Life sciences giant Danaher (DHR) made a splash today by announcing a merger with Masimo (MASI), a major player in the wearables industry.

Danaher will acquire Masimo in an all-cash transaction valued at roughly $9.9 billion.

Shares of Masimo traded at $130.15 last Friday and are trading at a slight discount to the $180 a share purchase price. The stock is up about 34% this morning.

Danaher expects to close the acquisition in the second half of this year.

Why would Danaher put up so much money for Masimo… a company that few folks know of? What could it signal for DHR? And are there any opportunities for investors on the back of this news?

Let’s unpack all that.

Masimo Is Already the Industry Standard

We think this deal makes a lot of sense for Danaher…

Masimo has been a long-time innovator in the wearables industry. The company is most known for pulse oximeters, which measure blood-oxygen levels in a non-invasive way.

Its top products are the Signal Extraction Technology (“SET”) pulse oximetry and the advanced “rainbow” Pulse CO-Oximetry. Masimo’s rainbow technology provides additional monitoring of hemoglobin and methemoglobin, a form of hemoglobin that can’t carry oxygen.

Put very simply, this technology can monitor how much oxygen is in your blood without drawing blood. It does this by shining infrared light through a patient’s fingertip. Because blood absorbs light differently depending on oxygen levels, these devices can calculate oxygen levels in a non-invasive way.

Source: Masimo.com

Each year, roughly 200 million people are monitored with Masimo’s SET pulse oximetry. These products have been proven to outperform other pulse-oximetry technologies in more than 100 independent, objective studies.

Masimo has expanded over the years to offer other products besides its bread-and-butter pulse oximeters. The company has products to monitor brain functioning, capnography and gas, body temperature, and even minimally invasive products for pain and addiction reduction.

You’ll find Masimo patient-monitoring products in just about all hospitals and clinics. In fact, according to the U.S. News and World Report, nine out of the top 10 hospitals in the U.S. use Masimo technologies.

It’s the industry standard.

Danaher Changes the Game for Masimo

For years, Masimo has built its reputation on hospital-grade monitoring of oxygen in the blood. It sells to intensive care units. It built algorithms that can read through motion and noise. That intellectual property is its crown jewel.

Then Apple (AAPL) put a blood-oxygen sensor in the Apple Watch.

Masimo sued, arguing Apple infringed its pulse-oximetry patents. The case spilled into the U.S. International Trade Commission, which issued an import ban on certain Apple Watch models. A federal jury later awarded Masimo $634 million in damages.

Apple is appealing. The legal chess match continues.

Now, with Danaher’s agreement to acquire Masimo, it changes the equation. This is not a scrappy standalone med-tech company fighting a trillion-dollar giant. Danaher is a $200-plus billion life sciences and diagnostics powerhouse.

It understands regulatory battles. It understands intellectual property. It has deep legal knowledge and the balance sheet to sustain a multi-year appeal process without blinking.

That matters.

Appeals are expensive. Expert testimony is expensive. Time favors the party that can outlast the other side. Under Danaher, Masimo’s claims don’t disappear into settlement fatigue. They gain institutional backing.

There’s also strategic alignment. Danaher’s diagnostics portfolio is built around measurement tools that hospitals rely on for life-or-death decisions. Protecting the integrity of Masimo’s oxygen-monitoring IP reinforces Danaher’s broader medical tools.

From an investor’s perspective, the acquisition does three things.

First, it de-risks Masimo’s litigation by placing it inside a larger, financially resilient platform.

Second, it increases leverage in negotiations. Apple is no longer facing a niche competitor… It’s facing a global diagnostics operator with scale.

Third, it potentially strengthens damages and enforcement efforts going forward, especially as the ITC continues to review Apple’s redesign.

We suspect Danaher did some due diligence on this case, and we bet management believes they can take Apple for more than what Masimo was awarded.

A Serial Acquirer

Masimo did about $2.1 billion in sales in 2024. It’s profitable, too… The company generated $176 million of free cash flow on those sales.

Danaher said this acquisition will strengthen its diagnostics segment.

We couldn’t agree more. Masimo has great products and a lot of room for growth in the years to come.

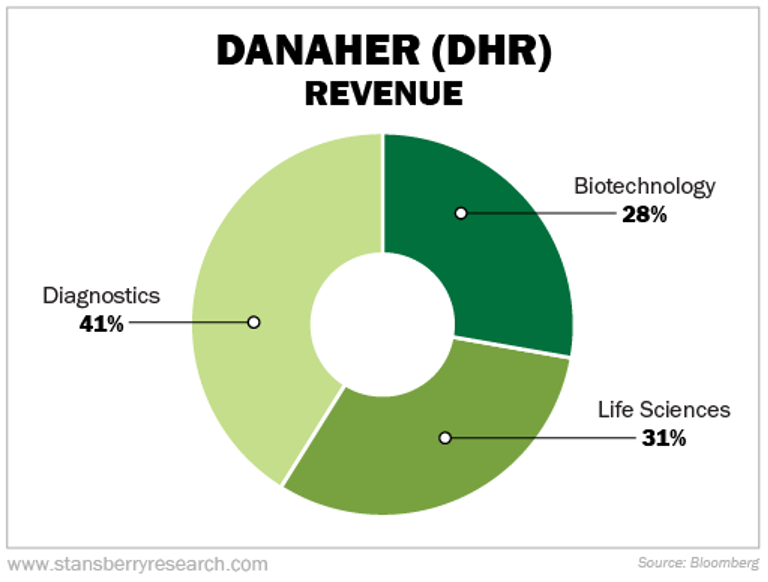

We’re not surprised by this acquisition… You see, Danaher is what we call a serial acquirer in the life science industry.

Back in 2015, Danaher had its hand in a lot of different businesses.

Its business segments were dental, test & measurement, industrial technologies, environmental, and life sciences & diagnostics. As you can tell, there’s not much in common among these businesses.

In mid-2015, Danaher changed course. It announced plans to exit the old-line manufacturing companies that were struggling and focus on health care.

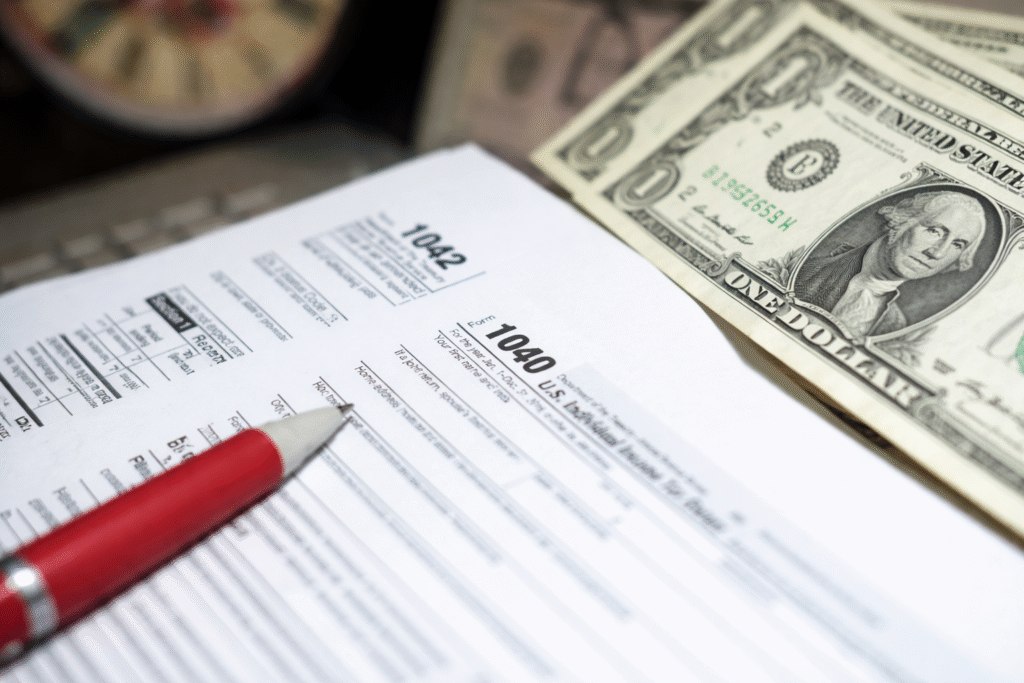

Today, Danaher sells across three core divisions: biotechnology, life sciences, and diagnostics.

From the start, mergers and acquisitions (“M&A”) have been Danaher’s main growth engine. It has completed hundreds of deals, with a clear bias toward the life sciences industry and health care…

You can see this through a few of Danaher’s recent buyouts in the past few years.

For example, in 2015, it bought chemical manufacturer Pall. Danaher paid about $13.8 billion to get access to Pall’s filtration and separation tools for bioprocessing.

Then, in 2020, it closed a $20 billion deal for GE Biopharma, now called Cytiva. That added instruments and software for drug discovery and biologics manufacturing to Danaher’s lineup.

Danaher carved these two companies out, let them grow, and then merged their bioprocess units into a single biotechnology unit.

It now has one of the broadest product portfolios in the biomanufacturing industry, leading to billions of dollars in annual revenue.

Danaher does this repeatedly. It has built an empire of companies that feed the business with new tools, talent, and cash flow.

In general, new businesses join Danaher as relatively independent operating companies. Their existing leaders keep running the day-to-day while Danaher sets clear metrics, conducts detailed talent reviews, and helps teams use something called the Danaher Business System (“DBS”) tool kit to reduce waste and shorten lead times.

Danaher’s Bumpy Few Years

Danaher’s stock has returned 13% a year over the past 20 years. For patient investors, that has made it a wonderful stock to own for the long term. But over the past few years, it has been a different story.

As you can see, DHR has been choppy for the past five years. As a result, its five-year total return is negative 3.7% as I write. Many analysts chalk this up to a “post-COVID hangover.”

As you might imagine, a life sciences company like Danaher was a popular trade during the COVID era. From the COVID-crash lows in March of 2020, DHR soared more than 170% to its all-time high of $294, set in September of 2021.

But as the urgency around COVID began to fade, the torrid demand for Danaher’s products waned. For instance, in Q3 2022, the company said orders for Cytiva and Pall – two bioprocessing tools used for COVID programs – had fallen by 20%.

Put another way, COVID was a Black Swan event that pulled forward demand for Danaher. Customers have been using up existing inventory rather than placing new orders. The stock has been drifting lower off that “sugar high” ever since.

But none of this is an indictment of the business itself, and it’s not an existential risk. And, with the acquisition announcement, it’s an opportunity for Danaher to change the conversation around its future.

Is Danaher a Buy After the Masimo Acquisition?

Danaher is a master at paying what looks like a premium today for a business that will look like an absolute steal five years from now.

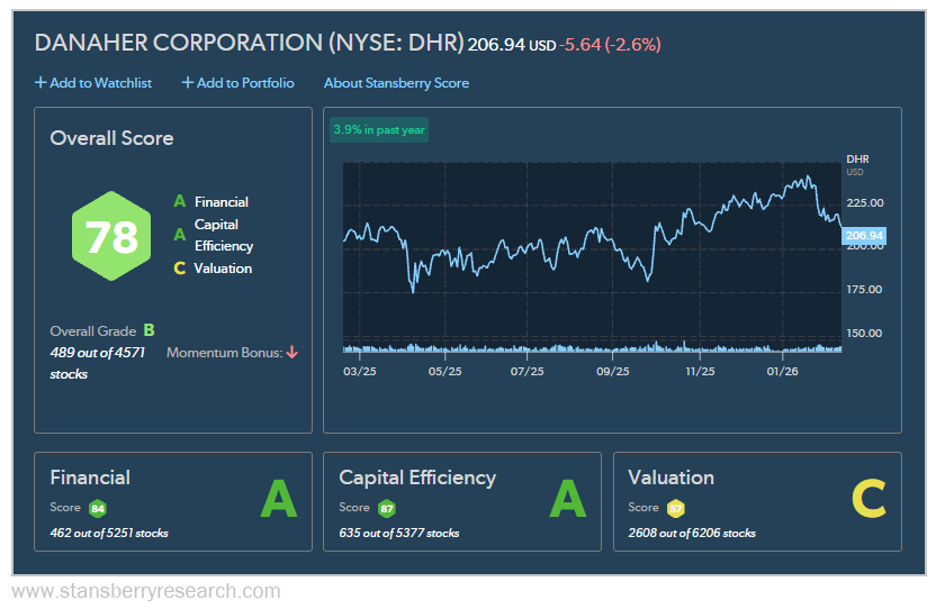

To see if you should consider buying shares of Danaher today, let’s turn to our proprietary Stansberry Score…

The Stansberry Score helps us rank any stock with a simple score between 0 and 100. It builds our strategies for assessing value, business strength, and momentum into a one-click way to make sure that the stocks you own are quality.

Today, the Stansberry Score gives Danaher “A” grades in both financial and capital efficiency (the hallmark of a great business). But the stock does get dinged for its valuation, earning it a “C” grade. Our system gives Danaher an overall “B” grade.

We’re not too worried about Danaher’s valuation, though. This is a company that deserves a premium valuation.

The Masimo acquisition is just the latest gear in this massive compounding machine.

By integrating Masimo into its life sciences portfolio, Danaher is doubling down on a market that requires extreme precision and reliability – exactly where its “kaizen” culture of continuous improvement thrives.

Plus, Danaher’s size will help Masimo in its legal battle with Apple.

Shares of Danaher dipped slightly following the merger announcement, more than a 3% drop.

Short-term traders are worried about the $9.9 billion cash outlay.

But the best investors don’t look at just the next quarter. They look at the next decade.

If you want to build lasting wealth, you want to own the companies that know how to grow through any environment. Danaher is that company.

– Jeff Havenstein and John Engel

Editor’s Note: A strange change is coming to the stock market – and it’s about to have dramatic consequences for anyone over the age of 50.

“If you own popular AI stocks like Nvidia, you’re in for a big shock,” says Whitney Tilson, who predicted the 2000 Tech Wreck and founded a $200 million hedge fund firm.

He isn’t the only leading figure warning investors to tread carefully.

Michael Burry, who made hundreds of millions shorting banking stocks before 2008, just placed a $1 billion bet against AI stocks – he’s short both Nvidia and Palantir.

And if Whitney is correct, what’s coming to AI stocks next won’t be a crash or mass rush for the exits…