s projected to stay strong in 2026.

How can you outperform the Magnificent Seven stocks?

The Magnificent Seven are making utterly massive investments to grow in the future. These investments are expected to benefit them, of course, but they can also have huge impacts further down the AI value chain. So, many smaller companies may ride the wave, too.

For example, manufacturers of hardware such as memory and data storage surged in 2025. These stocks include Western Digital (WDC), Micron Technology (MU), Seagate Technology (STX), and Sandisk (SNDK).

Sandisk, which was spun off from hard-drive maker Western Digital in February 2025, soared over the course of the year. The stock could be bought below $40 for months – even $30 if you timed it right – before it ballooned to more than $280 by November. From $40 to $280 is a 600% gain, and investors may well have done better, depending on when they bought.

Today, Sandisk’s market cap sits around $40 billion. But at just $40 per share as recently as August the market cap was around $6 billion. At that time, Sandisk was well less than 1% the size of a Microsoft, Apple, or Alphabet.

But it’s exactly the kind of smaller company that could soar as the Magnificent Seven companies make massive investments in a supertrend such as AI data centers.

Regards,

James Royal

Editor’s Note: A former hedge-fund manager known for spotting early winners is sounding the alarm once again.

He called Netflix (NFLX) at $7.78 (up 4,200% since), Apple at $0.35 (up 20,000%), and Amazon at a split-adjusted $2.41 (up 3,200%).

Now, this renowned investor just released a new list of his favorite AI stocks… and not a single Magnificent Seven name made the cut.

Instead, an AI stock you’ve likely never heard of just flagged as “near-perfect” in his new investing scoring system.

Click here to watch his brand-new presentation, where he reveals the name, ticker symbol, and why this could be the smartest AI move of the year… especially if you’re over 50.