On January 8, President Donald Trump announced via Truth Social that he’s instructed his “representatives” to buy $200 billion worth of mortgage bonds.

The goal behind the directive? Drive mortgage rates lower and make homebuying more affordable for Americans.

Trump’s announcement certainly moved the market. Housing stocks saw substantial spikes that day:

- Mortgage-lender stocks like loanDepot (LDI) and Rocket Companies (RKT) surged 24% and 7%, respectively.

- Housing-technology company Opendoor Technologies (OPEN) rose around 19%.

- Homebuilder Lennar (LEN) gained nearly 8%, while peers D.R. Horton (DHI) and PulteGroup (PHM) both gained 6%.

- Even consumer-credit scorers Fair Isaac (FICO), Equifax (EFX), and TransUnion (TRU) each spiked roughly 5%.

That’s great news for housing investors.

And for homebuyers, Trump’s plan did move the needle on interest rates… at least, for a brief moment.

Post-announcement, 30-year mortgage rates dipped to 5.99%, the lowest level since February 2023. That drop was fairly short-lived, though, with the average 30-year fixed mortgage rate back around 6.2% as of this writing.

Still, that’s a significant decrease from the roughly 7% average we saw in January 2025.

The question is, can homebuyers count on Trump’s bond-market strategy to make a long-term impact on mortgage rates and the housing industry?

Today, we’ll determine what homebuyers (and investors) should watch for as the president’s plan rolls out.

Trump’s Bond-Market Strategy and the Market’s Early Reaction

According to Trump, Fannie Mae and Freddie Mac – the government-sponsored enterprises (“GSEs”) created to stabilize the American housing market – are flush with cash.

As a result, he’s directing both to purchase $200 billion in mortgage-backed securities from the public market.

Mortgage-backed securities are home loans that Fannie Mae, Freddie Mac, and private banks buy and package into bonds. Those bonds are then bought and sold by investors.

Again, Trump said this move is one of many in his plan to restore affordability to America.

As his Federal Housing Finance Agency director, Bill Pulte, explained…

What will happen is that, as mortgage bond prices go up, interest rates theoretically go down. It’s a very, very big opportunity for the housing market and for all Americans aspiring to get that American dream.

In other words, when demand for mortgage bonds increases, bond prices go up. And when bond prices go up, the yield – or return – goes down. This formula allows lenders to lower their mortgage rates.

This is, as Pulte noted, theoretically true. But a common misconception is that mortgage rates follow short-term interest rates, which are set by the Federal Reserve. Instead, mortgage rates actually follow long-term Treasurys, namely the 10-year Treasury note.

It’s important to note that this strategy does not involve the Fed creating new money (literally) to buy bonds. That process, called quantitative easing, increases the risk of inflation. GSEs purchasing mortgage bonds typically does not.

As we mentioned, Trump’s announcement had an immediate impact on the housing market, with related stocks jumping as the news broke.

Those surges were likely due to investors pricing in a potential increase in mortgage applications, new refinancing activity, and a better outlook on the overall housing market.

However, not everyone is sold on Trump’s mortgage-rate strategy as a long-term fix…

Skepticism Around the President’s Plan

Plenty of industry experts are highly skeptical of Trump’s mortgage-rate demands.

Edward Pinto, a former Fannie Mae executive and current co-director of the Housing Center at the American Enterprise Institute, compared Trump’s plan with a “sugar high.”

“It may have an effect, but it will be fleeting,” said Pinto.

To support his point, Pinto pointed to the market’s reaction following Trump’s announcement: Mortgage rates fell, at first… then quickly climbed back up after the president threatened a takeover of Greenland.

Not to mention, escalating tariff tensions with Greenland and the rest of Europe caused longer-term Treasury yields to rise. That’s the complete opposite of what Trump’s plan needs to succeed.

Michael Bright, CEO of industry group Structured Finance Association, agreed that Trump’s desired $200 billion purchase of mortgage bonds would “lower rates by a little bit.” But he said it also makes Fannie Mae and Freddie Mac vulnerable to major risks if the market sways… the same risks that almost led to their complete collapse in 2008.

Bright also said he believes Trump’s strategy will be much less effective than quantitative easing because the GSEs don’t have access to unlimited cash like the Fed does.

Brian Jacobsen, chief economic strategist at Annex Wealth Management, explained to Reuters that…

Every little bit will help push mortgage yields lower, but this might be self-defeating in terms of housing affordability. It might get a few people off the fence about listing their homes, but it will also increase demand for housing.

As noted, that would drive housing prices up. And affordability, which is what the president specifically said he was addressing with this strategy, may not actually improve.

Many housing industry experts and economists believe Trump’s plan is a Band-Aid solution that doesn’t address the actual barriers to affordability… construction and zoning bottlenecks, constant lack of supply, and the reluctance of homeowners to let go of their current low-mortgage-rate homes.

Plus, the amount of money Trump is proposing is a drop in the mortgage-industry bucket.

According to JPMorgan Chase…

Similar to our view on President Trump’s post regarding a ban on institutional investors buying homes, we do not believe this initiative will have any significant impact on the housing market.

$200 billion of mortgages accounts for only roughly 1.4% of the approximately $14.5 trillion mortgage market.

There’s also the fact that the average American simply doesn’t earn enough money to afford an average-priced home.

Realtor.com’s Senior Economic Research Analyst Hannah Jones put it quite plainly…

Purchasing a median-priced home in today’s market ranges from challenging to downright impossible for median-income households.

According to data from Realtor.com, the average American household would need to earn around $118,530 per year to be able to afford a median-priced home of $402,500.

Unfortunately, that income level is more than 50% higher than the actual median household income of around $77,700.

So, skeptics abound. But that doesn’t mean the housing market can’t turn itself around.

And behind Trump’s strategy, plenty of housing-related companies could benefit from lower mortgage rates if they come to fruition over the long term…

Housing Stocks to Watch

As we saw in the market activity following the president’s social media announcement, the entire housing industry could benefit from lower mortgage rates and improved housing affordability.

Let’s look at a couple layers of the housing industry, as well as some companies to watch in the aftermath of Trump’s proclamation…

Homebuilder Stocks

Perhaps the biggest potential winners from Trump’s $200 billion plan are American homebuilders.

Lower interest rates and better homebuyer affordability should, in theory, lead to more demand for homes. And that should increase homebuilder output.

Plus, lower rates decrease the need for homebuilders to incentivize buyers with expensive mortgage-rate buydowns, helping improve homebuilders’ margins.

Keep in mind, though, that homebuilder stocks are historically volatile. Their dependence on interest rates and direct connection to cyclical housing markets leave them vulnerable to the whims of the market.

Factor in all the various parts of homebuilder operations – such as labor, inventory, supply chains, and construction – and there’s a significant element of risk when investing in these stocks.

But if Trump’s plan ultimately succeeds in lowering interest rates, homebuilders should benefit.

Below are a few to monitor in the coming months…

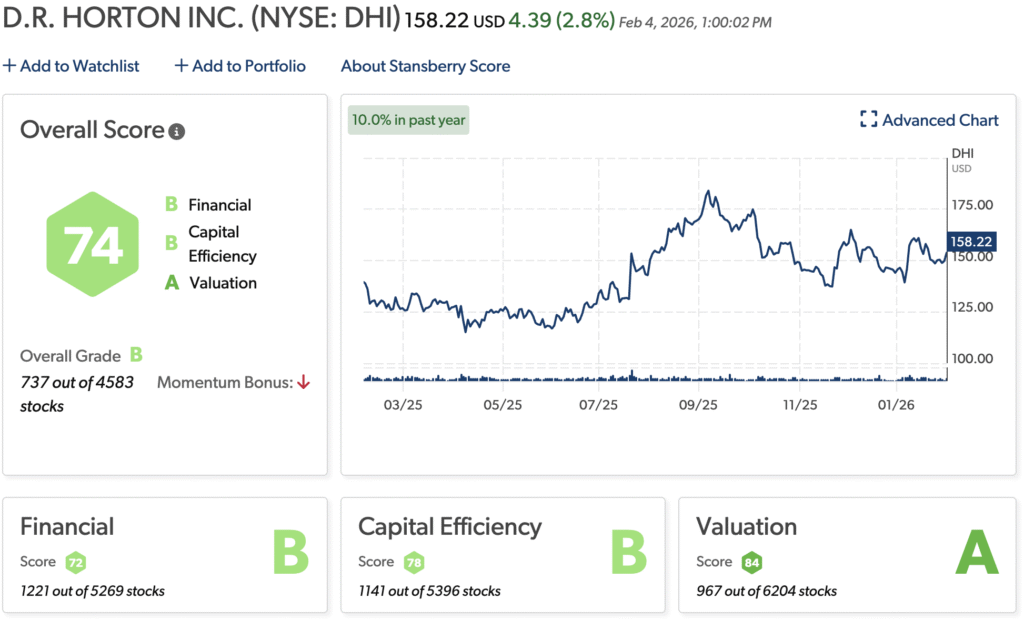

D.R. Horton (DHI)

America’s largest homebuilder by volume since 2002, D.R. Horton operates in 125 markets across 36 states. Its range of homes spans entry-level to luxury to active-adult units (those for folks 55 and up).

The company had a mixed fiscal 2025. It reported $34.3 billion in revenue, though its $3.6 billion in net income was a 25% full-year drop. DHI’s earnings per share also fell 19% to $11.57. The company managed to maintain a strong financial position, repurchased $4.3 billion worth of stock, and paid $494.8 million in dividends.

The Stansberry Score (courtesy of our subsidiary Stansberry Research), which measures the value of stocks, rates DHI favorably. It gives it a solid “B” grade thanks to outstanding valuation (“A”) and strong financials and capital efficiency (“B”)…

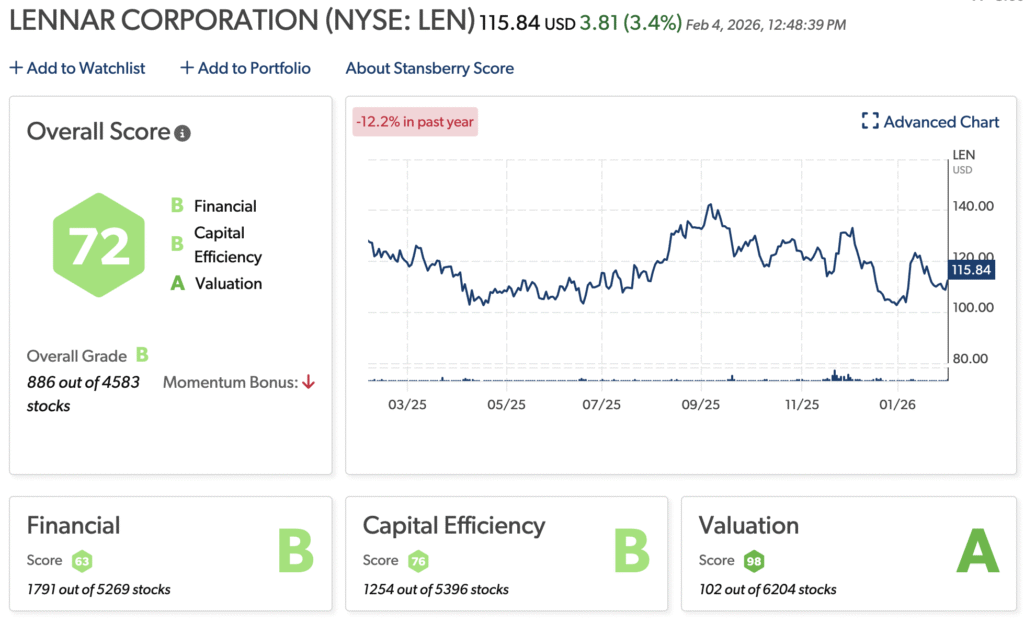

Lennar (LEN)

Lennar, a major homebuilder since 1954, builds single-family, multigenerational, and active-adult homes across 30 states.

Last year, Lennar lowered its prices and increased incentives for homebuyers in efforts to spark a sluggish market and help make homebuying more affordable.

Unfortunately, these efforts likely hurt the company more than they helped…

Lennar’s total revenue dropped 3.5% to $34.2 billion. And its net earnings plummeted from $3.9 billion the year prior to just $2.1 billion. The company is now forecasting a modest 3% delivery growth for fiscal 2026.

Despite its declining sales, the Stansberry Score gives Lennar an overall “B” grade. It gets an “A” for valuation (ranking at No. 102 out of the more than 6,000 stocks in that category) and a solid “B” for capital efficiency.

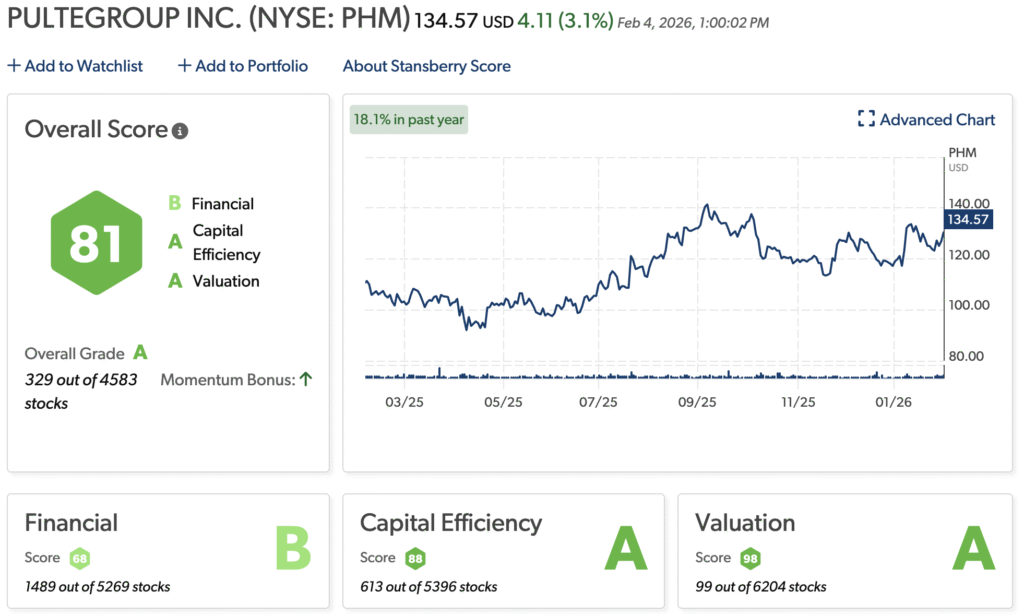

PulteGroup (PHM)

PulteGroup operates in 25 states, primarily under the Pulte Homes, Centex, Del Webb, and DiVosta Homes brands. Each brand is tailored to different buyer groups – like first-time homebuyers, move-up buyers (those looking for larger homes), and active adults – and offers a variety of housing types and price points.

PulteGroup’s just-released 2025 earnings were generally positive…

The company saw $16.7 billion in home sales revenue and $2.2 billion in net income, with nearly 30,000 homes delivered. Its gross margin finished at an impressive 26.3%.

PulteGroup is another strong performer, according to the Stansberry Score, with an “A” grade overall. It has healthy marks across the board, with a “B” in the financials category and “A’s” in capital efficiency and valuation…

Mortgage Lending Stocks

Like homebuilder stocks, mortgage-lender stocks are volatile. They obviously depend heavily on interest rates. And they’re exposed to risks such as loan defaults.

But mortgage lenders could also receive a boost from President Trump’s housing strategy.

That’s because lower mortgage rates would likely increase loan volume and bump revenue through more origination fees.

Let’s look at a couple of mortgage-lender stocks below…

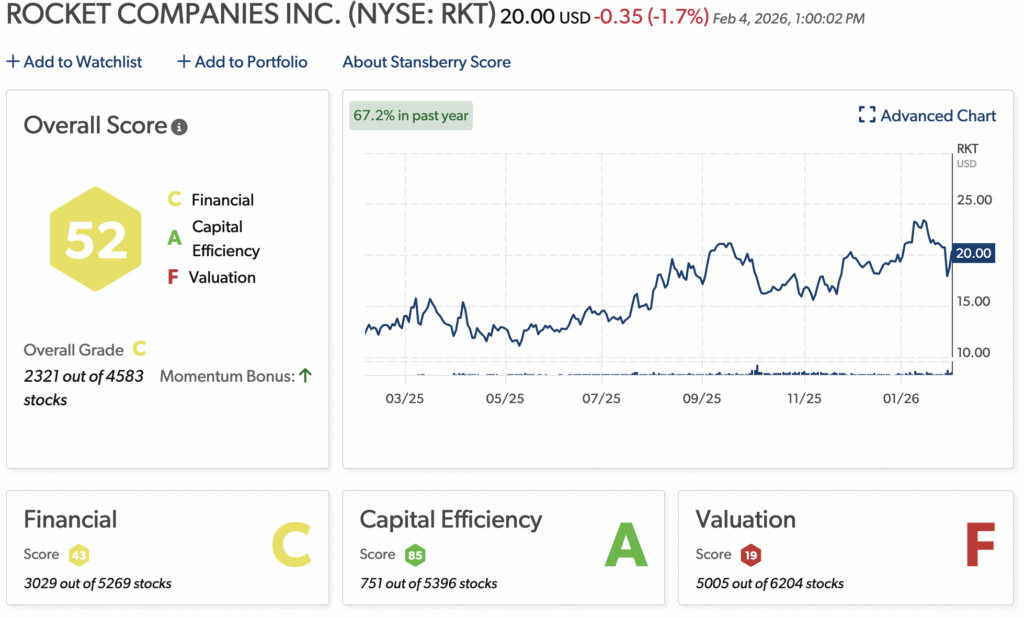

Rocket Companies (RKT)

Rocket Companies provides various mortgage, real estate, and personal-finance services in the U.S. and Canada.

Its subsidiaries include Rocket Mortgage (its mortgage-lender service), Rocket Loans (its personal-loans business), and Rocket Homes (its homebuying and -selling segment), among others.

Rocket Companies saw adjusted revenue of around $1.78 billion in third-quarter 2025, which beat projections. It also maintained positive adjusted net income of $158 million… though, on a generally accepted accounting principles (“GAAP”) basis, it reported a $124 million loss. While that loss is significant, it’s substantially less than third-quarter 2024’s $481 million net loss.

The Stansberry Score gives the company an average “C” grade. Its capital efficiency is excellent, garnering an “A.” But its financials only earn a “C,” and its valuation gets an “F.”

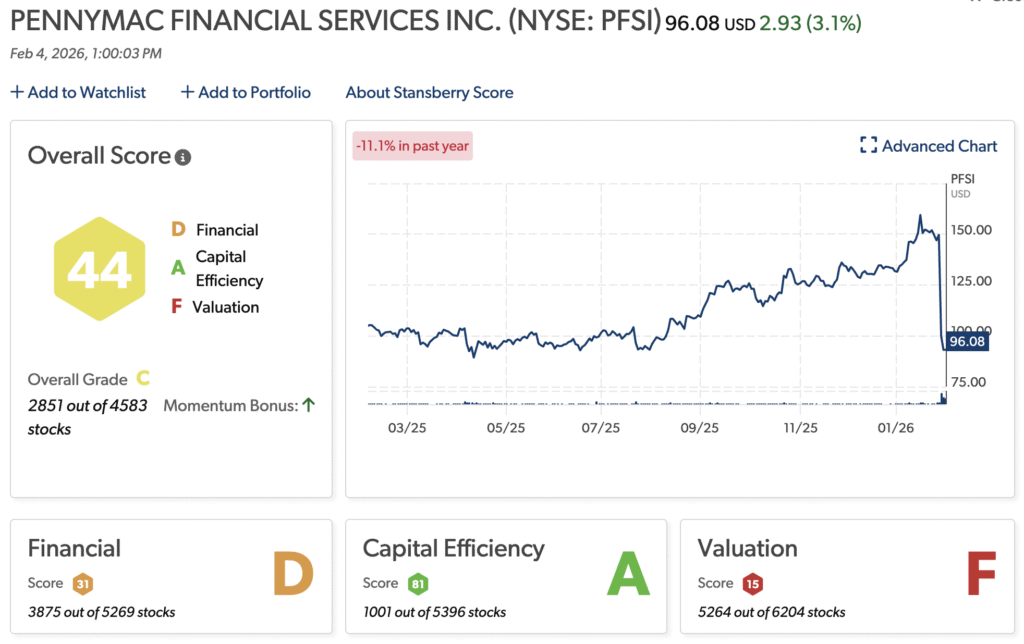

PennyMac Financial Services (PFSI)

PennyMac Financial Services is one of America’s leading nonbank mortgage companies. It specializes in purchasing, producing, and servicing residential home loans.

Despite a challenging market, PennyMac had a solid fiscal 2025. Its servicing portfolio increased 10% year over year, hitting $733.6 billion in unpaid principal balance. And net income soared 61% year over year to $501.1 million.

That’s promising for the company – though the Stansberry Score still sees some problems under the hood…

It gives PennyMac an “A” for capital efficiency. But its financials, though improving, get a “D.” Its valuation is even worse, garnering an “F.”

Interestingly, PFSI shares hit an all-time high of $160.36 on January 16. But by February 4, the price had plunged to $95.65, illustrating its volatility.

We wouldn’t jump on this stock just yet, but the Stansberry Score says it has solid momentum…

Our Outlook as the Bond Market Enters a Tug-of-War

The housing market is tricky by nature. Trump’s entering the bond market to force down rates makes it even more unpredictable.

That presents some risks for investors…

For one, Trump’s war on mortgage rates doesn’t solve the lack of supply. And when rates go down without an increase in supply, demand rises… and home prices skyrocket.

So, yes, interest rates may be a tick lower. But that’s more than offset by home prices increasing by the thousands.

Second, artificial rate decreases often disrupt the market for mortgage rates. And that often masks underlying risks that true market conditions would reveal. These include inflation, reduced home inventory, an imbalance of supply and demand, unsustainable debt loads for homebuyers, and a weakening economy overall.

When natural forces eventually correct the market, high levels of volatility ensue. That’s when we see major price fluctuations, cratering sales volumes, and a rise in home inventory. This is what happened when the COVID-era homebuying frenzy died down.

And those market corrections greatly impact home affordability. The period of mass homebuying during the pandemic, which was prompted by artificial rate decreases, caused the “lock in” effect we’re seeing today. Homeowners who secured mortgage rates of just 3% to 4% don’t want to sell their home and get stuck with a new mortgage rate that’s nearly double.

Lastly, there are Trump’s omnipresent tariffs.

With lingering fears of tariff disputes and trade wars, inflation is a real risk… and it’s part of what causes Treasury yields to rise. (It’s also why the market tends to rally when Trump backs off tariffs.)

It bears repeating… Mortgage rates are directly linked to the yield on 10-year Treasury bonds.

So, even if Fannie Mae and Freddie Mac buy $200 billion worth of mortgage-backed securities, bond market investors could still demand higher yields because of fears over inflation or government deficits. Those higher yields will result in higher mortgage rates.

This, of course, would directly impact housing stocks…

If Trump’s mortgage-bond initiative proves to be a short-term fix, or if it shines more of a spotlight on the actual housing-affordability problems, housing-related stocks may come back down again.

The Bottom Line for Investors Watching Mortgage Rates

Trump’s mortgage-rate plan spurred a quick drop in interest rates and a brief uptick in the prices of housing stocks. But it didn’t last long… And that’s what many industry experts fear will be the result of this strategy.

When investing in housing stocks, it’s critical to monitor a few things.

From a bullish perspective, keep an eye on…

- Rising housing inventory levels

- A lack of noise around tariffs

- A shrinking gap between the interest rate on a 30-year fixed mortgage and the yield on the 10-year U.S. Treasury note

On the bearish side, watch for…

- An increase in tariff-related rhetoric

- Spikes in 10-year Treasury yields

- A widening gap between the rate on a 30-year fixed mortgage and the yield on the 10-year U.S. Treasury note

The housing market is trending toward a buyer’s market. Demand has decreased, prices have dropped, and mortgage rates are down 85 basis points this year compared with late January 2025.

The question now is whether Trump will push America even further into a buyer’s market… or if this is just a temporary solution that doesn’t address the actual housing problem.

We’ll all have to keep a close eye on the housing market to find out.

Regards,

David Engle

Editor’s Note: The drama out of Washington, D.C. this year has been intense…

And according to Whitney Tilson – a former hedge fund manager who predicted the dotcom crash, the housing crisis, and the 2022 tech stock bloodbath – a little-known executive order from the President’s first day in office could spark a paradigm-shift that will likely catch millions of Americans off guard.

“The vast majority of Americans know nothing about Executive Order 14154,” says Tilson. “And they need to start preparing for it now.”

He recommends taking three critical steps to get ahead of this radical economic change.

Tilson’s analysis has appeared in the pages of the Wall Street Journal, Forbes, Barron’s, and Fortune magazine.

And because of the massive changes impacting U.S. stocks, Tilson has agreed to publish his latest findings online for free.