Today’s issue in preview:

-

How to get your share of Big Tech’s $600 billion+ AI spending spree

-

Four of the world’s “mega miners” break out to new highs. The bull market in critical resources rolls on

-

The AI Lawnmower cuts down America’s largest tax software companies. The K-Shaped stock market strikes again.

-

Our hot hand continues: Our oil, robotics, critical resources, EPC, and Power Grid Upgrade themes climb to new highs

How to get your share of Big Tech’s $600 billion+ AI spending spree

Credit: MF3d

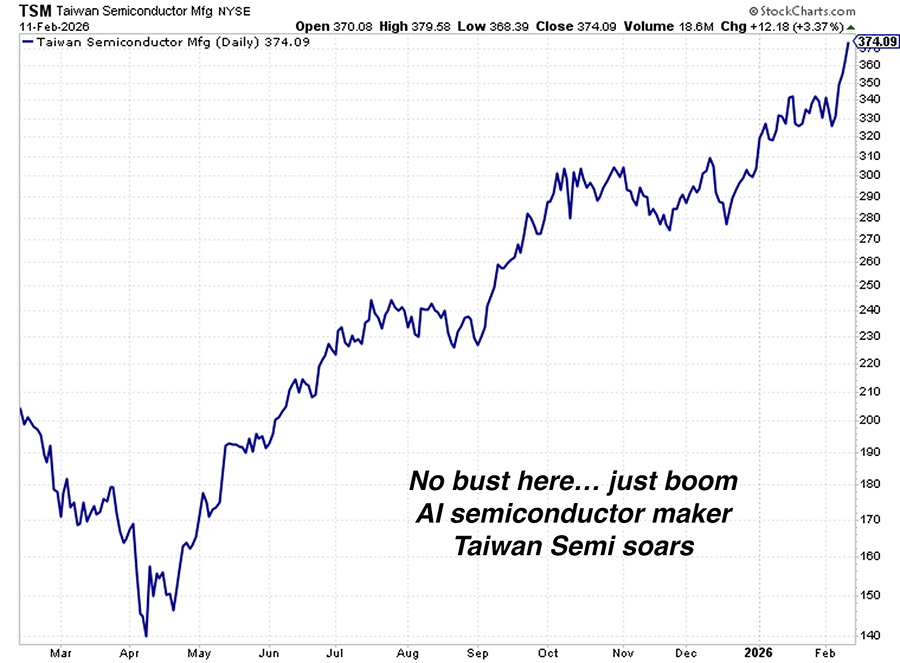

My longstanding recommendation to ignore the “AI Bust” camp… and stay in the “AI Boom” camp continues to pay off.

As evidence, I present the soaring market values and new all-time highs registered this week by Taiwan Semiconductor (TSM), Vertiv (VRT), GE Vernova (GEV), Comfort Systems (FIX), and Analog Devices (ADI).

Each of these companies plays an important role in the historic AI infrastructure build-out. And their booming businesses are sending us an important message.

In late 2022 – before Chat GPT was released to the public – I began telling friends and colleagues that AI was about to explode into public awareness. Shortly after, AI did just that, marking the beginning of one of the biggest investment themes of our lives.

Now, more than three years into this super boom, big tech companies Meta, Google, Amazon, OpenAI, and Microsoft are engaged in an epic race to build the world’s best AI models and infrastructure. This year, they are on pace to spend over $600 billion on AI infrastructure, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in world history.

Whether Big Tech’s massive investment pays off has become the most important issue in the stock market.

AI bears say much of this spending is madness. It won’t generate the revenues and profits required to justify it. Once the world realizes this is the case, GDP growth will stall, and the stock market will crash.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The investments will pay off.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs. For the past three years, I’ve frequently cited how the market likes the “AI Boom” thesis, as evidenced by the rising market values of AI infrastructure stocks.

The companies mentioned above produce advanced semiconductors, electric power equipment, and data center equipment… all critical to the AI infrastructure build. They are on the receiving end of Big Tech’s historic, multi-trillion-dollar spending spree. This week, each one hit a new all-time high. AI continues to boom.

The AI infrastructure megatrend will end someday. All trends eventually end. But the market says this one is alive and well. In the parlance of today’s youth, the market is telling the AI Bust camp, “Have fun being poor.”

Four of the world’s “mega miners” break out to new highs. The bull market in critical resources rolls on

Credit: guvendemir

A truck load of copper wire… a pile of iron ore… a pallet of aluminum ingots.

All these things pass our critical “toe test” stock screener. You can stub your toe on them.

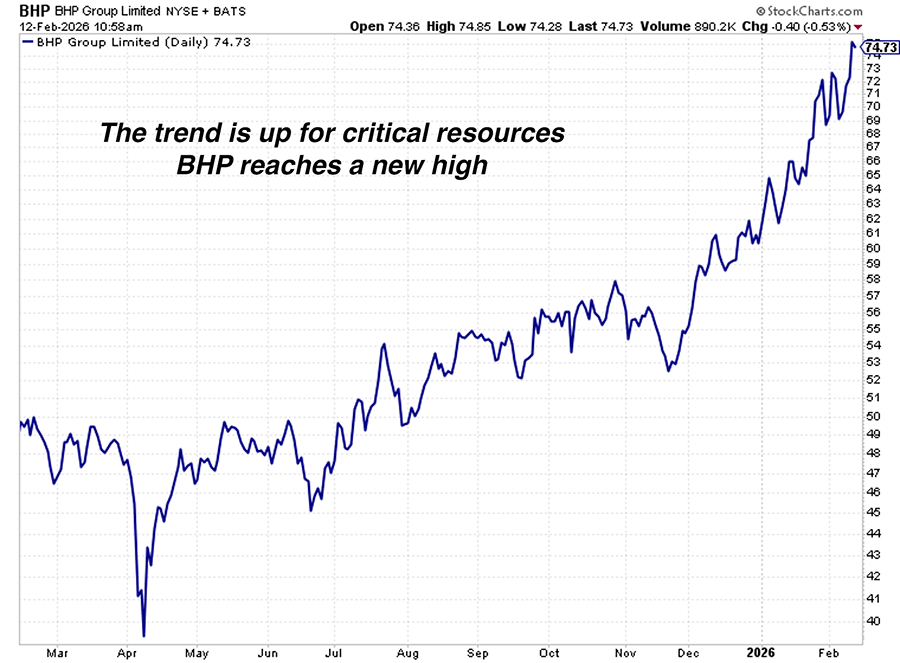

It’s a big reason why our 2025 recommendation to own critical resources is paying off so well… and a big reason why giant mining firms Rio Tinto (RIO), BHP Billiton (BHP), Teck Resources (TECK), and Vale (VALE) reached new all-time highs this week.

Over the past seven months, I’ve repeatedly made the case that we are in a favorable environment for critical resources… one in which many individual resource sectors will generate large returns.

Critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, corn, and cotton.

Even today’s high-tech world of AI, apps, email, and Zoom calls is built on a “low-tech” foundation of steel, concrete, copper, lumber, and aluminum. Every day, our cars, trucks, and airplanes consume millions of barrels of fuel. Our lights turn on because we burn coal and natural gas.

Mining, extracting, planting, harvesting, processing, refining, and transporting critical vital resources is a multi-trillion-dollar business that affects every area of your life.

BHP Billiton, Rio Tinto, Vale, and Teck Resources are four of the world’s largest mining companies. They produce a large portion of the world’s iron ore, copper, and coal. Given their size, scope, and trading liquidity, BHP, Rio, Teck, and Vale are “go-to” choices for large money managers when they want to take positions in critical resources.

If you prefer ETFs, the strength in the four companies above is driving the iShares MSCI Global Metals & Mining Producers ETF (PICK) – a fund comprised of many large miners – to new one-year highs.

These companies are on the right side of the AI-driven “K-shaped stock market.” Much of their output is in high demand for high-tech products and infrastructure. Plus, you can stub your toe on what they produce. As great as AI is, it cannot code a large copper mine or a pallet of aluminum ingots into existence.

Right now, gold and silver are in bull markets. Uranium and uranium stocks are in a bull market. Copper is in a bull market. Coal stocks are in a bull market. And four of the world’s largest mining companies just reached new all-time highs. It’s a bull market in critical resources.

The AI Lawnmower cuts down America’s largest tax software companies. The K-Shaped stock market strikes again

Credit: egon69

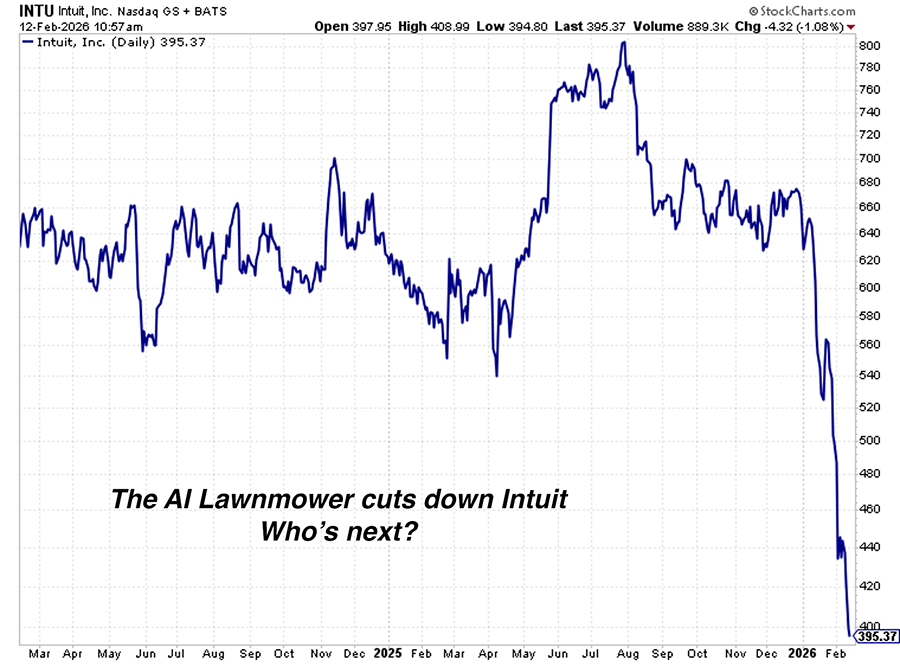

Unlike a spool of copper wire or a pallet of aluminum ingots, you cannot stub your toe on tax software. This is a big problem for Intuit (INTU) and H&R Block (HRB) – America’s largest tax software/tax prep companies.

Both firms reached new one-year lows this week. Both were cut down by the AI Lawnmower. Both are victims in our new K-shaped stock market.

Over the past six months, we have scored big wins with our oil, critical resource, silver, gold, copper, robotics, pipeline, and Latin America recommendations.

Each position above has its own favorable fundamental drivers, but they are united in that, at the end of the day, the investor in them is investing in things you can stub your toe on. Things a person using AI cannot code or prompt into existence. As wonderful as AI is, it cannot create 100 miles of 30-inch steel pipe.

On the other hand, companies in the category I’ve called KIDS have suffered historic declines in market values. KIDS is my acronym for Knowledge work, Information collection & analysis, Data collection & analysis and Software.

Generally, these businesses sell digital products and services. We’re talking consulting firms. Credit rating agencies. Financial data providers. Software firms. You can’t stub your toe on what they sell.

These companies sell products and services that AI programs could produce for very low cost soon. If someone using AI can code a product or service into existence, then any business related to it is in danger.

AI will put some of these KIDS work companies out of business. But keep in mind, it doesn’t have to put them out of business to make them stock market losers. AI only needs to lower the cost of producing what they produce over the long run. This will enable hordes of AI-centric competitors, which will throw a heavy wet blanket on their growth rates, profit margins, and P/E multiples.

America’s largest tax software/tax preparation companies – Intuit and H&R Block – are experiencing the wrong side of the K-shaped stock market right now. Intuit, for example, is the company behind the hugely popular TurboTax and QuickBooks software packages.

Thanks to investor concerns that AI is a big threat to its business model, Intuit has lost an incredible 41% of its market value in just the past two months. H&R Block has lost 31% of its market value during the same time. Both stocks are members of today’s new one-year low list.

Blazing technological progress isn’t just creating big winners and losers amongst individuals in a “K-shaped economy”… it’s doing it in stocks in a “K-shaped stock market.”

Market Notes

-

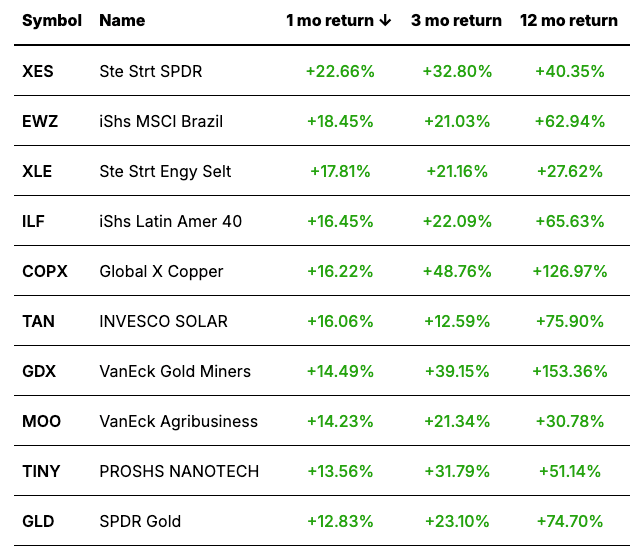

Our September 29, 2025, recommendation to own oil stocks continues its winning ways. Oil giants ExxonMobil (XOM), Chevron (CVX), SLB (SLB), Shell (SHEL), Suncor (SU), and Canadian Natural Resources (CNQ) reached new one-year highs this week.

-

Our longstanding recommendation to be long the Power Grid Upgrade theme continues to be a winner. The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) reached a new all-time high today.

-

Our longstanding recommendation to invest in robotics continues to pay off. Semiconductor and robotics leader Teradyne (TER) reached a new all-time high this week. The stock is up 190% over just the past six months.

-

Our September 23, 2025, bullish note on solar stocks is proving to be incredibly well timed. The Invesco Solar ETF (TAN) is up 12% over the past month and just reached a new one-year high.

-

Our recommendation to own Engineering, Procurement, and Construction (EPC) firms to benefit from the booms in U.S manufacturing capacity and data center construction continues to pay off. EPC leaders Sterling Infrastructure (STRL), EMCOR (EME), Argan (AGX), Mastec (MTZ) and Quanta Services (PWR) powered to all-time highs today.

-

The quiet boom in U.S. manufacturing continues. The Industrial Select Sector ETF (XLI) reached a new all-time high today.

-

Streaming giant Netflix (NFLX) reached a new one-year low today.

-

The big consulting firm Accenture (ACN) reached a new one-year low today.

-

The financial data firm Factset Research (FDS) reached a new one-year low today.

-

The AI Lawnmower continues to cut down software stocks. Major software firms Adobe Systems (ADBE), Workday (WDAY), Docusign (DOCU), Box (BOX), Asana (ASAN), Tyler Technologies (TYL), and Paycom Software (PAYC) reached new one-year lows today.

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends