Today’s issue in preview:

-

Six ways to invest in the biggest product of all time

-

In a weak market, Boomer health care keeps going up. Are you profiting?

-

The quiet boom in U.S. manufacturing continues. More critical-but-under-the-radar stocks reach all-time highs.

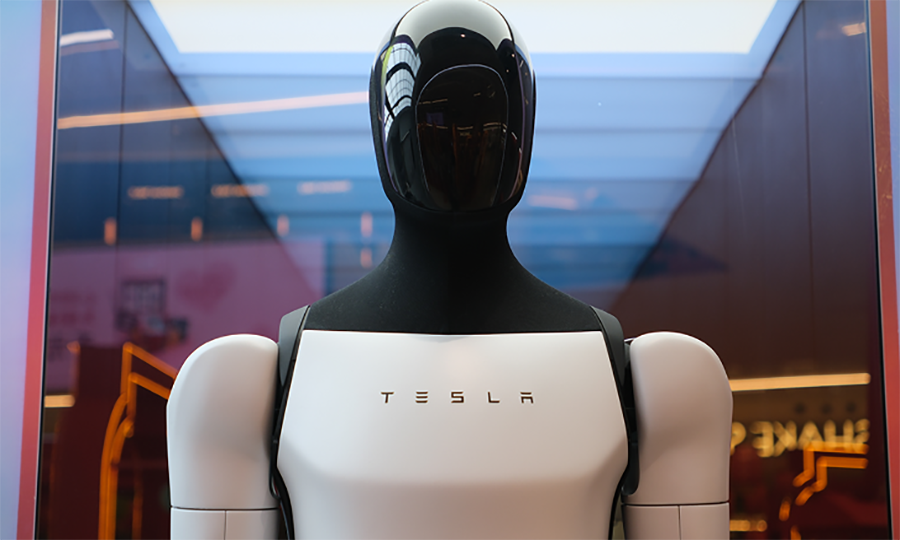

Six ways to invest in the biggest product of all time

Last week, Tesla (TSLA) CEO Elon Musk made it clear: The humanoids are coming.

During Tesla’s fourth quarter earnings call, Musk announced the company would phase out two car models to free up factory capacity to build Optimus humanoid robots.

Humanoids are poised to become one of the most impactful, most popular innovations in history. Imagine millions of robots in our homes, factories, mines, and fields doing work most of us consider to be dirty, dangerous, and tedious. (Personally, I’m most excited about the humanoid that displaces me from my job as family dishwasher.)

The futurist I put the most stock in – Elon – says humanoids will be “the biggest product of all time.” Point taken.

In pursuit of humanoid market dominance, venture capitalists and large tech firms such as Tesla, Google, Amazon, and Microsoft are pouring billions of dollars into humanoid factories and related R&D. Over a dozen humanoid makers are competing for the title of “king of the humanoid market.”

In short, this is an enormous emerging megatrend… and a huge investment opportunity.

If I had to bet on one humanoid maker, I’d pick Tesla. Because Elon is Elon. He is the greatest high-tech manufacturer of all time. Making this bet requires zero courage or insider knowledge. It’s just common sense. It’s like betting on prime Michael Jordan to win that year’s NBA title.

However, rather than trying to pick a single winner of the humanoid war, I’d rather sell arms to all combatants… aka “sell highly specialized component parts to all robot makers.” This is a surer bet than trying to pick a single winner.

Producing humanoid components is a difficult business. Robot joints, frames, gears, batteries, motors, and sensors must possess a very-hard-to-achieve balance of lightness, precision, durability, and functionality. This is ultra-high-tech manufacturing.

Plus, any big league humanoid component maker must be able to fill large orders from the likes of Tesla. Being able to produce 10,000 precision components is one thing. Being able to produce 10 million of them is a different thing.

Unfortunately, most of the world’s key robotics component makers are based and listed in China. Most U.S. investors are justifiably reluctant to buy China-listed stocks. However, some U.S. companies with humanoid market exposure are poised to benefit from this emerging megatrend. They include:

Regal Rexnord (RRX) is a $11 billion actuation and bearings company. It makes the muscles and joints that allow humanoids to stand and lift heavy objects. Without these parts from RRX, robots are very smart, but static pieces of metal. With them, they become high torque machines capable of executing complex tasks. RRX’s humanoid component sales are a small part of its revenue mix but could grow much larger.

RBC Bearings (RBC) is a $16 billion maker of precision components including bearings for machines. Like Regal Rexnord, RBC’s exposure to humanoids is relatively small but could grow much larger. We’ve covered RBC in the past. The stock is up ABC% since our original note.

Ambarella (AMBA) is a $2.5 billion company that builds the chips to allow robots to see and understand their environment and interact with the physical world (known as Edge AI). This makes them a competitor to Nvidia (NVDA), but they use a fraction of the energy of NVDA chips. Edge AI now accounts for over 70% of AMBA’s total revenue, validating its position as a high-exposure robotics play.

Allient (ALNT) is a $1 billion small-cap company that manufactures the highly precise coreless motors used in robotics hands (known as end effectors). This technology is why it been a supplier for surgical robots like Intuitive Surgical (ISRG) Da Vinci systems. Now it is deploying those same precise motors into humanoid fingertips, solving the “dexterity” bottleneck that prevents current humanoids from performing very delicate tasks.

Teradyne (TER) is a large $44 billion semiconductor equipment giant that is slowly being disguised as a robotics play. Its primary business (90% of revenue) builds automated testing systems that validate chips for NVDA, Apple, and other companies, including Qualcomm. However, it owns two “pure play” robotics companies: Universal Robots (market leader in robotic arms) and MiR (autonomous mobile warehouse robots).

Vishay Precision Group (VPG) is the smallest stock on this list, with a market value of just $715 million. Its technology is what gives humanoids a sense of touch and is embedded in their joints, feet, and hands, providing the feedback loops for delicate manipulation. Some analysts believe VPG is involved in Optimus robots, which, if true, would make VPG’s robotics revenue increase dramatically based on Musk’s vision for Optimus being “the most valuable product of all time.”

The coming humanoid megatrend is poised to change the world forever. The world’s largest tech companies are betting big on it. Specialized component makers like the ones above allow us to bet on it as well.

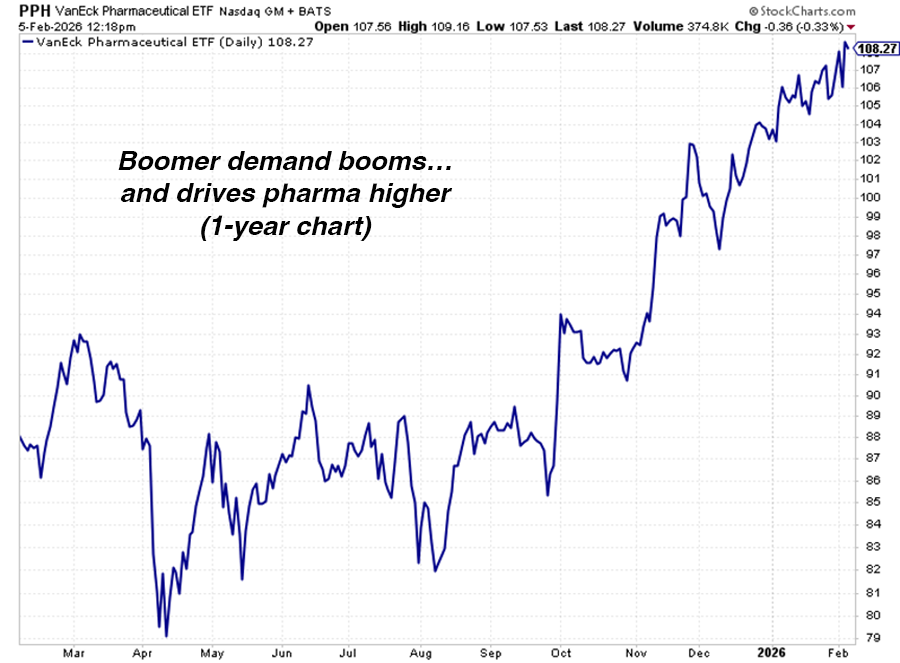

In a weak market, Boomer health care keeps going up. Are you profiting?

Since the start of this month, the S&P 500 is down 2.15%. AI leader Nvidia is down 10%. Software giant Microsoft is down 6.7%. Defense tech leader Palantir is down 11%.

In other words, a lot of high-profile stocks are suffering significant corrections.

Health care stocks, however, are still rising… and our recommendation to be long the Boomer health care theme continues to pay off. The VanEck Pharmaceutical ETF (PPH) is comfortably at an all-time high.

Regular readers know that Boomer health care is one of our highest conviction long-term investment themes. The bull case here is simple: More than 10,000 Americans reach retirement age every day. This is the enormous Baby Boom generation entering the phase of life where health care and longevity spending skyrockets.

For many boomers, a typical month involves going to see at least one doctor to have something looked at, removed, or treated.

This means that many health care businesses are experiencing huge demand now – and will for at least the next decade. It’s going to rain money on many health care businesses.

One way to track and trade this megatrend is with the PPH. It’s the largest ETF focused on big drug companies such as Eli Lilly (LLY), Novartis (NVS), Merck (MRK), and Pfizer (PFE). These companies sell Boomers medication by the truckload.

More important than these fundamentals, however, is what the market thinks of these fundamentals.

As you can see from the one-year chart below, PPH is trading at all-time highs. These new highs are impressive on their own, but even more impressive is that they’ve been reached in a weak broad market. Boomer health care continues its winning ways. I remain bullish.

Market Notes

-

Our recommendation to own biotech stocks continues its winning ways. Large cap biotechs Amgen (AMGN) and Gilead (GILD) hit all-time highs today.

-

The bear market in software continues. Big software makers ServiceNow (NOW), Salesforce (CRM), and Atlassian (TEAM) reached new one-year lows today.

-

The bear market in crypto continues. Mega crypto brokerage Coinbase (COIN) reached a new six-month low today. It’s down 41% in just the last two months. Bitcoin proxy stock Strategy (MSTR) reached a one-year low. It’s down 69% over the past year.

-

As I write, the iShares Silver Trust ETF (SLV) is down 15% on the day… yet still within the confines of a long-term uptrend.

-

Nothing runs like a Deere. As I expected, precision farming leader John Deere (DE) reached a new all-time high today.

-

The quiet boom in U.S. manufacturing continues. Modine Manufacturing (MOD) and Advanced Drainage Systems (WMS) reached new highs today.

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends