Today’s issue in preview:

-

Big news in the great “AI Boom or AI Bust” debate

-

How to make 1,000%+ returns from the next wave of AI winners

-

A big new development in the biotech megatrend

-

Our gold stock and commodity recommendations are huge winners.

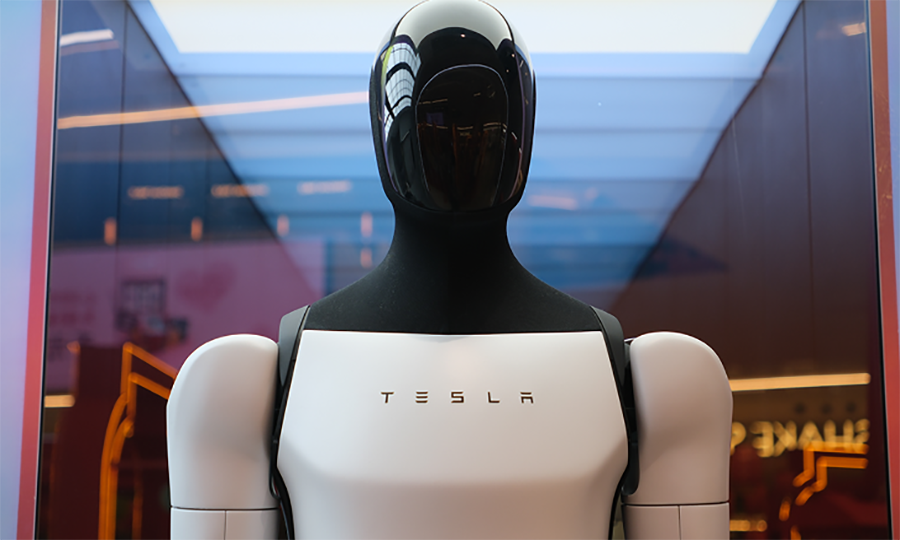

Big news in the great “AI Boom or AI Bust” debate

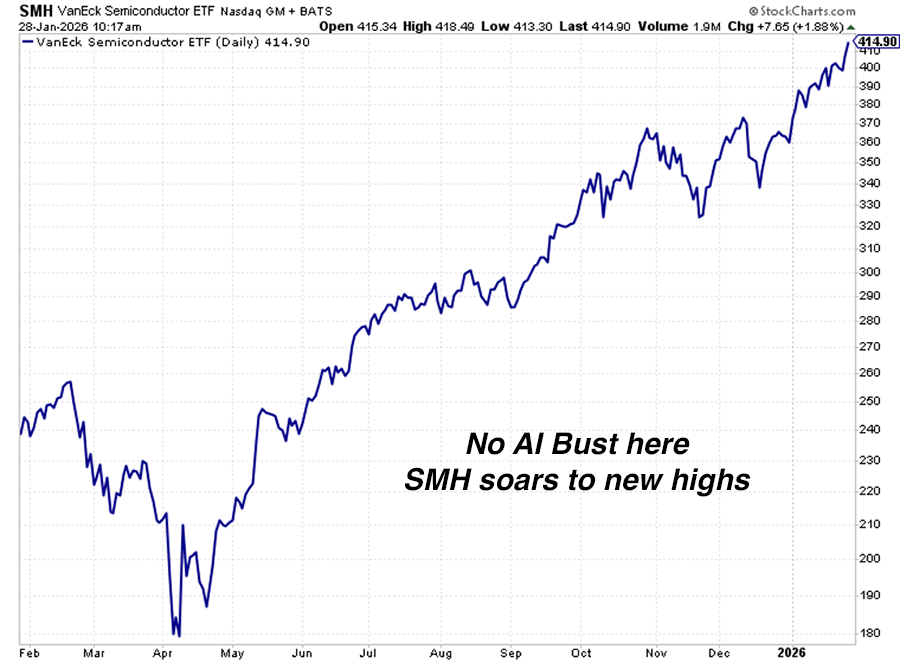

Today, the VanEck Semiconductor ETF (SMH) advanced 1.8% to reach an all-time high.

That’s bad news for the “AI Bust” crowd.

Over the past six months, I’ve frequently highlighted how “AI Boom or AI Bust” has become the world’s most important financial debate.

More than three years into the AI boom, tech giants Meta, Google, Amazon, OpenAI, and Microsoft are in an epic race to build the world’s best AI models and infrastructure. This year, they are on pace to spend over $450 billion on AI infrastructure, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in history… which has driven many powerful stock rallies.

Whether Big Tech’s huge investment pays off or not has become the most important issue in the stock market.

AI bears say much of this spending is madness. It won’t generate the profits required to justify it. Once the world realizes this is the case, GDP growth will stall, and the stock market will plummet.

AI bulls say, “AI is the greatest innovation of the century. Big Tech leaders know what they are doing. The coming innovations will justify the enormous investments.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

The market currently prefers the bull case.

This week, leading AI infrastructure chain stocks ASML (ASML), Lam Research (LRCX), Micron (MU), and Applied Materials (AMAT) reached new all-time highs. These moves sent the VanEck Semiconductor ETF (SMH) to new highs.

This fund is the largest semiconductor ETF on the market. Its new high tells us that AI-related spending is very strong… and the AI bull market is alive and well.

Will the AI Boom eventually suffer a vicious correction or even a prolonged bear market? Of course. All trends go through corrections. All trends eventually end. But for now, it’s boom times for AI.

How to make 1,000%+ returns from the next wave of AI winners

Apple. Amazon. Google. YouTube. Facebook. Netflix.

These are some of the largest and most successful businesses in history. Their early investors made 1,000%+ returns. And they all have one thing in common: They didn’t build the worldwide communications network we call the Internet. They built wonderful businesses on top of that infrastructure.

They were the “applications layer” of the Internet.

It’s important to understand the applications layer because we’re on the cusp of a historic boom in companies that don’t build critical AI “hard infrastructure” such as data centers and semiconductors… but instead build wonderful businesses on top of that infrastructure… just like Apple, Amazon, and Google did with the Internet.

I’m talking about AI-centric businesses that revolutionize how we develop medicines… how we create movies… how we design cars… how we shop… how we learn… how we transfer and invest money… and thousands of other things. The Internet changed every industry and created many new ones. AI will do the same.

Investors who follow the Internet applications layer playbook into big AI applications layer winners stand to make giant returns.

Some of these future winners haven’t been started yet. Some of them are existing businesses that apply AI to greatly increase revenue and crush the competition.

Over the next decade, the AI Applications Layer megatrend will prove to be one of the greatest wealth-generating trends in history.

Some potential winners in this theme include:

**Tempus AI (TEM) is a $11.9 billion AI-centric medical diagnostics company. Tempus builds the world’s health data set – over 400 petabytes encompassing clinical records, molecular profiles (DNA/RNA), and tumor imaging from millions of patients. It currently focuses on cancer treatment.

Cancer care is becoming truly personalized. Doctors no longer need to rely on one-size-fits-all treatments. Instead, every patient’s unique DNA, past treatments, scans, notes, and more is analyzed in seconds by AI to uncover hidden patterns and predict which therapy will work best.

**Upstart (UPST), a $4.5 billion lending marketplace company, is replacing traditional “rear view” credit scoring models with huge machine learning models that analyze non-traditional variables such as employment history, income stability, recent promotions, education details, cash flow patterns, etc.

It creates a far more detailed picture and fair view of the customer compared to legacy peers who don’t have the technology and models to do this.

**Zeta Global Holdings (ZETA) is a $4.9 billion marketing technology firm. It uses AI and large datasets to help clients track customer behavior and market effectively.

Traditional CRMs (Customer Relationship Management) like Salesforce rely on the data entered by clients, rendering them useless if the data is weak. Zeta challenges this entire model with a massive pre-loaded database containing over 2.4 billion consumer identities and trillions of behavioral signals.

ZETA recently announced a partnership with OpenAI to power Athena, its new Agentic AI, that combines reasoning with its data. Athena can autonomously plan campaigns, write budgets, and ultimately compress weeks of human labor into seconds of processing.

Now that much of the early AI infrastructure is in place, you can expect the AI applications layer to start generating huge winners just like the Internet did. And you can expect to learn about those future winners in Money & Megatrends… before they take off.

A big new development in the biotech megatrend

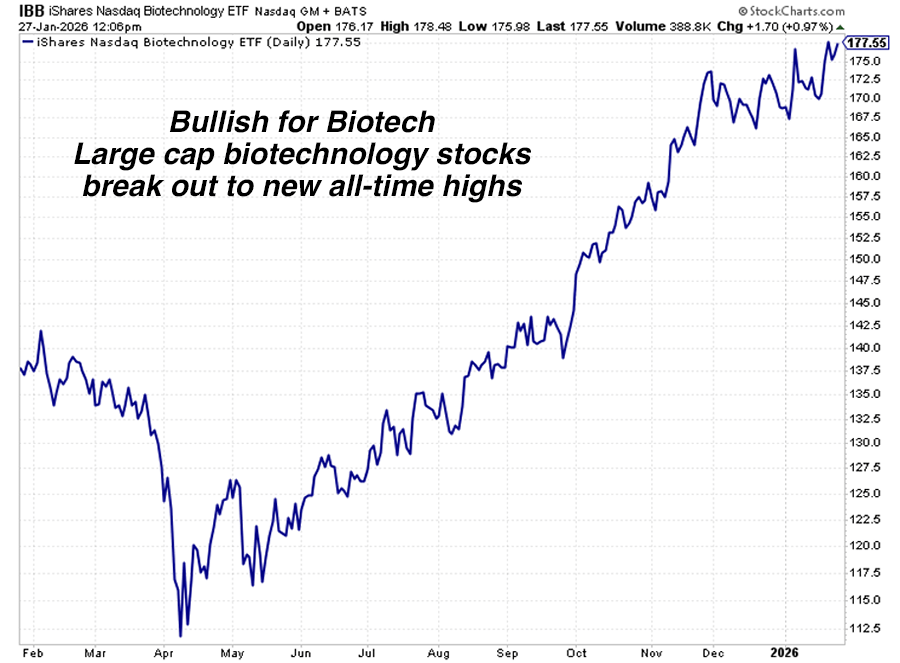

Readers who took our advice to own biotech stocks can celebrate this week. Amgen (AMGN) and Gilead Sciences (GILD) broke out to new all-time highs.

Regular readers are familiar with my bullish stance on biotechnology. On August 18, I sent a research note to colleagues outlining my bullish view of the sector’s price action. Since then, I’ve written more than a dozen updates on the biotech bull market, as the sector has outpaced the S&P by an incredible 42% to 8.3%.

The biotechnology sector is full of companies working on cures and treatments for hundreds of diseases. When investors grow interested in this industry, the returns can be incredible. During the last biotech bull market, the sector soared 300% over four years.

Since biotech has performed poorly since 2021, most investors are indifferent to it. But I see major potential here. I believe this industry could start regularly generating stock market doubles and triples.

The fusion of AI plus biology will generate dozens of compelling stock narratives over the coming years. Researchers running super-intelligent AI programs will be able to run millions of digital simulations for drugs and treatments. This will put medical innovation into overdrive… and create many big stock market winners.

Companies that leverage AI to “crack the code” for various diseases, treatments and drugs will enjoy 100%… 500%… even 1,000%+ stock rallies.

In many cases, these rallies will happen thanks to stories and potential… rather than a company generating revenue or earnings.

Capitalizing on many of today’s biggest stock market trends means focusing on promise over profits. The biotech sector holds the potential for both.

I often cite the price action of the S&P Biotech ETF (XBI) when I talk biotech stocks. However, the iShares Biotechnology ETF (IBB) is also a quality fund for tracking and trading biotech. IBB has more exposure to the “largest of the large-cap” biotechnology companies, including Amgen and Gilead Sciences.

These are two of the oldest, most important, and most influential biotechnology firms. The valuations, sentiment, and forecasts related to these two giants play a big role in the valuations, sentiment, and forecasts across the whole sector.

Over the past year, the market has assigned steadily rising Price-to-Sales ratios to Amgen and Gilead. This indicates improving sentiment towards the sector and greater interest from large institutional investors.

The strength in Amgen and Gilead has helped propel IBB to multi-year highs. As you research this sector, remember that biotech uptrends tend to be large and they tend to last a long time.

Market Notes

-

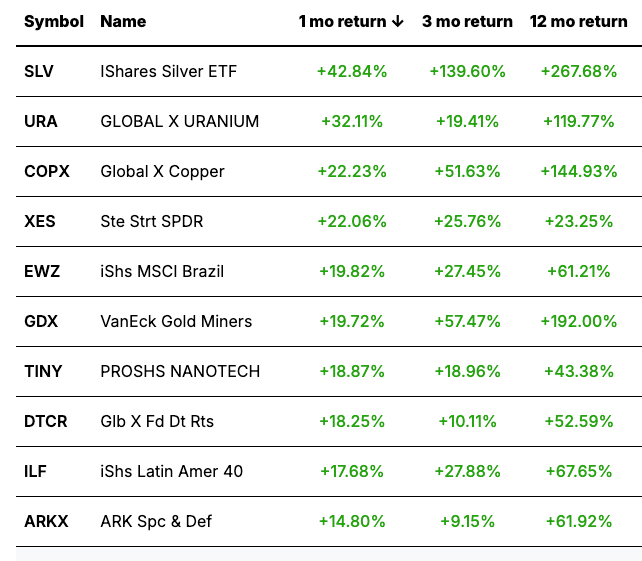

Our longstanding recommendation to own gold and gold stocks is proving to be on the money. Gold climbed above $5,250 this week. Many gold stocks reached new all-time highs. The VanEck Gold Miners ETF (GDX) is up an incredible 294% over the past two years.

-

Our September 29, 2025, bullish note on oil stocks continues its winning ways. Oil stocks of all shapes and sizes reached one-year highs today. New highs include oil giants ExxonMobil (XOM), Chevron (CVX), Devon Energy (DVN), Canadian Natural Resources (CNQ), and Suncor (SU).

-

My 2022 recommendation to uranium stocks continues to pay off. The Global X Uranium ETF (URA) reached an all-time high today. It’s up 126% in the past year.

-

Our solar energy trade continues to be an extraordinary winner. The Invesco Solar ETF (TAN) advanced 2% today to reach an all-time high.

-

Our advice to own Brazilian stocks continues to pay off. The iShares Brazil ETF (EWZ) reached an all-time high today. The fund is up 29% since our September 2025 bullish note.

-

Mega miners Rio Tinto (RIO) and BHP Billiton (BHP) reached new highs this week. The critical resources bull market we’ve pounded the table on continues to generate winners.

-

Engineering, Construction, and Procurement (EPC) firm Mastec (MTZ) reached a new high this week. Our 2025 recommendation to own EPC stocks to benefit from the data center and power grid upgrade booms continues to pay off.

-

High tech battery leader EnerSys (ENS) reached a new all-time high this week. The stock is up 22% since our December 8, 2025, bullish note on the Battery Tech megatrend.

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends