Today’s issue in preview:

-

A huge, inevitable tech trend is creating stock market winners… are you on board?

-

BULLISH: One of America’s most important consumer stocks soars to an all-time high

-

You can make money in stocks faster than ever. You can also lose it faster than ever

A huge, inevitable tech trend is creating stock market winners… are you on board?

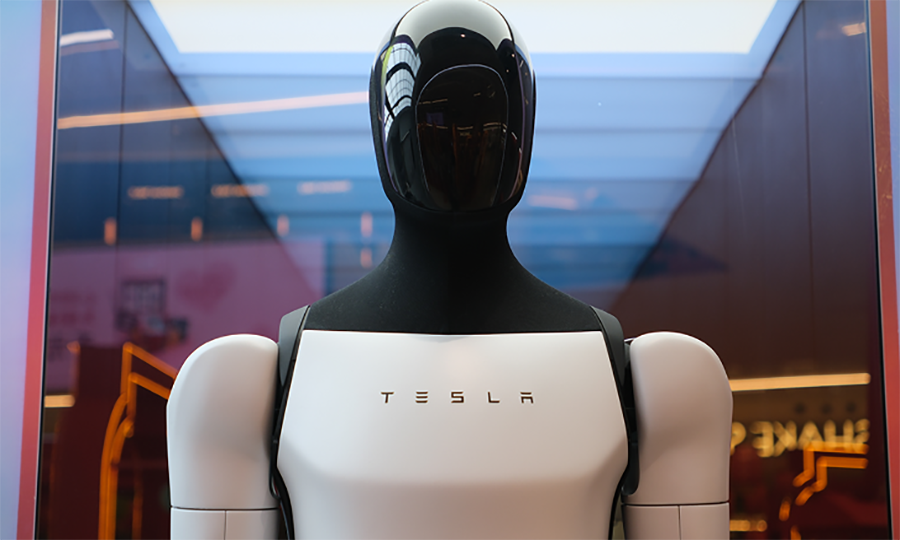

On Wednesday of this week, Tesla CEO Elon Musk announced the automaker is ending production of its Model S and X vehicles. The extra factory capacity will be used to build Optimus humanoid robots.

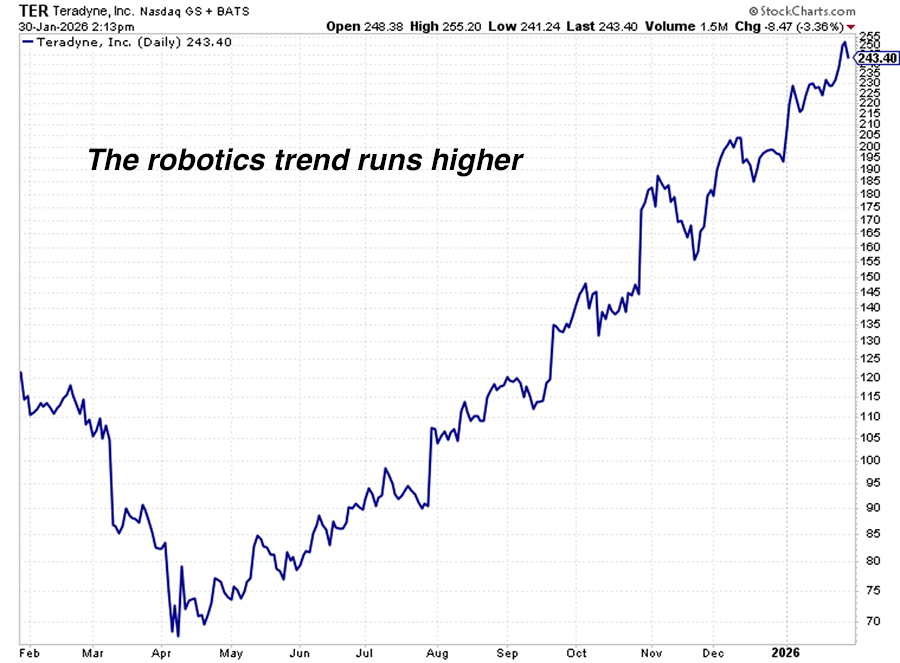

This news, plus the recent all-time high in Teradyne (TER), is more confirmation that you want to be long the robotics megatrend.

Over the past two years, I’ve urged friends and colleagues to become heavily involved in the robotics megatrend. It is one of the biggest financial opportunities of our lives.

It is a massive, multifaceted trend that will transform the world. It will yield greater factory automation, surgical robots, autonomous cars, autonomous air taxis, humanoid worker robots, and much more. It will allow us to interact with AI every day. Robotics investment is expected to increase by at least 15% annually through the rest of this decade. Within five years, Amazon will utilize more robots than employees.

Much more important than this forecast, however, is what the market thinks of this forecast. This week, the market reminded us that it loves this forecast. Factory robotics leader Teradyne, climbed to a new one-year high. It’s up an incredible 101% over the past 12 months.

Teradyne’s all-time high is a reminder that the robotics megatrend is in full swing. Invest accordingly!

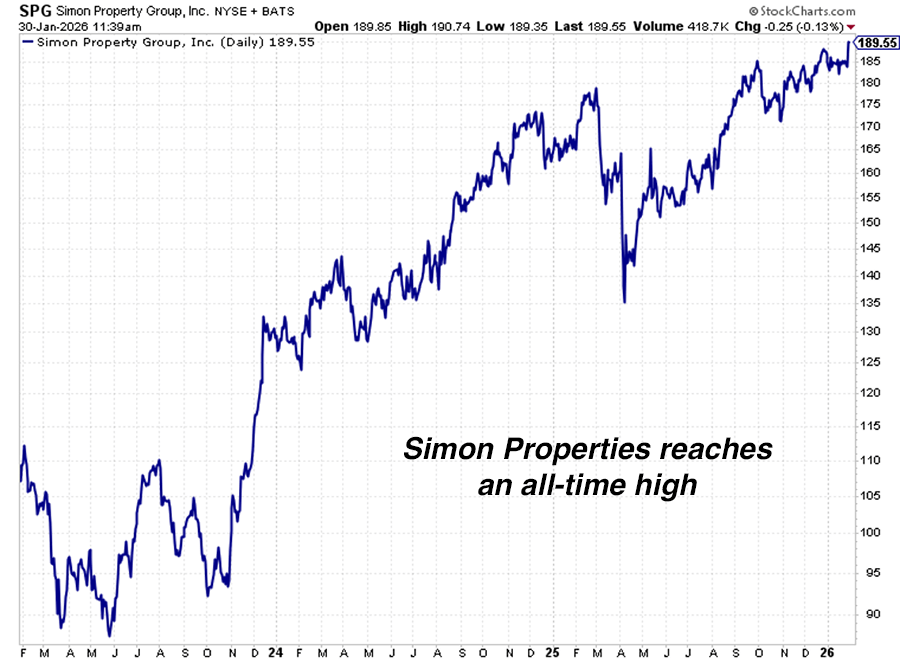

BULLISH: One of America’s most important consumer stocks soars to an all-time high

This week, investors received more confirmation that, despite predictions to the contrary, the American consumer is still spending.

Simon Properties Group (SPG) – America’s largest shopping mall operator – reached an all-time high

In our January 13, 2026, issue, I highlighted the all-time highs in the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RSPD)

This ETF is full of consumer spending stocks of all shapes and sizes. Its holdings include Carnival Cruise Line, Chipotle, Marriott International, Ulta Beauty, General Motors, Airbnb, Lululemon, Expedia, Amazon, Home Depot, Nike, Starbucks, Ford, Ralph Lauren, and Hasbro.

It’s an equal-weight fund, so no one dominant company skews returns.

Plus, the companies above serve a big swath of mid-to-upper-level consumers. It’s not heavily reliant on ultra-wealthy spending… or ultra-poor spending. Companies in this fund serve good ol’ fashioned red, white, and blue American consumers… the ones who drive $90,000 SUVs… go on $5,000 Caribbean cruises, drink $6 lattes, and wear $100 leggings. And it just soared to an all-time high.

I’ve been investing and reading financial research for 28 years. During all that time, I’ve heard many famous pessimists forecast the death of the American consumer. Well, not even the dot.com crash or the 2008 financial crisis could knock it out.

This is why I like to say that in the event of global thermonuclear war, two things will survive: cockroaches and the American consumer.

The super resilient American consumer is a friend to Simon Properties Group. With a market cap of $71 billion, Simons is a real estate giant. It operates over 200 malls across America. This means its fortunes rise and fall with the consumer’s capacity to blow $1,000 at the mall.

This week, the market told us that Simon’s business is strong enough to send its share price to a new all-time high. Like RSPD’s new highs, the takeaway here is that the consumer is a lot stronger than the pessimists would have you believe.

You can make money in stocks faster than ever. You can also lose it faster than ever

Right now, you can make money in stocks faster than ever before.

This is one of the foundational beliefs that guides my trading and my work at Money & Megatrends.

Stocks of all kinds are moving much faster than they used to.

This acceleration is thanks to the fusion of three modern-day phenomena.

One, technological progress is now advancing at incredible rates that speed up every year. This is creating and changing industries at the fastest rates in history. Second, thanks to the internet and social media, market information now gets disseminated globally at light speed. And finally, AI-powered trading programs and smartphone apps allow hedge funds and individuals to execute rapid trades from anywhere.

Add those up, and you get a stock market that moves much, much faster than it did 20 years ago. Stocks are soaring and crashing at incredible speeds now.

Over the past few years, a variety of investment themes have demonstrated what I’m talking about…

-

AI memory storage stocks such as Micron and Western Digital advanced 384% and 489% respectively, from early 2025 to early 2026.

-

AI data center power company Bloom Energy advanced 594% from early 2025 to early 2026.

-

Space-related companies AST SpaceMobile and Rocket Labs advanced 4,191% and 1,681% respectively over a recent two-year period.

-

Drone companies Kratos and Ondas advanced 532% and 718% respectively over a two-year period.

This list goes on, but you get my point: Right now, you can make money in stocks faster than ever.

This is great news if you know what you’re doing in the market.

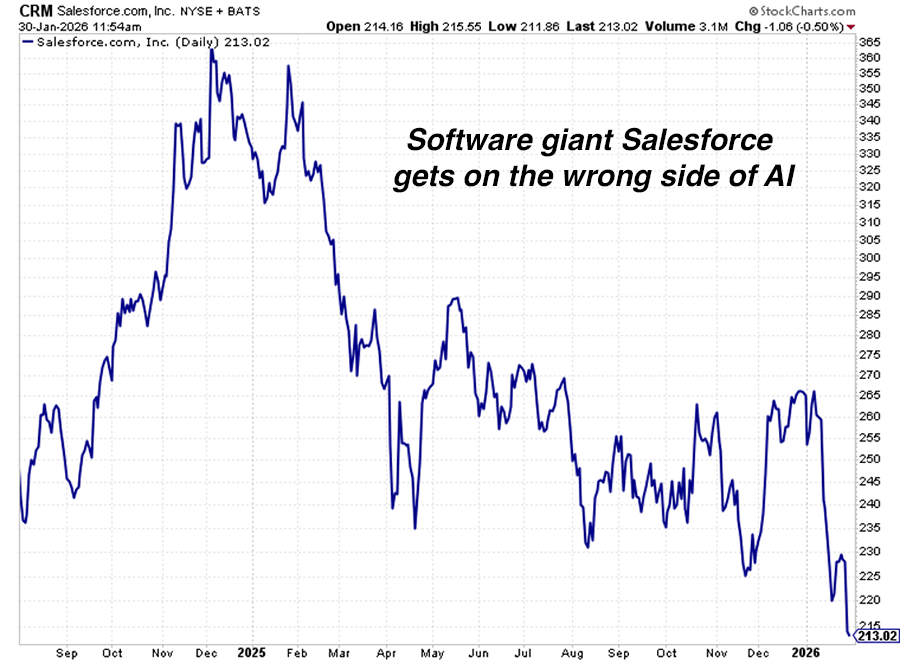

However, it’s not all roses. There’s another side to this coin. These days, you can also lose money in stocks faster than ever… especially when you’re on the wrong side of major technological trends like the ones detailed above.

No industry has demonstrated this phenomenon better over the past year than the software industry.

Over the past 15 years, the software industry has been a wonderful place to invest. It gave life to many huge stock market winners. It became a favorite of institutional investors.

But over the past 18 months, investors have dumped software stocks by the truckload, worried that AI will let us create specialized software at much, much lower costs than we can now.

The software bears among us say that in the future, a single person using AI will be able to create specialized software programs that currently require teams of expensive programmers. HR software, graphic design software, accounting software, you name it, producing it is going to get a lot cheaper. This will depress software company revenues, profit margins, and P/E multiples.

Over the past year, these worries have sent graphic design software giant Adobe down 34%, business software firm ServiceNow down 51%, HR software firm Workday down 36%, advertising software firm Trade Desk down 73%, business software firm Salesforce down 39%, business software firm Atlassian down 56%, business software firm HubSpot down 64%, payroll software firm Paycom down 37%, and the list goes on.

Mind you, these big losses came during a time that other technology-related sectors such as semiconductors (up 72%) and robotics (up 24%) did well, and the broad market returned 15.6%. So not only did software investors suffer real money losses, but they also suffered lost opportunity costs.

Now that software stock prices are way down, and sentiment towards the sector is terrible, are there any good, beaten-down buys?

I bet there are some quality buys in the trash heap of discarded software companies. Surely some of these companies will adapt and prosper. However, separating the winners from losers is a dangerous game best played by those with specialized knowledge or by Senators who trade on insider information. I’m in neither position.

The biggest thing I’m taking away from this software sector meltdown is to be paranoid … especially in technology companies. Never get too comfortable with your stock positions. In the age of blazing technological progress, today’s seemingly strong company can be tomorrow’s roadkill.

Review your portfolio frequently for positions vulnerable to technological change. In our new world of rapid change, only the paranoid survive. And remember that you can make money in stocks faster than ever… but you can also lose money in stocks faster than ever.

Read Money & Megatrends to stay on the right side of things.

Market Notes

-

Power equipment giant GE Vernova (GEV) reached a new all-time high today. GEV is one of the highest-profile “AI power” stocks on the market.

-

Optics giant Lumentum (LITE) – which is a big beneficiary of the AI boom – reached an all-time high today.

-

Language learning firm Duolingo (DUOL) reached a new one-year low today. It’s on the wrong side of AI and is down 61% over the past year.

-

As I write, the iShares Silver Trust (SLV) is down 20%+ today. After rising 200% in six months, it was due for a profit-taking correction.

-

AI infrastructure leader Sandisk (SNDK) advanced 12% today to reach an all-time high. The stock is up 1,784% over the past nine months.

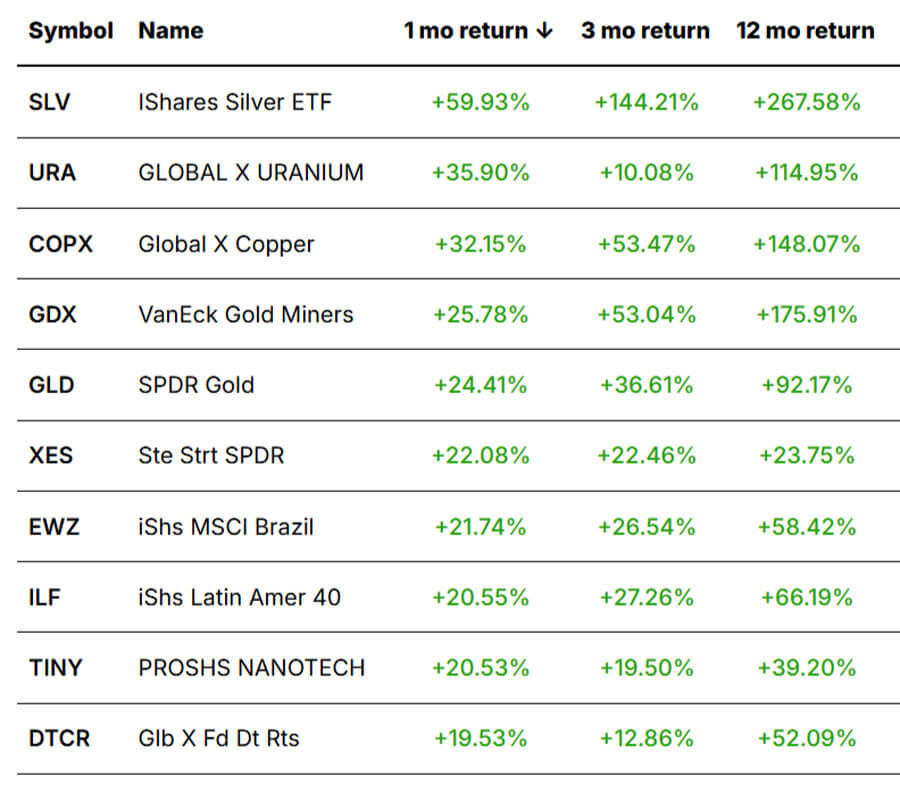

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends