Today’s issue in preview:

- Trump’s Venezuela move creates a powerful investment opportunity

- Small-cap stocks are poised for a big 2026

- An AI trade that could explode higher… that nobody is talking about

- Gold stocks, copper stocks, and silver continue their bull market ways

Trump’s Venezuela move creates a powerful investment opportunity

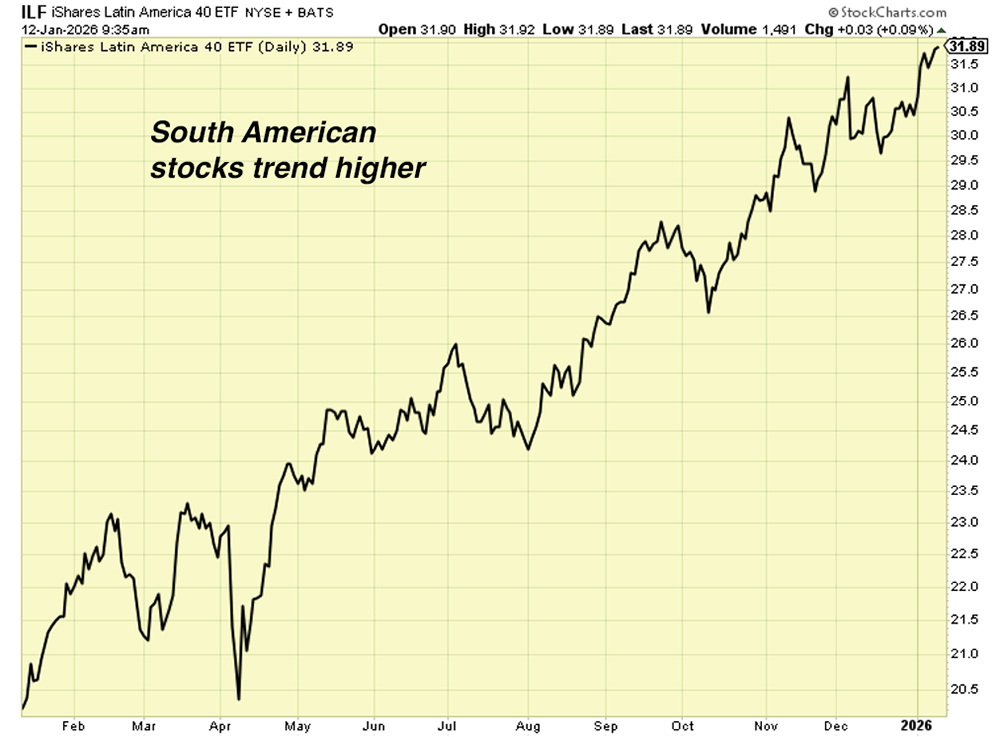

Owning South American stocks was a great trade in 2025 (up 45%), and that’s likely to continue in 2026.

In the most recent development, the region’s stock markets appear to like Donald Trump’s controversial removal of Nicolas Maduro from power in Venezuela.

Back in November, we highlighted how South American stocks were outperforming their more popular North American cousins. Additionally, we pounded the table multiple times last year on owning Brazilian stocks.

Bulls on South America point out how “left-wing, full-blown socialist” Latin American political parties look increasingly to be replaced by “less left-wing, not full-blown socialist” political parties. This should be good for the continent’s stock markets. It has certainly been the case for Argentina, which has recently shifted towards “less socialism” and seen its stock market soar 378% over the past two years.

Latin American stock markets are also heavily leveraged to critical resource markets, including iron ore, agriculture, copper, and oil. The critical resources boom we’ve been covering is good for “LatAm” stocks.

After the removal of Maduro from power in Venezuela, South American markets responded favorably to the idea of the U.S. exerting more influence and financial involvement on the continent. South American stocks have climbed since Maduro was removed.

Trends tend to persist, and rising markets tend to keep rising, so I still like the idea of owning South America. For now, I’m trading these markets with the thesis that more U.S. involvement in South American politics is good for the region’s stock markets.

If you agree, you can consider high-growth South American names such as “the Amazon of South America,” MercadoLibre (MELI) and fintech dominator Nu Holdings (NU). Or, you can go the diversified route with the iShares Latin America 40 ETF (ILF), which is essentially the “S&P 500 of South America.” As you can see from the 1-year chart below, ILF is in a strong uptrend. I bet it keeps running.

Small-cap stocks are poised for a big 2026

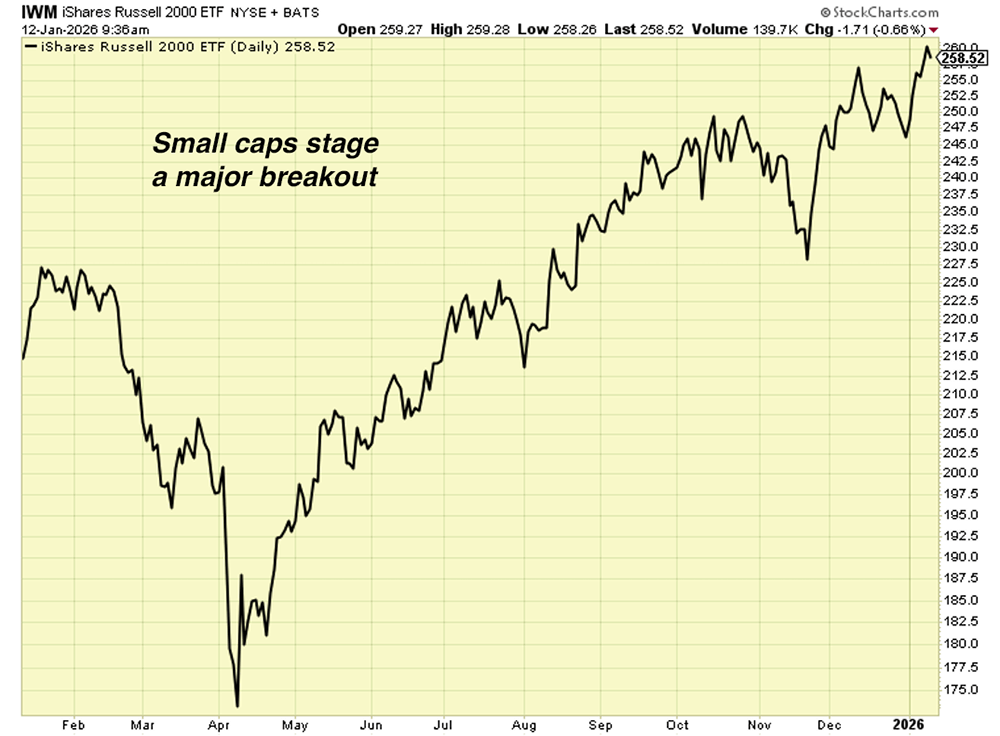

Over the weekend, news broke that federal prosecutors recently opened a criminal investigation into Federal Reserve Chairman Jerome Powell. Powell responded by saying he believes the case was opened because he hasn’t delivered the lower interest rates that Donald Trump wants.

Whether Powell pushes for lower rates or not, it looks like Trump is going to get them soon. Powell’s term ends in May. His replacement’s chief qualification will not be an impressive academic record but a love of low interest rates.

The coming lower interest rates are key for one of the market’s highest potential trades over the next 12 months: Long small-cap stocks.

On October 15, I highlighted the bullish price action in small-cap stocks and suggested it was time to add a position in this area.

Small-cap bulls argue these stocks have underperformed large caps because high interest rates and high inflation have a greater impact on smaller companies than on larger ones. This underperformance has left small caps relatively cheap, trading at a forward P/E ratio of 15.9, compared to the S&P’s 22.1.

If Donald Trump gets his wish for lower interest rates, however, small caps could become much less cheap. Lower rates should benefit small-cap stocks more than large-cap stocks.

In my original note, I mentioned that the small-cap-focused iShares Russell 2000 ETF (IWM) had reached a new 1-year high. After that, IWM traded sideways for about two months.

But as you can see in the chart below, IWM has cleared that sideways trading pattern and recently broke out to new all-time highs. The small-cap uptrend is back on. This is one trend we expect to persist in 2026.

An AI trade that could explode higher… that nobody is talking about

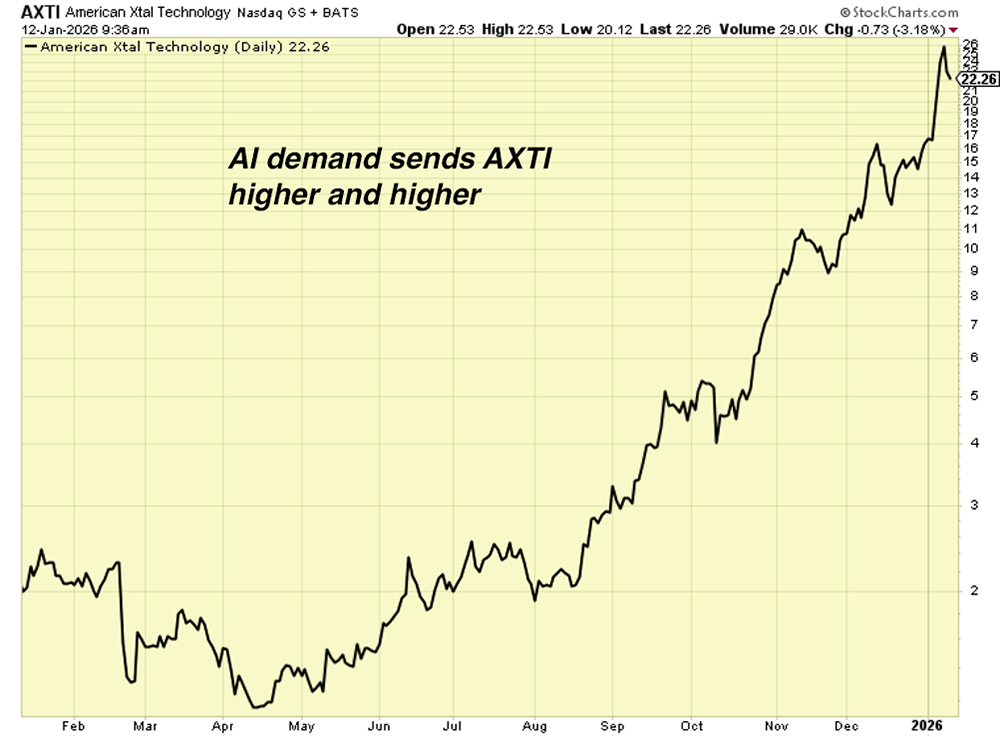

Does the future of the AI revolution hinge on a single element?

While the world fixates on NVDA chips, semiconductor factories, and data centers, a far more critical bottleneck is forming in the “nervous system” that links the AI chain together.

Broadcom CEO Hock Tan recently noted that the demand for networking gear – the switches and cables that enable AI chips to talk to each other (connect) – is exploding.

He said connectivity expenses are expected to rise towards 15-20% of 2030 CapEx compared to 5-10% today. This represents a structural shift in where the big money is going.

Given this massive CapEx, the interconnect industry is an opportunity for investors to track over the next decade. Nvidia’s extraordinary AI chips are useless if they can’t talk to each other in real time.

Traditionally, copper wiring has been used to allow data to travel between servers for connectivity. But copper simply cannot move data fast enough or cool enough at these distances.

The only path forward is photonics: a technology that uses lasers to transmit data as pulses of light rather than electricity.

However, the photonics transition rests entirely on one compound semiconductor material that is becoming dangerously scarce: Indium Phosphide (InP). Without InP to power the lasers and transceivers needed in photonics, the trillion-dollar AI buildout hits a brick wall.

This copper bottleneck is well understood. We’ve spoken about it before. But the InP solution creates a new, more severe constriction: a bottleneck within a bottleneck.

Laser-grade InP requires a purity of what’s called 6N (99.9999%), which is scarce. This extreme purity requirement funnels the entire global supply into the hands of a tiny group of refiners, creating a duopoly that is disturbingly concentrated between Japan’s Sumitomo (SMTOY) and US-based AXT (AXTI).

AXTI is a US-headquartered firm, but its operations are mainly in China. It controls the entire process from the mines and refineries all the way through to the final substrate output. This makes it the only company (that we know of) that can bypass the merchant market for raw materials. It’s a huge moat in a hugely dependent sector.

This makes a multi-trillion AI revolution very reliant on a small ($1.2 billion market cap) materials company based in China. It also makes AXTI a bet on one of the most necessary materials in the world. If geopolitical tensions rise and export controls on Indium or Gallium increase, this “bottleneck of a bottleneck” could become a very big deal. Until then, the upside in AXTI is very large.

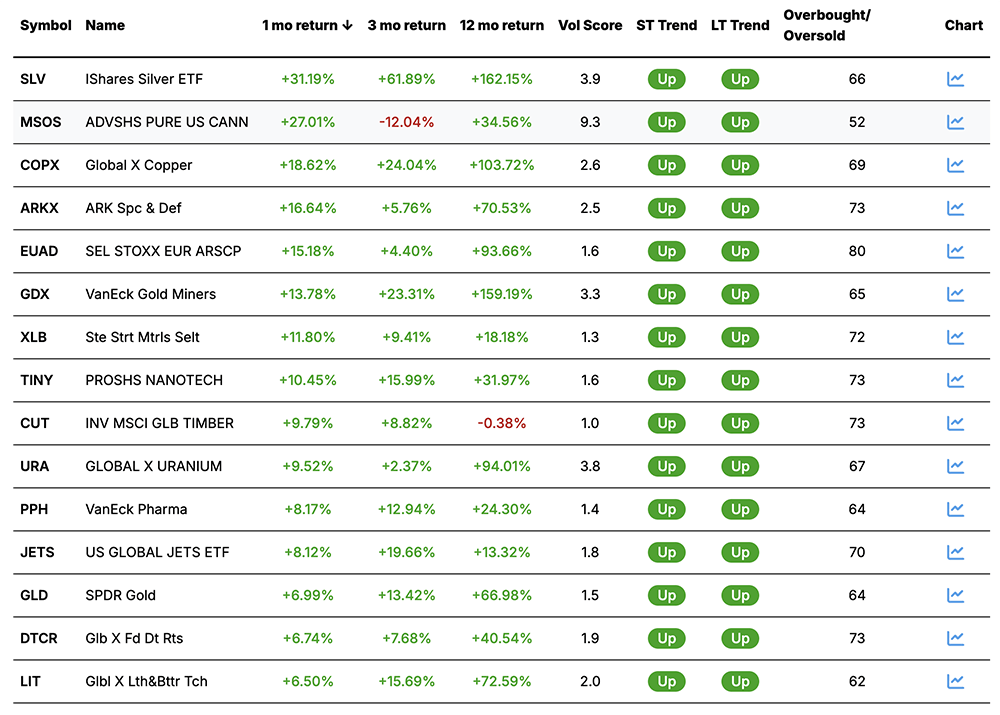

Market Notes

- Large cap gold miners Newmont Mining (NEM), Barrick Mining (B), and Agnico Eagle (AEM) reached new all-time highs today. As we forecasted, the gold stock bull market keeps running.

- Drone making giant Elbit Systems (ESLT) reached a new all-time high today. The drone bull market we forecasted is in full swing.

- Silver advanced to a new multi-year high today. The metal is up 248% over the past two years.

- The critical resources bull market keeps running. The VanEck Rare Earth and Strategic Metals ETF (REMX) reached a new 1-year high today.

- The copper mining stock bull market continues. The Global X Copper Mining ETF (COPX) reached a new 52-week high today.

- The “space trade” we’ve highlighted many times keeps generating winners. The ARK Space Exploration & Innovation ETF (ARKX) reached a new all-time high today.

Today’s Trend Leaderboard

Top performing themes and trends over the past 3 months

Regards,

Brian Hunt