Today’s issue in preview:

- More military spending sends space stocks higher

- The AI Bears get trampled… again

- The crazier socialism gets in New York, the higher this stock goes

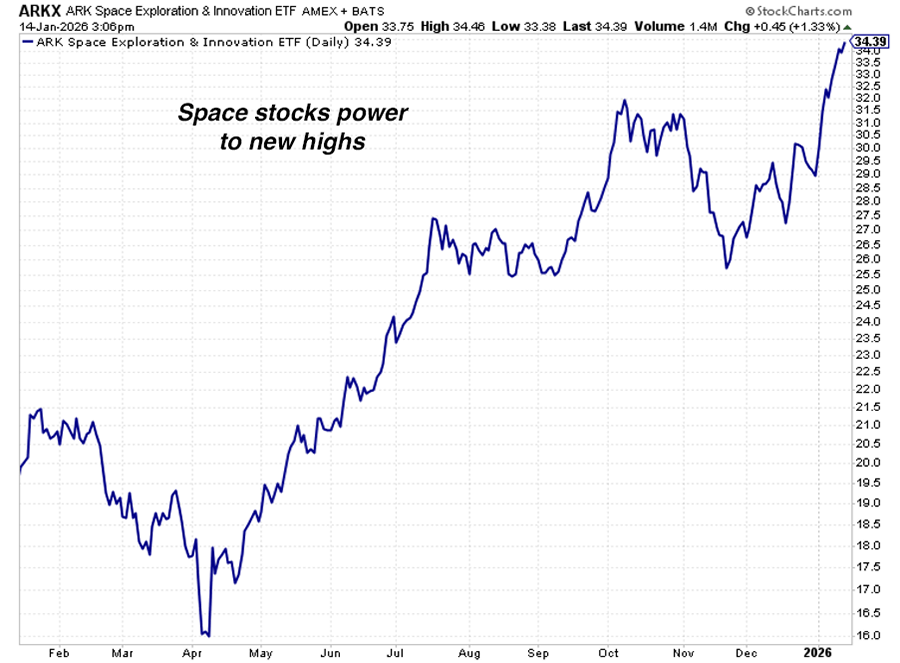

More military spending sends space stocks higher

More military spending equals more space spending.

This year, as you read news about wars, Trump, military budgets, Iran, Venezuela, and Taiwan, keep this fact about conflict in the late 2020s in mind. It can make you money.

More military spending equals more space spending.

Regular readers know space is one of our top megatrend “picks to click” for the next decade. Innovations in satellite and rocket technology have made space an incredible “platform” in which to place communications and surveillance equipment.

Last September, we put a spotlight on the upside breakout in space stocks and said it’s a sector the “public could go wild for.”

At the time, we stated:

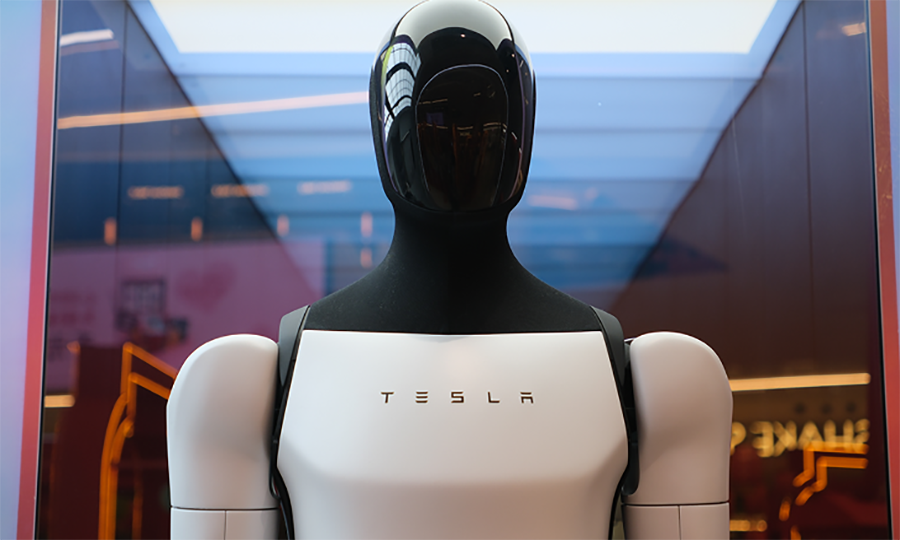

When people think of investing in space, they often go towards the business of launching rockets and Elon Musk’s Space X. But many of the most promising “space stocks” are in the business of space-based communication platforms and equipment. Think government surveillance, military communication, GPS, internet service, and cell service.

The best big picture fundamental case for space stocks right now is that the Trump administration believes America in a hugely important competition with China and other countries for “space dominance.” This means regulatory and financial support for the U.S. space industry.

Since that note, space-related stocks have soared. Rocket launch firm Rocket Labs (RKLB) is up 88%. Satellite operator AST SpaceMobile (ASTS) is up 106%. Satellite operator Planet Labs (PL) is up 135%.

Also, since our note, President Donald Trump announced a $500 billion increase in the U.S. military budget. This could add fuel to the fire of an already hot global arms market. Global military spending climbed by 9% to a record $2.7 trillion in 2024. It was the biggest annual increase since 1992, according to data from the Stockholm International Peace Research Institute.

Since warfighting is getting more and more high tech, soldiers are using space-based assets more and more. This means more satellites in the heavens… which means more rocket launches are needed to get them there. It means more specialized communication systems to shuffle data, audio, and video back and forth.

In other words, more military spending equals more space spending.

Given this fact, it’s no wonder the ARK Space Exploration & Innovation ETF (ARKX) and the Procure Space ETF (UFO) are among the top-performing ETFs this week, according to our Global Trend Tracker. These are two of the largest space-industry-focused ETFs on the market. Both reached new all-time highs on Wednesday.

It’s likely that Trump will continue shaking up the global order. It looks likely that China, the Middle East, Europe, and the U.S. will spend big on their militaries over the next decade. This spending will help drive the space trade higher and higher.

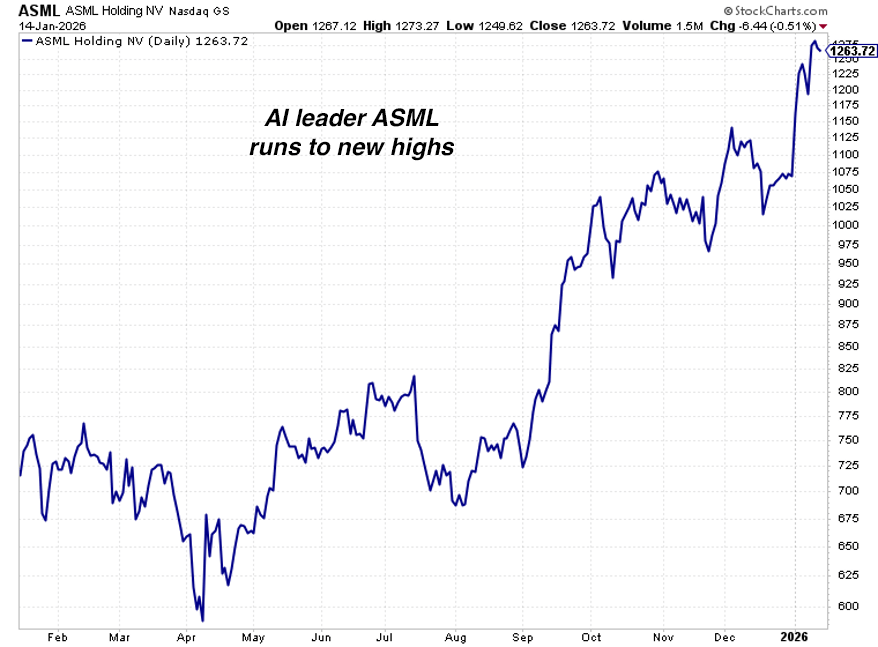

The AI Bears get trampled… again

The “AI is a bubble” crowd is having a rough year. They keep getting in front of a freight train, and it keeps running them over.

Over the past six months, I’ve frequently highlighted how “AI Boom or AI Bust” has become the world’s most important financial debate.

More than three years into the AI boom, tech giants Meta, Google, Amazon, OpenAI, and Microsoft are in an epic race to build the world’s best AI models and infrastructure. This year, they are on pace to spend over $450 billion on AI infrastructure, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in history… which has driven many powerful stock rallies.

Whether Big Tech’s gigantic investment pays off or not has become the most important issue in the stock market.

AI bears say much of this spending is crazy. It won’t generate the revenues and profits required to justify it. Once the world realizes this is the case, GDP growth will stall, and the stock market will plummet.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The coming innovations will justify the enormous investments.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

The market currently prefers the bull case.

Greatly.

Shares of AI semiconductor chain leaders ASML (ASML) and Taiwan Semiconductor (TSM) soared to new all-time highs this week.

ASML is the only company in the world that can currently create Extreme Ultraviolet Lithography (EUV) Machines. These EUV machines are used by semiconductor makers to build the most advanced AI chips in the world.

Taiwan Semiconductor is the world’s largest semiconductor chip maker. It uses ASML machines to build advanced AI chips for companies such as Nvidia (NVDA) and Apple (AAPL).

Both companies sport world-class earnings growth and are enjoying incredible demand from customers.

Will the AI Boom eventually suffer a vicious correction or even a prolonged bear market? Of course. All trends go through corrections. All trends eventually end. But for now, it’s boom times for AI.

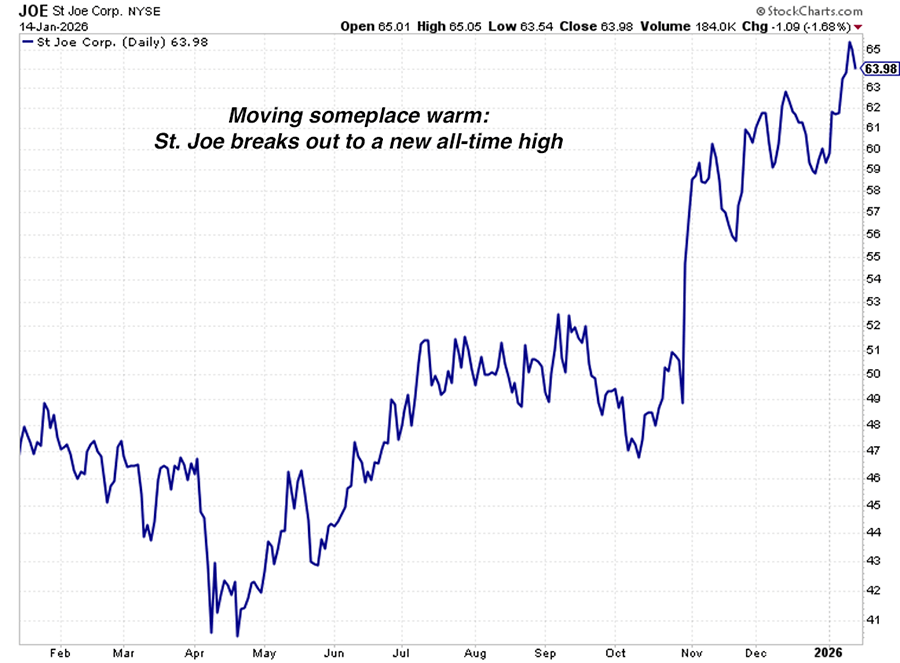

The crazier socialism gets in New York, the higher this stock goes

It’s a bull market in Florida.

For evidence, look at St. Joe’s new all-time high.

Not the St. Joe from the bible. This St. Joe is one of America’s largest publicly traded real estate developers. The official name is The St. Joe Company (JOE).

St. Joe is a $3.7 billion market cap real estate developer that owns more than 150,000 acres of land, primarily in the Florida Panhandle. As the owner of that land, it develops and operates residential communities, commercial buildings, hotels, and golf courses.

St. Joe is almost entirely focused on Florida. This makes its stock a good gauge of what’s going on in the Sunshine State.

St. Joe bulls say the company is benefiting from trends toward socialism in New York and high taxes in California and Illinois. The more these state governments pursue high taxes and bloated government budgets, the more likely their residents are to flee and move to Florida, which has no state income tax. Many people have already made this move in the last five years.

St. Joe is also a demographics play. It benefits from members of the enormous Baby Boom generation wanting to retire somewhere warm.

As you can see in the chart below, it’s boom times in Florida.

St. Joe stock just cleared a multi-year sideways consolidation to reach new all-time highs. If you want to bet that more people will flee New York, California, and Illinois, you can own St. Joe.

Market Notes

- Defense industry giant RTX (RTX) reached an all-time high this week. It’s up 69% over the past year. The bull market in defense rolls on.

- American warehousing giant Prologis (PLD) reached a new one-year high this week. This is a bullish economic signal.

- Chinese tech giant Baidu (BIDU) reached a new one-year high this week. The China trade is picking up momentum.

- Blue chip gold firm Franco Nevada (FNV) reached new all-time highs this week. It’s up 129% over the past two years.

- One of the world’s largest steelmakers – ArcelorMittal (MT) – reached an all-time high this week. This is a bullish economic signal.

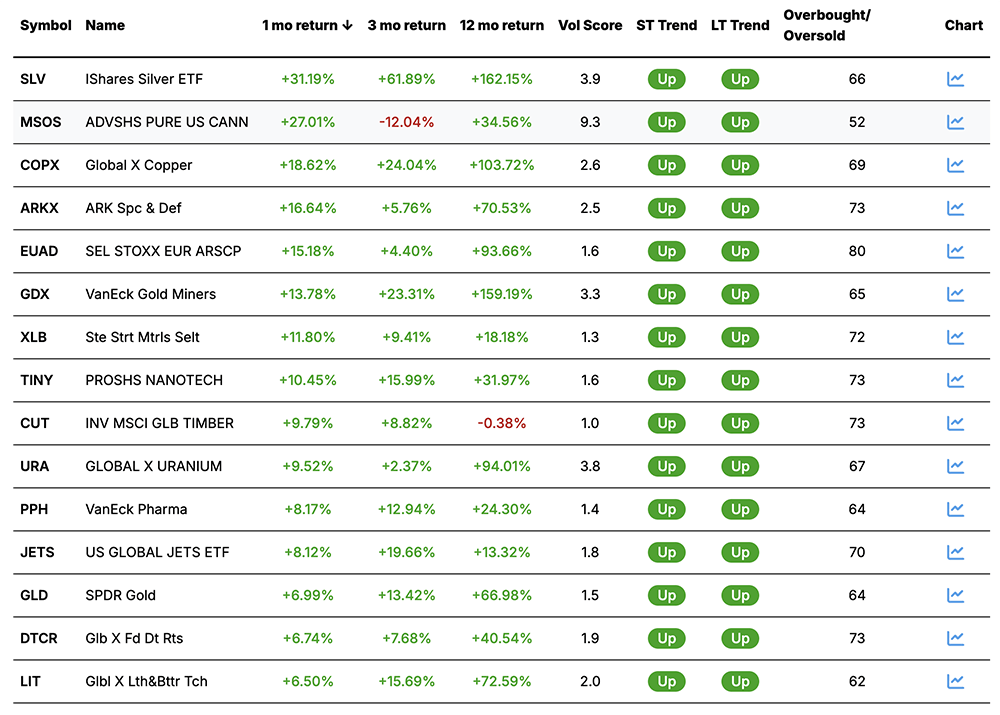

Today’s Trend Leaderboard

Top performing themes and trends over the past month

Regards,

Brian Hunt

Editor, Money & Megatrends