The story at Tesla (TSLA) is rarely about what it has just accomplished, but rather where it’s going under CEO Elon Musk. And in 2026, some of Tesla’s moves are a hard 180, though many others are meant to accelerate the company toward Musk’s vision of an autonomous future.

The key news from the recent quarterly report:

- Tesla is ceasing production of the Model S and Model X in the second quarter.

- Tesla is investing $2 billion in xAI, which owns the Grok chatbot and social media platform X (formerly known as Twitter).

- The third-gen Optimus robot is set to be unveiled later this quarter.

- Management is projecting more than $20 billion in capital expenditures this year.

Oh, sales and earnings?

Tesla reported those, too. Annual sales came in at $94.8 billion, down about 3% year over year. Earnings plummeted 46% to about $3.8 billion.

That’s scant earnings for a company valued at more than $1.6 trillion, leading some investors to steer clear of the stock. Noted Big Short investor Michael Burry, for example, has called Tesla “ridiculously overvalued,” panning how the company richly rewards Musk with stock.

But it may not matter… for now.

That’s because Musk’s promises about a big, bold future – robotaxis and humanoid robots, for example – are keeping investors from looking too closely at a struggling electric-vehicle (“EV”) unit. And Musk is putting $20 billion toward that future this year alone.

Tesla’s Car Sales Continue to Plummet

While Musk’s promises about robotaxis and robots may come to fruition in time, it’s the car unit that needs to generate profit today. In recent years, car sales have been going anything but ludicrous speed.

Check out sales in the automotive unit over the past few years, and you’ll see an unsettling trend:

- 2022: $71.5 billion

- 2023: $82.4 billion

- 2024: $77.1 billion

- 2025: $69.5 billion

Tesla’s automotive sales peaked in 2023, and in 2025, its car sales were less than in 2022!

But that’s only part of the story, because Tesla’s two other units – energy generation/storage and services – have grown solidly over that same time frame. These segments have blunted the overall impact of Tesla’s sagging car sales. Here are overall sales for the past several years:

- 2022: $81.5 billion

- 2023: $96.8 billion

- 2024: $97.7 billion

- 2025: $94.8 billion

While sales aren’t off that much from their all-time high, annual profit fell by almost 75%, from about $15 billion at its peak in 2023 to just $3.8 billion in 2025.

Meanwhile, Tesla is trading with a market cap of $1.615 trillion – about 425 times earnings.

As mentioned above, Tesla is discontinuing the Model S and Model X, leaving the Model 3 and Model Y as standard-bearers. Don’t expect the move to affect unit volumes much, however. Model 3 and Model Y accounted for the vast majority of total sales volume in 2025, with all other vehicles coming in at 3% combined.

And it’s moving more drivers – 1.1 million, a new high – to subscriptions for Full Self-Driving. The move should help generate some needed cash flow.

But Tesla is facing some serious sales headwinds. President Donald Trump’s One Big Beautiful Bill Act ended an existing $7,500 subsidy for EVs. And Chinese competitors such as BYD – which took the crown of world’s top-selling EV maker from Tesla in 2025 – are fierce.

Tesla Shifts to Robotaxis and Robots

Amid falling sales, Musk reemphasized that Tesla’s focus is autonomous vehicles (“AVs”) such as its robotaxi – not merely EVs – as well as even bigger initiatives like humanoid robots.

“We’re really moving into a future that is based on autonomy,” said Musk in the year-end earnings conference call.

But the timeline is anything but certain on robotaxi autonomy, even though it does appear to be creeping closer. Musk has been promising investors that AVs are just a couple years away for a decade or more. The company now has a fleet of more than 500 robotaxis in Austin and the San Francisco Bay Area combined.

In the quarter, Tesla reported progress on robotaxis, even if it seemed much like Musk’s old game of bait-and-switch. The EV maker said that it “began removing [the] safety monitor from [its] Robotaxis in Austin in January.” The statement left the impression that the cars – still in a testing phase on the Texas city’s streets – were not under supervision with a monitor.

In fact, Tesla had simply moved the safety monitor from the passenger seat of the robotaxi into a trailing vehicle that followed the car around, with a team of engineers along for the ride as well.

Yes, Tesla’s investor update laid out planned robotaxi coverage for a handful of major American cities (Phoenix, Dallas, and Las Vegas, among others) in the first half of 2026. Musk stated that Americans should expect to see them in “dozens of major cities by the end of the year.”

But Musk has shown investors that they need to verify well before trusting.

Competition is heated in the AV space, too, even if the field is much narrower. And one of the deepest pockets in the business world – Alphabet (GOOGL) – is behind key AV rival Waymo.

Riders can actually hail a Waymo AV in Phoenix, San Francisco, and Los Angeles today. Further expansions are on the way in 11 U.S. cities, and testing is being done in a dozen more in advance of a rollout of service.

So, we’ll see where Tesla is at the end of the first half of the year.

Waymo also recently announced that it was raising $16 billion at a $110 billion valuation. Its parent company Alphabet is providing $13 billion of that total raise.

Waymo is out in force – even moving internationally – with a wad of cash in its pocket.

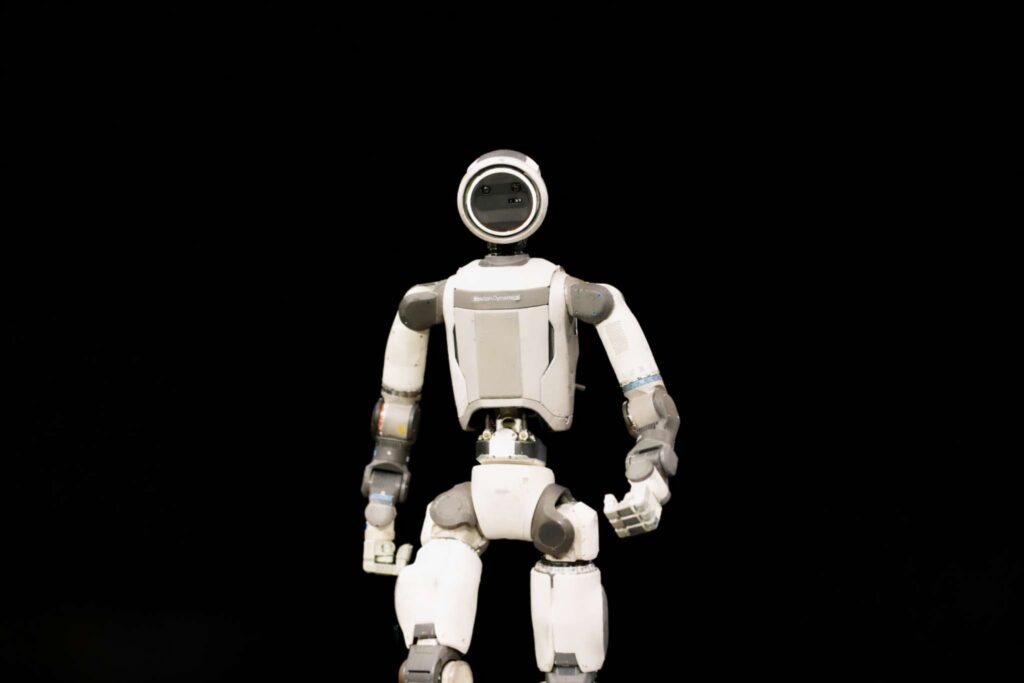

And the Optimus humanoid robot?

Tesla’s production lines for the Model X and S at its plant in Fremont, California are being shifted over to the Optimus. And the company will trot out – presumably literally – the third-generation Optimus later in the quarter.

Tesla’s planned $20 billion and more in capital expenditures for 2026 will need to power a lot of development on the various fronts that the company has open.

Tesla: A Pricey Call Option on an Uncertain Future

Investing is all about buying something for less than it’s worth now or will be worth in the future. Tesla is already one of the world’s most valuable companies, blowing past the $1 trillion mark.

Can Tesla possibly achieve even more than what the market has already priced in so that investors today could have a chance at making a profit?

Consider Tesla’s valuation in light of the company’s key assets:

- A shrinking EV unit, which forms the cornerstone of a business that earned $3.8 billion in 2025, compared with rivals such as Ford Motor (F) and General Motors (GM), worth only tens of billions

- An AV segment with a key rival already being hailed on city streets and priced at just $110 billion in a recent capital raise

- An uncertain timeline for the rollout of a humanoid robot

- A cash hoard of $44 billion (as of year-end) that will shrink by about $20 billion due to capital investment this year alone

- A CEO whose focus is not just on Tesla, but also on xAI and SpaceX, the latter of which is discussing an IPO this year

Investors appear to be pricing in a lot of “call value” to Tesla’s stock – that is, expecting a lot of future greatness from a company and CEO who have built plenty of expectations into the stock.

With Musk’s hard pivot in 2026 to invest heavily in his vision, we’re about to see whether investors are paying too much for this call option on Tesla’s future.

Regards,

James Royal

Editor’s note: Should investors prepare for an AI crash or buy the dips? True Wealth editor Brett Eversole just posted a surprising answer. According to Brett’s research, there’s a pattern taking shape that could defy all the worst predictions about a bust. He’s calling it a Melt Up Tsunami. And he has identified at least a half-dozen stocks that could benefit, including his No. 1 stock to own right now. He shares the ticker in this new presentation.