Today’s issue in preview:

- This bet on AI power consumption is poised to run higher. How to invest.

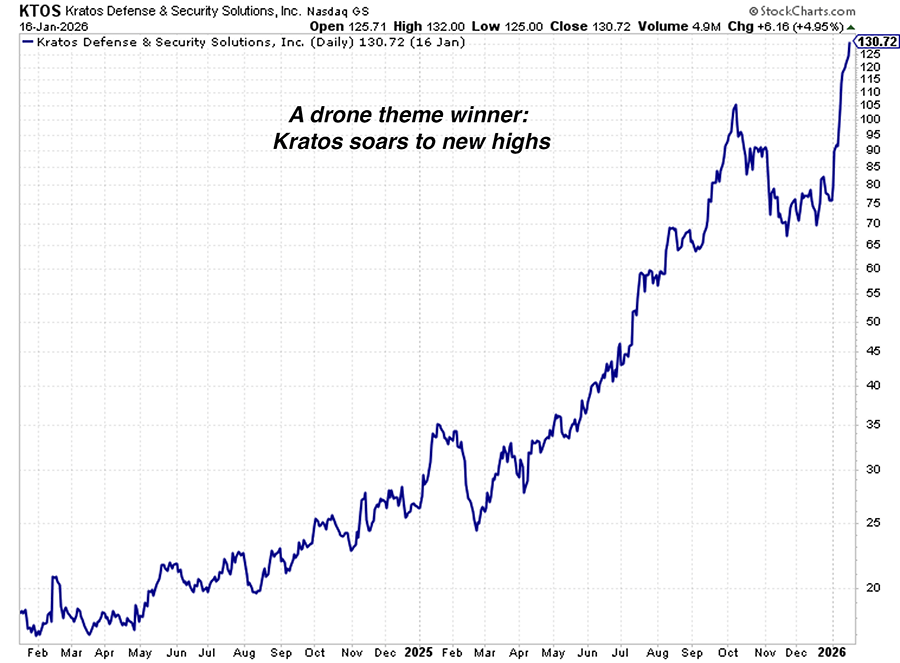

- Drone stocks prove you can make money in stocks faster than ever

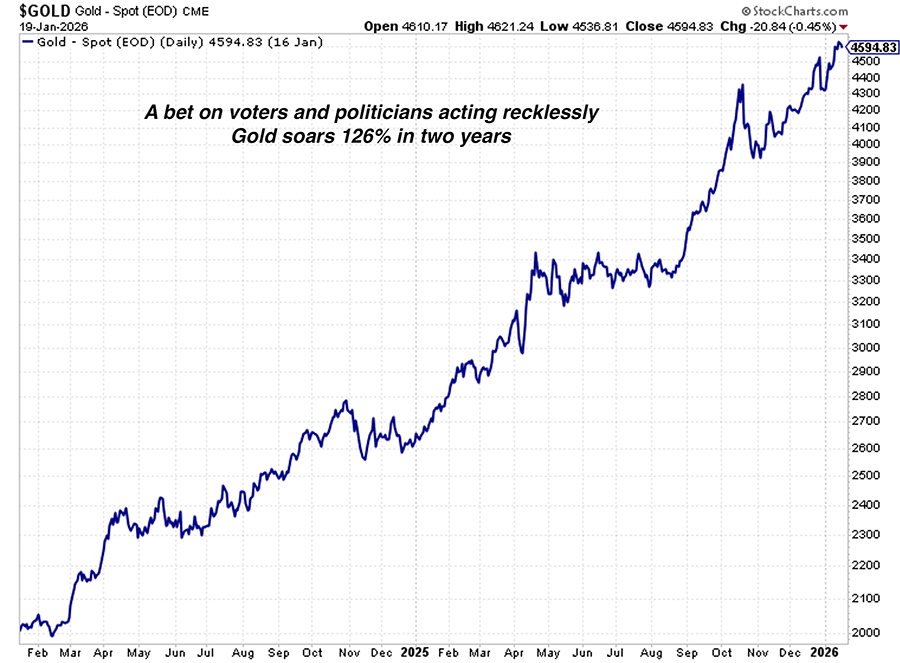

- Owning gold is a bet that voters and politicians will continue to act recklessly

This bet on AI power consumption is poised to run higher. How to invest.

These days, you can hardly spend two minutes reading financial news without hearing about AI’s soaring power needs. That’s good for one of our top themes – the Power Grid Upgrade.

On October 7, we detailed how the world’s largest companies are making the biggest business “bet” in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars per year on data centers, AI chips, and other infrastructure components. Their total investment in this space will run into the trillions.

All that AI infrastructure is poised to consume huge amounts of electricity. Goldman Sachs forecasts global power demand from data centers will climb 50% by 2027 and by as much as 165% by the end of the decade.

This creates a huge investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s a giant network of power stations, transmission lines, substations, and underground wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s no Netflix, and your iPhone doesn’t charge.

Industry experts say the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) gave the energy sector a D+ in its 2025 Infrastructure Report Card, citing concerns about rising energy demand, aging infrastructure, and a lack of transmission capacity.

Soaring electricity demand… a grid badly in need of an upgrade… AI supremacy on the line… trillion of dollars of economic output on the line…

This is a recipe for a bull market in companies that build, repair, and upgrade our power grid.

This is a broad theme with individual leaders such as Quanta (PWR), Hubbell (HUBB),Monolithic Power Systems (MPWR), and Eaton (ETN) on the menu. If you prefer ETFs, the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) is an option. It owns a diversified basket of companies that manufacture electric grid components and perform grid-related installation/construction services.

As you can see in the chart below, the market likes the Power Grid Upgrade theme. GRID is up 32% over the past year and is poised to break out to a new all-time high. This trend is your portfolio’s friend.

Drone stocks prove you can make money in stocks faster than ever

A core belief that guides our research and recommendations at Money & Megatrends is that right now, you can make money in stocks faster than ever before. Stocks of all kinds are moving much faster than they used to.

This acceleration is thanks to the fusion of three modern-day phenomena. First, technology is advancing by leaps and bounds every month. Second, stock information now gets disseminated globally at light speed. And finally, fintech innovation allows people to execute rapid trades from anywhere.

Add those up, and you get a stock market that moves much, much faster than it did 20 years ago. Stocks are soaring and crashing at incredible speeds now.

Take my December 10, 2024, recommendation to be long drone stocks.

Back then, the case for owning drone stocks was simple: After years of innovation, military and surveillance drone makers can now produce large amounts of effective drones at low cost. Many drone applications now have very high “cost-to-damage inflicted” ratios. This is why drones have played a huge role in the Russia/Ukraine war.

The now pervasive use of drones in warfare means we are in what military experts call a “Revolution in Military Affairs (RMA).”

A Revolution in Military Affairs is a fundamental change in how wars are fought, typically driven by technological innovation. For example, the introduction of mechanized warfare in the form of tanks, battleships, and airplanes drastically changed the battlefield. Airplanes, in particular, introduced a whole new dimension to war.

I’m anti-war and anti-surveillance, so a big part of me wants to see drones manufactured only for peaceful activities like delivering pizza and Amazon packages. However, I don’t make the rules. Governments around the world are buying drones by the thousands. Drone maker revenue is soaring. We have an investment megatrend on our hands.

Since my original note, drone maker Elbit Systems (ESLT) is up 202%. Drone maker Kratos Defense & Security Solution (KTOS) is up 380%. And drone equipment maker Ondas Holdings (ONDS) is up an incredible 1,395%.

Yes, you can make money in stocks faster than ever before. And the drone theme remains one of the world’s most promising megatrends.

Owning gold is a bet that voters and politicians will continue to act recklessly.

Today, gold continued its impressive run that began in early 2024. The yellow metal is up 126% over the past two years.

I’ve made a lot of money in gold during that time… although I didn’t want to.

I like to think of gold as a form of “wealth insurance.” Much like car and home insurance, you buy it and hope never to use it.

I’m one of the most bullish and optimistic people on the U.S. economy you’ll ever meet. The U.S. is the most dynamic and innovative economy on the planet. However, anything can happen.

Although I run a generally bullish portfolio, I like to own “wealth insurance” in the form of physical gold, gold stocks, and physical silver.

I view gold as “wealth insurance” because it typically performs well when the U.S. government debases the dollar, also known as “creating high inflation.”

When the dollar’s value is going to hell, it typically coincides with economic chaos and sinking stock prices. So, gold often zigs when stocks and bonds zag. I’d rather see gold “zig” to the downside for the rest of my days. This would mean we are in a good economic climate.

Unfortunately, gold hasn’t been going down. It’s been skyrocketing.

This is the byproduct of an unfortunate situation. Contrary to government claims, the U.S. dollar has lost tremendous value over the past seven years. I estimate the dollar has lost at least 33% of its value since 2018. Prices seem so high… because the value of our money is so low.

Over the past 50 years, the U.S. government has promised too many things to too many people. It is struggling under a giant burden of debt and unfunded liabilities. These debts and liabilities cannot possibly be paid with sound, honest money. They can only be paid back with debased, devalued money… much of which is created out of thin air. This is driving inflation and significant currency debasement. Prices are rising because the value of our money is falling.

As a result, individuals and whole countries are buying vast amounts of gold to protect their savings. This is driving gold’s price higher.

This trend will not slow down anytime soon. Too many voters are net tax recipients, which means they receive more in government benefits and handouts than they pay in taxes. This means no politician who promises reduced government spending can win a major election. As a result, spending, deficits, and the gold price will go higher. A bet on gold going higher is a bet that voters and politicians will continue to act recklessly.

As for gold stocks, I’ve been urging people to be heavily involved in them for more than two years. It’s been a grand slam home run position. The large increase in the gold price has produced correspondingly large increases in gold miner revenues and cash flows. The gold mining business has been transformed.

At this point, gold mining firms don’t need gold to continue rising to generate incredible revenue growth, profit margins, and share price gains. Gold could trade down from its current price of $4,740 to $4,000, and quality gold miners will remain cash flow machines, and their bull markets will continue. I’m staying long.

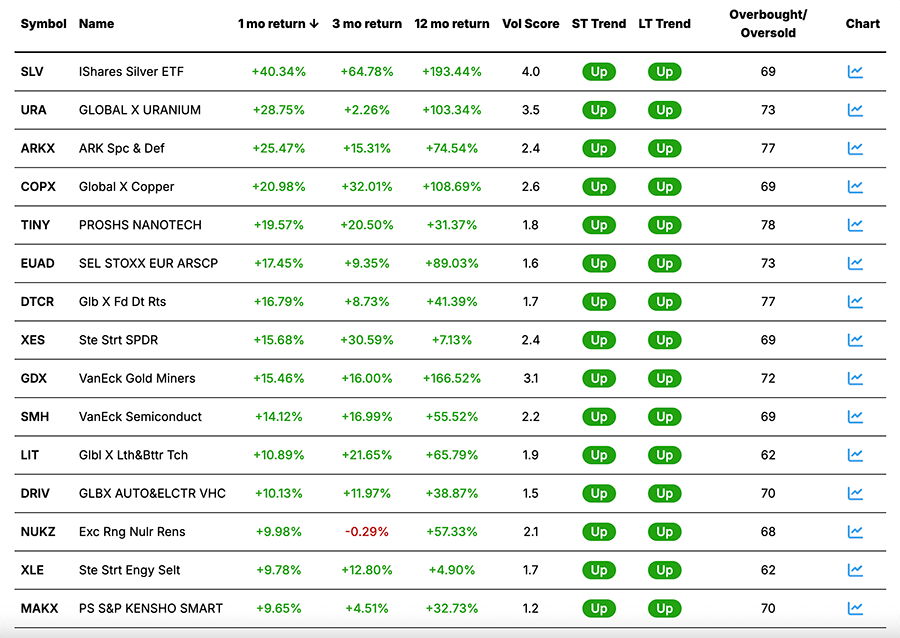

Market Notes

- Today’s new highs list is dominated by gold and silver miners. The Global X Silver Miners ETF (SIL) is up 213% over the past 12 months. The VanEck Gold Miners ETF (GDX) is up 208% over the past 12 months.

- The Global X Columbia ETF (COLO) reached a new all-time high today. As we’ve covered in the past, the market seems to like the idea of greater U.S. influence and financial ties in South America.

- The Sprott Uranium Mining ETF (URNM) reached a new all-time high today. The nuclear power theme continues to generate winners.

- Software giants Adobe Systems (ADBE), Workday (WDAY), Trade Desk (TTD), Docusign (DOCU) and Atlassian (TEAM) reached new one-year lows today. The market believes AI presents a danger to many software businesses.

Today’s Trend Leaderboard

Top performing themes and trends over the past month

Regards,

Brian Hunt

Editor, Money & Megatrends