The world has a power problem… and AI is to blame.

A recent study from Gartner projects that electricity demand fueled by AI data centers will double by 2030.

Right now, data centers consume 448 terawatt-hours (“TWh”) of power… That figure is expected to rise to 980 TWh by the end of the decade.

That would represent roughly 3% of the entire world’s power consumption.

For context, 980 TWh could:

- Power a country the size of Germany for a full year

- Provide power to around 93 million average American homes for an entire year

- Give electric vehicles enough juice to drive billions of miles

It’s an unthinkable amount of energy. And AI data centers require that much power just to train and run large language models (“LLMs”).

With more and more data centers going up around the globe, the need for power is real.

The U.S. and China are projected to use more than two-thirds of the 980 TWh of power… Almost half of America’s total electricity demand growth between now and 2030 will come from data centers.

But there’s a problem…

AI’s Energy Appetite Will Outpace the Grid’s Capacity

Electricity grids are maxed out. And they can’t expand enough to accommodate the power-hungry demands of AI.

The International Energy Agency (“IEA”) found that around 20% of planned data-center projects face long delays until grid capacity can support their massive energy requirements.

In other words, the construction of AI data centers isn’t the issue. They can be built in a year or two.

Rather, the lack of available power and the projected wait times to get a data center connected to the grid are the problem. And it’s delaying some data centers from becoming operational for up to 10 years.

That’s why the No. 1 factor in data-center site selection is access to power.

It makes sense. Why spend hundreds of millions of dollars building a data center if you have to wait five to 10 years for it to be connected to the power grid?

In the U.S. alone, data-center electricity consumption represented around 4% of the country’s total energy usage in 2024. But that number could be 9% to 12% by 2030.,

This energy shortage is pushing tech titans to get creative in developing energy solutions.

As I wrote in an article about natural gas stocks back in October…

Rather than wait in a yearslong grid interconnection queue, many tech companies are partnering with utilities to build off-grid, natural-gas-powered facilities directly on data-center sites, as well as behind-the-meter (“BTM”) systems that are physically connected to the grid but mainly serve onsite loads.

Examples include:

- GE Vernova, Chevron (CVX), and Engine No. 1 are collaborating to build off-grid natural gas power plants co-located with AI data centers. The initiative is expected to deliver up to 4 GW of reliable, affordable energy, with initial service projected by the end of 2027.

- Oracle (ORCL) and Project Stargate will build and operate large-scale data centers to support OpenAI’s next-generation models. This includes a multibillion-dollar agreement to develop 4.5 GW of AI data-center capacity, powered by a dedicated onsite natural gas facility in Abilene, Texas…

- CloudBurst Data Centers [CF1] [DE2] and natural gas producer Energy Transfer (ET) signed an agreement for a 1.2 GW off-grid power supply involving a newly constructed, dedicated lateral pipeline directly to its data center.

- Nvidia (NVDA)-backed Poolside is partnering with CoreWeave (CRWV) to build a 2 GW AI campus called Horizon in the Permian Basin. The facility will generate its own electricity onsite using natural gas, completely bypassing the Texas grid.

- And Brookfield Asset Management (BAM) is investing up to $5 billion to deploy Bloom Energy’s (BE) natural gas fuel cell technology for its AI data centers globally. This will provide reliable onsite power that avoids delays from legacy grids.

Behind-the-meter natural gas facilities, while physically connected to the grid, are designed to serve onsite power requirements while bypassing the grid itself. This reduces reliance on the grid and allows data centers to still control their power supply onsite.

Another solution is solar power. And Big Tech is all over it…

Why AI Data-Center Demand Locks in Solar Revenue

There has been a recent surge in large-scale power purchase agreements (“PPAs”) – also known as mega-PPAs – between solar developers and the biggest names in business.

In fact, major corporations are now a huge driver of American solar power, accounting for 18% of all solar capacity in the country. In 2023, 20% of new solar projects were built for a corporate buyer.

Among the top 10 corporate solar adopters are Alphabet (GOOGL), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), Apple (AAPL), Target (TGT), Walmart (WMT), Verizon Communications (VZ), and Home Depot (HD).

One thing these companies have in common, besides their use of solar power?

They make a ton of money. Combined, they raked in nearly half a trillion dollars in profitsin 2024.

That means huge business for solar-energy providers. PPAs guarantee solar developers and utilities companies revenue for up to 25 years.

Businesses like those above can lock in fixed energy prices… while developers can bank on significant, reliable income and financial stability for years. It’s a win-win.

The Benefits of Solar Power: Why Cost, Speed, and Reliability Win for AI

There are plenty of reasons why solar makes sense as a power source for AI data centers.

To name a few…

Cost: Solar power is the most affordable energy source on the planet. And when tech companies are building data centers that use mind-boggling amounts of power, cheap is ideal.

Availability: Solar farms, when equipped with batteries for energy storage, provide 24/7 power, which is exactly what AI data centers need. Called “solar-plus-storage” systems, they combine solar panels with huge battery systems that capture and store excess solar energy. Not only does this setup deliver power all day, but it remains on during outages and doesn’t rely on the grid.

Location: Many tech companies are building solar farms on the same land as their data centers, ensuring their power source is close by. For example, Elon Musk’s xAI has plans to build a 30-megawatt (“MW”) solar farm next to its Colossus data center in Memphis, Tennessee. And Apple pulls energy for its Mesa, Arizona data center from its nearby 50-MW solar farm.

Construction time: Building a solar farm can take anywhere from eight months to nearly two years. That’s a whole lot quicker than waiting five to 10 years to get connected to a local power grid. Last October, Meta announced plans for two solar farms (totaling 385 MW) to power its Louisiana data centers. Both should be operational by 2027, demonstrating how quickly solar farms can be built.

The demand for power is clear, and it’s not going away anytime soon.

Solar energy (and especially solar-plus-storage systems) can deliver that power affordably, reliably, and quickly.

And solar providers, like the ones we’ll get to next, could very well be the next beneficiaries of the AI boom…

4 Solar and Energy Stocks Positioned to Benefit From the AI Power Boom

1. First Solar (FSLR)

First Solar is the largest solar-panel manufacturer in the U.S. And it’s sure to see high demand as more businesses tap into solar energy to power their AI data centers.

Its third-quarter 2025 sales growth illustrates as much. First Solar brought in $1.6 billion in net sales… a year-over-year gain of roughly 80%. That was propelled by nearly 5.2 GW of power sold during the quarter, a record high for the company.

Also reflective of solar-energy demand is First Solar’s $16.4 billion project backlog (as of October 2025). That’s the reliable income that comes from PPAs for large-scale projects.

Now, there are a few things investors should keep an eye on…

For one, skyrocketing costs, partially attributed to President Donald Trump’s tariffs, have eaten into First Solar’s operating margin. In the third quarter, the company’s operating margin dropped from 36.3% to 29.2%.

Its earnings per share also missed the target due to some supply chain issues and related cost increases.

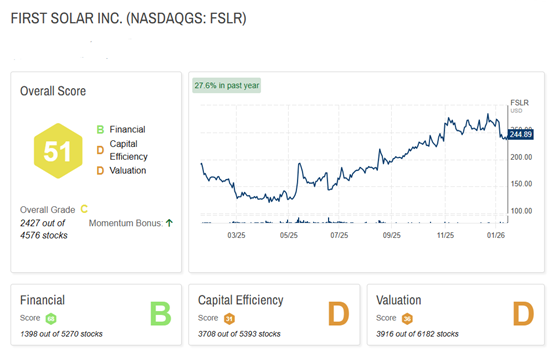

The Stansberry Score, courtesy of our affiliate Stansberry Research and used to measure stocks as long-term investments, gives First Solar an overall grade of “C” (as of this writing). Its financials, driven by the company’s large backlog and impressive revenue, earn a solid “B.”

However, the company earns “D” grades for valuation and capital efficiency. We suspect such a low capital-efficiency score is the result of First Solar’s major capital expenditures (“capex”) and a history of negative free cash flow.

2. SolarEdge Technologies (SEDG)

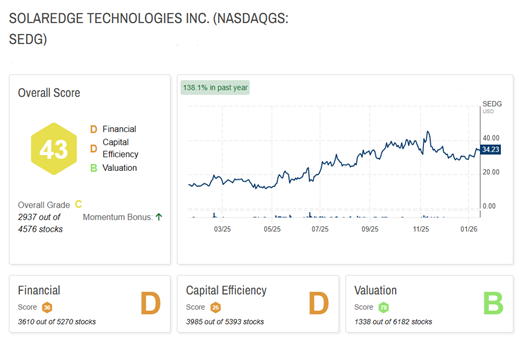

This next company also doesn’t rank very highly on the Stansberry Score, but it may be turning things around.

SolarEdge Technologies designs and manufactures inverters for solar photovoltaic (“PV”) systems for both residential and commercial customers around the world.

In the U.S., it dominates the residential solar inverter market. The company’s power optimizers, inverters, lithium-ion cells, batteries, storage solutions, and more are in demand as more data centers turn to solar power.

Its third-quarter earnings call was proof. Compared with the prior quarter…

- Revenue was up 18% to $340.2 million.

- Non-generally accepted accounting principles (“GAAP”) revenue increased 21% to $339.7 million.

- GAAP gross margin nearly doubled, from 11.1% to 21.2%.

- Free cash flow, which was negative in the second quarter, grew to $22.8 million.

This is encouraging news. But it’s important to keep in mind that SolarEdge isn’t yet profitable. It reported a net loss of $50.1 million in the third quarter… though that was a huge improvement over the prior quarter’s $124.7 million loss.

Its operating loss also remains significant, at $35.2 million. But again… that’s a big turnaround from its $115.5 million operating loss in the second quarter.

In short, it’s a mixed bag of financials for SolarEdge. The company is still in the red, but it’s showing promising signs. It even raised its fourth-quarter revenue guidance from $310 million to $340 million.

We wouldn’t recommend buying SolarEdge today. But its revenue growth and the data-center-driven demand for its products make it a stock worth watching.

3. Enphase Energy (ENPH)

Enphase Energy is the world’s leading supplier of microinverter-based solar and battery systems.

Its microinverters, which help independent solar panels perform at optimal levels even when other panels are damaged, have revolutionized solar power systems.

That innovation is a big reason why Enphase is the market leader in U.S. residential microinverters, with a market share of about 60%. Enphase also leads the overall U.S. residential inverter market, with a market share of about 50%.

Enphase’s third-quarter 2025 revenue was strong at $410.4 million, up from $363.2 million in the second quarter.

Meanwhile, its revenue growth compared with the end of 2024 is staggering. In the fourth quarter of 2024, Enphase reported that revenue was down around 42%. However, its year-over-year revenue growth increased nearly 8% in the third quarter of last year. The company’s gross margin also increased to nearly 49%.

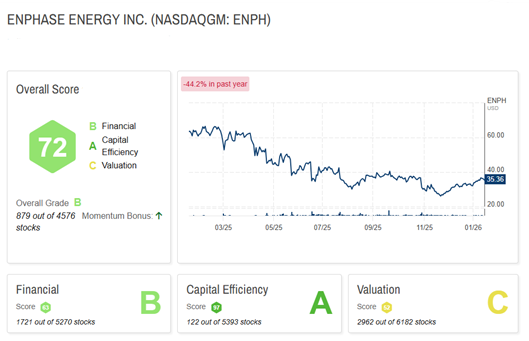

As of this writing, the Stansberry Score gives Enphase a solid “B” grade overall. It gets an “A” for capital efficiency, driven by the improving gross margin. And while its valuation is average, its price-to-earnings (P/E) ratio fell dramatically from 90.39 times in the fourth quarter of 2024 to 23.66 times in the third quarter of 2025.

The future looks promising for Enphase. It recently announced shipments of its next-generation IQ EV Charger 2 in America and unveiled PowerMatch battery optimization technology in Europe. It also shipped a record 195 megawatt-hours of IQ batteries in the third quarter.

Perhaps most importantly, Enphase expanded a safe harbor agreement with a solar financing company to support deployment of its IQ8 microinverters. This should increase demand for those microinverters and bring in more revenue. But the safe harbor agreement also secures the domestic content bonus for Enphase.

This is an important 10% bonus credit that, according to the IRS, is “available to taxpayers that certify their qualified facility, energy project, or energy storage technology was built with certain percentages of steel, iron, or manufactured products that were mined, produced, or manufactured in the United States.”

Enphase satisfies this requirement because its American-made IQ8 microinverters and battery systems will be used in upcoming projects.

In other words, the company has set itself up to meet the growing demands of U.S. data centers… and it’ll benefit in more ways than one.

4. NextEra Energy (NEE)

Last up is NextEra Energy – the largest renewable-energy developer in the U.S. and the world’s leading producer of wind and solar power.

NextEra boasts some of the biggest corporations in the world as customers. It has secured deals with:

- Meta Platforms,for 2.5 gigawatts of clean energy through 11 PPAs and two energy storage agreements for new solar and storage projects.

- Google, for multi-gigawatt data-center campuses with connected power plants. This includes restarting a nuclear facility in Iowa to deliver dedicated AI data-center power. NextEra is also working with Google on AI-powered grid management for Google Cloud Marketplace.

NextEra clearly recognizes the need for more electricity capacity in the U.S. My colleague Nick Koziol covered the company’s plans in depth in a recent article. He wrote…

As part of its Investor Day event, NextEra CEO John Ketchum said that the company plans to build 15 GW of power capacity by 2035 to help meet the incredible demand from AI.

For comparison, the Energy Information Administration has said that – in 2024 – 1 GW of electricity could power 800,000 homes. So over the next 10 years, NextEra plans to add enough capacity to power 12 million homes.

And that’s a “fairly conservative” outlook… Ketchum also said that NextEra could double that target to 30 GW over the same period…

NextEra is clearly the leader when it comes to investing in capacity. Over the past four years, the company has added 33 GW of power infrastructure. That’s more than the next 20 utilities combined, by NextEra’s measure.

How does NextEra plan to reach that capacity? Through strategic innovation. It’s leading the way through a “bring your own generation” model, where hyperscalers finance their own power generation… and NextEra builds and runs it.

NextEra is also implementing hybrid energy solutions by combining solar-plus-storage with natural gas and nuclear power to satisfy AI’s massive energy demands.

With that in mind, let’s return to Nick’s article, where he thoroughly analyzed NextEra’s Stansberry Score:

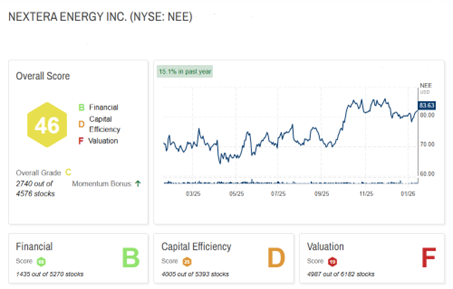

Looking at our proprietary Stansberry Score… NextEra gets an overall score of [46]. That’s good for an overall grade of “C.”

Under the hood, NextEra gets a “B” grade for its financials, but a grade of “D” for its capital efficiency. That’s not surprising…

With the planned expansion in power capacity, NextEra has a lot of capital expenditures coming. And while that will be good for the company in the long term, it isn’t the capital-light business model our system typically looks for.

As for valuation, NextEra gets an “F” here. At its current [P/E] ratio of 25 times, NextEra is just about trading in line with the S&P 500’s [P/E] ratio of 27 times.

But it’s higher than the 20 times P/E ratio of the broader utilities sector, as measured by the State Street Utilities Select Sector SPDR Fund (XLU).

So our Stansberry Score is telling us that there may be better investing opportunities out there in the utility sector.

Solar Stock Risks vs. AI’s Protective Long-Term Demand

Solar stocks are risky because they’re notoriously volatile. The average five-year beta for the four stocks we examined is 1.4. On average, they’re 40% more volatile than their benchmark index.

There are a few reasons for that volatility…

For one, solar companies rely heavily on incentives like tax credits. They also face constant supply chain problems and high capex (which is also impacted by changing interest rates)… not to mention interconnection delays that result in years-long grid backlogs.

Plus, solar has stiff competition in the form of wind and nuclear energy.

Solar stocks clearly have their challenges. But they’re also riding the wave of significant AI energy demand that promises consistent growth. And that growth shows no sign of waning anytime soon, especially as Big Tech and other major businesses search for affordable, reliable energy solutions.

Bottom Line: AI Is Power-Hungry – and Solar Stocks May Be the Next Big Winners

AI demand for energy is real… and it’s massive. So massive that you could safely call solar energy an AI infrastructure play.

With PPAs in place, and more undoubtedly to come, solar companies are set for decades of steady revenue.

First Solar, SolarEdge, Enphase, and NextEra could very well become the foundation of AI power across the globe. But they still have a ways to go before we’d consider them good investments.

For now, keep these stocks on your radar. And watch for new PPA announcements and solar-based AI data-center expansions to see which of these companies starts to separate from the pack.

Regards,

David Engle

P.S. We know that AI is gobbling up energy at an unprecedented rate and straining America’s already vulnerable power grid.

All the big players are racing to find a new way to meet AI’s power-hungry daily demands, pouring billions of dollars into alternative energy sources… including solar.

Regular folks can still get in on this tech, too – but time is running out.

Because Amazon may have just cracked the code.

A new breakthrough technology is being hailed as “the Holy Grail of Power,” and Amazon just went all-in on it…

Get the details right here, including how to prepare and what to buy.