Today’s issue in preview:

- Megatrend update: How to partner with the U.S. Government and make a lot of money

- The public couldn’t care less about this profitable trend, and that’s bullish

- More bullish news: Two of America’s most important companies soar to new highs

- Space stocks, defense stocks, and Boomer health care stocks soar to new highs.

Megatrend update: How to partner with the U.S. Government and make a lot of money

In a research note last June, I detailed how there’s a new way to partner with the U.S. government and make a lot of money.

The megatrend thesis goes like this: President Donald Trump has staked his legacy and reputation on massively expanding U.S. manufacturing capacity. The Trump & Friends administration is working with business leaders to invest trillions in pursuit of this goal.

However, any plan to increase domestic manufacturing capacity must overcome a big problem: We don’t have the critical resources to build the required infrastructure.

We don’t have the copper, iron ore, rare earths, lithium, antimony, nickel, and other vital building blocks required to build all those data centers… all those factories… all those robots…. all those electric grids… all those power plants… and so on.

To make matters worse, we also lack the refining, smelting, and processing facilities needed to turn the raw forms of those resources into ready-to-use end products. We rely on China for a lot of that.

It’s as if we very much want to build a big house… but we don’t have the lumber, screws, or nails we need to make it happen.

Solving the big “critical resources problem” is possible… and it is an enormous financial opportunity.

To ensure we have the critical resources to build trillions of dollars in infrastructure, the U.S. government will change any law, kill any regulation, and write any check that will lead to more production and processing capacity.

This means that after more than 30 years of the U.S. government being hostile to domestic mines and mineral processing facilities, it is now supporting them. Trump can’t have his big manufacturing dream without them.

Mining investors and entrepreneurs are now operating in an incredible new era… one where the U.S. government is their best friend. It means the critical resource industry will most likely generate dozens of huge stock market winners… helped massively by its powerful, big spending partner.

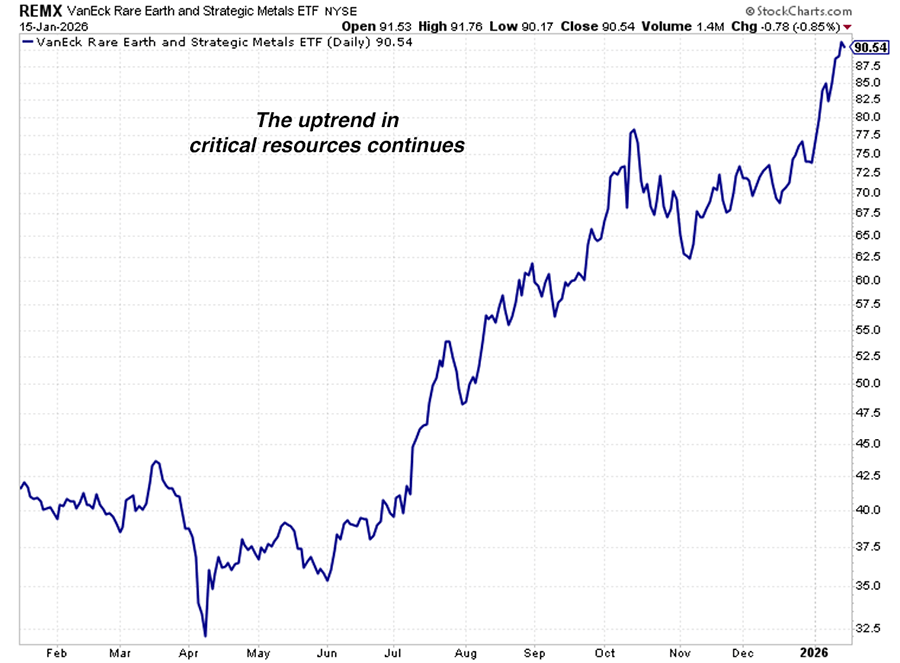

Companies such as Idaho Strategic Minerals (IDR) and MP Materials (MP) have the greatest potential for significant upside. Diversified one-click ways to play this megatrend include the VanEck Rare Earth and Strategic Minerals ETF (REMX) and the Sprott Critical Materials ETF (SETM). Both funds own a variety of critical resource miners and processors.

As you can see in the one-year chart below, this trend is moving. REMX had a strong 2025, spent time consolidating at year’s end, and just broke out to a new high.

Given this price action, I stand by my original thesis: Partnering with the U.S. government to increase domestic and friendly-country supplies of critical resources will prove to be one of the most lucrative financial activities of this decade.

The public couldn’t care less about this profitable trend, and that’s bullish

We nailed the oil trade. Are you profiting?

On September 29, we highlighted the emerging leadership of oil and gas stocks and stated it’s time to be long this sector.

The bull case for oil stocks is simple. As the global economy grows, oil demand will remain solid. However, importantly, U.S. shale oil production growth appears to be peaking.

Flatlining supply from this region would remove a critical and reliable source of production growth that has been in place for more than a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value in oil.

With all that in mind, we’ve written bullishly on Canadian oil giant Suncor (SU), U.S. oil giant ExxonMobil (XOM), and the S&P Oil & Gas Equipment & Services ETF (XES).

You can forecast higher prices for a commodity or industry until you’re blue in the face, but if the market disagrees with you and sends prices lower, then the forecast isn’t worth a hell of a lot.

In this case, however, the forecast is paying off well. The XES fund is up 22% in less than four months (an 86% annualized rate). Suncor, ExxonMobil, and many other oil & gas stocks just struck new one-year highs.

Going forward, the investment public is largely indifferent towards the oil and gas uptrend. Compared to other assets, oil is still dirt cheap. And trends tend to persist, so I expect to see the sector higher over the coming months.

More bullish news: Two of America’s most important companies soar to new highs

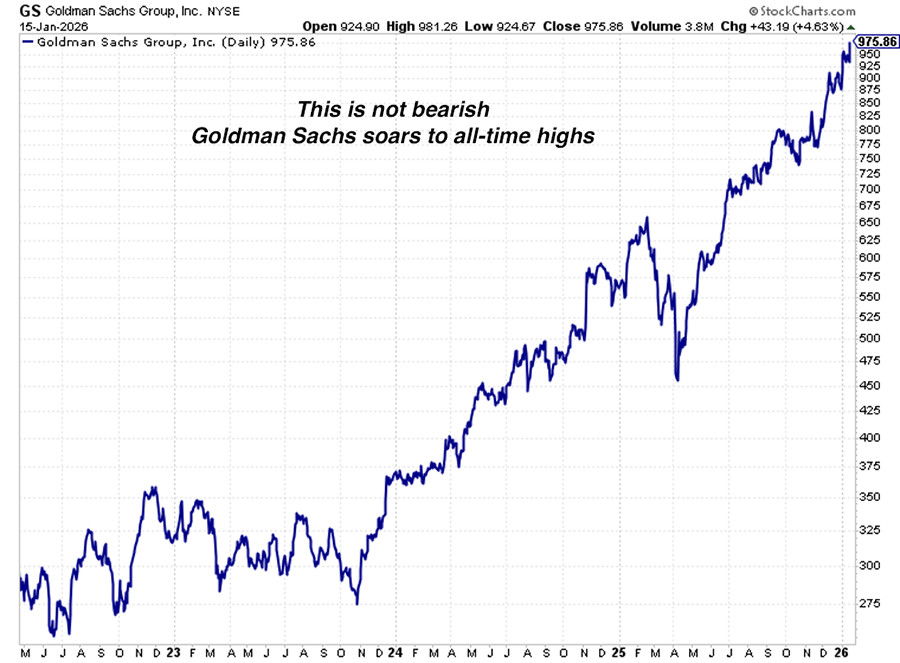

Someone should call an ambulance because Goldman Sachs (GS) and Morgan Stanley (MS) just drove over the stock market bears.

Since the current bull market began in 2023, a group of well-known bearish forecasters has constantly predicted recessions, bear markets, and hyperinflation.

Anyone who listened to these “prophets of the apocalypse” and avoided stocks has missed a historic wave of wealth creation. Following their advice has been very costly in terms of opportunities missed.

Their bearish advice will likely remain costly in 2026. After all, Goldman Sachs, Morgan Stanley, and the rest of the financial industry is booming.

Goldman and Morgan are two of America’s largest, most important financial companies. They raise money for businesses in the equity and debt markets. They assist with mergers and acquisitions. They manage money for wealthy clients and companies. They make markets in various assets. All this means their fortunes rise and fall with America’s ability to earn money, invest money, raise money, and service debts.

On Thursday, Goldman Sachs reported fourth-quarter earnings. Goldman profit climbed 12%, and the stock jumped 4% in response, a new all-time high.

Morgan also reported Thursday and quarterly net income increased 18% year over year. The stock climbed 5.7% in response, a new all-time high.

In other words, two of America’s largest and most important financial companies are booming. These are very bullish economic signals.

Are there big problems and imbalances in the U.S. economy? Absolutely.

There are always big problems and imbalances in the U.S. economy.

Economic growth and rising asset prices are never about getting into a problem-free environment. They’re about being in an environment where the big negatives are overwhelmed by the even bigger positives. Right now, the positives are bulldozing the negatives.

Trends like this tend to persist. Position yourself accordingly.

Market Notes

- Health care giant Johnson & Johnson (JN) reached an all-time high this week. This is yet more confirmation the Boomer health care megatrend is one of the world’s biggest wealth creation forces.

- Airplane manufacturing giant Boeing (BA) reached a new one-year high this week. This is a bullish economic signal.

- Defense giant Lockheed Martin (LMT) reached a new all-time high this week. The defense spending megatrend continues to create stock winners.

- Hotel giant Hilton Worldwide (HLT) reached a new all-time high this week. People are doing a lot of traveling. Bullish economic signal.

- One of the market’s premier “space stocks,” Rocket Labs (RKLB), reached a new high this week. The stock is up 264% over the past year and the space megatrend is in full swing.

Regards,

Brian Hunt

Editor, Money & Megatrends