U.S. oil companies are “pissed”…

They’re not happy about the idea of President Donald Trump repairing (and subsidizing) Venezuela’s oil sector – and driving down oil prices even further.

There’s already an oversupply of oil in the market. American oil producers have been stuck with idling rigs. Cheaper oil will just force them to idle more… and put American oil output on the chopping block.

“We’re talking about this administration screwing us over again,” a top executive at one of the country’s leading shale firms told the Financial Times on January 9.

Geopolitical risks aside, 2026 is already setting up to be another lackluster year for oil prices…

But the longer-term picture looks different. As I’ll explain today, the analysts are missing some key catalysts that could eventually send oil in an unexpected direction – up.

Oil’s Supply and Demand May Seem Simple… But It Isn’t

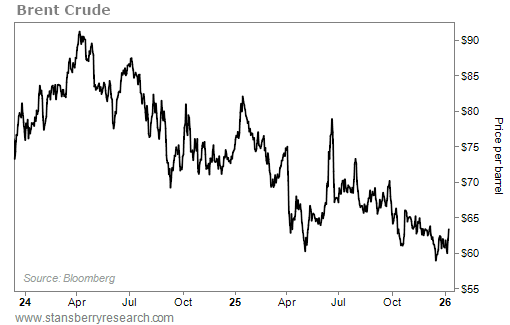

Brent crude (the international standard) is trading around $64 per barrel today. The U.S. Department of Energy (“DOE”) expects it to trade lower, at an average price of $56 in 2026.

Over the past few years, Brent crude has traded between $59 per barrel and $91 per barrel. That puts the $56 per barrel estimate below that range. And it’s a huge drop from April 2024’s peak…

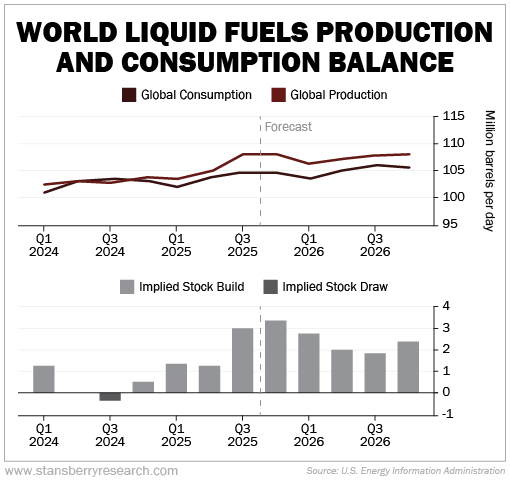

That’s because global oil production is outpacing consumption. As a result, the DOE expects oil inventories to rise in 2026. That will put more pressure on prices – at least in the coming months.

We can see this in two ways below…

World oil demand averaged 105 million barrels per day (“MMbpd”) at the end of 2025. The DOE expects consumption to only increase modestly in 2026.

Meanwhile, the agency sees average global oil production around 108 MMbpd this year. We’re looking at global inventory growing more than 2 MMbpd in 2026 – which is similar to 2025.

So, supply is growing moderately, while demand is remaining roughly in stasis. But this story may not be as straightforward as it seems.

Even if Brent trades down to $55 per barrel, it’s hard to see it trading much lower than that…

Why We’ll See a Floor Under Oil Prices

The U.S., OPEC+, Brazil, Guyana, and Canada are the major drivers of oil production growth. Asia, the Middle East, and Africa, on the other hand, are the regions driving consumption growth.

OPEC+ plans to keep oil production flat. It has indicated it may even cut back on production if prices keep falling.

China has been storing a large portion of excess oil in its strategic stockpiles. And the DOE expects that to continue.

Plus, the U.S. Strategic Petroleum Reserve (“SPR”) – the U.S.’s backup oil supply – still needs to be refilled. It needs around 226 million barrels added to it to get back to the 638-million-barrel level of January 2021.

All of this should rein in supply. That’s going to keep a floor under oil prices for years to come.

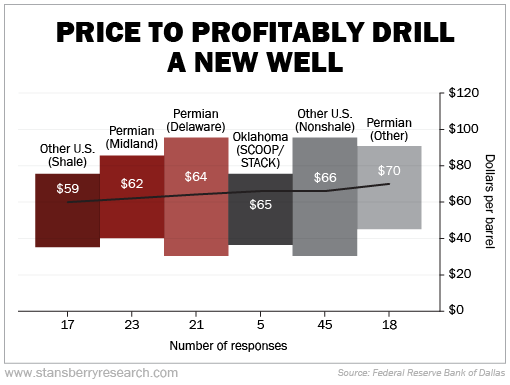

Oil companies aren’t excited about drilling new wells at these price levels, either… which should also help keep supply in check. The Federal Reserve Bank of Dallas surveyed 144 exploration and production (E&P) companies in March 2024. It asked what prices West Texas Intermediate (“WTI”) crude – the U.S. standard – would need to be at for them to profitably drill a new well per basin. You can see the answers in the chart below…

The breakeven prices on existing wells in these basins can be as low as $31 to $45 per barrel. But the price to profitably drill new wells is much higher.

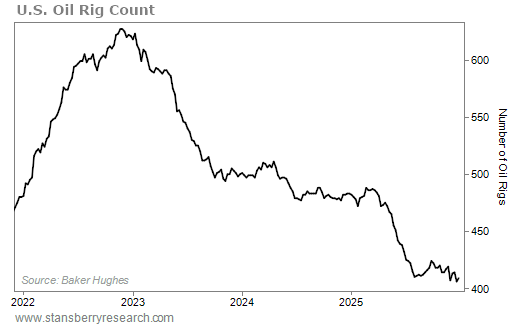

That’s why we’ve seen the number of U.S. oil rigs in operation plummet from 627 in November 2022 to 409 at the end of December 2025…

Now you see why U.S. oil companies are “pissed.” No one is going to drill new wells if it doesn’t make economic sense.

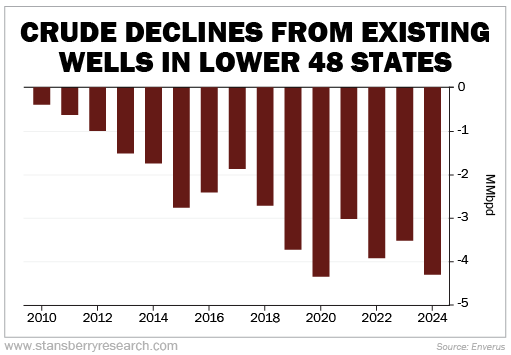

At the same time, production from existing wells has been falling steadily in the lower 48 states. In 2024, it declined at a rate of 4.3 MMbpd. Take a look…

That means the U.S. must grow oil production by 4.3 MMbpd (around 32% of total production) just to keep production flat. The DOE expects the U.S. to produce 13.6 MMbpd in 2025, and for that to slightly decline to 13.5 MMbpd in 2026.

Production naturally declines over time as reservoir pressure decreases. But horizontal wells created by fracking – which injects a mixture of sand, water, and chemicals under high pressure to open fissures and extract oil and gas – dry up even faster. And around 75% of current U.S. oil and gas production comes from fracking shale formations.

Operators need to bring new wells on line to sustain current production levels… But that’s only going to happen with higher prices.

So it’s only a matter of time before oil starts to rise again as demand outstrips production.

Plus, even though there’s a lot of talk in the media, Venezuela is not going to be able to change the supply dynamics. The plan won’t flood the market with supply, simply because it can’t…

ExxonMobil (XOM) CEO Darren Woods already let the cat out of the bag… He told President Trump that Venezuela was “uninvestable.” Venezuela’s oil infrastructure is in shambles, the country is in a mess politically, and it’s hard to safeguard investments without the rule of law. The country could require $100 billion or more in new investments.

My colleague Dan Ferris recently described all the problems of bringing Venezuelan oil back on line at scale here.

That means unless we see a major market surprise – like a geopolitical conflict so bad that it chokes off supply – we’re looking at Brent crude trading in the high $50 to low $60 range this year and into next.

So what’s an oil investor to do?

Oil Is a Long-Term Contrarian Bet

The saying holds true… The solution to low prices is low prices.

Oil companies will cut production over the next year or so. That will bring supply and demand back into balance, and prices will start to rise.

But prices will likely stay range-bound over the next year (again, unless something major happens). So now is a good time to be patient and build energy positions when you see oil prices dip.

Some of the best stocks to pay attention to are the high-quality exploration and production (“E&P”) companies…

The biggest of these are called “supermajors.” They’re mega-cap corporations that produce more energy than a lot of countries do. They’re so big that they cover every aspect of energy… from drilling to the gas pump.

I’m talking about companies like ExxonMobil, Chevron (CVX), ConocoPhillips (COP), Shell (SHEL), BP (BP), TotalEnergies (TTE), and Eni (E).

Supermajors’ size is a tremendous advantage. They can boom when the energy markets are soaring. And they offer stability during a recession. That makes them a great way for conservative investors to gain long-term exposure to energy.

I expect energy investors to find good entry points over the course of 2026 that will really start to pay off in 2027, as supply and demand come back into balance.

So how do you know when it’s a good time to take on new positions in oil stocks?

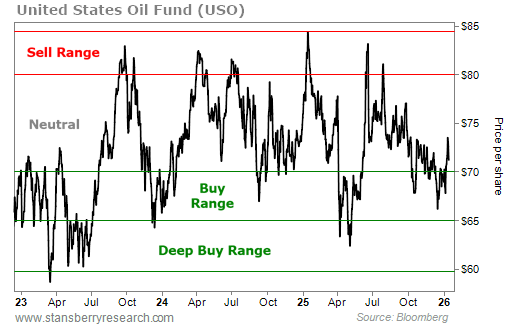

The chart below of the United States Oil Fund (USO) is a good guide…

USO primarily holds futures contracts of WTI crude, which typically trades at a discount to Brent. Take a look…

Oil has been range-bound for the past three years. Again, I expect the range to hold in 2026.

When you see USO trading at $70 or less… it’s generally a good time to invest in quality oil stocks. And when you see USO trading at $65 or less… it’s generally a great time to invest in quality oil stocks.

Please note: I’m not suggesting you invest in USO. USO is only a tool for speculation. Exchange-traded funds comprised of commodity contracts make terrible long-term investments because they must roll over expiring contracts each month – and that works against investors long-term.

So long-term investors are better off gaining oil exposure through the stocks of quality energy companies or ETFs that hold them. Make sure you’re watching this part of the market.

Good investing,

Bill McGilton

Editors Note: What should you invest in right now?

A renowned former hedge fund founder and his research team have found what they believe is the next big tech trend that could make investors rich.

It’s a breakthrough they’re calling “Helios” – and if you haven’t yet heard of it, you soon will.

Over the next few years, it could impact the food you eat… the water you drink… the places you live and work… and even the prices you pay for airfare, gas, electricity, and household goods.

“Helios” is going to cause a lot of people to lose money, too. Dozens of well-known businesses could go bankrupt.

But if you own a stake in this new tech, the positive effects will far outweigh the negatives. Get the facts for yourself. Make sure you’re not on the wrong side of this trend. Click here to see this new analysis…