In preview:

- Four stocks and two ETFs for the bull market in nuclear power.

- Why the “machine sensory perception” business is poised to power big stock winners over the next decade.

- Rio Tinto’s new high confirms the bull market in critical resources.

Four stocks and two ETFs for the bull market in nuclear power

As we head into 2026, we can look at the chart of the Range Nuclear Renaissance ETF (NUKZ) and say, “It’s still a bull market in nuclear energy investments.”

On October 13, we highlighted the megatrend in nuclear energy and named NUKZ a “pick to click” for investors.

Regular readers know one of the largest and most profitable facets of the AI megatrend is power consumption. Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is consuming huge amounts of electricity. We quote the International Energy Agency:

… electricity demand from data centres worldwide is set to more than double by 2030 to around 945 terawatt-hours (TWh), slightly more than the entire electricity consumption of Japan today. AI will be the most significant driver of this increase, with electricity demand from AI-optimised data centres projected to more than quadruple by 2030.

Given this outlook, AI companies and their electric power providers are making enormous investments to expand nuclear power capacity. Nuclear can provide vast amounts of “always on, always there” carbon-free baseload power. Bloomberg reports that surging demand will drive $350 billion in nuclear spending in the U.S. by 2050.

I often say you want to live and invest in areas of the economy where it is raining money. You want to work and invest in super booms where money is flowing freely. The nuclear power industry is one such area.

Investors should do well owning uranium miners (the fuel for nuclear) such as Cameco (CCJ). Companies that supply the nuclear power industry with vital equipment and services are also good bets, including firms such as BWX Technologies (BWXT, nuclear plant design/build), Mirion Technologies (MIR, radiation monitoring), and Centrus (LEU, uranium enrichment).

You can also take the “one click, and you’re done” route with NUKZ or the VanEck Uranium and Nuclear ETF (NLR). Both funds offer diversified baskets of companies in the nuclear power industry.

As shown in the chart below, the nuclear power industry is experiencing an uptrend. Given the long-term tailwinds, I bet this trend continues in 2026 and beyond.

It’s a bull market in nuclear power

Why the “machine sensory perception” business is poised to power big stock winners over the next decade

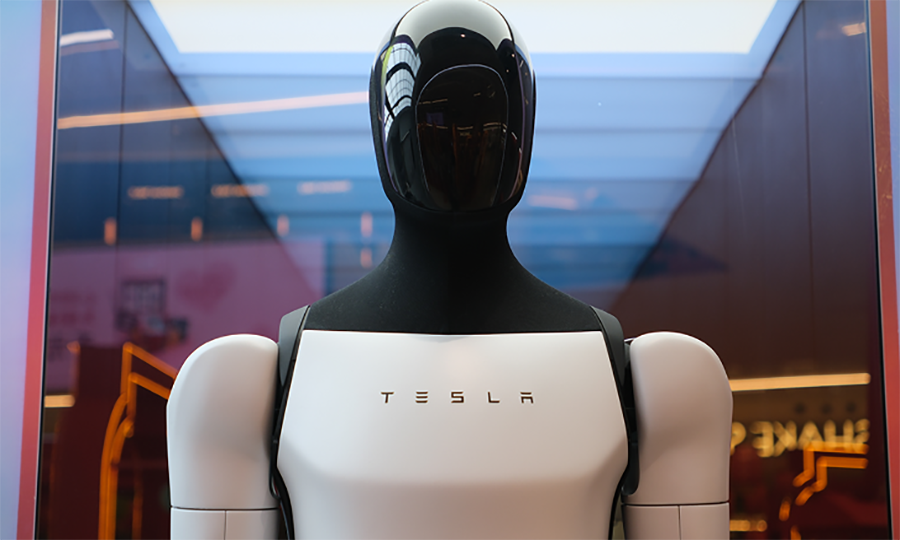

On June 30 of this year, Amazon announced it had deployed its one millionth robot across its business. This deployment solidified Amazon’s status as the world’s largest operator of mobile robots. It also furthered the robotics megatrend.

Regular readers know this megatrend is one of our top investment themes for the next decade. Robotics is a giant, multi-faceted theme that will forever change the world. It will yield greater factory automation, surgical robots, autonomous vehicles (AVs), autonomous air taxis, humanoid worker robots, and much more. Robotics investment is expected to rise at least 15% annually through the rest of this decade. Within five years, Amazon will employ more robots than people.

For robots to be safe and useful, they must be able to sense their surroundings. That’s why one of this trend’s most promising “angles” is machine sensory perception. Robots seeing, feeling, and sensing.

This field includes cameras, lasers, heat sensors, force sensors, and magnetic field sensors. Companies in machine sensory perception are poised to enjoy a huge tailwind. Demand for their products and services is set to stay high for decades.

Plus, well-positioned machine sensory equipment makers are “picks and shovels” plays on the robotics boom. Investments in machine sensory perception companies are not bets on who will make the best robots. Instead, they sell their products and services to numerous robot makers. This adds a layer of safety and stability to their business models.

Machine sensory firms poised to benefit from this boom include:

Ouster (OUST). OUST is a $1.25B company that develops LiDAR sensors for robotics, AVs, and other industrial applications. It’s growing revenues ~38% each year and expected to sustain this growth for at least the next four years. OUST’s latest tech, called the “Photon Counter,” has 125 million transistors and counts approximately 10 trillion photons per second. That allows OUST-powered robots to map environments with LiDAR precision at a range of up to 240 meters. Humans are nowhere near this.

Analog Devices (ADI). ADI is a $130B company that designs chips for motion, control, balance, and real-time sensing for robots. When humans start to fall, we know we are falling because we feel it. Robots use an Inertial Measurement Unit made by firms like Analog Devices (ADI), which sense millisecond gravity shifts far quicker than vision ever could.

This year, ADI adopted NVIDIA’s Jetson Thor platform, enabling Edge AI for real-time decision making in humanoid and industrial bots. ADI now powers over 70% of the high-precision motion control in robots worldwide.

Sensata (ST). ST is a $5B company generating nearly $3.8B in annual revenue. Sensata specializes in force, pressure, and haptic sensors that give robots a human-like sense of touch. Currently, ST operates across many industries, such as tire pressure monitoring systems, for example, but it’s making a giant push into electronics and automation after a recent partnership with Boston Dynamics.

Market Notes

- Banking leaders Banco Santander (SAN), UBS Group (UBS), Barclays (BCS), and KeyCorp (KEY) broke out to new 1-year highs today.

- Athleisure giant Lululemon (LULU) broke out to a new 3-month high today.

- Global defense and drone leader Elbit Systems (ESLT) broke out to an all-time high today. The bull market in drones continues.

- Medical device manufacturing giant Penumbra (PEN) just hit a new 3-month high. The healthcare trend continues.

- Automaking giant Toyota TM reached an all-time high today.

- Mega miner Rio Tinto (RIO) reached an all-time high today. The bull market in critical resources rolls on.

- Gold mining giant Barrick Mining (B) reached an all-time high today. It’s a bull market in the gold mining industry.