Today’s issue in preview:

-

This “AI Power” trade is moving higher… are you on board?

-

One of our top “Trump Trends” is paying off and stronger than ever

-

An unusual “debasement trade” asset to put on your radar

This “AI Power” trade is moving higher… are you on board?

Over the past month, gold and silver have dominated headlines in the commodity sector for good reason. Gold and silver are enjoying historic rallies. Gold is up 71% over the past 12 months. Silver is up 229% over the past 12 months. Many gold miners are up more than 200% over the past 12 months.

These rallies are good reminders that when a commodity market trends, that trend can be very large and last a long time. It can surprise most market participants with both its size and lifespan.

This is because the supply/demand dynamics in metals, energy, and agricultural markets play out over years, not months. For example, when the world decides it needs a big new copper mine, it’s not going to get that copper mine for at least 10 years. Big copper mines take a long time to finance, permit, and build. Same with big gold mines. Same with big oil fields.

Today, let’s focus on the investment opportunity in big uranium mines.

Regular readers know the “nuclear energy renaissance” is one of our highest conviction long-term megatrends to own.

Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants such as Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is consuming huge amounts of electricity. S&P Global estimates that global electricity demand will increase by nearly 50% by 2040.

Given this outlook, AI companies and their electric power providers are making enormous investments to expand nuclear power capacity. Nuclear can provide vast amounts of “always on, always there” carbon-free baseload power. Bloomberg reports that surging demand will drive $350 billion in nuclear spending in the U.S. by 2050.

I often say you want to live and invest in themes where it is raining money. You want to work and invest in super booms where money is flowing freely. The nuclear power industry is one such area.

In 2022, I sent a bullish note to colleagues highlighting the emerging uptrend in uranium miners Cameco (CCJ) and UEC (UEC), and in uranium finance company Uranium Royalty Corp (UROY). Uranium is the fuel that powers nuclear reactors.

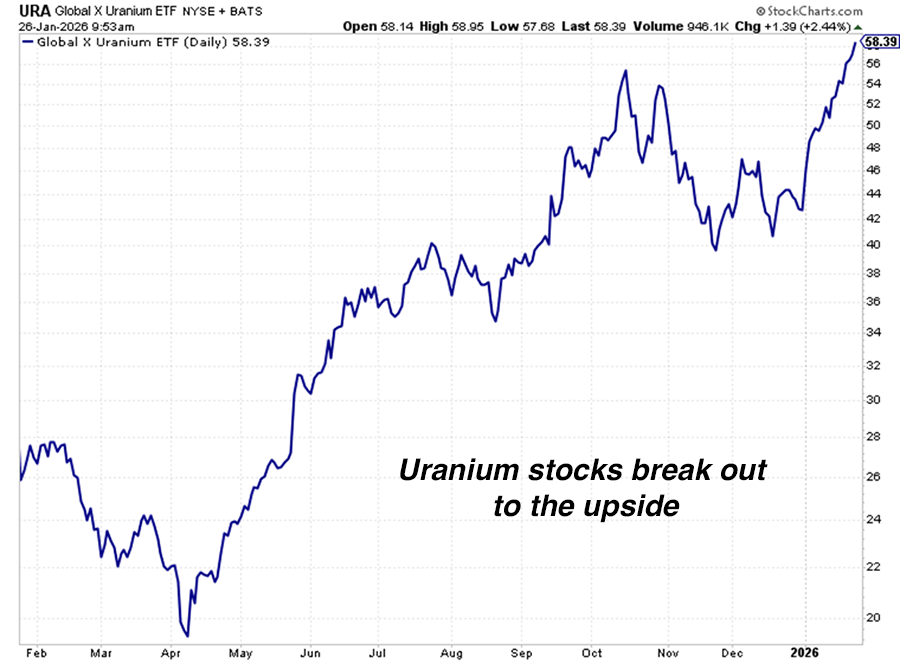

Since my original call, uranium stocks have skyrocketed. Cameco is up 333%. UEC is up 297%. Importantly, this trend is likely to continue. The uranium market is tight and demand is soaring. After trading in a sideways consolidation for the three months, the Global X Uranium ETF (URA) recently broke out to a new all-time high. This fund owns a who’s who of uranium mining. And it’s starting to trend again. Now, remember the nature of commodity trends and trade accordingly…

One of our top “Trump Trends” is paying off and stronger than ever

“Partnering with the U.S. government to increase domestic and friendly-country supplies of critical resources will prove to be one of the most lucrative financial activities of this decade.”

I issued the guidance above in June 2025. It’s proving to be on the money. Critical resource stocks of many shapes and sizes are soaring.

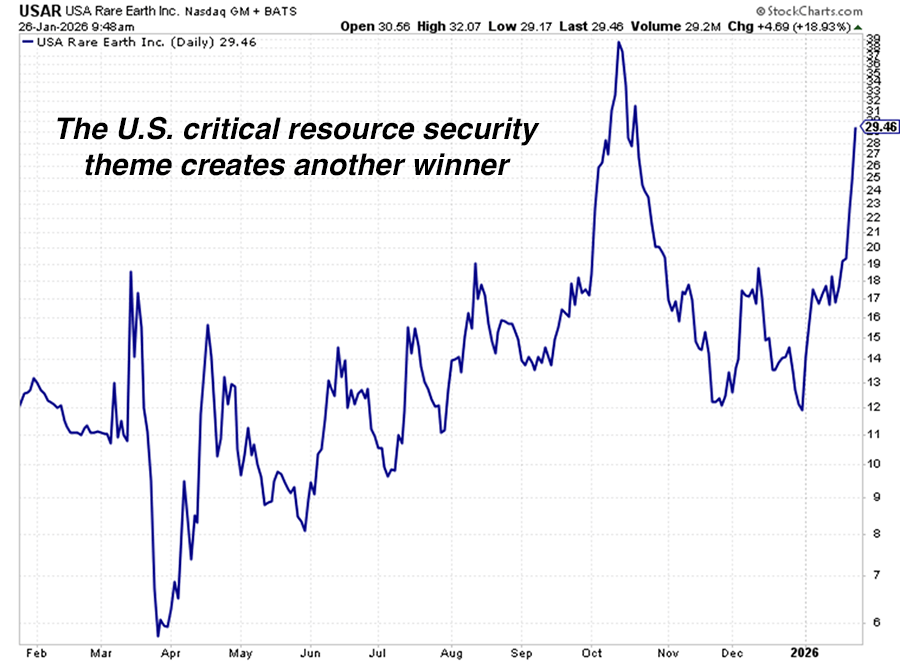

The latest big story in this trend: The U.S. government just bought a stake in critical resource firm USA Rare Earth (USAR). The government investment will help USA Rare Earth advance its plan to build a high-tech magnet manufacturing plant in Oklahoma and develop a rare earth deposit in Texas. The news sent USAR up 27% during the morning session.

USAR is yet another winner inside the “U.S. critical resource security” theme. The bull case here goes like this: President Donald Trump has staked his legacy and reputation on massively expanding U.S. manufacturing capacity. His administration is working with business leaders to invest trillions to pursue this goal.

However, any plan to increase domestic manufacturing capacity must overcome a big problem: We don’t have the critical resources to build the required infrastructure.

We don’t have the copper, iron ore, rare earths, lithium, antimony, nickel, and other vital building blocks required to build all those data centers… all those factories… all those robots…. all those electric grids… all those power plants… and so on.

To make matters worse, we also lack the refining, smelting, and processing facilities needed to turn the raw forms of those resources into ready-to-use end products. We rely on China for a lot of that.

It’s as if we very much want to build a big house… but we don’t have the lumber, screws, or nails we need to make it happen.

Solving the big “critical resources problem” is possible… and it is an enormous financial opportunity.

To ensure we have the critical resources to build trillions of dollars in infrastructure, the U.S. government will change any law, kill any regulation, and write any check that will increase production and processing capacity.

This means that after more than 30 years of the U.S. government being hostile to domestic mines and mineral processing facilities, it is now supporting them. Trump can’t have his big manufacturing dream without them.

Mining investors and entrepreneurs are now operating in an incredible new era… one where the U.S. government is their best friend. Companies such as USA Rare Earth and those in the VanEck Rare Earth and Strategic Minerals ETF (REMX) and the Sprott Critical Materials ETF (SETM) should continue to do well.

An unusual “debasement trade” asset to put on your radar

Over the past week, gold traded through the key level of $5,000, reaching its current price of $5,086.

The gold trade is one of my biggest winners of the past few years. Regular readers are familiar with the bullish drivers. The governments of most wealthy Western nations have promised far too many things to far too many people.

The related debts and obligations governments have taken on cannot be paid back with sound money. They can only be paid back with debased, devalued money… much of which is created out of thin air. This is driving inflation and significant currency debasement. Prices are going up because the value of our money is going down.

It’s important to note that the prices of scarce resources are going up. Things that cannot be easily produced or replicated. Things you can’t print. Gold. Copper. Silver. Rolexes. Beachfront homes. These are proving to be sound “debasement” hedges.

And this might sound odd to you, but I include professional sports teams in this group. Like gold and beachfront homes, professional sports teams are valuable, in-demand, scarce resources that cannot be printed or easily produced.

Every year, we hear new superlatives for how the values of professional football, basketball, and baseball teams are rising. CNBC reports that the average NFL franchise is worth $7.65 billion. That figure marks an 18% jump from the year before. CBS reports that Major League Baseball generated a record $12.1 billion in revenue in 2024, and franchise valuations increased 8%. The New York Yankees recently achieved a valuation of $8.2 billion.

Professional sports contests are one of the few television products people still reliably watch. In a world where our attention is pulled away from television, sports become incredibly valuable to big advertisers.

Plus, sports team valuations are benefiting from the K-shaped economy and soaring asset values. The ultra-rich love to buy and own sports teams.

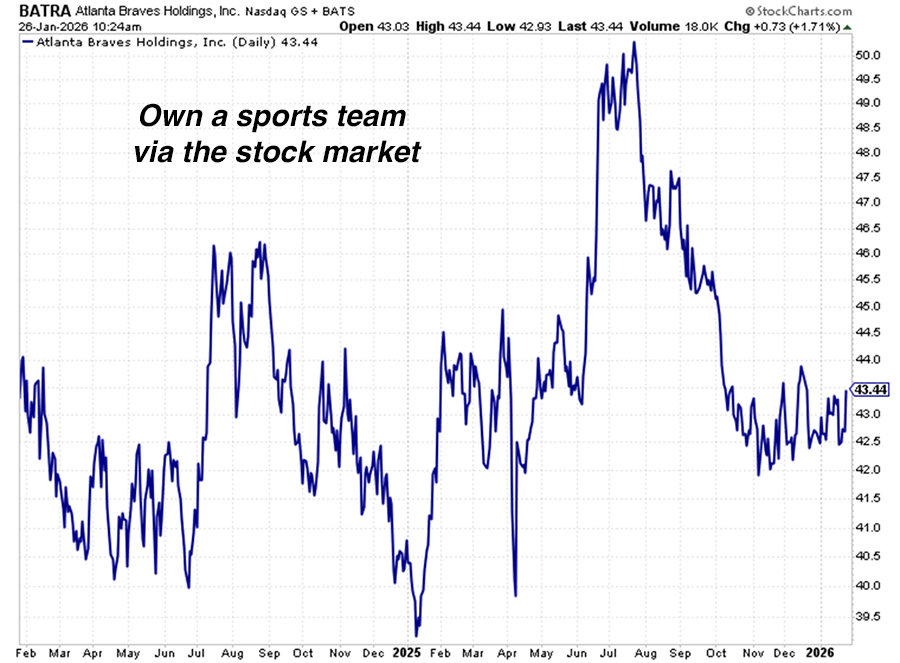

This backstory came to mind when I recently read that famed money manager Mario Gabelli recommends owning some of the few ways to own sports franchises via the stock market. Gabelli is bullish on Atlanta Braves Holdings (BATRA), which owns MLB’s Atlanta Braves, and Madison Square Garden Sports (MSGS), which owns the NBA’s New York Knicks and NHL’s New York Rangers. Gabelli believes both stocks are undervalued and poised to go higher as the professional sports franchise megatrend runs higher. This is an unusual “debasement” trade you can literally cheer for.

Market Notes

-

Our September 29, 2025, bullish note on oil stocks is proving to be incredibly well timed. Oil stocks of all shapes and sizes reached one-year highs today. New highs include oil giant ExxonMobil (XOM), Canadian Natural Resources (CNQ), and Suncor (SU).

-

Our longstanding recommendation to own copper stocks to play AI and electrification is paying off like a broken slot machine. The Global X Copper Miners ETF (COPX) reached a new all-time high today. It’s up 134% in the past year.

-

AI infrastructure giant ASML (ASML) reached a new one-year high today. The AI bears continue to be wrong.

-

Steelmaking giant ArcelorMittal (MT) reached a new all-time high today. This is a bullish economic signal.

-

Latin America continues to rally with several plays hitting yearly highs. Banco Santander (BAC) and Banco Bilbao (BBVA) are up 147% and 124% respectively.

-

Silver reached a new all-time high of $111 an ounce today. The Global X Silver Miner ETF (SIL) is up an incredible 252% over the past 12 months.

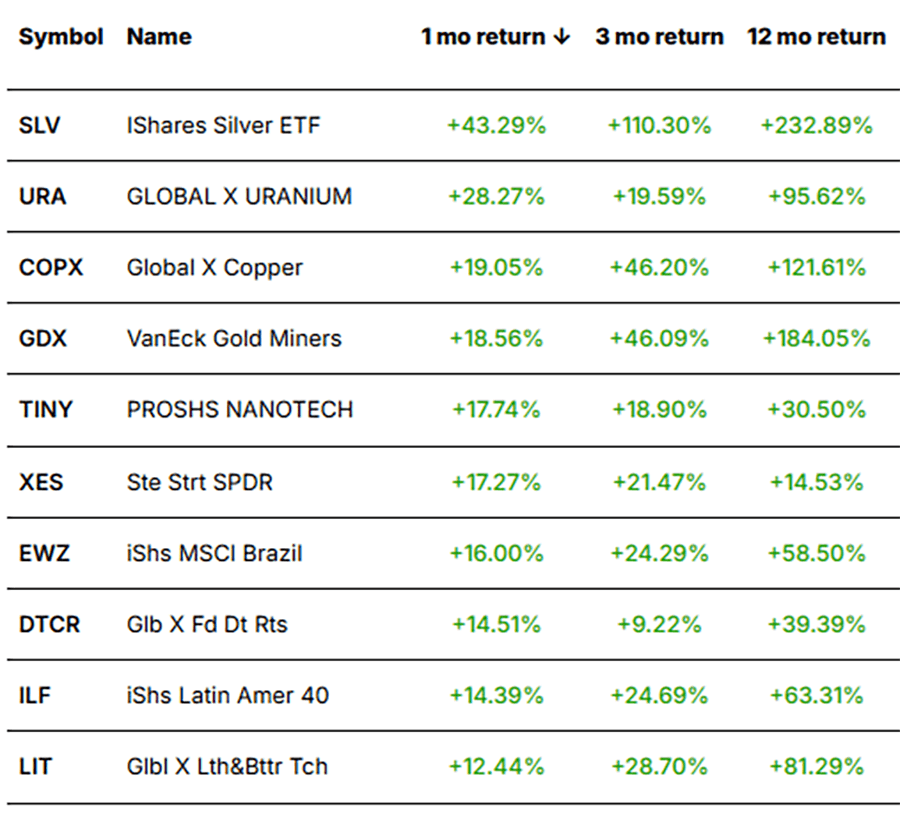

Today’s Trend Leaderboard

Top performing themes and trends over the past month. (Click the image to view our Global Trend Tracker database.)

Regards,

Brian Hunt

Editor, Money & Megatrends