Today’s issue in preview:

-

The K-Shaped stock market is creating a huge winners and huge losers. Are your stocks at risk?

-

Why you should invest in things you can stub your toe on

-

Check your portfolio. Do you own stocks that AI is coming for?

-

Our hot hand continues: Oil stocks, Boomer health care stocks, and Power Grid Upgrade stocks reach new highs.

The K-Shaped stock market is creating a huge winners and huge losers. Are your stocks at risk?

If a company makes something AI cannot, it’s going up.

If a company makes something AI can, it’s going down.

That sums up two of the world’s most important megatrends right now.

As you read this, these two megatrends are creating havoc in the stock market. In today’s issue, I’ll explain what’s happening and what we should do about it.

First, let’s cover what is going up…

Over the past six months, I’ve frequently highlighted the quiet bull market in U.S. manufacturing. Large U.S. manufacturers such as Cummins (CMI, engines), Caterpillar (CAT, construction equipment), Honeywell (HON, diversified), and John Deere (DE, farm equipment) are reporting strong business results, and their stocks are in strong uptrends.

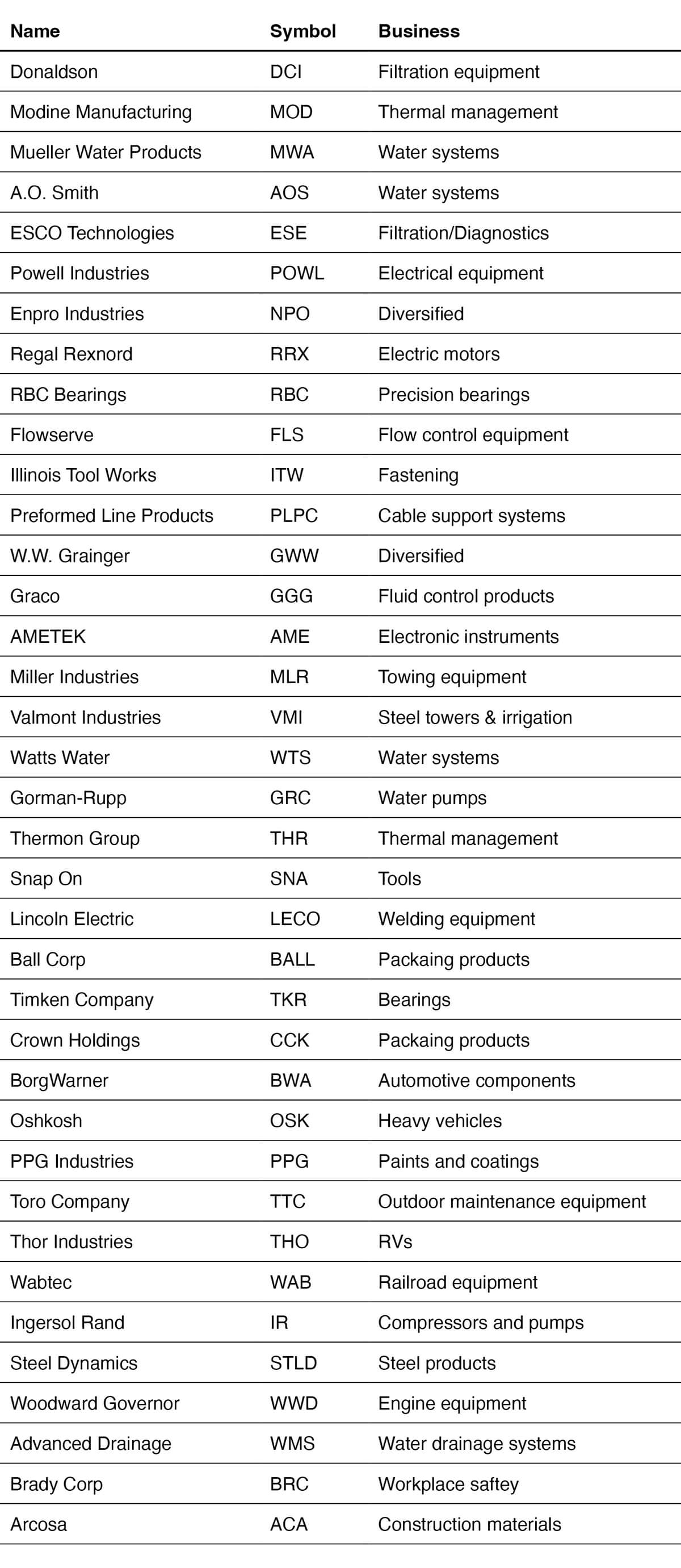

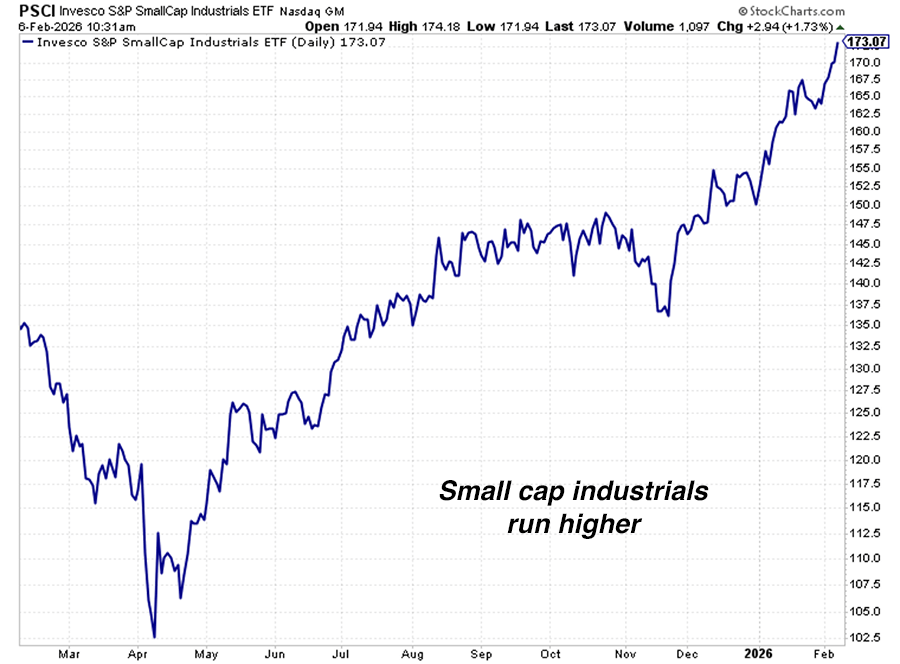

I’ve also highlighted the boom in smaller, under-the-radar U.S. manufacturers. The mainstream news pays almost no attention to this boom, but we are seeing an extraordinary rally in the smaller, unsung heroes of U.S. manufacturing.

These companies typically don’t make front-page news. No investment analyst will “go viral” for making a call on these stocks. They operate with little fanfare, providing critical equipment and services the U.S. economy cannot function without. Our factories, vehicles, homes, and cities wouldn’t function without their specialized pumps, motors, filters, valves, gaskets, bearings, and switches. And their businesses are booming.

Below is a list of “not well-known” U.S. manufacturers at or near new one-year highs. Forgive the length, but what’s happening is incredible:

You can see that these companies make things you can stub your toe on.

Water pumps. Welding equipment. Lawnmowers. Power line poles. Transmissions. Engine parts. Ball bearings. Not as glamorous as AI semiconductors, but critical economic inputs.

The strong business and stock performance of both large and small manufacturers tells us the U.S. economy is doing much better than the pessimists would have you believe. It tells us to expect excellent GDP news in the months ahead. Plus, it shows the government’s push to massively increase the U.S. manufacturing base is having an effect.

Manufacturing stocks are enjoying another tailwind: K-Shaped stock market money flows. Investors are selling companies vulnerable to AI-driven disruption and buying companies that are not.

The end products listed above are not glamorous, but they have the wonderful quality that you cannot code or prompt any of them into existence. As incredible as AI is, it cannot create an industrial water pump or a bulldozer engine.

The above factors are why the large-cap industrials ETF – the Industrial Select Sector Fund (XLI) – and the small-cap industrials ETF – the Invesco S&P SmallCap Industrials ETF (PSCI) – are trending higher and near their all-time highs. I expect this trend to continue running. I like being long things I can stub my toe on. Things that cannot be coded into existence. As for things that can be coded into existence, it’s a much different story…

Check your portfolio. Do you own stocks that AI is coming for?

Two 23-year-olds graduate college in 2021.

One moves to San Francisco, gets into the booming, exciting software business, and expects to make lots of money. The other one moves to Ohio and gets into the welding equipment business.

Fast forward to February 6, 2026, and the software guy is out of work… while the welding equipment guy… is doing great?

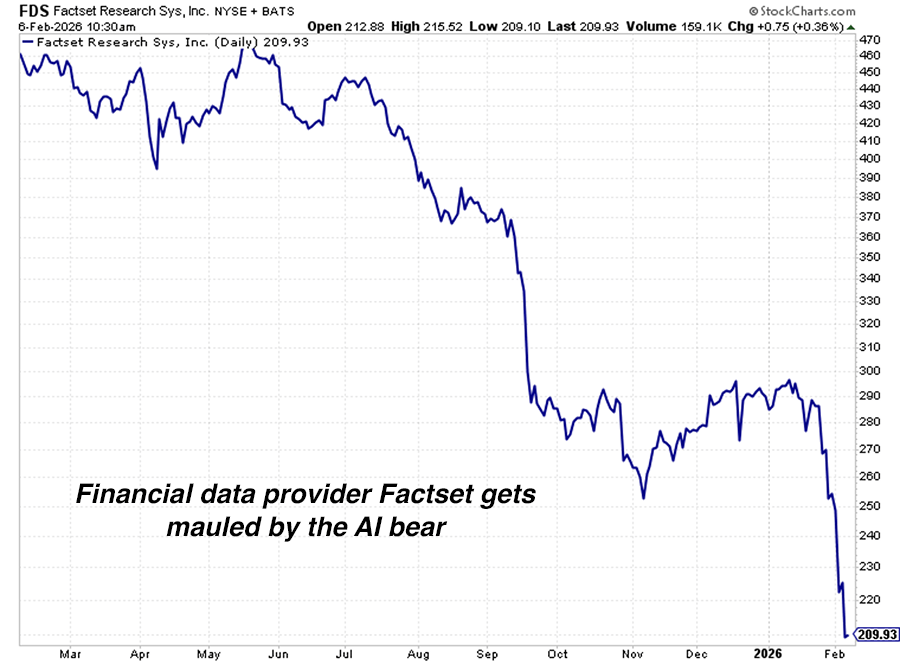

For better or worse, this is what’s starting to happen across America. As I detailed in the January 30 issue, the software industry is amid a historic and horrendous bear market. Many of the world’s largest and most important software firms are down 33% – 75% over the past year. “Bloodbath” barely begins to describe what’s happening right now in the software sector.

Many investors believe AI models will create useful software programs much more cheaply than they are being created now. This could put many software firms out of business or, at the very least, lead to a large number of new competitors. These new competitors could drive down the revenue growth, profit margins, and P/E multiples of existing companies.

Software isn’t the only industry on the wrong side of AI. This week, the giant technology consulting firm Gartner (IT) plunged 20.8% in one day. The stock is down an incredible 71% over the past year.

Gartner’s business is based on charging large sums to consult with businesses on technology system purchases. Bears on the stock say AI programs such as ChatGPT and Anthropic’s Claude will provide such consulting for less than 10% of the current price.

Also, shares of big information tools business RELX (RELX) are down 39% over the past year. Shares of legal and tax info business Thomson Reuters (TRI) are down 47% over the past year. Shares of consumer credit info firm Equifax (EFX) are down 28% over the past year. Shares of financial data firm FactSet (FDS) are down 54% over the past year. Shares of financial data firm Morningstar (MORN) are down 47% over the past year.

In other words, if a business is built on Knowledge work, Information collection & analysis, Data collection & analysis, or Software (KIDS work), then AI could pose a lethal threat. If someone using AI can code a product or service into existence, then any business related to it is in danger.

Big AI companies such as OpenAI and Anthropic could be ferocious new competitors. Upstart competitors using AI could prove to be ferocious new competitors. These new competitors will greatly lower the cost and value of KIDS work. If this is close to describing your current job or one of your portfolio holdings, you should be sweating bullets.

AI will put some of these KIDS work companies out of business. But keep in mind, it doesn’t have to put them out of business to make them stock market losers. AI only needs to lower the cost of producing what they produce over the long run. This will throw a heavy wet blanket on their growth rates, profit margins, and P/E multiples.

To be clear, not every business in the KIDS category will be a casualty of AI. Some will adapt and thrive. There’s going to be opportunity in this stock market wreckage. But for me, I prefer to keep most of my bets in the realm of things I can stub my toe on.

Market Notes

-

Our September 29, 2025, bullish note on oil stocks continues its winning ways. The S&P Oil & Gas Equipment & Services ETF (XES) reached a new 1-year high today.

-

Our longstanding recommendation to be long the Power Grid Upgrade theme continues to be a winner. The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) reached a new all-time high today… and power grid infrastructure firm Quanta Services (PWR) reached an all-time high today.

-

The U.S. transportation sector continues to boom. The iShares Transportation ETF (IYT) reached a new all-time high today. This strength in airlines, ground shippers, and railroads is a bullish economic signal.

-

It’s a bull market in high quality dividend paying stocks. The Invesco Dividend Achievers ETF (PFA) reached a new high today. This fund is focused on America’s top dividend paying stocks.

-

Giant steelmaker ArcelorMittal (MT) reached a new all-time high today. If we are making and using lots of steel, that’s a bullish economic signal.

-

Our longstanding recommendation to own Boomer health care stocks continues to pay off. Drug giants Johnson & Johnson (JNJ) and Amgen (AMGN) both hit all-time highs today.

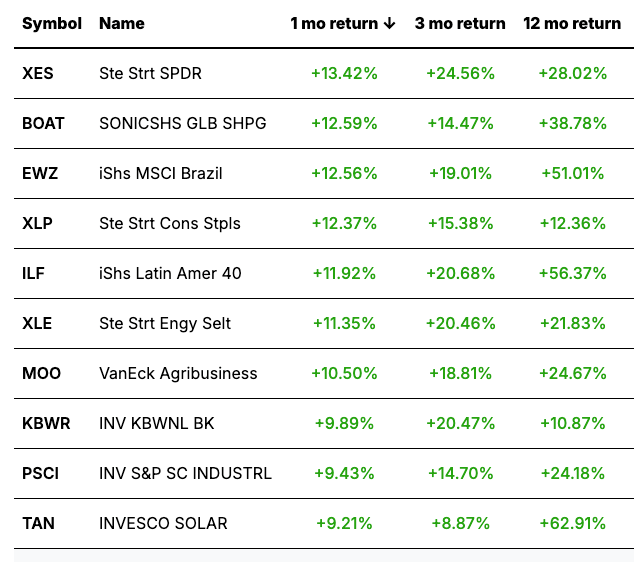

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends