Today’s issue in preview:

-

The most important financial trend you don’t know about

-

This stock may be the best way to invest in AI and Robotics at the same time

-

Software vs. AI infrastructure: Why “think of it as a market of stocks, not a stock market” is so important.

-

Our recommendation to invest in the Boomer health care theme continues to pay off

The most important financial trend you don’t know about

Over the past two months, the benchmark S&P 500 index is up 2.4%. During the same time, the big U.S. industrial stock – the State Street Industrial Select Sector SPDR ETF (XLI) – is up 9.5% and trading near its all-time high.

This is some of the best economic news the mainstream media isn’t reporting. XLI is made up of America’s largest manufacturing firms, including Boeing (BA), Honeywell (HON), Caterpillar (CAT), General Electric (GE), Deere & Co (DE), and Eaton (ETN). Their new highs and strong earnings tell us the U.S. economy is doing a lot better than the media’s negative headlines would have you believe.

But it gets even better for the optimists…

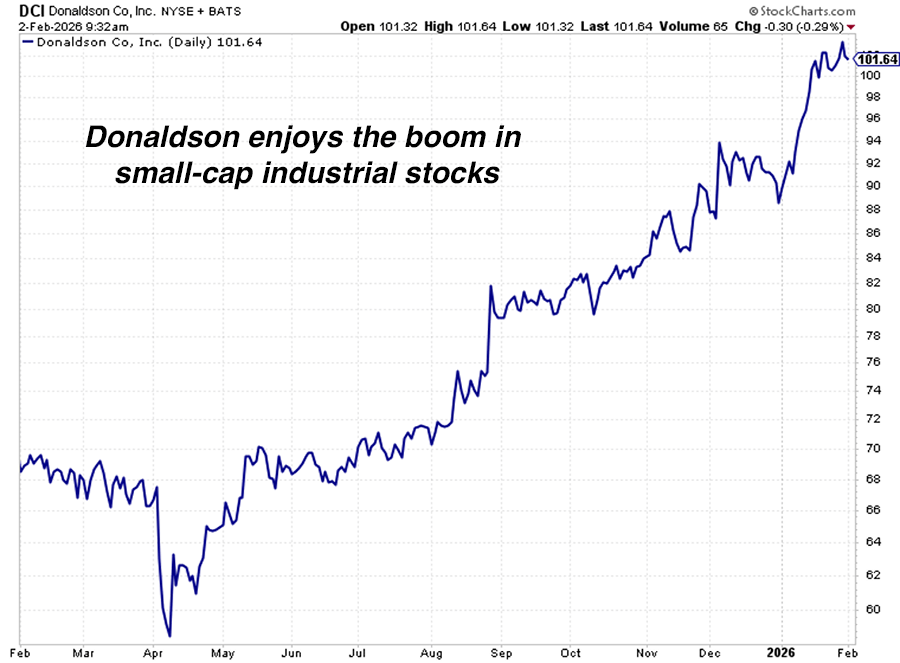

Smaller, niche U.S. manufacturing companies are also experiencing a boom.

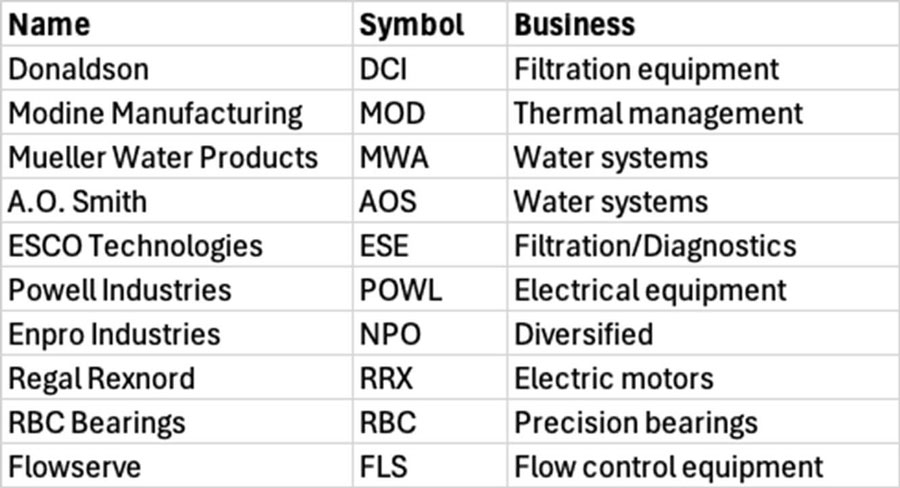

Below is a list of smaller (sub $50 billion market cap) U.S. manufacturing firms that are very close to or at one-year highs. Many of them are up 20%+ over the past year:

These companies typically don’t make front-page news. No investment analyst will “go viral” for making a call on these stocks. They operate with little fanfare, providing critical equipment and services the U.S. economy cannot function without. Our factories, vehicles, homes, and cities wouldn’t function without their pumps, motors, filters, valves, gaskets, bearings, and switches. And their businesses are booming.

The stock market is the world’s greatest forecasting mechanism. It tends to look ahead 6 -12 months. When an industry is in a recession, its stock prices will rise before the news media announces it is recovering. When an industry seems to be doing well, its stock prices will decline before the news covers its downturn. This is often called “discounting” or “pricing in” the future.

The strong business and stock performance of both large and small manufacturers tells us the U.S. economy is doing much better than the pessimists would have you believe. It also tells us to expect to see strong GDP news in the summer and fall.

This stock may be the best way to invest in AI and Robotics at the same time

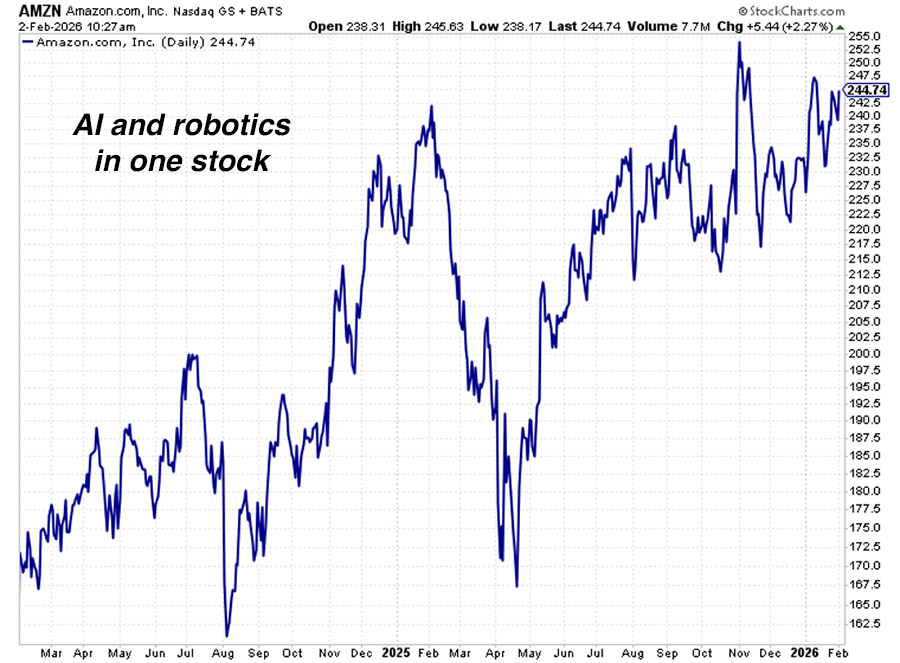

One of the world’s best bets on AI and robotics is poised to reach an all-time high. That’s bullish for all things technology.

Over the past year, I’ve frequently called Amazon (AMZN) one of the best ways to invest in the robotics megatrend.

Robotics is a massive, multifaceted trend that will transform the world. It will yield greater factory automation, autonomous cars, autonomous air taxis, humanoid worker robots, and much more. It will allow us to interact with AI every day. Robotics investment is expected to increase by at least 15% annually through the rest of this decade.

Although everyone knows about Amazon, the online retailer, and almost everyone is a customer, most people don’t know about Amazon, the giant employer of robots.

Last June, Amazon announced it had deployed its 1 millionth robot across its business. This deployment further cemented Amazon’s position as the world’s largest operator of mobile robots.

Amazon operates more than 1,000 warehouses in the U.S. It ships millions of packages across millions of miles every month. This blizzard of activity can become more efficient and profitable with the use of AI-enhanced robots that don’t complain, don’t take coffee breaks, and don’t ask for raises.

In other words, Amazon is uniquely suited to benefit from a megatrend that will see robots get cheaper, faster, more dexterous, more durable, and smarter in the near future.

Amazon is also heavily involved in AI. Its huge AWS cloud computing division is benefiting from AI compute demand. Amazon also owns a large stake in AI leader Anthropic. It could soon own a stake in fellow AI leader OpenAI.

Add these robotics and AI assets to the world’s largest online retail business, and you get a pretty good bet on the future of technology in one stock. It’s no wonder Amazon is within a stone’s throw of new all-time highs. We expect to see them in 2026.

Software vs. AI infrastructure: Why “think of it as a market of stocks, not a stock market” is so important.

When the mainstream press reports on the economy and business, the performance of “the stock market” is almost always cited.

“The stock market climbed 2% today…”

“The stock market fell today on news of higher inflation.”

That sort of thing.

Reporting on the economy and businesses using simple concepts, such as “the stock market,” makes sense for the media. It’s fast. It’s easy. And that’s all many people care to understand.

However, I believe there’s a much smarter, more useful way of thinking about the economy, businesses, and your investments.

Instead of focusing on what “the stock market” is doing, I recommend you adopt the mindset of “Don’t think of it as a stock market. Instead, think of it as a market of stocks.”

In other words, realize that the stock market is a place where you can buy and sell ownership stakes in many different types of businesses that operate in many different industries. And realize that various economic climates affect those businesses and industries differently.

Something good for one industry isn’t necessarily good for another.

For example, the 2020 Covid-19 crisis was beneficial for video-conferencing companies and delivery companies because so many people stayed home… but it was terrible for fitness centers and cruise operators.

Or, consider how a long period of declining oil prices is bad for oil producers… but it’s great for airlines, since fuel is a major cost for them.

Instead of thinking of “the stock market” as a monolithic entity into which you put money, I prefer to focus on individual industries, unique market trends, and how those affect individual companies.

A whole lot is happening behind the curtain we call the S&P 500 index.

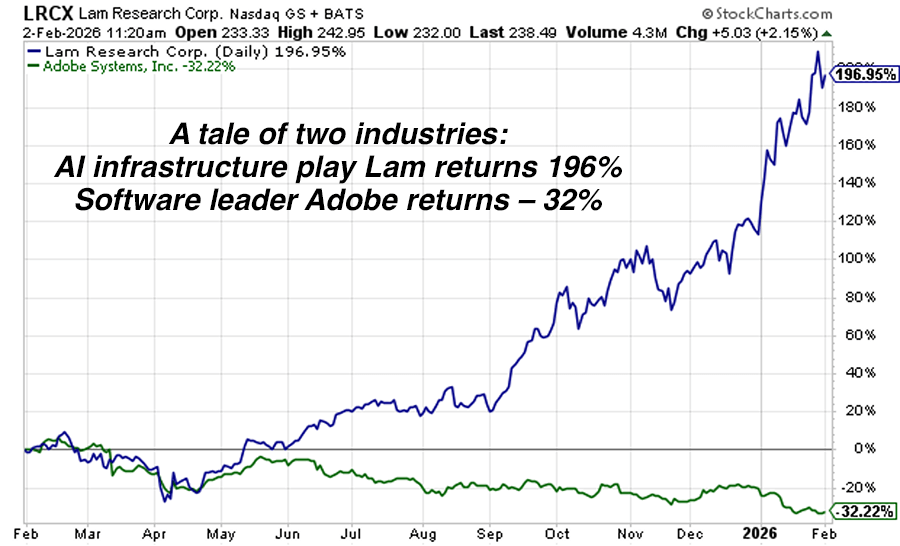

In last Friday’s issue, I highlighted how many software companies have recently plunged in value by 30%-75%. Many investors believe AI-created software is a major threat to their businesses. You could say they are on the wrong side of a big technological change.

On the other hand, semiconductor firms that sell chips and chip-making equipment to the companies building AI models are enjoying a historic boom. AI memory maker Micron is up 376% over the past year. AI semiconductor equipment leader ASML is up 97% in the past year. AI semiconductor equipment maker Lam Research is up 195% over the past year.

These strong individual stock runs have propelled the VanEck Semiconductor ETF (SMH) to a 12-month return of 68%.

In other words, the recent returns of software stocks and AI infrastructure stocks have been vastly different. One year ago, two different investors could have been identified as “tech investors.” One could have bet on software and ended up in the poorhouse. One could have bet on AI infrastructure and ended up in a beach house.

Not only can the annual returns of different asset classes vary greatly… and not only can the annual returns of different sectors vary greatly… but the annual returns of various industries inside a sector can vary greatly. So yes, it’s useful and profitable to think of “a market of stocks, not a stock market.” Stick with Money & Megatrends to stay in the booms and avoid the busts.

Market Notes

-

Tech giant Google (GOOG) reached an all-time high today. It’s good to be the AI king.

-

Our longstanding recommendation to invest in the “Boomer health care” theme continues to pay off. Health care giant Johnson & Johnson (JNJ) reached a new all-time high today.

-

Retail giant Walmart (WMT) reached a new all-time high today.

-

Construction equipment giant Caterpillar (CAT) reached an all-time high today. The company recently reported outstanding quarterly earnings. This is a bullish economic signal.

-

America’s largest shopping mall operator Simon Property Group (SPG) reached a new all-time high today. The American consumer is still spending.

-

Record-keeping/signature software firm DocuSign (DOCU) reached a new 52-week low today. It’s down 45% over the past year. Another casualty of being on the wrong side of technological change.

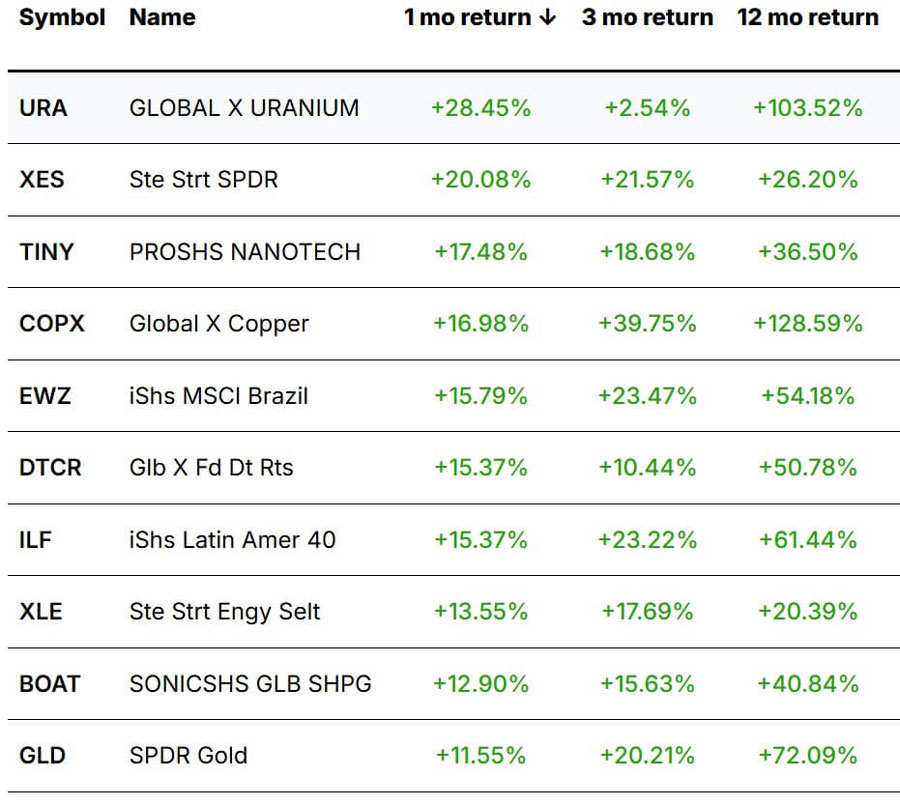

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends