As 2026 begins, investors are navigating a market environment shaped by volatility, shifting economic signals, and heightened emotional pressure.

While fundamentals continue to matter, investor behavior increasingly reflects how individuals perceive risk, opportunity, and uncertainty.

To better understand what is influencing investment decisions this year, MarketWise surveyed more than 1,000 American investors on their financial outlook, emotional relationship with their portfolios, and responses to market headlines. We also analyzed Google Search Trends to assess how investor interest and concern vary by state, offering a broader view of where confidence and caution are emerging across the country.

The findings highlight a clear reality: emotions are not operating on the sidelines. They are actively shaping asset preferences, risk tolerance, and portfolio behavior in 2026.

Key Takeaways

- Nearly 1 in 8 American investors claim FOMO (fear of missing out) affects their investment decisions.

- American investors are most cautious and fearful about cryptocurrency in 2026 (54%), while they are most excited and optimistic about gold or commodities (44%).

- 18% of American investors have made a panic-driven investment decision due to doomscrolling.

- Cash/cash investments, stocks, and bonds are the most invested-in asset classes among American investors.

- 1 in 2 American investors check their portfolio at least once per day.

Emotions in the Driver’s Seat: How Feelings Are Steering Investment Strategies

Investor psychology is playing a powerful role in portfolio moves in 2026. Across generations and income levels, emotions like fear, excitement, and even panic are influencing where people put their money and how they feel about those decisions.

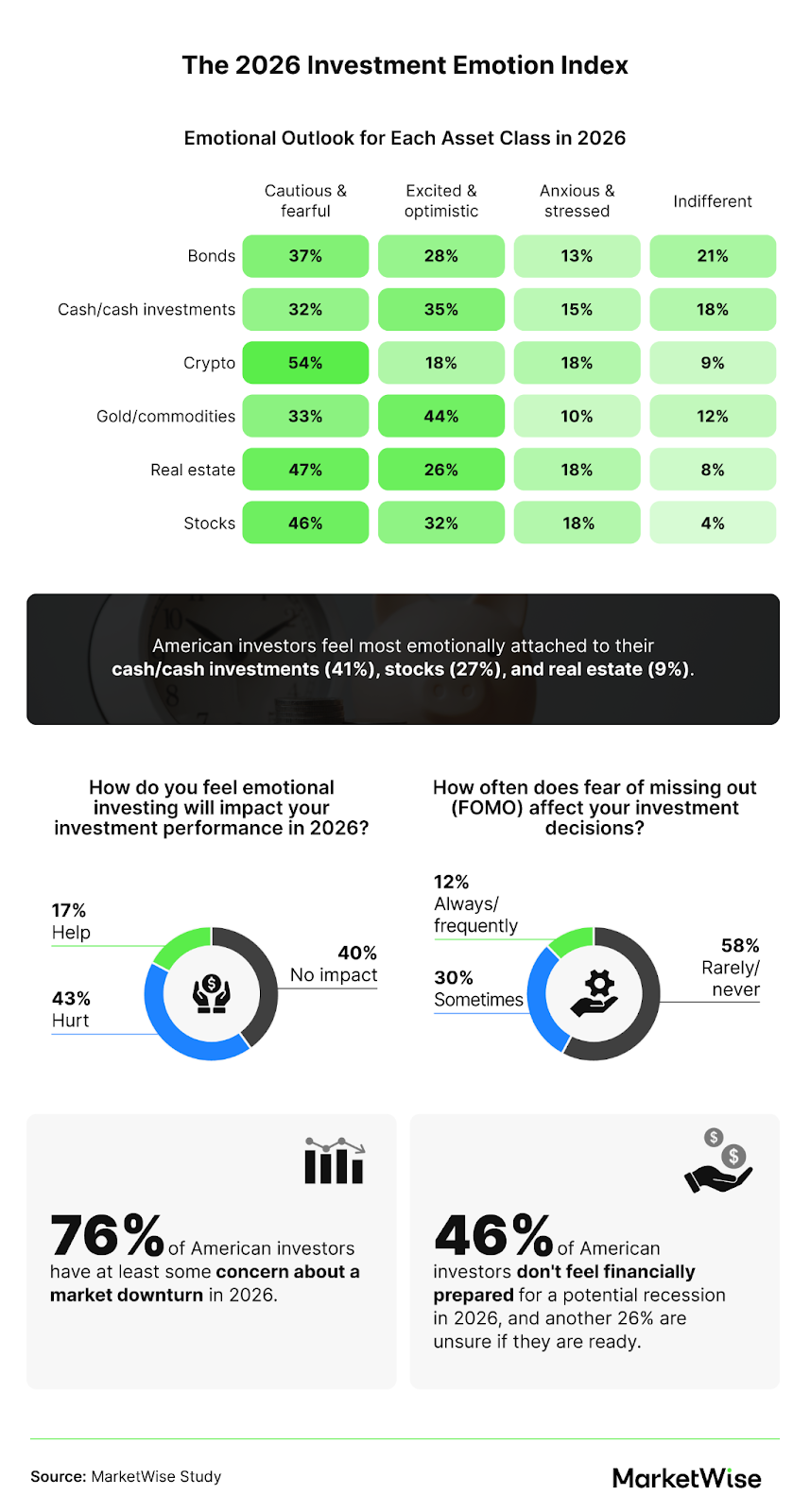

More than half of American investors said they’re most cautious about investing in cryptocurrency (54%), while gold and commodities are generating the most excitement and optimism (44%). Millennials in particular are leaning into gold, with 47% feeling positive about its prospects. Gen X, meanwhile, shows the most skepticism toward real estate (54%).

When it comes to emotional attachment, American investors feel strongest about their cash/cash investments (41%) and stocks (27%), followed by real estate (9%). Men are significantly more attached to crypto and stocks than women, while women are twice as likely to feel emotionally tied to their cash and savings.

But emotions aren’t just passive feelings; they’re actively shaping strategy. Forty-three percent of American investors believe emotional investing will hurt their performance this year, and nearly 1 in 8 admit FOMO affects their decisions regularly. Gen Z is especially susceptible: 17% said FOMO frequently drives their choices, and 25% think emotional investing could actually help them. And in the digital age, doomscrolling has real consequences. Eighteen percent of American investors, including 23% of Gen Z and 21% of millennials, admit to making a panic-driven investment move as a result.

Anxiety around market conditions looms large. Seventy-six percent of American investors express some concern about a downturn in 2026, and nearly half (46%) don’t feel financially ready for a potential recession. Those earning under $75,000 annually are even more vulnerable, with 54% saying they’re not prepared.

Flight to Safety: Where American Investors Are Investing in 2026

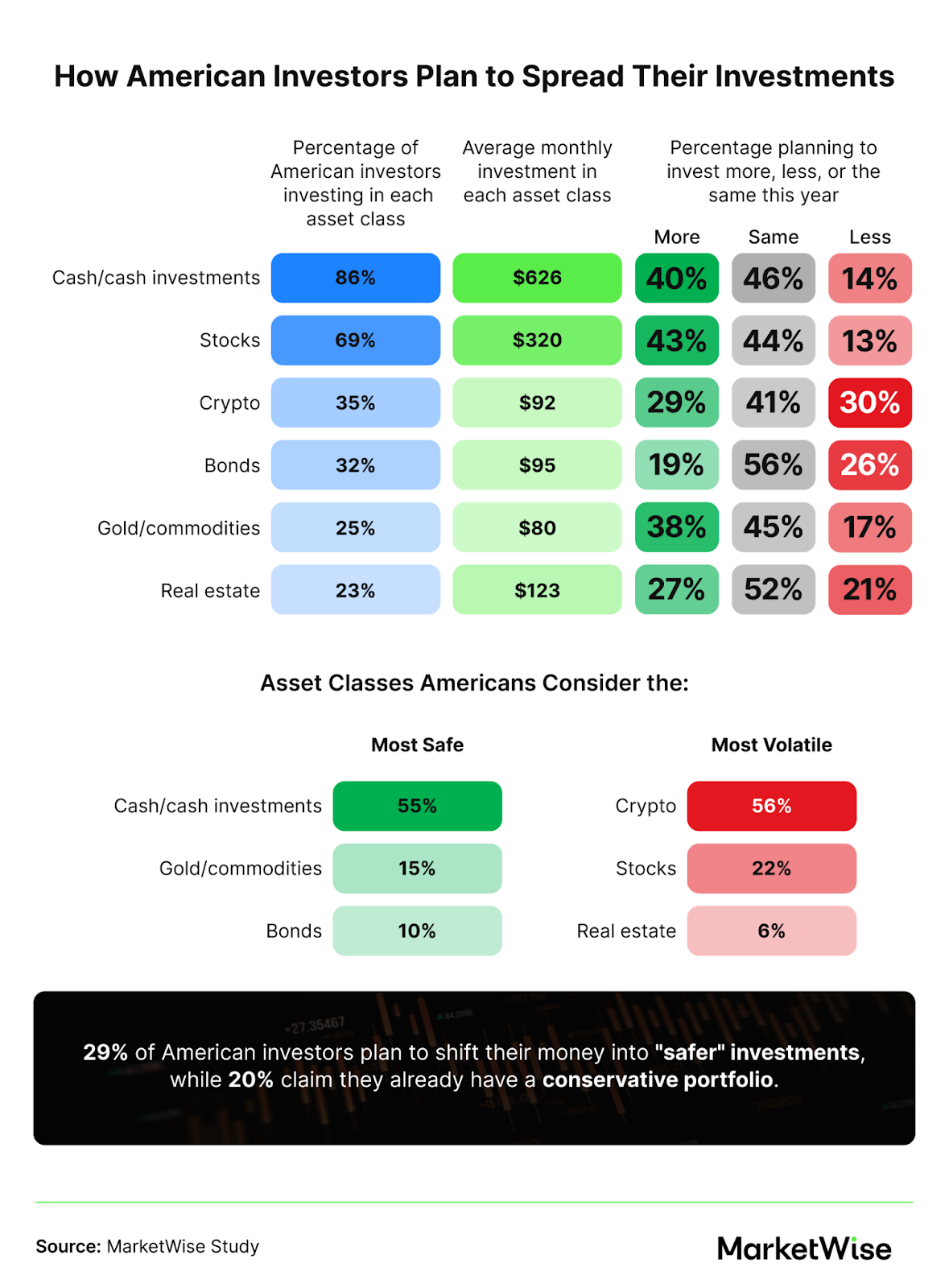

The next visual breaks down which asset classes American investors are currently prioritizing and where they’re planning to increase or decrease investments in 2026.

In the face of emotional investing and economic uncertainty, American investors are gravitating toward assets that feel stable, familiar, and safe. Leading the way are cash/cash investments stocks, with millennials showing the strongest interest in equities (72%) and Gen Z showing a notable preference for crypto (41%).

On average, American investors are allocating $626 each month to cash/cash investments. It’s not just about where money is today, it’s about where it’s going. Most plan to invest more in stocks (43%), cash/cash equivalents (40%), and gold or commodities (38%) this year, while many are pulling back from crypto (30%), bonds (26%), and real estate (21%).

Safety is top of mind. Cash/savings is widely considered the safest asset class (55%), while crypto ranks as the most volatile (56%). In response, 29% of American investors plan to shift into more conservative investments this year. Gen Z is leading this trend, with 36% moving toward safer options.

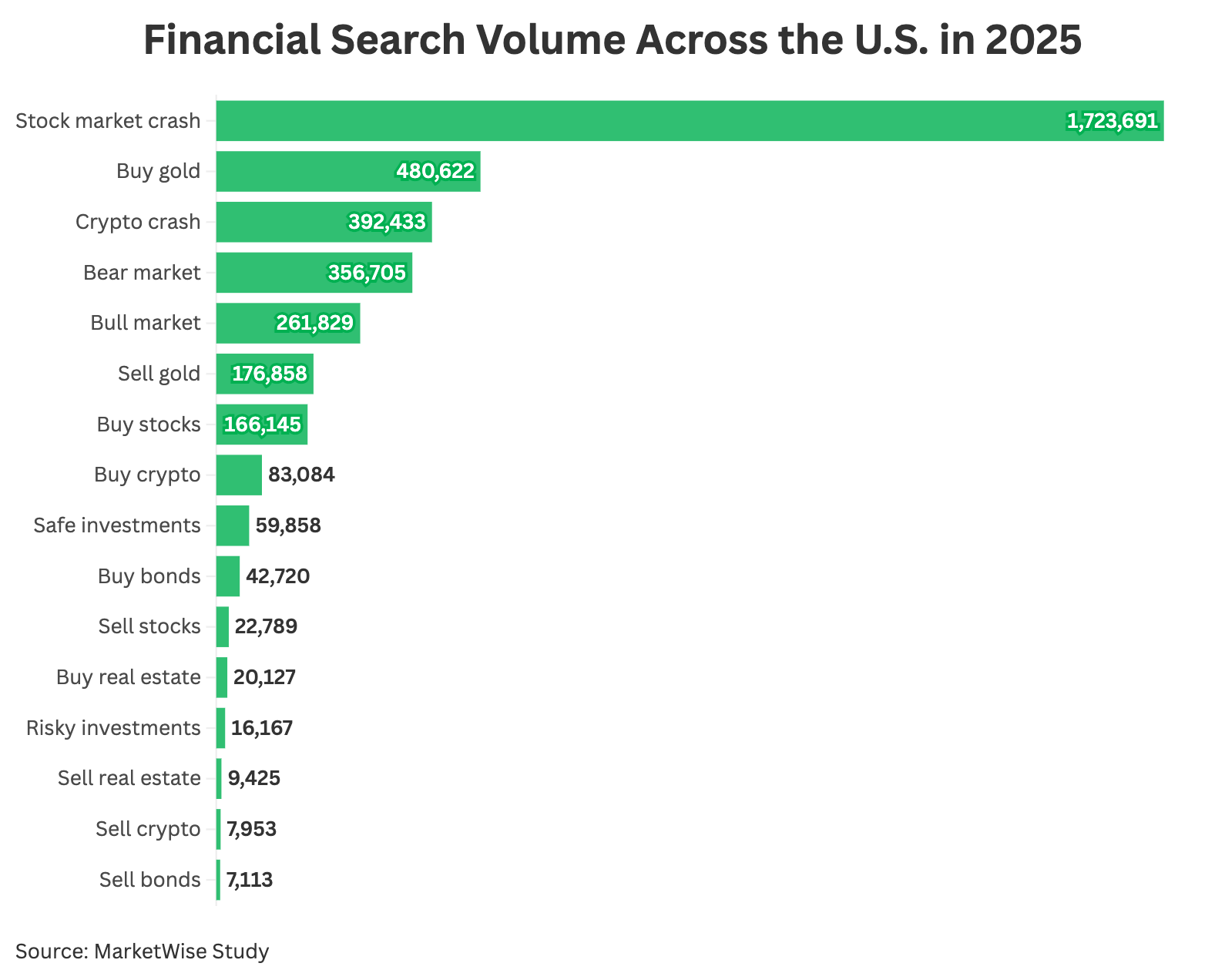

Curious what’s been top of mind for American investors? The chart below highlights national Google Trends data from 2025, revealing which financial terms like “bear market,” “safe investments,” and “buy gold” captured the most interest as the country prepared for 2026. It offers a clear snapshot of where public attention and investor curiosity were focused heading into the new year.

To dig deeper into geographic differences, the dynamic map below shows where these same financial terms gained the most traction at the state level. Search interest is measured on a per capita basis (specifically, per 100,000 residents) so you can see which states were most actively searching for each term relative to their population size. It offers a regional lens on how investor sentiment and search behavior varied across the U.S.

Mental Load of Investing: Stress, Obsession, and Coping Mechanisms

We’ll next explore how often American investors check their portfolios, how frequently they feel stress related to investing, and which generations are using mental health tools to cope with financial anxiety.

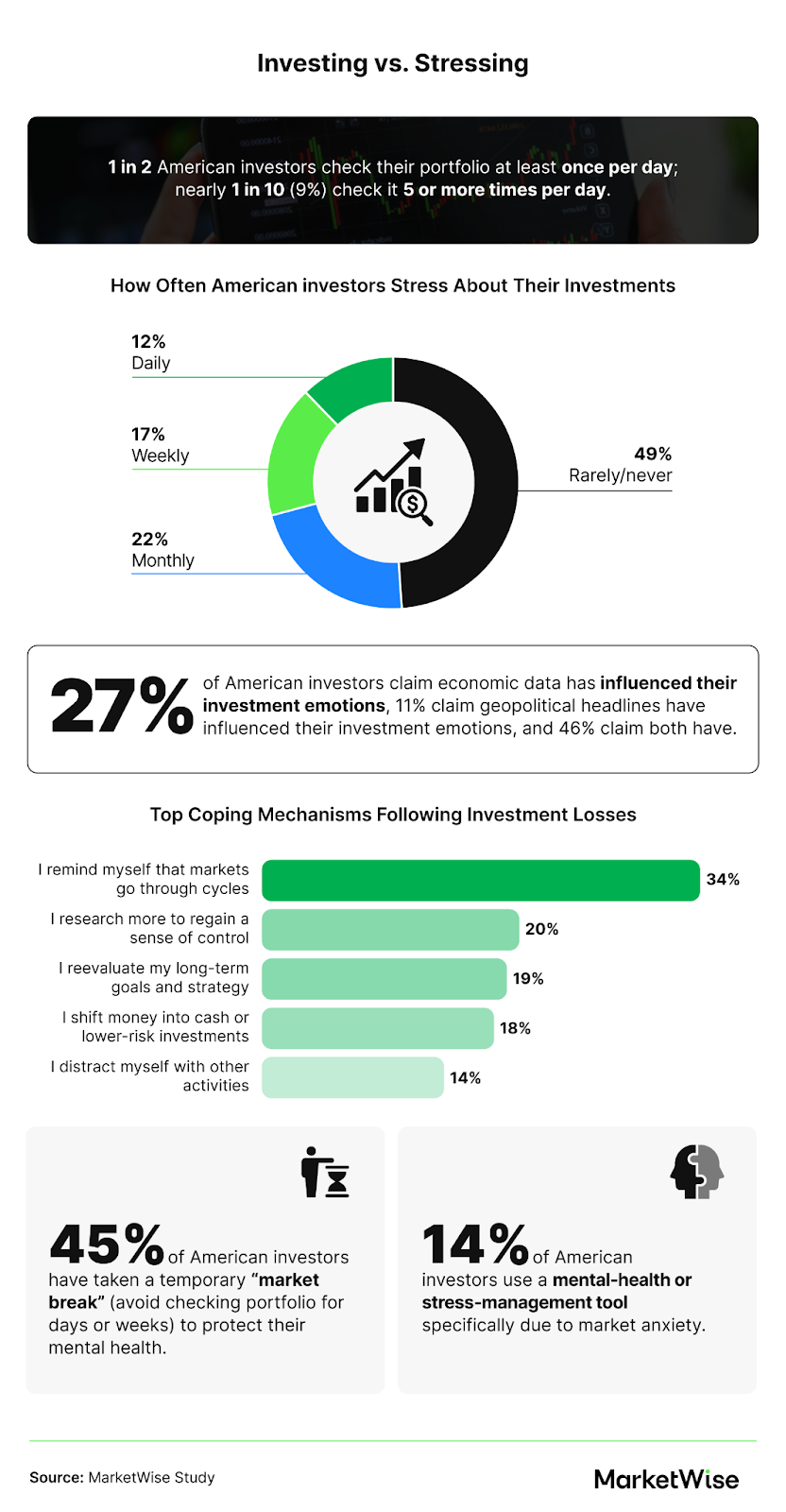

Behind every investment decision is a mix of analysis and emotion, but for many American investors, the emotional side is taking a toll. Half of all investors check their portfolios at least once per day, and nearly 1 in 10 say they check five or more times daily. Millennials are especially prone to this behavior, with 11% admitting to frequent checks.

Stress is widespread: 51% of American investors experience some level of anxiety about their investments. While 22% feel it monthly, 17% feel it weekly, and 12% grapple with it daily. Gen Z faces the most intense pressure, with 61% experiencing investment stress, and more than a third (36%) feeling it daily or weekly.

External forces are also at play. Nearly half of American investors (46%) said both economic data and geopolitical headlines have influenced their investment emotions. And many are taking steps to manage the impact: 45% have taken a temporary “market break,” stepping away from their portfolios to protect their mental health. Millennials are most likely to do this (47%).

To further cope, 14% of American investors use stress‑management or mental‑health tools specifically because of investment anxiety. Among younger generations, 17% of Gen Z and millennials rely on these supports to navigate emotional turbulence in the markets.

Navigating 2026 With Strategy and Self-Awareness

The data suggests that investor behavior in 2026 is influenced by emotional response alongside market fundamentals. While many American investors are shifting toward assets viewed as more stable, elevated stress levels and frequent portfolio monitoring point to heightened sensitivity to short-term volatility. This dynamic increases the risk of reactive decision-making, particularly in asset classes perceived as speculative or uncertain.

From a portfolio construction perspective, the findings reinforce the value of diversification, defined risk exposure, and disciplined rebalancing. Concentrated positions driven by fear or optimism can amplify downside risk during volatile periods. Investors who establish clear allocation targets, maintain long-term time horizons, and apply risk management frameworks consistently may be better positioned to navigate uncertainty and protect performance over time.

Methodology

For this study, we surveyed 1,004 Americans holding investments about their financial outlook for investments in 2026 and how their emotions influence their investment decisions. 51% of respondents identified as female, 47% identified as male, and 2% identified as non-binary. Generationally, 8% reported as baby boomers, 25% reported as Gen X, 50% reported as millennials, and 17% reported as Gen Z. The survey was conducted on CloudResearch’s Connect platform on December 11th, 2025.

Additionally, we leveraged Google Search Trends to identify which states are searching for specific financial search terms most (per capita).

About MarketWise

MarketWise is a leading financial research and education platform serving self-directed investors. Through a network of independent brands, including Stansberry Research, Altimetry, Chaikin Analytics, TradeSmith, InvestorPlace, Brownstone Research, and Wide Moat Research, MarketWise delivers independent insights, tools, and software to help individuals navigate complex markets with confidence. Whether you’re exploring emerging opportunities or seeking stability, MarketWise supports every investor with credible research and actionable strategies.

Fair Use Statement

We welcome the use of this study for noncommercial purposes. If you share or reference any part of this content, please include a link back to this page to credit MarketWise appropriately.