Today’s issue in preview:

- We nailed the homebuilding sector trade and it’s likely going higher

- Isaac Newton was right… and this fund is a good bet to run higher

- The most important, most bullish news you haven’t heard today

- Gold stocks, silver, and South American stocks power to new highs

We nailed the homebuilding sector trade and it’s likely going higher

Our November 21 homebuilder trade is off to a heck of a start.

Up 15.9% in less than two months… with more to go.

Back in November, I noted how persistently high interest rates and unaffordability combined to hammer homebuilder stocks in 2025. I expected Trump & Friends would recognize home affordability is a huge election issue… then make moves that could improve the situation, which would be positive for the homebuilding sector.

Since then, Trump has made various announcements that could lead to lower home prices and improving sentiment.

Plus, current Fed Chair Jerome Powell’s term ends in May. The new chair – whoever it may be – will likely deliver Trump the interest rate cuts he desires, which would be good for housing.

I like to know the bull thesis for a sector, but much more important than that is what the market thinks of the bull thesis. In the case, the market likes it so far. Since our November note, the two major homebuilder ETFs have rallied more than 10%.

A stock that moves with housing trends, the big appliance maker Whirlpool (WHR), is also moving higher since we wrote bullishly on it in January.

When a sector is as depressed as housing is now, it takes just a little good news to turn things around and get a rally started. That looks to be the case in the homebuilding industry right now. The odds favor a continuation of this new rally.

Isaac Newton was right… and this fund is good bet to run higher

Isaac Newton was right. An object in motion tends to stay in motion. Trends tend to persist, and winners tend to keep on winning.

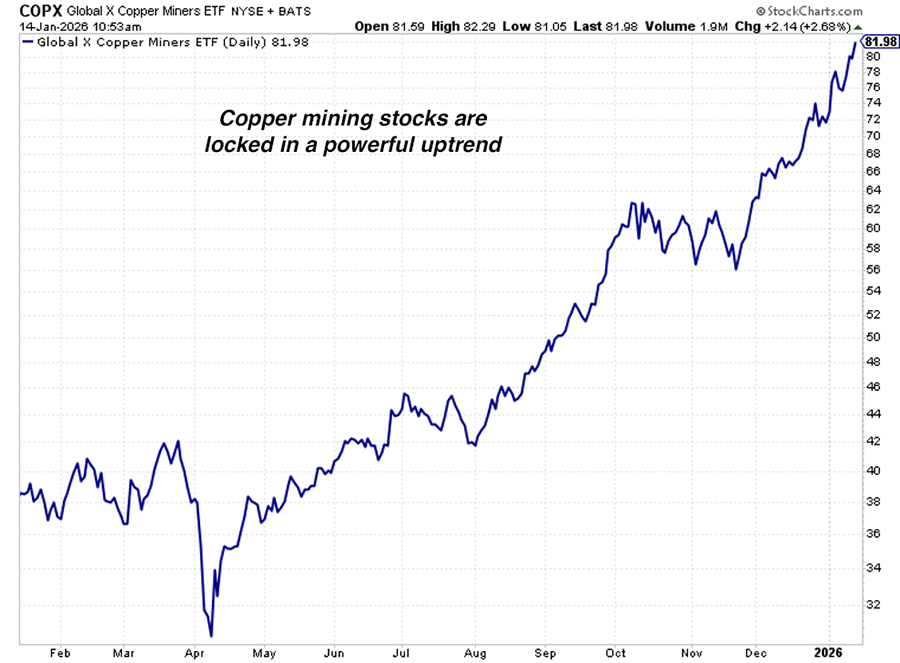

If there’s a lesson to take away from the booming copper mining industry’s recent price action, it’s that trends tend to persist.

In May 2024, I wrote bullishly on copper’s future. The bull case went like this:

Copper is widely used as a conductor to build power grids, data centers, power lines, and communication networks. When demand for power grids, renewable energy, and AI power usage booms, copper demand goes up. Plus, copper supply is constrained due to a lack of new discoveries.

In other words, copper is a “domino effect” way to invest in the AI infrastructure boom. The dominoes fall like this: Consumers want AI applications. Big tech wants to sell those applications. To do so, big tech must build AI data centers. AI data centers consume lots of copper… and the power grids that supply AI data centers consume lots of copper.

This means that as AI demand goes up, so does copper demand.

Since our note, copper mining stocks – as tracked by the Global X Copper Miner ETF (COPX) – have climbed 72%. They’re up 32% in just the past two months. Today, they advanced 2.3% to reach all-time highs. It’s now safe to say copper is in a raging bull market.

The copper mining sector’s incredible run is a reminder that when you’re looking for trends that can make you money, it’s often a good idea to place your bet on a proven winner. After all, trends tend to persist.

The most important, most bullish news you haven’t heard today

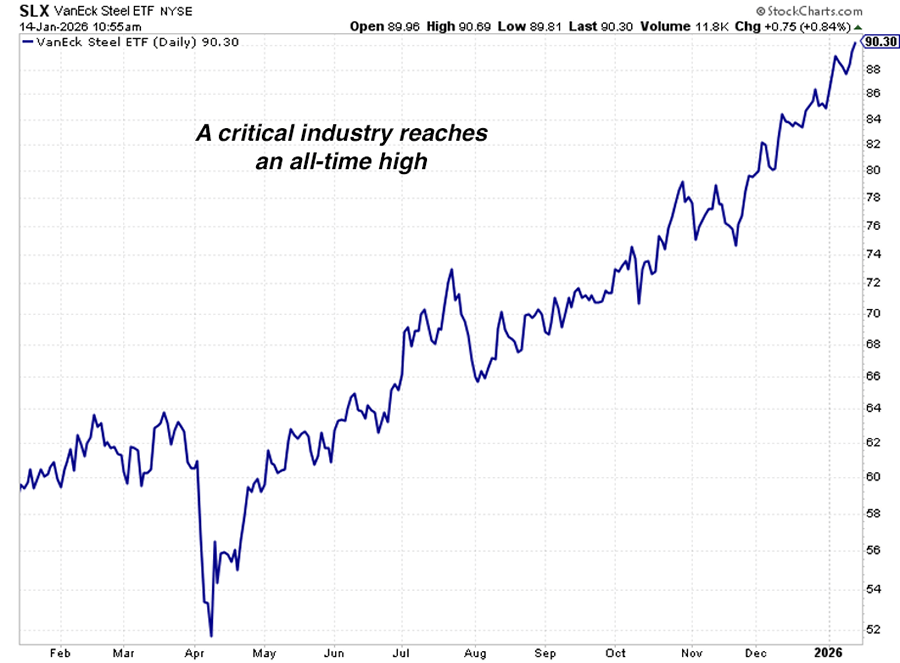

This week, we received big news about America’s economic growth.

No, it wasn’t about jobs or inflation. It was about making steel. The VanEck Steel ETF (SLX) soared to a new all-time high.

Many investors obsess over government data such as unemployment figures, job hirings, and the CPI. I like to know that data like anyone else does. However, when I want a read on what’s really happening in the economy, I look at what’s happening in the real world. I look at stock prices. I listen to the judge, jury, and executioner of any thesis, any trend, and any claim: The market.

Specifically, I look at the stock price action of companies and industries that make up the world’s economic core… companies sensitive to megatrends in manufacturing and infrastructure building.

In this group, you have construction equipment maker Caterpillar (CAT), high-horsepower engine maker Cummins (CMI), heavy truck maker Paccar (PCAR), trucking firms, and cement firms. These firms rise and fall in line with the world’s ability to finance and build factories, cities, airports, highways, and skyscrapers.

The stock market is one of the world’s greatest forecasting mechanisms. It tends to look ahead 6-12 months in advance. When an industry is in a recession, its stock prices will rise before the news says it is recovering. When an industry seems to be doing well, its stock prices will decline before the news says it is entering a downturn. This is often called “discounting the future.”

All this makes the new all-time high in the VanEck Steel ETF (SLX) an important new development. This fund owns a variety of big steelmakers and iron ore miners.

In a high-tech world of iPhones, ChatGPT, and Instagram, it’s easy to forget our world is built on a low-tech foundation of steel and concrete. Steel is a major component of bridges, cars, trucks, power lines, ships, pipes, factories, construction equipment, and skyscrapers. This means when the global steel industry is enjoying strong revenues and rising share prices, it’s a very good signal for the global economy.

As you can see in the chart below, the steel industry is doing well. SLX is up 54% over the past year and just reached an all-time high. It’s yet another bullish signal for the U.S. economy.

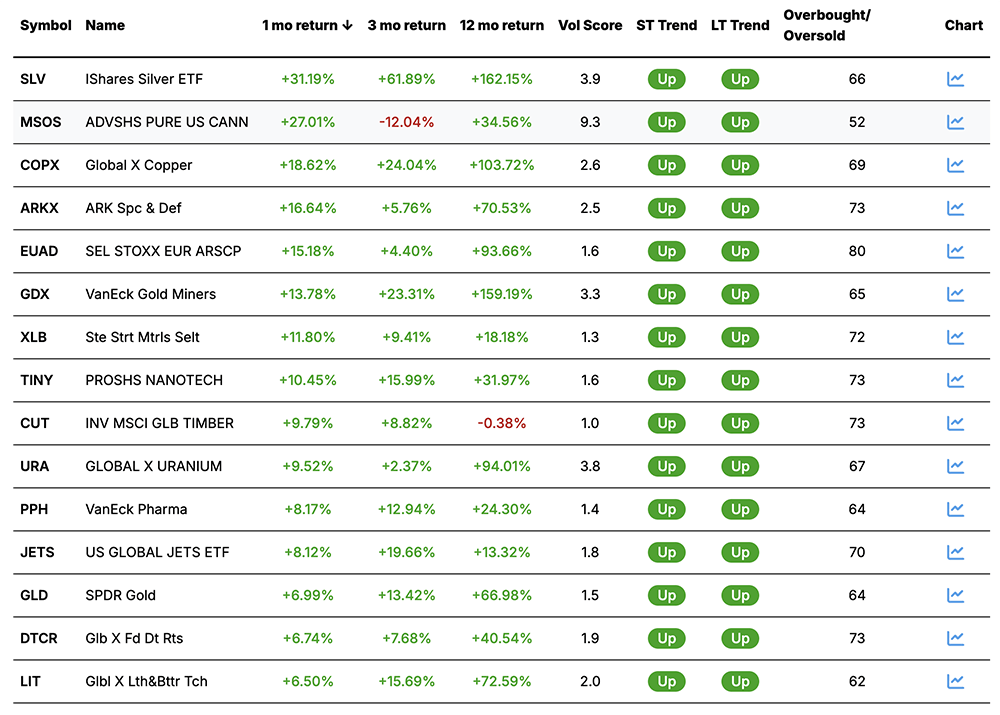

Market Notes

- The gold stock trade we pounded the table on in 2024 is paying out like a broken slot machine. Gold stocks of all shapes and sizes reached new all-time highs today. The VanEck Gold Miners ETF (GDX) is up 241% over the past two years.

- The silver traded we pounded the table on in early 2025 is also paying out like a broken slot machine. Silver reached a new all-time high today. It’s up 205% in the past 12 months.

- Oil giant ExxonMobil (XOM) reached a new one-year high today. Our oil trade continues its winning ways.

- Mega miner BHP Billiton (BHP) reached a new all-time high today. Our mid-2025 call on critical resources is yet another winner.

- the iShares Latin America 40 ETF (ILF) reached a new one-year high today. The market likes America’s increasing influence and economic ties in the region.

Today’s Trend Leaderboard

Top performing themes and trends over the past month

Regards,

Brian Hunt

Editor, Money & Megatrends