In the early 2000s, only a few hundred robotic medical procedures were performed each year in the U.S.

Today, that number has surged well past a million – and climbing.

The most common uses have been in urology and gynecology. But now, robots are helping with orthopedics, general surgery, and even lung and heart procedures.

Still, only 22% of surgeries performed in the U.S. use robotics.

Right now, the Health Resources and Services Administration (HRSA) − a division of the U.S. Department of Health and Human Services (HHS) − estimates there’s a shortfall of nearly 100,000 doctors in the U.S. to meet current demand. That shortfall is expected to be nearly 130,000 by 2030.

Put simply, hospitals are under pressure to deliver better outcomes with fewer resources.

As a result, demand for surgical robots is booming.

The robotic-surgery market is projected to grow by roughly 15% a year until 2030.

This growth will benefit the clear leader in the space: Intuitive Surgical (ISRG).

Intuitive Surgical is the maker of the da Vinci system, a well-known and trusted device that has long been cleared for robotic urologic procedures.

Source: Intuitive Surgical

With the da Vinci system, Intuitive Surgical controls nearly 60% of the global robotic-surgery market. And this dominant position has led to a lot of growth for the company… Sales have more than doubled since 2019.

Intuitive Surgical reported fourth-quarter earnings after the market closed yesterday. Let’s look at recent results to see if it continued its impressive run…

A Monster Quarter for Intuitive Surgical

Shares of Intuitive Surgical spiked as high as 3% this morning after both revenue and earnings for the quarter came in higher than expected.

The company reported fourth-quarter revenue of $2.9 billion, a robust 19% increase compared with a year ago. This growth was fueled by a continued rise in procedure volumes and the aggressive rollout of its next-generation devices.

Worldwide surgical procedures grew roughly 18% in the quarter.

On the hardware side, the company successfully placed 532 da Vinci surgical systems, up from 493 a year ago. Most notably, 303 of these were the new da Vinci 5 systems, nearly doubling the 174 placed a year ago. This rapid adoption of the “dV5” is a critical win, as it locks hospitals into Intuitive Surgical’s ecosystem for years to come.

The only “yellow flag” was guidance…

Management forecast worldwide procedure growth of 13% to 15% in 2026. While still healthy, this represents a deceleration from 2025… It’s also slightly below some analyst expectations.

Still, Intuitive Surgical posted a massive 28% profit margin in 2025. And it generated $2.5 billion in free cash flow, up from $1.3 billion in 2024.

Intuitive Surgical’s CEO said physicians used the company’s robotic systems to treat more than 3.1 million patients in 2025.

This year’s results only cement Intuitive Surgical as the undisputed king of the operating room.

So, the question for investors − is the stock still worth buying today?

After a Great Run, ISRG Looks Expensive

You might think it’s too late to buy Intuitive Surgical. After all, the stock is up nearly 185% since late 2022.

It’s true that Intuitive Surgical does sport a premium valuation. It trades for a whopping 75 times earnings. But this is one of the best businesses in the world.

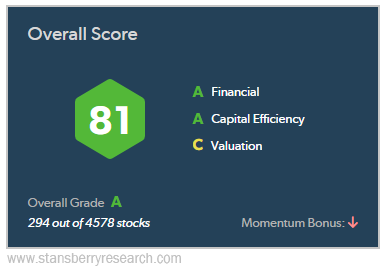

We can see this with our proprietary Stansberry Score.

This tool helps us rank stocks with a simple score between 0 and 100. It builds our strategies for assessing value, business strength, and momentum into a one-click way to make sure that the stocks you own are high-quality.

Today, the Stansberry Score gives Intuitive Surgical A grades in both financial and capital efficiency (the hallmark of a great business). But the stock does get dinged for its lofty valuation, earning it a C grade.

Overall, Intuitive Surgical is still one of the best stocks in the market. Take a look…

Because of Intuitive Surgical’s rich valuation, it might be smart to wait for a larger dip before you consider adding the stock to your portfolio.

But there is a competitor of Intuitive Surgical’s that could warrant a spot in your portfolio today…

An FDA Approval to Challenge Intuitive Surgical

Medtronic (MDT) has spent more than a decade developing its own robotic-surgery device, Hugo.

Hugo is cart-based, modular, and more portable than many competing systems.

Back in April of last year, Medtronic announced that it filed for FDA approval of its Hugo robot. The company wanted to break into the U.S. market with a focus on urologic procedures – a direct challenge to Intuitive Surgical’s longtime dominance.

Medtronic’s FDA submission followed its completion of a large U.S. trial, known as Expand URO, which tested Hugo in “multi-port” urologic surgeries on cancer patients. Multi-port means the surgeon uses several access points (typically three to five small incisions) instead of one. Each port holds a different robotic arm or tool.

Participants in Medtronic’s study underwent prostate, kidney, or bladder-tissue removal. The results, unveiled at the American Urological Association’s annual meeting in Las Vegas, showed a 98.5% success rate and fewer serious complications than historical benchmarks.

Medtronic got great news last month…

The FDA finally approved Hugo for use in urologic surgical procedures. These include prostatectomy, nephrectomy, and cystectomy – accounting for roughly 230,000 surgeries per year in the U.S.

While the Hugo system will start in urology, Medtronic has also tested the device in hernia repairs and procedures involving noncancerous gynecological ailments. It will soon seek approvals to use Hugo in a wider variety of fields.

Expanding the uses of its robotic systems has been a big growth driver for Intuitive Surgical. Medtronic will follow suit.

To be clear, Medtronic won’t take significant market share from Intuitive Surgical overnight. Convincing health care facilities to switch to Hugo over the da Vinci system will take time. Remember, Intuitive Surgical has been in business since the 1990s. And the da Vinci system has been approved by the FDA since 2000. The company and its products are known and trusted by the health care industry. Convincing them to switch to Medtronic won’t happen right away.

Fortunately, Medtronic doesn’t have to steal Intuitive Surgical’s customers for Hugo to be a hit. As I mentioned earlier, so few surgeries are currently done with robotics that both companies have ample room to expand.

Medtronic is a great way to play the growth in the robotic-surgery market.

And you don’t have to pay 75 times earnings for Medtronic…

Is Medtronic a Better Buy?

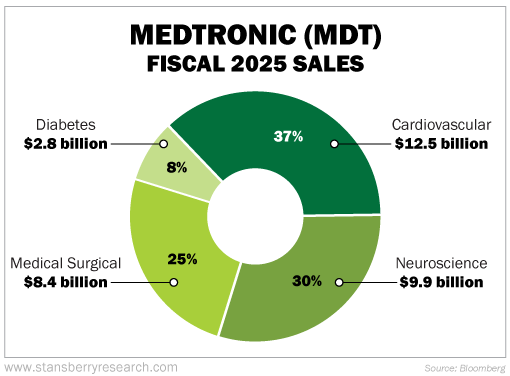

Medtronic won’t just rely on Hugo for growth in the coming years. This is a diversified giant.

Here’s a breakdown of the company’s fiscal 2025 sales…

The cardiovascular segment is Medtronic’s powerhouse. This segment focuses on the diagnosis, treatment, and management of heart-rhythm disorders and heart failure.

Medtronic got its start with pacemakers, which remain a large part of the business today. The company also makes defibrillators and heart valves.

One of the biggest growth drivers within Medtronic’s cardiovascular portfolio is its pulsed-field ablation (“PFA”) franchise. The PulseSelect PFA system is a game changer in treating atrial fibrillation (“AFib”) – an abnormal heartbeat that can often lead to heart failure. The PFA system uses pulsed electric fields – rather than extreme temperatures – to treat AFib. This leads to fewer complications like nerve damage.

AFib affects roughly 50 million people worldwide. Currently, less than 5% of eligible patients who could benefit from a cardiac ablation procedure for AFib receive one.

Most importantly, the PFA franchise helped grow Medtronic’s cardiac-ablation revenues by 71% in the second quarter of fiscal 2026.

The medical-surgical segment makes products that move hospitals toward more minimally invasive procedures… products like staplers, vessel sealers, and the Hugo system. Expect many years of growth in this division as Hugo makes its way into more operating rooms.

Neuroscience focuses on the brain, spine, and nervous system, treating conditions ranging from chronic pain to Parkinson’s disease. This segment’s sales have steadily climbed from $8.2 billion in fiscal 2021 to $9.9 billion at the end of April 2025.

Finally, in the diabetes segment, Medtronic makes insulin pumps and continuous glucose monitors (“CGMs”).

As you can see above, diabetes is Medtronic’s smallest segment. It makes up just 8% of the company’s sales… and less than 6% of operating income.

Many analysts are excited that Medtronic plans to spin off its diabetes business into a separate company called MiniMed.

This move is good for two reasons… It will let Medtronic focus on its bigger, higher-margin businesses. And it will let MiniMed’s leadership focus specifically on the diabetes market, where Medtronic’s CGM system has a tiny 7% market share.

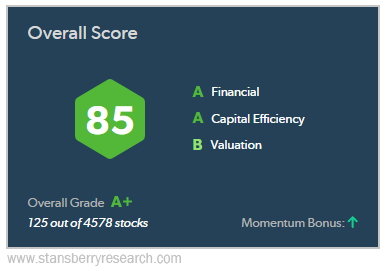

Now, let’s go back to our Stansberry Score to see where Medtronic ranks…

Like Intuitive Surgical, Medtronic receives A grades for both financial and capital efficiency. But unlike Intuitive Surgical, Medtronic trades for a reasonable price.

It trades for just 23 times earnings – earning it a B grade for valuation.

As you can see below, our Stansberry Score gives Medtronic an overall grade of A+, ranking it 125th out of nearly 5,000 stocks.

So if you are looking for a way to play the high-growth robotic surgery market, Intuitive Surgical is an option… but it’s expensive.

Meanwhile, Medtronic will also benefit as more surgeons rely on robotic devices… and you can get Medtronic for a reasonable price today. You’ll also receive its 2.8% dividend yield.

Regards,

Jeff Havenstein

If you’re 50 or older… or thinking ahead to retirement… legendary investor Whitney Tilson says this could be your smartest financial move of the entire AI boom.

It’s time to look past Nvidia and the “Magnificent Seven.”

Whitney, a retired hedge fund manager once dubbed “The Prophet” by CNBC, is sharing a new AI story.

His brand-new stock system just gave one company a near-perfect grade… and it’s not a name you’ve heard on the news.

The company just signed a huge new AI deal with a key tech partner, and you’ll soon see a massive nationwide rollout.

Whitney’s giving away the name, ticker, and full breakdown for free.