Today’s issue in preview:

- Please tell me you’re long this extraordinary stock market trend

- The most important thing you’ll read all week: It’s a raging bull market in global financial liquidity.

- Our Power Grid Upgrade trade is creating big stock market winners: Are you in or on the sidelines?

- Our recommendation to own oil stocks, gold stocks, and defense stocks continues to pay off.

Please tell me you’re long this extraordinary stock market trend

Isaac Newton was right. An object in motion tends to stay in motion. Trends tend to persist. These facts can make you a lot of money in stocks.

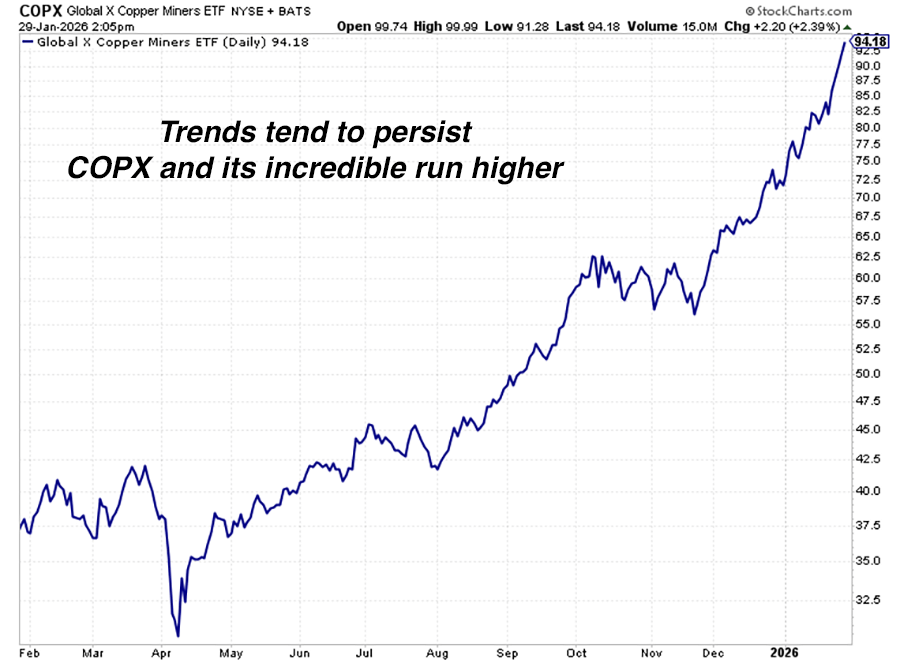

If we can learn anything from the recent extraordinary rally in copper and copper mining stocks, it’s the concept above… which is one of the foundational beliefs that guides my thinking and trading.

For over two years, I’ve been personally long the copper mining theme, and I’ve urged others to go long as well. In a September 25, 2025, note, I highlighted the copper mining sector’s bullish price action and reiterated my call to own it.

The bull case here is simple: Over the past 20 years, the copper mining industry has discovered or developed few meaningful copper deposits. Meanwhile, demand from AI, power grid builders, renewable energy, and EVs is turbocharging copper demand.

My call is proving to be a big winner. The Global X Copper Miners ETF (COPX) is the world’s largest copper mining-focused ETF. In August 2025, COPX broke out to a new 52-week high and bolted 35% in less than two months.

After digesting this huge short-term gain and moving sideways for a few months, COPX resumed its uptrend. Since December, COPX has climbed relentlessly… reaching new all-time highs week after week after week. COPX climbed 15% in December 2025 and 29% in January.

Today, COPX is up more than 1% to reach an all-time high after a surge of Chinese buying sent physical copper to a record high. COPX is up 104% since the August breakout (a greater than 280% annualized rate).

The big move in copper miners is one of the biggest and best trades of the past few years. It reminds us that yes, Isaac Newton was right. An object in motion tends to stay in motion. Trends tend to persist. I expect this one to do just that. Still long.

The most important thing you’ll read all week: It’s a raging bull market in global financial liquidity.

This week, the stock market leaderboard is sending us a simple and powerful message: It’s a raging bull market in global financial liquidity… and you need to be long stocks.

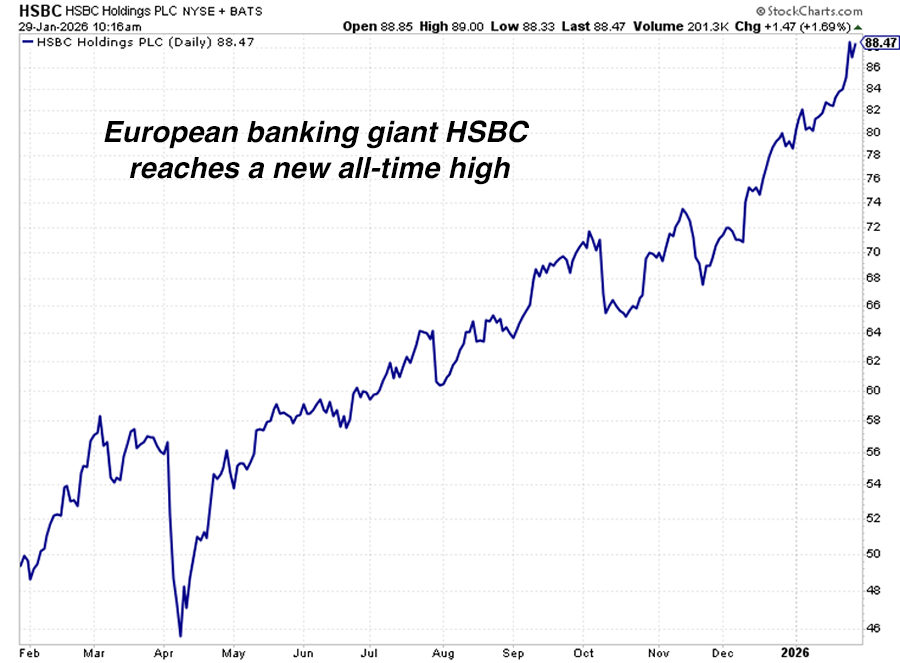

This week, stock market optimists were blessed with one of the largest and most varied lists of major banks reaching new highs in recent history.

Major bank stocks with market caps of over $30 billion reaching new all-time highs this week include: HSBC Holdings (HSBC), Banco Santander (SAN), UBS (UBS), Banco Bilbao Vizcaya Argentina (BBVA), Mizuho Financial (MFG), Bank of Nova Scotia (BNS), Barclays (BCS), Toronto Dominion (TD), Lloyds Banking Group (LYG), Deutsche Bank (DB), US Bancorp (USB), National Australia Bank (NABZY), Sumitomo Mitsui Financial Group (SMFG), and Itau Unibanco (ITUB).

These are among the world’s largest, most important financial companies. You can tell by their names that they operate across Europe, North America, South America, and Asia. And they are all registering new highs. This is a big, big deal.

I typically avoid individual banking stocks. Since I started trading stocks in 1997, I’ve seen too many seemingly strong and safe financial companies look good one day and then blow up the next day… with the investment community later finding out they were hiding or mismanaging liabilities.

However, I like to monitor the price action in broad groups of banking stocks. The health of a region’s financial system can serve as a good barometer of its overall economic health… or at least a good gauge of all-important financial liquidity, which has a huge influence on asset price movements.

The stock market is the world’s greatest forecasting mechanism. It tends to look ahead 6 -12 months. When an industry is in a recession, its stock prices will rise before the news media announces it is recovering. When an industry seems to be doing well, its stock prices will decline before the news covers its downturn. This is often called “discounting” or “pricing in” the future.

Applied to banking, when a region is about to start doing well, its banks will rise in advance of the good times. When a region is about to struggle, its banks will plummet in advance of the bad times.

A list of banking stocks as large and varied as the one above, all hitting new highs, means there is tremendous liquidity sloshing around the world’s banking systems.

It means there’s plenty of money to fund new businesses, big real estate projects, and massive infrastructure projects. It also means there’s plenty of money that can flow into stocks and send them higher. In layman’s terms, it means “Party On.”

I know reading about bank stocks isn’t nearly as exciting as explosive sectors such as silver, space, and AI, but this surge in a wide variety of major banks is hugely important.

Will the boom in global financial liquidity and stock markets come to an end someday? Sure. All booms eventually end. But for now, this very important trend is up. Position yourself accordingly!

Our Power Grid Upgrade trade is creating big stock market winners: Are you in or on the sidelines?

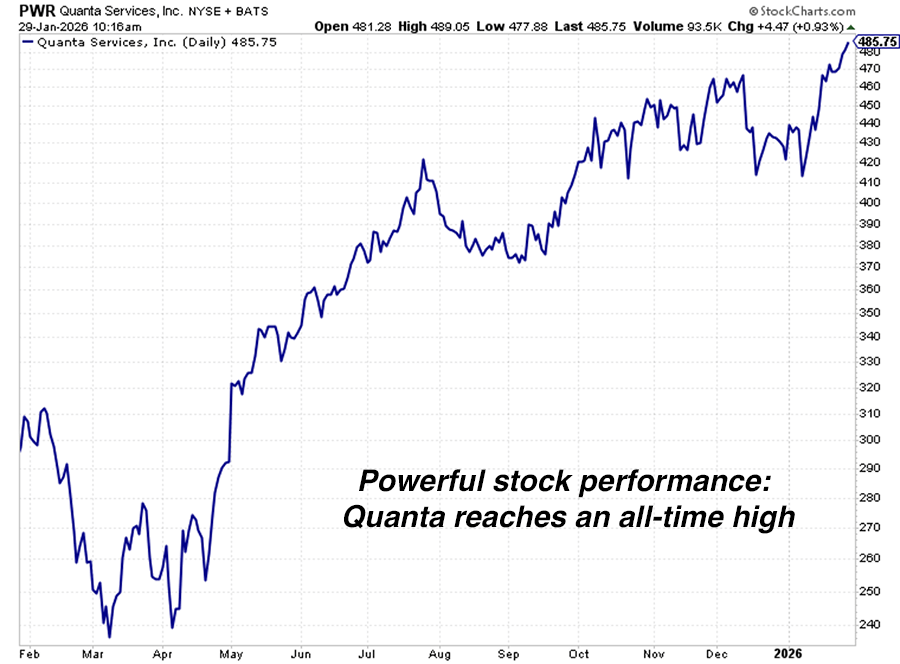

This week, Quanta Services (PWR) reached a new all-time high.

This is the market reminding you that the Power Grid Upgrade megatrend is a major opportunity.

On October 7, we detailed how the world’s largest companies are making the biggest business “bet” in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars per year on data centers, AI chips, and other infrastructure components. Their total investment in this space will run into the trillions.

All that AI infrastructure is poised to consume huge amounts of electricity. Goldman Sachs forecasts global data center power demand will climb 50% by 2027 and as much as 165% by the end of the decade.

This creates a huge investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s a giant network of power stations, transmission lines, substations, and underground wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s no Netflix, and your iPhone doesn’t charge.

Industry experts say the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) gave the energy sector a D+ in its 2025 Infrastructure Report Card, citing concerns about rising energy demand, aging infrastructure, and a lack of transmission capacity.

Soaring electricity demand… a grid badly in need of an upgrade… AI supremacy on the line… trillion of dollars of economic output on the line…

This is a recipe for a bull market in companies that build, repair, and upgrade our power grid.

As we covered in October, Quanta Services is one of the market leaders in this megatrend. Quanta is America’s largest publicly traded electrical contracting company. It generates much of its revenue building the transmission lines, power connections, and electrical substations that the AI spending boom requires. Thanks to the AI boom, Quanta has market-leading earnings growth and strong share price momentum.

Over the past year, Quanta is up 64%… far outpacing the S&P 500. This week, the stock reached an all-time high. The Power Grid Upgrade bull market is alive and well.

Market Notes

- Our September 29, 2025, bullish note on oil stocks continues its winning ways. Oil stocks of all shapes and sizes reached one-year highs today. New highs include oil giants ExxonMobil (XOM), Chevron (CVX), Shell (SHEL), Baker Hughes (BKR), Devon Energy (DVN), Canadian Natural Resources (CNQ), and Suncor (SU).

- Our recommendation to own pipeline stocks continues to be a winner. The Alerian MLP ETF (AMLP) reached a new one-year high today.

- Our recommendation to own gold, silver, and gold stocks continues to be a giant winner. This week, gold advanced to an all-time high of $5,200 an ounce. Silver advanced to $118 an ounce. The VanEck Gold Miner ETF (GDX) is up 185% over the past 12 months.

- Construction equipment maker Caterpillar (CAT) reached a new all-time high today. This is a bullish economic signal.

- Our recommendation to be long the defense industry continues to pay off. Defense giant Northrop Grumman (NOC) reached an all-time high today. The trend tailwinds continue to blow for defense stocks.

- The VanEck Steel ETF (SLX) reached a new all-time high today. This is a bullish economic signal. When we’re making and using a lot of steel, it’s a sign the economy is growing.

Regards,

Brian Hunt

Editor, Money & Megatrends

Recent Issues

A tidal wave of cash is headed towards this high tech sector. How to get your share of it.

A massive AI bottleneck is generating giant stock market winners. Do you own them?