Netflix has been a leader in the streaming wars for more than a decade.

Now it’s back in the headlines for a different reason: its move to acquire Warner Bros. Discovery’s (WBD) studio and streaming assets in an all-cash deal.

For some background, Warner Bros. Discovery originally agreed to be acquired by Netflix back in December in a deal that valued the company at $82.7 billion. Netflix planned to pay for the purchase with a mix of cash and stock.

But then, Paramount Skydance (PSKY) entered the picture.

The Netflix competitor put up an all-cash offer that would value Warner Bros. Discovery at $108.4 billion. Despite the higher price tag, the WBD board is sticking with the Netflix deal. And that’s what this new offer is all about.

By making the deal all cash, Netflix hopes to provide greater certainty to investors and get the transaction over the finish line.

The announcement sparked a fresh round of questions on Wall Street. Can Netflix digest a huge acquisition? Is it paying too much? Will regulators try to step in?

Those are fair questions. But they risk missing the real story.

Beneath the noise, Netflix just wrapped up another strong year of growth. The company is quietly turning itself into a cash-rich media and advertising machine. And the Warner Bros. deal, while expensive, fits that bigger plan.

For long-term investors, the question isn’t “Is this deal scary?” It’s “Does Netflix still look like a winner in streaming five years from now?”

Right now, the evidence says yes.

What Netflix’s Latest Earnings Show

Let’s start with the numbers.

For 2025, Netflix’s revenue grew almost 16% to roughly $45 billion. Net income climbed faster, up about 26% as margins improved.

The company ended the year with about 325 million global subscribers, about 23 million more than a year ago.

Management expects that momentum to continue into the new year. For 2026, Netflix is guiding for double-digit revenue growth and a higher operating margin around 31%.

Put simply, this is not a mature business limping along at low single-digit growth. It’s still growing at a healthy rate while throwing off more cash every year.

Under the hood, three engines are driving that performance:

- A global subscription base that keeps getting larger and more engaged

- A young but fast-growing advertising business

- A push into live events and sports that creates “must watch” moments

The Warner Bros. deal should fuel these growth engines.

Steaming Ads Are Eating Linear TV’s Lunch

To understand why Netflix is leaning into advertising, you must zoom out.

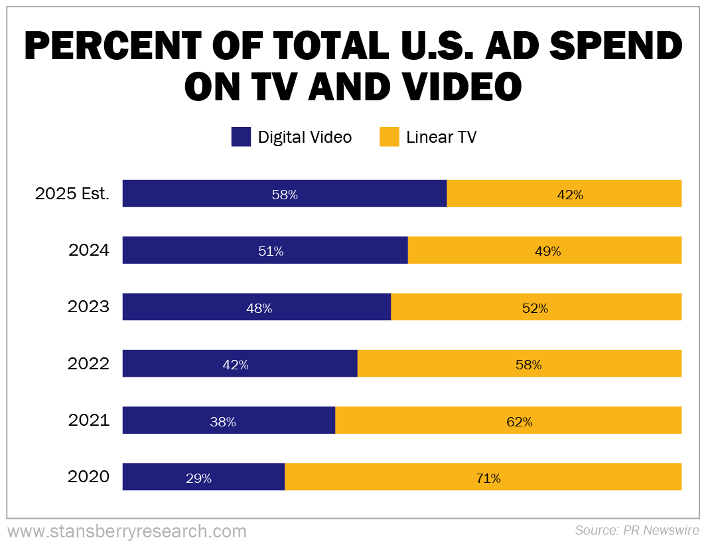

In our July issue of Stansberry Innovations Report, John Engel and I showed how ad dollars are stampeding away from traditional TV and into streaming. U.S. ad spend on connected TVs and streaming platforms has more than tripled in the past five years and is projected to hit about $40 billion by 2027.

Digital video already takes the majority of TV and video ad budgets, and that share keeps rising while linear TV ad revenue shrinks each year.

The reason is simple: Streaming ads are targeted, measurable, and flexible. Linear TV is like a shotgun blast – you pay for a broad audience and hope the right people are watching. At the same, that audience is getting less broad every year. Only 34% of American households had cable TV in 2024. That’s down from 80% in 2011 .

Steaming turns that into a laser-guided ad, served to specific households in real time.

In that July issue, we highlighted Roku (ROKU) as a pure-play way to profit from this shift in ad spending. That thesis has worked out well so far. The stock has returned 18% since our recommendation. That handily beats the S&P 500 Index, which was up about 10.7% over the same period.

Netflix is on the other side of this story as the largest premium streaming platform where viewers actually spend those hours.

That’s why its move into advertising matters so much.

Netflix’s Advertising Business Is Finally Showing Its Teeth

For years, Netflix resisted ads. That changed in late 2022 when it launched a cheaper, ad-supported tier and cracked down on password sharing.

The ad business started small, but this past year we finally got real numbers. Management disclosed that 2025 advertising revenue topped $1.5 billion. Now, this only accounts for 3% currently, but ad revenue grew 2.5 times from the year prior. And management expects it to double in 2026.

Co-CEO Greg Peters summed it up on the recent earnings call: “We’re making good progress and the opportunity ahead of us is massive.”

While advertising revenue is still a small slice of the business today, growth is accelerating rapidly as cost-conscious customers choose the ad-supported tier.

Moreover, Peters noted that the gap between what Netflix earns from ad-tier customers and ad-free customers is narrowing. This signals that the economics of the ad-tier will improve over time.

In other words, advertising is not trying to replace subscription revenue, but layer on top of it.

If you check out our July issue of Stansberry Innovations Report, you’ll see the full picture of why this matters. Steaming platforms that combine scale, engagement, and data usually end up with outsized ad economics.

Netflix has all three. It just needed a business model to match.

Live Sports and Events: Why They’re Worth the Cost

I touched on this theme in a recent Disney (DIS) article about ESPN and football season: Live sports are the shows people don’t cancel. They keep subscribers engaged, lift ad rates, and give platforms leverage when they raise prices.

Netflix is taking that same playbook and adapting it to its own brand.

Live programming is still a small slice of total viewing hours, but it packs a punch. The company highlighted big events like Anthony Joshua’s knockout win over Jake Paul during a live boxing match and its NFL Christmas Day game as examples where one night can drive higher sign-ups and engagement.

Looking ahead, Netflix plans to stream the entire 2026 World Baseball Classic in Japan and expand its slate of live shows and sports-style events.

Live content does two things:

- It gives Netflix “appointment viewing” moments that cut through clutter.

- It creates premium ad inventory that brands will shell out for.

That’s the same equation we walked through with Disney’s ESPN app – more time in the app, better targeting, and higher ad prices to offset rights costs.

Netflix is still early in this phase, but the direction is clear: more live events, more sports-adjacent programming, and more reasons for subscribers to stick around.

How Netflix Scores on Our Stansberry Scorecard

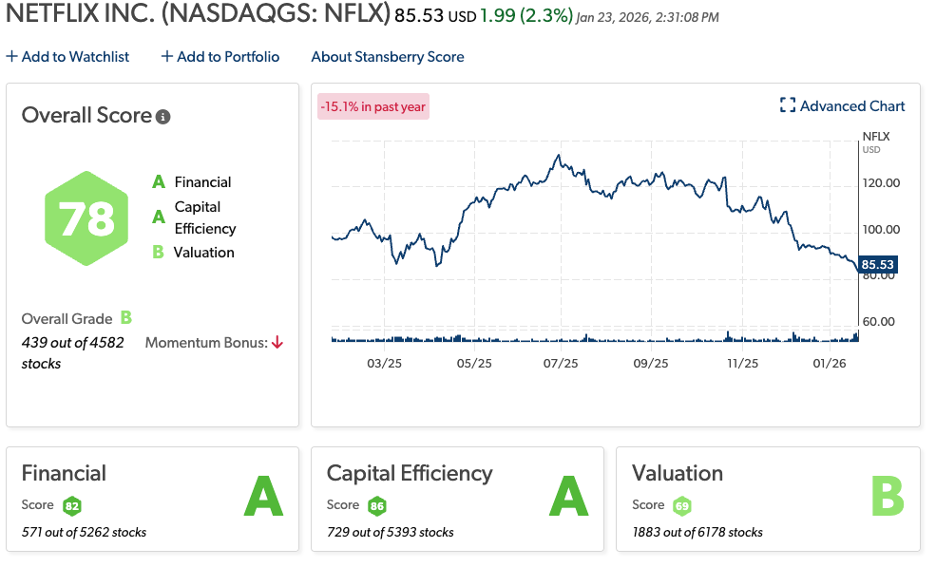

Despite all this progress, NFLX stock hasn’t been a rocket ship lately.

Shares trade around $84, down about 12% over the past year and near the low end of their 52-week range of roughly $82 to $134. The market cap sits near $356 billion as of writing.

With our proprietary Stansberry Score, Netflix earns a solid overall score of 78 and a grade of “B.” That puts Netflix inside the top 500 of the roughly 5,200 stocks we rate. It earns “A” grades for financial strength and capital efficiency, and a “B” for valuation.

The profile fits what we see in the fundamentals:

- Revenue and earnings are growing at a healthy double-digit pace.

- Margins are expanding as the business scales and the ad segment ramps up.

- Free cash flow keeps rising, giving Netflix the flexibility to invest in content, live rights, and strategic deals.

Looking at valuation, Netflix trades at about 22 times expected 2027 earnings, much lower than its five-year average price-to-earnings multiple north of 40. At the same time, its enterprise-value-to-EBITDA multiple is in the high teens, above its five-year average, reflecting higher margins and a stronger business than it had earlier in the decade.

So, this isn’t a bargain-bin stock. Investors are paying a richer multiple for a market leader that still has room to run.

The Warner Bros. Discovery Deal: Costly, but Telling

That brings us back to the Warner Bros. Discovery acquisition.

Netflix agreed to buy Warner Bros. Discovery’s studio and streaming assets in an all-cash deal, paying $27.75 per WBD share.

Investors zeroed in on the price tag and funding. The company will tap its cash balance and new financing, while halting buybacks as it builds cash and integrates its new assets.

On the surface, that may look like a step backward. Less cash for shareholders today. A bigger balance sheet. More integration risk.

But look at what Netflix is actually buying:

- A deep library of hit shows and movies from HBO, Warner Bros., and other franchises

- Additional steaming subscribers through the acquired services

- More advertising inventory tied to prestige content

In my colleague Jim Royal’s December article on Netflix’s earlier bidding war for Warner’s assets, he argues that the fight itself showed how crucial scale and premium content have become and that industry consolidation will remain a major force as media companies battle for the future of streaming.

This finalized agreement drives that point home. Netflix isn’t content to license content one piece at time. It wants to own more of the pipeline from production to distribution… and advertising.

Yes, the deal is expensive. Yes, there’s regulatory and integration risk. But it also signals confidence in Netflix’s cash-generation engine. Management doesn’t commit tens of billions of dollars in cash unless it believes the core business can support it.

Bottom Line: Netflix Still Looks Like a Leader Worth Owning

Short term, the Warner Bros. deal and questions about ad momentum can keep NFLX stock choppy. We’re seeing the same thing with Disney when late-night drama grabbed headlines and investors forgot that football, streaming economics, and park cash flow are what really matter.

For Netflix, the real drivers are just as clear:

- A growing global subscriber base

- An advertising business that’s finally hitting its stride

- A move into live events and sports that create must-watch moments and premium ad slots

- A stronger content library and more scale if the Warner Bros. deal closes as planned

With shares down from their highs and trading at a more reasonable earnings multiple, investors don’t have to bet on perfection.

Thet just have to believe that streaming, targeted ads, and global entertainment will be bigger business five years from now – and that Netflix will still sit near the top of that food chain.

From where we sit today, that looks like a smart bet.

Good investing,

Tyler Jarman

A former hedge fund manager known for spotting early winners is sounding the alarm once again.

He called Netflix at $7.78 (up 4,200% since), Apple at $0.35 (up 20,000%), and Amazon at a split-adjust $2.41 (up 3,200%).

Now, this renowned investor just released a new list of his favorite AI stocks… and not a single Magnificent 7 name made the cut.

Instead, an AI stock you’ve likely never heard of just flagged as “near-perfect” in his new investing scoring system.

Click here to watch his brand-new presentation, where he reveals the name, ticker symbol, and why this could be the smartest AI move of the year… especially if you’re over 50.