All in, 1.6 million traders lost $19 billion as bitcoin fell on October 10.

Exchanges shut down accounts that were borrowing to buy bitcoin. It’s called trading on margin. And if your bets go against you, you have to put more money in to keep the account open.

Things were unwinding so quickly that exchanges were just trying to keep up with closing accounts.

Even more, the crisis was enough to overwhelm exchanges like Binance. Its platform showed several assets depeg from their actual tokens… meaning that prices on the platform were way lower than the real value. What looked like a severe crash was a system error. And it caused accounts to close.

Since then, Binance has paid more than $280 million to those affected.

This was starting to look like the flash crash of 1987, where stocks fell 29% in a matter of days. Then, it was over, and the bull market returned.

But unlike the 1987 “Black Monday” crash for stocks, bitcoin hasn’t returned to a bull market yet.

Investors Are Finally Considering That Maybe a Quick Return to the Bull Market Isn’t Coming…

In fact, open interest in alternative coins (altcoins) has fallen 55% since October, when the carnage started. These are the more speculative bets in the crypto market. So, it’s no surprise that investors are getting more conservative.

It’s also happening with the majors like bitcoin as well…

You see, on January 5, there was a strong inflow of $697 million into the iShares Bitcoin Trust (IBIT). But last Friday, things started to reverse…

We saw roughly $252 million in outflows on Friday. This isn’t a big enough number to say people are panicking by any means. But it is a sign that investors are easing off the gas for at least the moment.

That’s why today, I want to break down where we are in the bitcoin cycle and why this latest “dip” is not a good buying opportunity. And in a little bit, we’ll look at how to navigate the latest shake-up in bitcoin.

First, let’s get to the big-picture view… It’s more important than ever to pay attention to bitcoin’s cycle.

We Are Entering ‘Phase 4’ of the Consistent Bitcoin Cycle

If history is any indication, the carnage since October is just the start. A Bitcoin Winter is likely kicking off. And here’s why…

Bitcoin has gone through four-year cycles several times. These cycles have followed a classic behavioral pattern.

The first year is known as the accumulation phase. Folks start to buy bitcoin after a big bust. The bottom sets in, and prices climb higher.

This is followed by a rally into the second year as a rebound kicks in. And in year three, the big “halving” event takes place.

This is when the amount of bitcoin you can mine falls by half. The idea behind this is to make sure that bitcoin is a finite asset. Folks can’t keep going out to mine more and create an infinite supply.

That halving event creates a speculative period before bitcoin peaks 12 to 18 months later… in year four.

Bitcoin last went through a halving in April 2024. And since 2009, there have been three other halving events: November 2012, July 2016, and May 2020.

In each case, the price of bitcoin soared into the next year before finding a peak. Here are those returns and when the rally peaked.

| Halving Event | Peak Date | Months From Halving Event |

| 11/28/2012 | 11/29/2013 | 12 Months |

| 7/9/2016 | 12/17/2017 | 17 Months |

| 5/11/2020 | 11/9/2021 | 18 Months |

| 4/20/2024 | 10/06/2025? | 18 Months |

Bitcoin topped out within 18 months of the halving every time.

Then, the bottom fell out. In 2013, bitcoin hit a high of $1,137 before crashing to $183 by early January 2015… an 84% crash in a little more than a year.

A similar crash took place after the 2017 peak. The cryptocurrency fell from $19,042 to $3,157 per coin by December 2018… an 83% crash in one year.

The most recent case was after the 2021 peak. Bitcoin hit a high of $67,734 and fell to $15,632 by November 2022. That’s a 77% crash in a year.

So far, bitcoin has fallen as much as 28% from its high. It has recovered some of those losses and is trading around $93,000 per coin. But it’s a far cry from a true rebound.

Now, there aren’t that many cases to go off of. But given the consistency of this cycle since bitcoin’s creation, we can’t ignore it.

That’s why, instead of buying the dip today, it’s time to set up a plan on how to trade bitcoin going forward.

Let’s Break Down the Two Possible Scenarios From Here…

- This turns out to be just a dip, and bitcoin breaks its behavioral cycle. Or…

- The four-year cycle holds, and we are entering a new crypto winter.

Here’s how to approach scenario one. If this is just a dip, you don’t have to buy at the low to benefit. That’s a risky bet anyway. The low is only obvious in hindsight.

Typically, when you think you are buying at the low, it turns out it wasn’t THE low. And you end up losing money in a quick fashion.

Instead, wait until the uptrend returns before buying. Yes, you are giving up some of the gains by being patient. But you’re also putting the odds in your favor to make money.

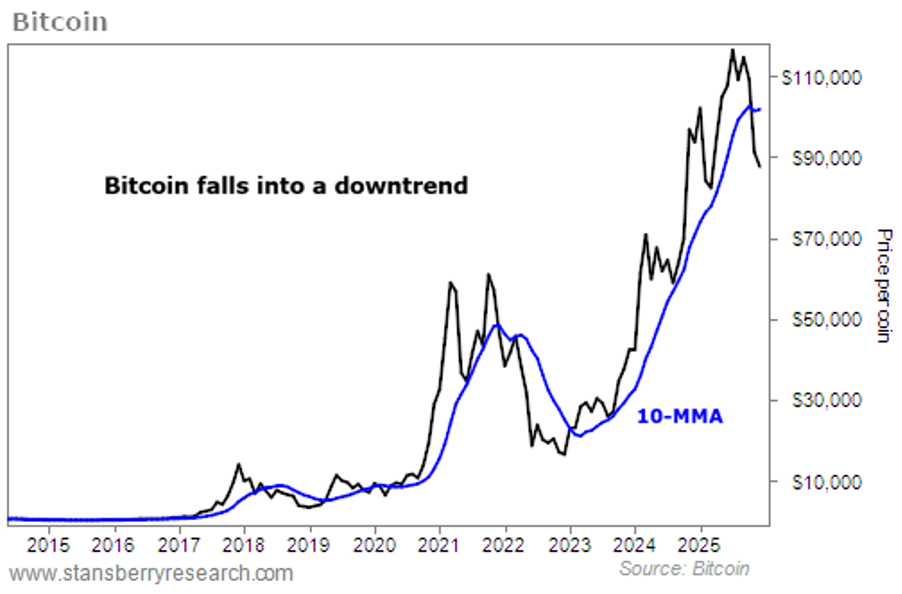

Let’s use a very simple way to prove it… the 10-month moving average (10-MMA) for bitcoin. If bitcoin trades above this moving average, that signals an uptrend. And if it’s below that moving average, bitcoin is in a downtrend.

How to Capture 184% Annualized Gains While Avoiding the Crash

We tested this as far back as bitcoin prices go. If you owned bitcoin when it was above the 10-MMA over that time, you saw 184% annualized gains.

We tested this as far back as bitcoin prices go. If you owned bitcoin when it was above the 10-MMA over that time, you saw 184% annualized gains.

Those who held on through all of the booms and busts made 152% annualized gains.

Put simply, by owning bitcoin only in an uptrend, you can increase your upside potential.

But if you owned bitcoin when it was below its 10-MMA, you did terribly…

That led to annualized losses of 10%. And bitcoin is still trading below its 10-MMA as I write…

This is not what you want to buy into. Being patient in the near term can help you avoid disaster and be ready to profit if this dip turns into another leg higher.

Now, let’s switch to the second scenario…

What to Do If We Are in the Early Stages of a Bitcoin Winter

Remember, previous crashes have led to 75%-plus drawdowns. If that was the case this time around, bitcoin would fall to around $31,000… that’s a 67% drop from the recent close.

Maybe you have ‘diamond hands’ and have held strong through previous bitcoin winters. Say you don’t flinch when the asset is down 75% and you have no doubt you will hold through it. Then maybe your strategy is to just sit tight.

But if you’re more like me, and don’t want to lose sleep in that kind of crash, there are a couple things you can do…

First, make sure you don’t have all of your eggs in one basket. A general rule is to not have more than 5% of your portfolio in a single trade.

If your bitcoin holdings are 40% of your portfolio and you don’t have diamond hands, consider lowering your exposure.

Another way to track your risk to bitcoin is by setting a stop price… This is the point where, if bitcoin falls below it, you sell, no questions asked.

It’s your line in the sand to make sure you live to invest another day. For example, with bitcoin a little above $93,000, maybe you are willing to risk it falling to $70,000 before getting out. That’s a 25% drop from the recent close.

Or maybe you are willing to risk 35% and hold until it hits $60,000. But wherever your “cry uncle” level is, you sell when it’s hit. Write it down on a piece of paper if you have to, so you follow the advice when it’s time.

Everyone’s risk tolerance is different. What works for you might not be right for me. The important part, though, is that you have a plan in place for when things go wrong.

That’s when you separate yourself from the average investor. And it’s how you become a winner in the markets over the long term.

Overall, bitcoin’s recent drop has wiped out billions. Instead of worrying about where bitcoin goes from here, build a plan for both scenarios.

You’ll be glad you did, no matter what happens next.

– Chris Igou

Editor’s Note: “A strange day is coming to America.”

That’s according to a former Goldman Sachs executive who predicted everything from the 2022 crash, the death of the 60/40 portfolio, and even the rise of blockchain.

He’s not the only one sounding the alarm:

- The Wall Street Journal calls it a ‘New World Order.’

- The Financial Times says, “the unimaginable is becoming imaginable”… and that it could “upend the global monetary system.”

- And one of President Trump’s senior advisers has already laid out the plan to accelerate this trend. It’s all written out, point-by-point, in black and white. (Details here.)

So, what should you do right now to come out ahead?Click here to learn more in Dr. Eifrig’s new free presentation… and get the three money moves to capture the biggest potential gains as this seismic change unfolds