On January 9, a late-Friday post on Truth Social from President Donald Trump jolted a section of the market…

Trump said that he wants to see a one-year, 10% cap on credit-card interest rates, starting as soon as next week, to help combat the “affordability” challenges folks are facing.

(For comparison, the average credit-card interest rate is above 20% right now.)

While such a plan is easier said than done (more on that in a bit), folks still sold off certain financial stocks. So, is it time to buy the dip on a couple beaten-down stocks? Or stay away?

First, let’s look at what a cap on credit-card interest rates would look to “fix”…

Why Both Sides of the Aisle Want a Cap on Credit-Card Rates

My colleague Corey McLaughlin has covered what he calls the “sour” consumer debt picture a lot in the Stansberry Digest. That includes things like buy now, pay later loans (“BNPL”), credit-card debt, and even the restart of student-loan repayments.

Here’s a quick refresher…

Credit-card debt is at an all-time high of $1.23 trillion (as of the end of the third quarter of 2025). And more than 12% of all outstanding credit-card debt is more than 90 days delinquent – the highest share since the first quarter of 2011.

With the average credit-card rate at nearly 21%, according to the St. Louis Federal Reserve, those delinquent accounts are accruing a lot of interest – putting even more burden on consumers.

On top of that, the consumer is under a lot of stress. For evidence, just look to the U.S. Consumer Sentiment Index, a barometer for the economic outlook of the average American household. As of November, the index reached its second-lowest level on record.

So, a temporary cap on credit-card interest rates could relieve some pressure.

Trump’s plan has (some) bipartisan backing, too.

Republican Senator Josh Hawley and Democratic Senator Bernie Sanders proposed a bill in February 2025 that would have capped credit-card interest rates at 10% for five years, but only two other senators supported it.

The president even held a “productive call” with Democratic Senator Elizabeth Warren over the credit-card plan (as well as housing prices).

The plan would have to go through Congress to be enforced, though.

And even with Trump calling for Congress to act during his speech at the World Economic Forum in Davos, Switzerland, that’s far from a done deal.

What Banks Are Saying About the Plan

Of course, banks and other financial companies have come out against the plan. America’s Credit Unions – a nonprofit advocating for credit unions – laid out just how many folks could be impacted.

From its report, a credit-card rate cap would mean…

- An estimated two-thirds of credit-card users carrying a balance would have their credit lines reduced or eliminated.

- Virtually all of the 47 million Americans with a subprime credit score would be unable to obtain or keep a credit card.

The question you may be wondering: why?

At the end of the day, interest rates are just a means to compensate for the risk of a loan… any loan. All else equal, more creditworthy borrowers get lower rates. Less creditworthy ones get higher rates. That’s why 10-year Treasurys carry a yield of 4.2% as I write. And it’s why credit cards – which are just unsecured loans – are easily north of 20%.

What the credit unions are saying is that, by capping rates, it limits their ability to adequately compensate for that risk. So, they’ll simply stop issuing credit. And they’re not the only ones saying it.

During JPMorgan Chase’s (JPM) post-earnings conference call last week, Chief Financial Officer Jeremy Barnum echoed the America’s Credit Unions’ report, saying that “instead of lowering the price of credit, we’ll simply reduce the supply of credit.”

Just this week, JPMorgan CEO Jamie Dimon said that a cap on credit card rates at 10% would be “an economic disaster.” He added that doing so would restrict credit for 80% of Americans.

Dimon even proposed that the government trial the plan in Vermont and Massachusetts – states represented by Senators Sanders and Warren, respectively – and “see what happens.”

He added that “restaurants, the retailers, the travel companies, the schools, [and] the municipalities” will be the ones that really feel the pain from the limited access to credit. And that in turn will hurt the entire economy.

How the Market Treated Banks and Credit-Card Issuers

Since the headlines on capping credit-card rates came out on January 9, the financial sector – as measured by the State Street Financial Select Sector SPDR Fund (XLF) – has fallen approximately 4%. That’s more than double the S&P 500 Index’s pullback over the same period.

And within the financial sector, the companies that are more vulnerable to changes to the credit-card landscape are doing even worse…

Take Capital One Financial (COF) for example. The company has the highest credit-card exposure of any major bank. The stock is down more than 9% since Trump’s call for a cap on credit-card rates.

The story is the same with Synchrony Financial (SYF) – which mainly focuses on retail credit cards. Since January 9, the stock is down more than 12%.

And big banks JPMorgan, Bank of America (BAC), and Citigroup (C) – which all have massive credit-card businesses – are down more than 5% over the past two weeks.

Are Capital One Financial, Bank of America, JPMorgan Chase, and Synchrony a Buy Today?

We’re going to look at each of these companies through our proprietary Stansberry Score – which measures a stock’s long-term prospects as an investment. Starting with Capital One…

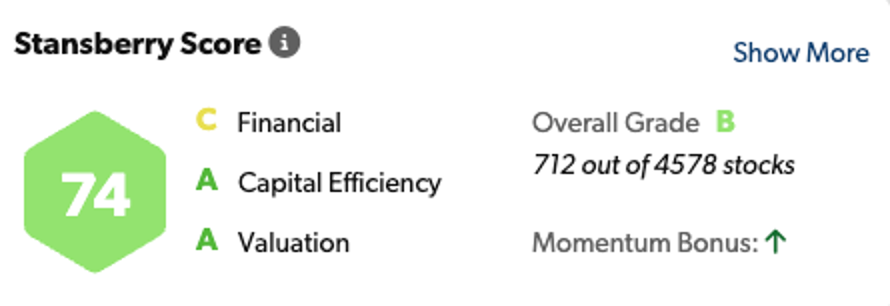

Capital One gets an overall score of 74, good for a “B” grade. Under the hood, it gets “A” grades for both valuation and capital efficiency. But it only receives a “C” grade for its financials.

Bank of America does not get as good of a grade…

Bank of America gets a score of 53 – good for a “C” grade. And while it has an “A” rating for its current valuation, it gets “C” and “D” grades for its capital efficiency and financials, respectively.

So, our score is telling us there are better opportunities in the financial space.

JPMorgan – whose credit-card business falls under its Chase consumer segment – is in the same boat…

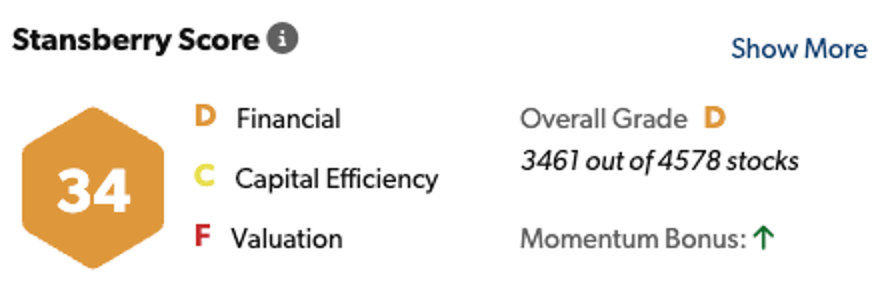

Our system gives it a score of 34, for an overall grade of “D.” Looking at the components, JPMorgan also earns “C” and “D” grades for its capital efficiency and financials, respectively. And it gets an “F” grade for its valuation.

Now turning to Synchrony – which offers credit cards usually in tandem with retailers like Amazon (AMZN) and Lowe’s (LOW)…

Synchrony gets an overall grade of 70, good for a “B” grade. And under the hood it gets a “B” grade for its capital efficiency and a “C” grade for its financials, with an “A” grade for valuation.

Extra Risks with Capital One and Synchrony Financial

While Synchrony and Capital One get better grades than the two big banks on our score, they are at higher risk from a change to credit-card rates…

Both of these companies have high exposure to “subprime” borrowers. For Capital One, these borrowers make up 27% of credit-card accounts and 49% of its auto loans. As for Synchrony, subprime clients also make up 27% of its card accounts.

Put simply, subprime borrowers are deemed less “creditworthy” by financial institutions, so they usually charge a higher interest rate to account for the higher risk.

And that means these are the folks that will be hit first (and hardest) if a credit-card cap comes to fruition. That, in turn, will likely force Capital One and Synchrony to pull back massively on lending to the very customers that make up a large part of their business.

So, I wouldn’t rush out to buy these stocks today with the overhang of credit-card rate caps still looming.

Two Companies Caught Up in the Selling

The banks and credit card companies weren’t the only ones that fell on the headline. Payment networks Visa (V) and Mastercard (MA) have both fallen more than 6% since Trump’s Truth Social post on capping credit-card rates.

These two companies still get incredible grades on our Stansberry Score. Visa gets a total score of 82 – good for a grade of A. Mastercard gets an identical 82 – good for an A grade.

Both companies get A grades for the financial and capital-efficiency components. That shouldn’t come as a surprise…

Contrary to what you might think, these companies do not actually issue credit. Instead, they operate the infrastructure that payments travel across whenever a Visa or Mastercard card is swiped. Once that infrastructure is in place, there’s no incremental cost to higher volumes on their network.

And together, they control nearly 90% of all spending volume in the U.S. So the more folks that use their cards, the more money these companies make – at no added cost to their businesses. Their stocks may get dinged from time to time on fears that folks are going to pull back on spending – or in this case a change to the credit-card industry.

But the sturdy nature of their business model means that both companies have been wonderful, bottom-line compounder for years. Over the past 10 years, Visa has grown its earnings per share (“EPS”) at an annualized rate of 15.2%. Over that same time, Mastercard grew its EPS at a rate of 17%.

That makes these two companies great stocks to own for the long term.

It’s not often that investors get to buy into a near-duopoly for a decent price. Because of their strong businesses, Visa and Mastercard deserve (and usually do) trade at a premium to other stocks on the market.

But right now, they both get “B” grades for valuation. So, our Stansberry Score is telling us that the recent dip could be a good time to establish a position, if you haven’t already.

Regards,

Nick Koziol

“A strange day is coming to America.”

That’s according to a former Goldman Sachs executive who predicted everything from the 2022 crash, the death of the 60/40 portfolio, and even the rise of blockchain.

He’s not the only one sounding the alarm:

- The Wall Street Journal calls it a ‘New World Order.’

- The Financial Times says, “the unimaginable is becoming imaginable”… and that it could “upend the global monetary system.”

- And one of President Trump’s senior advisers has already laid out the plan to accelerate this trend. It’s all written out, point-by-point, in black and white. (Details here.)

So, what should you do right now to come out ahead?

Click here to learn more in Dr. Eifrig’s new free presentation… and get the three money moves to capture the biggest potential gains as this seismic change unfolds.