Today’s issue in preview:

-

How to turn the AI boom into your personal passive income machine

-

Why Canadian stocks are poised to generate big returns

-

The S&P 500 Equal Weight ETF powers to a new high, laying waste to the “narrow market” bear thesis

-

The AI Lawnmower continues cutting down the world’s largest, most powerful data analytics and “knowledge work” firms

How to turn the AI boom into your personal passive income machine

Credit: Denis Shevchuk

What’s the most powerful, most profitable trend that gets no press here in 2026?

It’s the market waking up to my “AI income streams” idea.

In early 2024, I began seeing the natural gas pipeline business as the best way to earn lots of passive income from the AI boom.

Given AI’s enormous promise, the world’s largest and wealthiest companies are embarking on the biggest capex spending cycle in history. Giants such as Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars a year on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume vast amounts of electricity. S&P Global estimates that global electricity demand will increase by nearly 50% by 2040.

I’ve frequently mentioned how AI’s growing power demands are a bullish driver for natural gas. Natural gas is the preferred clean-burning fuel for power plants that support AI data centers. This is why I believe natural gas producers such as EQT (EQT), Antero (AR), Expand Energy (EXE), and Range Resources (RRC) are compelling long-term stock ideas.

However, all the natural gas in the world isn’t worth much if you can’t transport it to customers.

This is where America’s vast natural gas transportation, processing, and storage industry comes in. An extensive network of pipes crisscrosses America to allow energy companies to transport natural gas from the wellhead to the power plant. If we get an AI-driven boom in natural gas consumption, we get a boom in natural gas transportation by default.

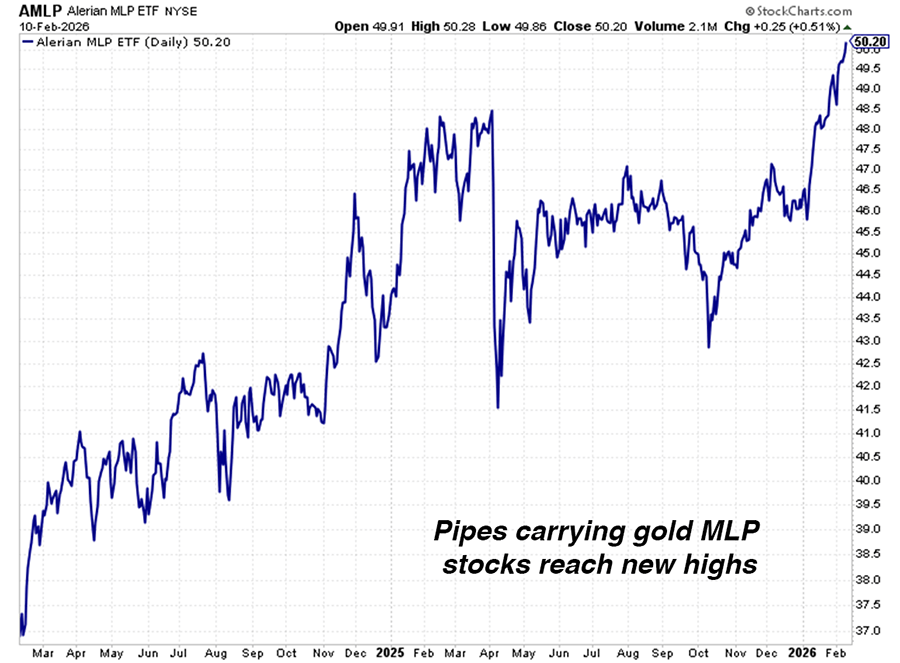

As evidence, I present the Alerian MLP ETF (AMLP), which is up 8.9% this year and has reached an all-time high.

AMLP is the world’s largest ETF focused on pipeline operators. It holds the “who’s who” of American energy pipeline operators. The fund’s current yield is over 7.5%. This is an incredibly high yield in a world where your typical dividend ETF yields 3%-4% and corporate bond funds yield 4%-5%.

The typical pipeline operator is not your conventional “high-risk, high-reward,” AI play. It’s not going to soar 500% in one year as some AI stocks can.

Instead, it’s a boring and predictable business that generates regular cash flows and shareholder distributions. And it’s getting an AI boost that will last for years. AMLP’s recent surge higher tells us the market is waking up to this big story.

Why Canadian stocks are poised to generate big returns

Credit: edb3_16

Over the past month, the financial media has fixated on high-tech subjects. The meltdown in software stocks. The bear market in bitcoin. Big Tech’s revised and enormous AI investment projections.

Given all this, it’s easy to forget about a very important megatrend: The bull market in critical resources. Perhaps the new all-time highs reached by Canadian stocks this week can remind us.

Over the past six months, I’ve made the case that we are in a favorable environment for critical resources… one in which many individual resource sectors will generate strong returns.

Critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, uranium, corn, and cotton.

Even today’s high-tech world of AI, apps, email, and Zoom calls is built on a “low-tech” foundation of steel, concrete, copper, lumber, and aluminum.

Mining, extracting, planting, harvesting, processing, refining, and transporting critical vital resources is a multi-trillion-dollar business that affects every area of your life.

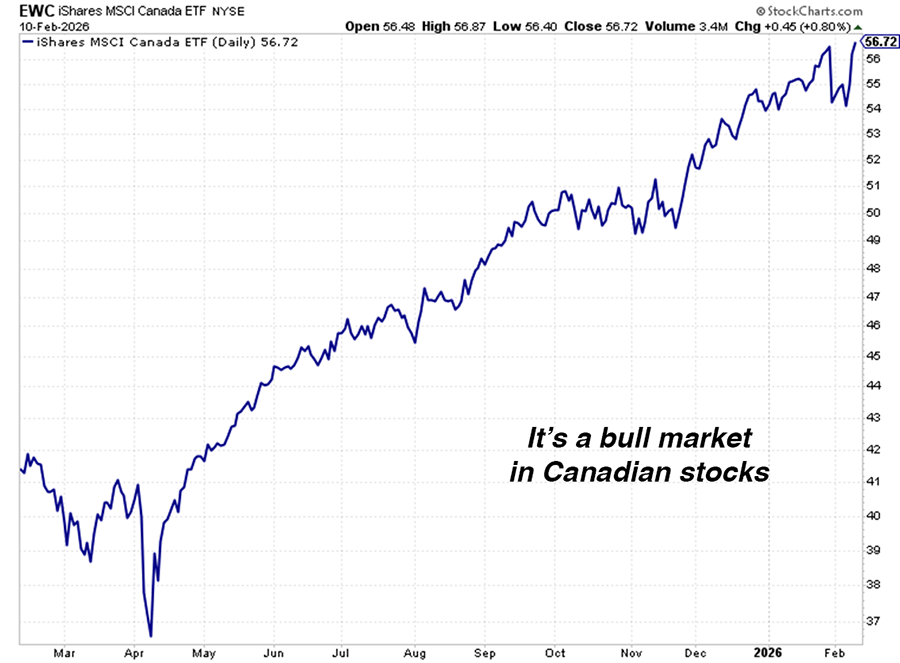

Recently, I’ve highlighted the uptrend in Brazil as evidence we’re in a critical resources bull market. It’s also worth talking about Canada. As you can see in the chart below, stocks in the Great White North are soaring.

Canada is the world’s second-largest country by area. This means there’s plenty of land to hold big oil and natural gas deposits… huge tracts of timberland… giant mineral deposits… and enormous farms. Canada is a major producer of oil, natural gas, fertilizer, gold, wheat, lumber, and uranium.

Since critical resource production is a major part of the Canadian economy, the country’s stock market is sensitive to price trends in oil, natural gas, copper, and agricultural products. As I’ve highlighted many times over the past year, many resources are in uptrends. Copper is in a bull market. Gold and silver are in bull markets. Uranium is in a bull market.

The bull market in critical resources means a bull market in Canada. The iShares Canada (EWC) is up 37% over the past year (more than double the U.S. market’s return) and just hit an all-time high. I bet this uptrend continues.

The S&P 500 Equal Weight ETF powers to a new high, laying waste to the “narrow market” bear thesis

Credit: JHVEPhoto

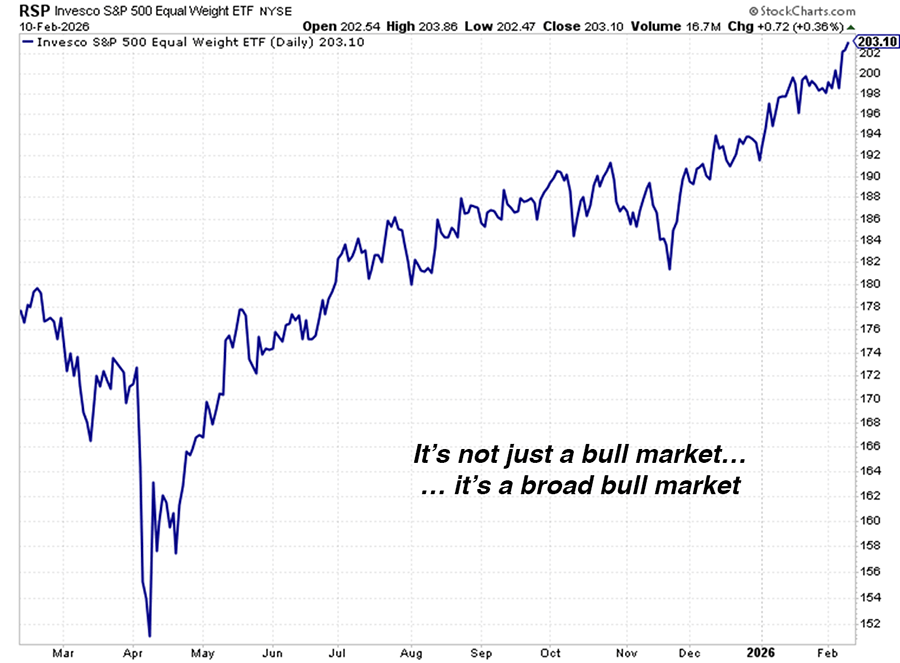

As you read this, the benchmark S&P 500 is within 1% of its all-time high. That means stocks are in a bull market.

Importantly, stocks are in a broad bull market… as demonstrated by the S&P 500 Equal Weight Index.

The S&P 500 has returned 38.9% over the past two years. During this run, bearish financial gurus have consistently fought the trend, claiming the market run was “narrow.”

A “narrow” bull market is one in which a small group of stocks account for most of the index’s gains… while most stocks go down or sideways. During this cycle, the top technology stocks have posted giant gains.

But do the bears have a point?

One of the best ways to gauge whether a market is narrow is to look at the performance of the S&P 500 Equal Weight Index. The popular S&P 500 Index you hear about on the news is a “market-cap weighted” index. This means that the biggest companies, such as Nvidia and Apple, have outsized effects on the index’s value than smaller companies.

An “equal weight” index nullifies those market value-related impacts – assigning equal weight to each stock in an index regardless of the company size.

The chart below shows the past year’s performance of the Invesco S&P 500 Equal Weight ETF (RSP), the market’s largest “equal weight” index fund. As you can see, this fund just registered an all-time high.

It’s not just a bull market… it’s a broad bull market. Trade accordingly!

Market Notes

-

Two of America’s largest construction aggregates (gravel, sand, crushed stone) producers – Vulcan Materials (VMC) and Martin Marietta (MLM) reached new all-time highs this week. The Build Baby Build boom is on.

-

Our longstanding recommendation to invest in the Boomer health care theme continues to pay off. Diagnostics giant Quest Diagnostics (DGX) reached a new all-time high this week.

-

Our Housing Rebound trade continues its winning ways. High-end homebuilder Toll Brothers (TOL) reached a new one-year high this week.

-

The under-the-radar bull market in the ProShares Nanotechnology ETF (TINY) continues. The fund reached a new all-time high this week.

-

Farm tractor and equipment giantJohn Deere (DE) reached a new all-time high this week.

-

Giant U.S. trucking company J.B. Hunt (JBHT) reached an all-time high today. Surging transport stocks are a bullish economic signal.

-

The AI Lawnmower continues to mow down stocks in the KIDS work category. Data analytics firm Verisk (VRSK) plunged to a new one-year low today. The stock is down 42% over the past year. Large insurance brokers Arthur J. Gallagher (AJG) and Brown & Brown (BRO) reached new one-year lows on AI disruption fears. The giant information/data analytics firm RELX (RELX) reached a new one-year low. Financial data and analytics firm Morningstar (MORN) reached a new one-year low this week. It’s down 49% in the past year.

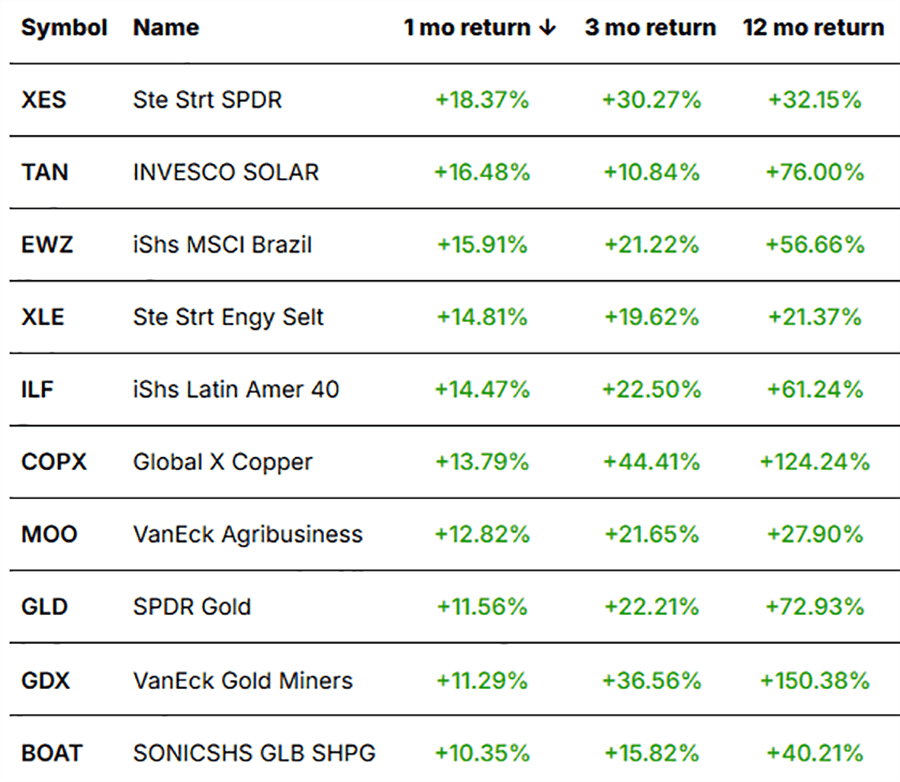

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends